Looking for free tokens with huge upside potential? LayerZero is one of the major upcoming crypto airdrops, funded by many reputable global enterprises such as PayPal. The LayerZero airdrop is now available to claim. This is our LayerZero airdrop ultimate guide.

Check out our zkSync ($ZKS) Token Airdrop Guide for another highly anticipated airdrop.

LayerZero ($ZRO) Airdrop Step-by-Step Guide

Here’s a step-by-step guide on how to get a potential LayerZero ($ZRO) token airdrop:

- Interact with Stargate Finance

- Interact with Stargate Bridge on LayerZero

- Use Stargate on Bungee

- Use the USDC LayerZero Bridge

- Use the Aptos Bridge

- Use LiquidSwap Bridge

- Use LEVEL Finance Bridge

- Use SushiSwap Cross-Chain Swap

- Use BitcoinBridge

- Interact with other dApps on LayerZero

- Get roles on the Stargate Guild

See below for more details!

What is LayerZero?

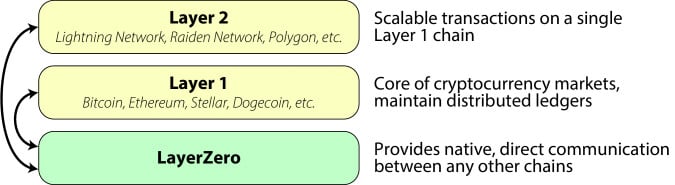

LayerZero is a trustless omnichain interoperability protocol designed to connect multiple chains. Let’s break it down what this means in simple terms:

Underlying Issues of Current Interoperability Techniques

Interoperability is a big problem for blockchains. Blockchains can’t talk to each other in a way that makes sense, so they’re like separate islands. This makes it hard for people to move things like money and data between them. There are two ways to fix this, but they both have problems.

Middle Chain

In the blockchain world, there are some protocols that help blockchains talk to each other such as Polkadot or Cosmos. They’re like a middleman that helps different blockchains exchange messages. This is a good way to make sure that blockchains can work together and it’s not too expensive. But it’s not very secure because if something goes wrong with the middleman, then everything can be stolen. It’s like having all your eggs in one basket.

On-Chain Light Node (Decentralized Bridges)

Instead of having one person in charge, decentralized cross-chain bridges use on-chain light nodes to communicate between blockchains. A light node is like a small part of the blockchain ledger’s transaction history. It’s connected to a full node to make sure everything is correct.

To send messages between chains, light nodes on one chain check the metadata of a block from another chain. Then they send proof of the transaction to the other chain. This is a safe way to send messages between chains, but it’s also very expensive. You would need to build a new bridge for every pair of chains, and each one would need its own interface and code.

LayerZero’s Solution to Interoperability

Instead of a middle chain or a layer-2 solution, LayerZero provides a massive infrastructure that would seamlessly enable direct, trustless transactions across all chains. Think of it like this: if blockchains are nations and bridges are immigration, then LayerZero would be a global super-passport and air-traffic control that allows communication between all blockchains at once. It focuses more on the communication problem of the interoperability layer (layer 0) rather than providing a third party solution like a bridge or middle chain.

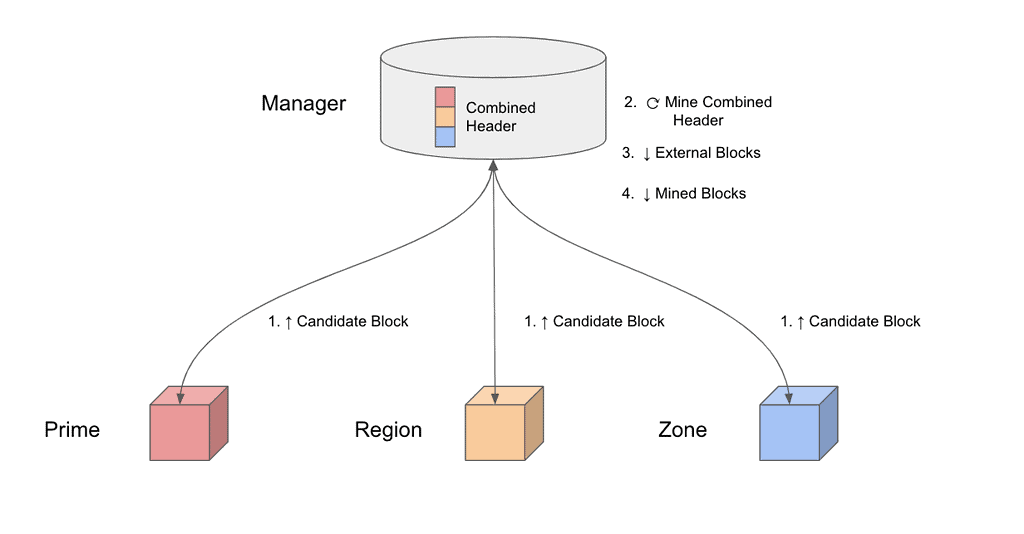

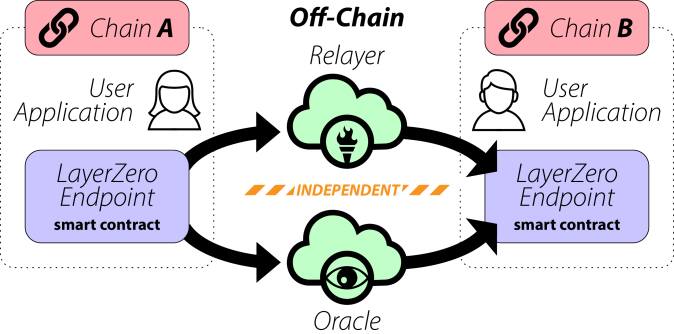

LayerZero achieves this by using on-chain light nodes in a much more economical way. The team behind LayerZero, LayerZero Labs, coined it Ultra Light Node (ULN). The ULNs are connected to oracles and relayers, both independent off-chain entities in charge of transferring messages from one chain to another.

Instead of keeping all block headers sequentially, block headers are streamed on demand by decentralized oracles, i.e. Chainlink, allowing the ULN endpoints to be small and cost-effective. The relayers are responsible for moving transaction proofs. Initially, LayerZero Labs will run and maintain the relayers, which will soon be fully open-sourced so that anyone can operate their own relayer.

Moreover, the use of an oracle-relayer pair provides additional layers of security since responsibilities are broken up. But if both parties are compromised, LayerZero would be vulnerable to attacks–no easy task, given the progressive decentralization of relayers growing in the network.

Who is the Team behind LayerZero?

LayerZero Labs, a Vancouver-based startup, developed LayerZero protocols to enable omnichain decentralized applications across multiple blockchains. LayerZero was co-founded in 2021 by Bryan Pellegrino, Ryan Zarick, and Caleb Banister. The three have previously worked together in computer network research labs at the University of New Hampshire.

LayerZero Labs have recently raised US$120 million in Series B funding at a valuation of US$3 billion. The funding is expected to go towards growth initiatives, in particular expanding the Company’s presence in the Asia-Pacific. In March 2022, LayerZero Labs raised $135 million in a Series B funding round from the likes of FTX Ventures, Coinbase Ventures, Uniswap Labs, Sequoia Capital, a16z, PayPal Ventures and more. Interestingly, LayerZero is PayPal’s first ever web3 investment. Seeing as that PayPal is one of the world’s leading payment networks this goes to show LayerZero has huge potential that spans beyond the crypto space.

Does LayerZero have a Token?

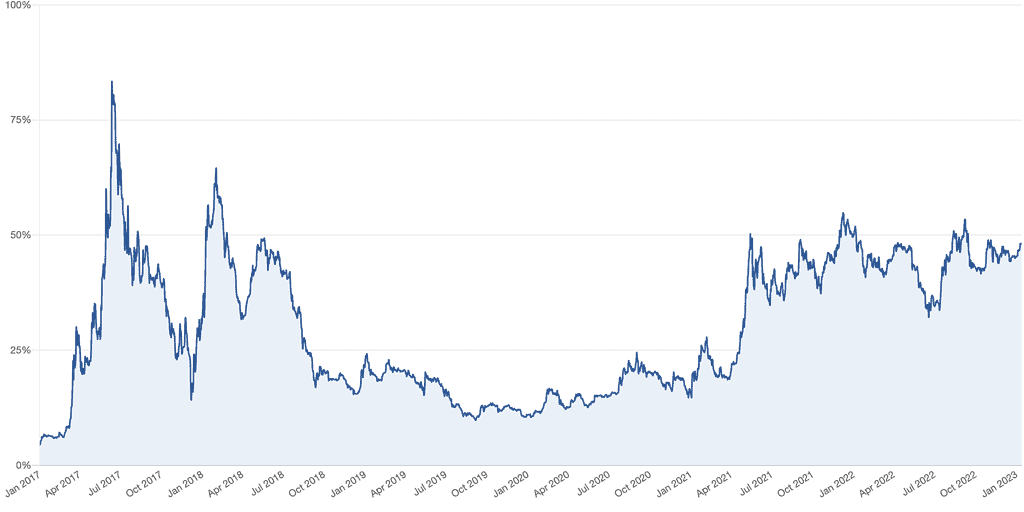

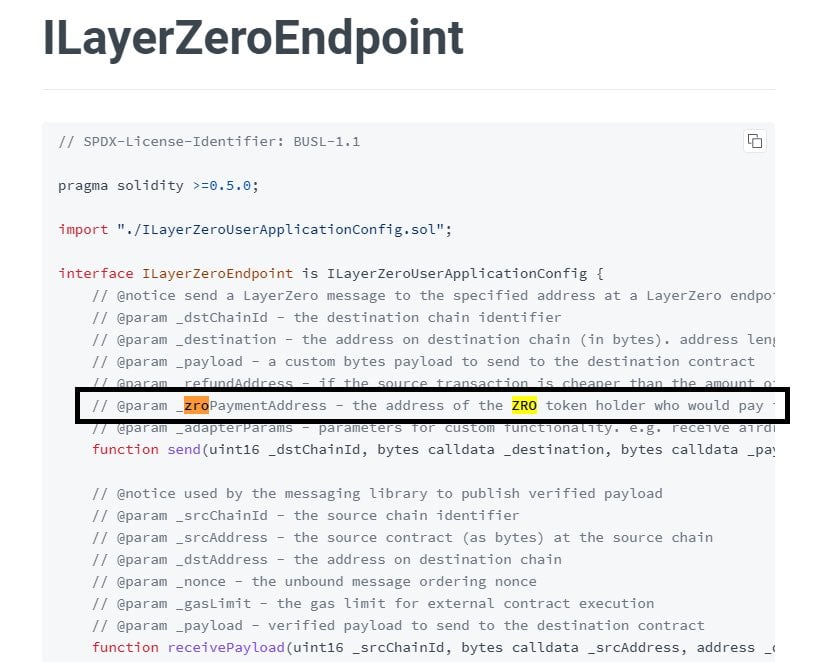

LayerZero does not have a token YET. But based on their information code we know it will be called $ZRO.

How to Receive Potential LayerZero Token Airdrop?

Interact with Stargate Finance

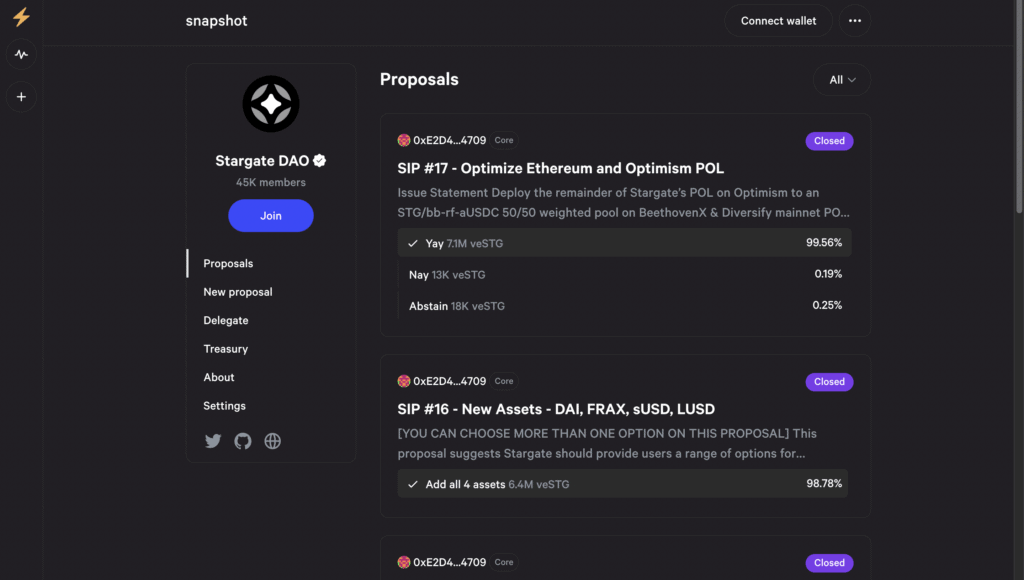

Stargate Finance (Check out our airdrop guide here) is the first live LayerZero protocol. LayerZero Labs believes Stargate will be integral to any dApp that wants to move cryptocurrency across blockchains. Thus, Stargate users, especially DAO voters, could have a very high chance to receive $ZRO airdrops. Here’s how to stake and become a DAO Voter on Stargate:

- Buy Stargate’s $STG token (for as little as $0.74) on centralized crypto exchanges like Bybit or on decentralized exchanges like Uniswap. We suggest staking at least 25 $STG because it is the minimum required to get some guild roles.

- Stake $STG to get $veSTG. This gives you voting power on Stargate’s staking tab: https://stargate.finance/stake. The staking period can range from 1 to 36 months. You can also browse the pools and farms on the staking page to earn more $STG yields.

- Add liquidity to Pools. Go to https://stargate.finance/pool, choose your preferred Pool and add liquidity. You can remove liquidity at any time on the “Remove” tab. You earn LP tokens as a reward, which then be farmed to get $STG. Check our guide here.

- Regularly vote on governance proposals. Tip: Select “Turn On My Notifications” so you don’t miss any voting opportunities.

Interact with Stargate Bridge

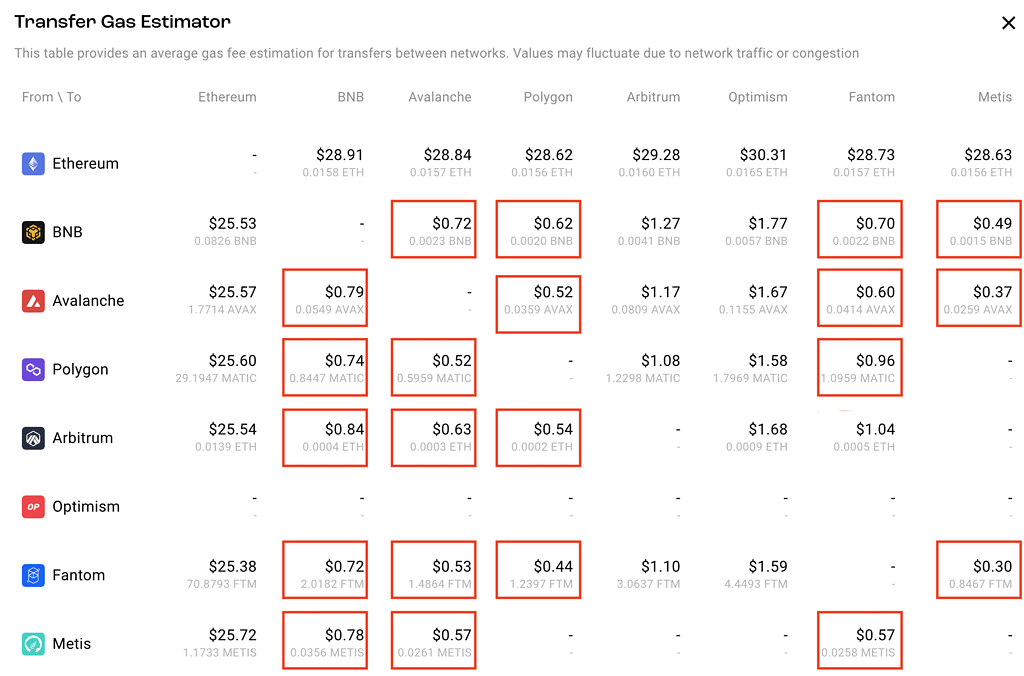

Interact with dApps such as Stargate Finance’s Stargate Bridge by bridging your funds across networks repeatedly to generate volume. To do this, select the “from” token and network, the “to” token and network, and confirm your transaction.

Bonus: How to save costs when using Stargate Bridge

Here’s how to save costs when using Stargate Bridge:

- Do not transfer assets to/from the Ethereum network as it usually costs the most.

- Instead, to save costs when using Stargate Bridge transfer to/from these networks: BNB/AVAX, BNB/MATIC, BNB/FTM, BNB/METIS, AVAX/MATIC, AVAX/FTM, AVAX/METIS, MATIC/FTM, ARB/BNB, ARB/AVAX, ARB/MATIC and FTM/METIS.

- Check the estimated gas cost before bridging by clicking “Transfer Gas Estimator” before transferring assets.

Use Stargate on Bungee

Bridge tokens on Bungee using the Stargate route. This will also make you eligible for the Bungee, Socket and Stargate potential airdrops. For more details, see our Bungee token airdrop guide.

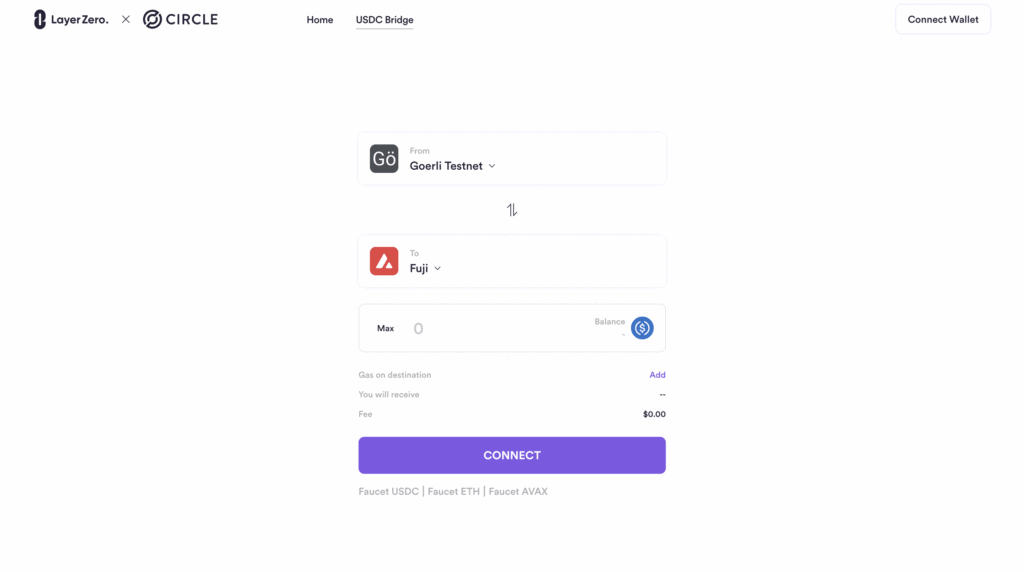

Use the USDC LayerZero Bridge

You can use the USDC LayerZero bridge (https://usdcdemo.layerzero.network/bridge) to transfer USDC between EVM chains.

USDC Goerli Contract Address: 0x07865c6E87B9F70255377e024ace6630C1Eaa37F

USDC Avax Contract Address: 0x5425890298aed601595a70AB815c96711a31Bc65

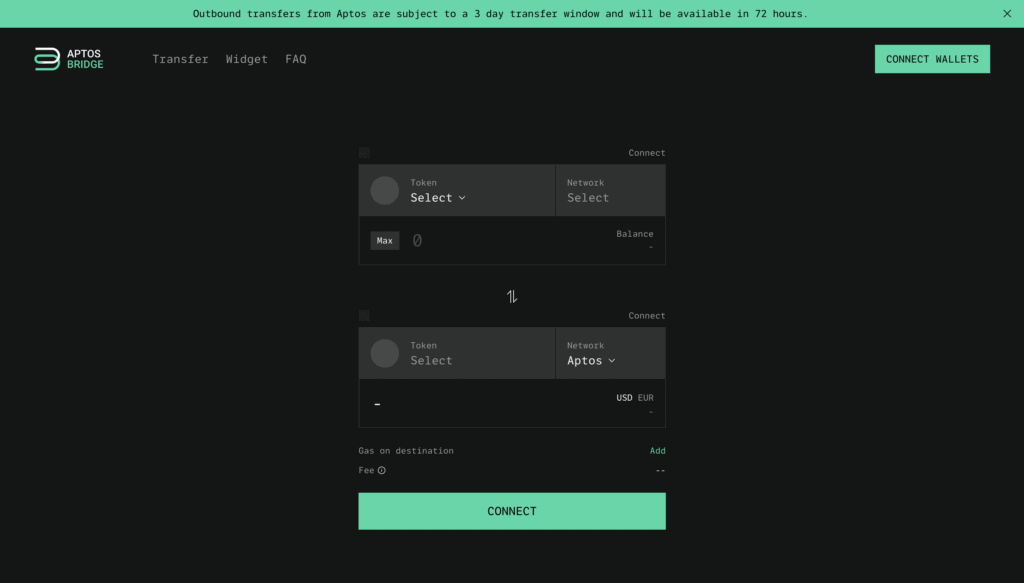

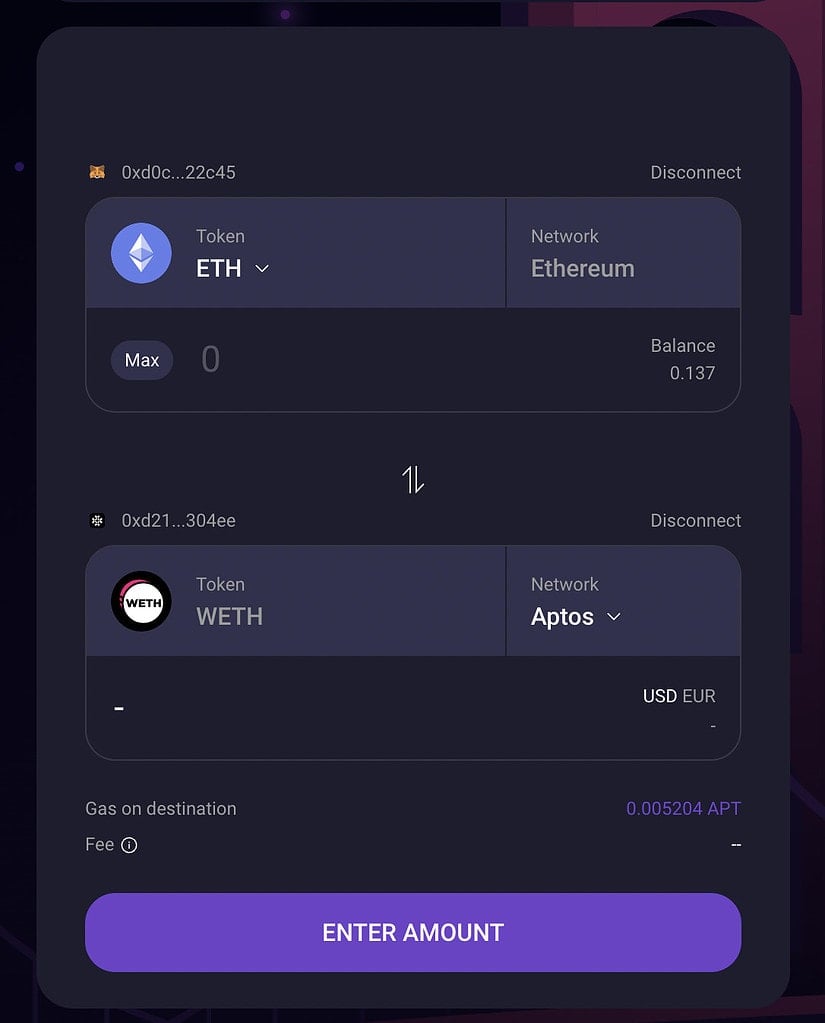

Use the Aptos Bridge

The Aptos Bridge is powered by LayerZero. You can move USDC, USDT, and ETH from Ethereum, Arbitrum, Optimism, Avalanche, Polygon, and BSC to the Aptos network. Connect your EVM (e.g. MetaMask) and Aptos wallets (e.g. Martian wallet). Then, choose the number of cryptocurrencies and networks you wish to use. However, keep in mind there is a 3-day transfer window if you want to withdraw your funds out of the Aptos ecosystem. You will also need to pay gas fees in Aptos $APT tokens.

To use the Aptos Bridge with the least amount of gas fees, transfer USDC from BNB Chain to Aptos network. To do this, you will need USDC and BNB (gas fees) in your EVM wallet (e.g. MetaMask). You will also need $APT to your Martain wallet to pay for gas fees.

Use the LiquidSwap Bridge

Go to https://bridge.liquidswap.com/ and bridge USDT, and ETH from Ethereum or Arbitrum to the Aptos network. Connect your EVM (e.g. MetaMask) and Aptos wallets (e.g. Martian wallet), and choose the cryptocurrency and network (Ethereum/Arbitrum to Aptos and vice versa) you wish to bridge tokens. Note you will need to pay gas fees in Aptos $APT tokens.

Use LEVEL Finance Bridge

LEVEL Finance is a decentralized perpetual exchange on BNB Chain that provides risk management solutions for liquidity providers and is built by experienced entrepreneurs and contributors. To use LEVEL, you will need to buy their native $LVL token on DEXs such as Uniswap or Pancakeswap. Then, go to LEVEL Bridge and bridge $LVL tokens between BNB Chain and Arbitrum. Note that depending on which direction you are bridging, you will need BNB or ETH for gas fees.

Use SushiSwap Cross-Chain Swap

SushiSwap released its SushiXSwap, which is built upon LayerZero’s Stargate protocol. You can swap tokens directly to another network without using a bridge. As such, users are likely to be qualified for a $ZRO token airdrop!

Use BitcoinBridge

BitcoinBridge allows users to transfer BTC.b. BTC.b is a new type of wrapped Bitcoin that can be used on the Avalanche Network. It is moved to Avalanche using the Avalanche Bridge. This makes it easy to use Bitcoin on many different networks with the help of LayerZero.

Meanwhile, BitcoinBridge is a good way for people on a budget to interact with the LayerZero ecosystem. Doing 20 transactions on BitcoinBridge will only cost around US$15! Here’s how to use BitcoinBridge:

- Buy BTC.b on Trader Joe here.

- Connect your EVM and Aptos wallets here.

- Bridge assets between different networks.

Use Rage Trade

Rage Trade is a double-legged trading protocol that offers a perpetual ETH swap and a USDC yield-farming product built on Arbitrum and LayerZero. Therefore, interacting with it may qualify you for 3 airdrops at the same time! To use Rage Trade, simply trade and deposit and stake on their platform. Also, contribute to their community.

For more details check out our Rage Trade Token Airdrop Guide

Use Altitude

Altitude ($ALTD) is a dApp built on LayerZero, designed to allow DeFi users to transfer assets with enhanced security features, inexpensive bridging fees, and fast transactions. Altitude have confirmed they will launch its $ALTD token as well as an airdrop when their mainnet launches!

See: Altitude ($ALTD) Token Airdrop Guide

Use Dexalot

Dexalot is a decentralized exchange that uses LayerZero as its default bridge provider. To use Dexalot, you will need to have ETH on the Arbitrum network and AVAX on the Avalanche network. Connect your wallet to Dexalot and go to the “Portfolio” tab, making sure you are on the Avalanche network. At the bottom of the page you will see a list of your tokens, select AVAX and click the 3 points on the right hand side. On the popup window, deposit some AVAX onto Dexalot. Note however depending on the amount of AVAX deposited, it may cost more gas fees to withdraw than the amount itself. So you may need to consider it as a loss for the sake of interacting with Dexalot.

Interact with Abracadabra

Abracadabra is intergrated with Layer Zero and allows users to borrow, leverage or earn yield. To interact with Abracadabra, you will need to have their native $MIM token. $MIM can be purchased on several decentralized exchanges such as Uniswap, Sushiswap or Trader Joe. Make sure you are on the Avalanche network, or you will have to first bridge your $MIM tokens there. Back on Abacadabra, send one $MIM token from Avalanche to Arbitrum network. If you don’t want to keep your $MIM tokens, you can proceed to sell it for ETH on Arbitrum.

Use SteakHut Finance

SteakHut Finance is a yield optimization protocol that has integrated with LayerZero to launch $STEAK as an omnichain token. On SteakHut, $STEAK will be abe to be bridged across Avalanche, Arbitrum and eventually other blockchains on a 1:1 ratio. To use SteakHut, you will need to buy $STEAK tokens on the Avalanche Network. Note that currently only Trader Joe offers $STEAK tokens. Afterwards, connect your wallet to SteakHut and go to the “Bridge” tab. Send your $STEAK tokens to Arbitrum. You can also send your $STEAK tokens in reverse i.e. from Arbitrum to Avalanche networks. This would increase the number of interactions you have with SteakHut, which may put you in a better position for any potential airdrop. Note that you will need to pay gas fees in AVAX.

Interact with Mummy Finance

Mummy Finance is integrated with LayerZero and lets users trade BTC, ETH, FTM, OP, ARB and other cryptocurrencies with up to 100x leverage. To interact with Mummy Finance, you will first need to buy some of their native $MMY tokens on the Arbitrum network here. Then, go to Mummy bridge and bridge your tokens from the Arbitrum to Fantom network. Note it may cost more gas fees transfer back or sell your $MMY tokens. Therefore, you may need to consider it as a loss for the sake of interacting with Mummy Finance.

Interact with other dApps on LayerZero

You can also interact with other dApps on LayerZero including Holograph, Mugen Finance, Radiant Capital, Omni X or Angle Protocol. You can make small transactions, deposit funds, provide liquidity, swap assets etc. By actively and consistently using the ecosystem, it is highly likely LayerZero will reward users who genuinely interact with the ecosystem.

Get roles on the Stargate Guild

Here’s how to get roles on the Stargate Guild:

- Connect your Ethereum wallet to https://guild.xyz/stargate.

- To get the veStaker role, hold at least 25 $veSTG. To do this, buy at least 25 $STG on exchanges such as Bybit, Binance, or Uniswap. Then, stake your $STG here to get $veSTG. For detailed instructions see above.

- To get the 100 STG role, you will need to hold at least 100 $STG. Note that staked $STG does not count.

- To get the 1k LP Farmer role, supply at least $1,000 of USDC, USDT or BUSD on Ethereum, BNB Chain, Avalanche, Polygon, Arbitrum, Optimism or Fantom (not Metis) to receive LP tokens.

How to claim the LayerZero ($ZRO) token airdrop?

Here’s how to claim the LayerZero ($ZRO) token airdrop:

- Connect your wallet or paste your wallet address to https://layerzero.foundation/claim to check your eligibility.

- To claim the LayerZero ($ZRO) token airdrop, those who are eligible must donate US$0.10 in USDC, USDT or native ETH per $ZRO. This is known as LayerZero’s Proof-of-Donation mechanism. Donations would go to the Protocol Guild.

- Users can claim from the following chains: Ethereum, Arbitrum, Optimism, Base, Polygon, BNB Chain, and Avalanche.

- Once claimed, $ZRO holders can transfer their tokens via the above chains using Stargate.

LayerZero Airdrop Review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: The LayerZero token airdrop is available to claim from 20th June to 20th September 2024.

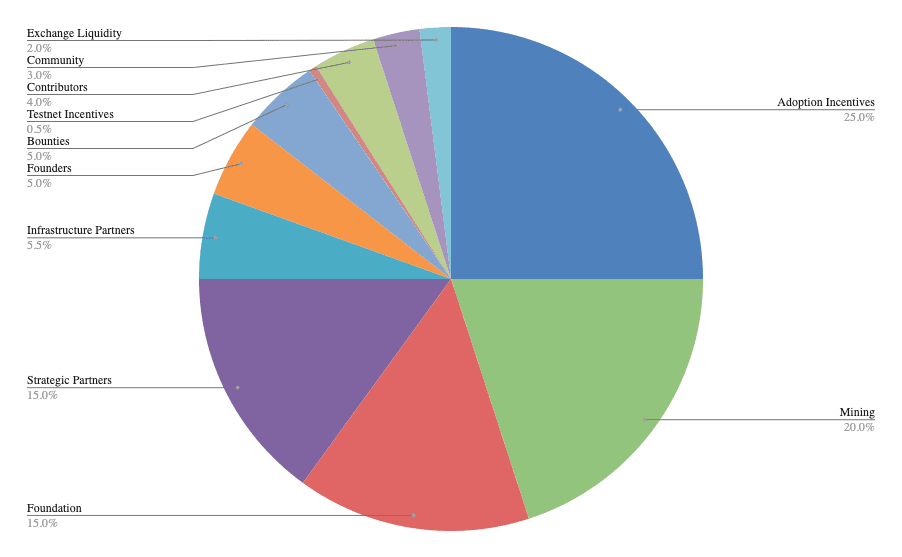

Airdropped Token Allocation: 85 million $ZRO are available to claim.

Airdrop Difficulty: To be eligible for the LayerZero token airdrop, users could submit unique proposals for LayerZero or provided multiple ongoing transactions on the protocol.

Token Utility: The LayerZero ($ZRO) token acts as a governance token, and to facilitate transactions across different blockchain networks.

Token Lockup: The token will be unlocked on launch. However, those who are eligible for the airdrop must donate US$0.10 per $ZRO to claim the token