Binance Chain was launched by Binance in April 2019. Home of the Binance Token ($BNB) currency, it is optimized for ultra-fast trading. To achieve this, it had to make certain trade-offs, one being that it wasn’t as flexible from a programmability standpoint as other blockchains. Smart contracts in a system optimized for fast trading could significantly congest the network. Like how CryptoKitties brought Ethereum blockchain to a standstill at the height of its popularity and scalability remains one of the most challenging hurdles to blockchain development.

Binance Smart Chain aims at changing this problem. It is a new blockchain with a full-fledged environment for developing high-performance decentralized applications. It was built for cross-chain compatibility with Binance Chain to ensure that users get the best of both worlds. Binance Smart Chain went live on mainnet on September 01, 2020, activating the parallel blockchain to Binance Chain, enabling the creation of smart contracts and the staking mechanism for BNB.

What is Binance Smart Chain (BSC)?

Binance Smart Chain (BSC) is best described as a blockchain that runs in parallel to the Binance Chain. However, unlike Binance Chain, BSC boasts smart contract functionality and compatibility with the Ethereum Virtual Machine (EVM). The design goal here was to leave the high throughput of Binance Chain intact while introducing smart contracts into its ecosystem.

BSC is not a layer two or off-chain scalability solution for the existing Binance Chain. It’s an independent blockchain that could run even if Binance Chain went offline. Because BSC is EVM-compatible, it makes it easy for developers to port their projects over from Ethereum. For users, it means that applications like MetaMask can be easily configured to work with BSC with just tweaking a couple of settings.

Binance Smart Chain vs Binance Chain: Differences?

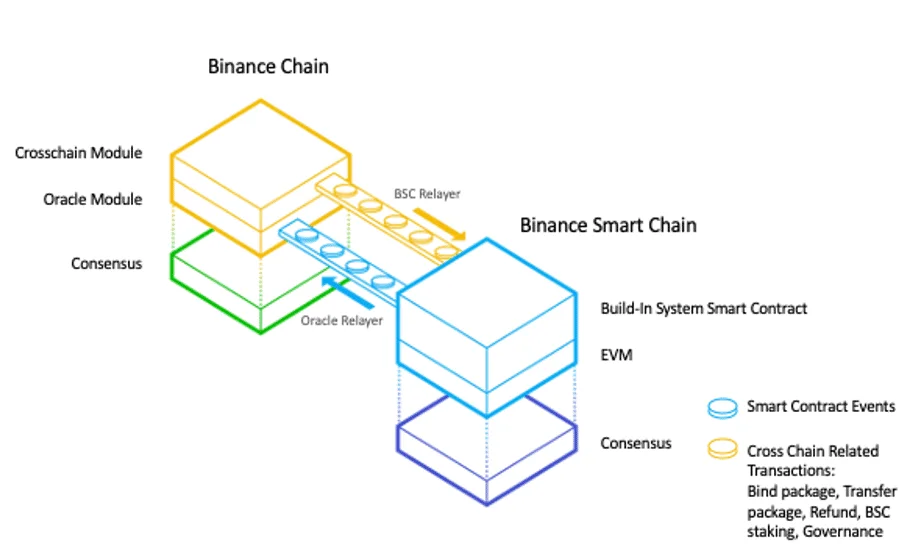

Binance Chain vs Binance Smart Chain (Image credit: Binance Smart Chain)

How does Binance Smart Chain work?

Cross-chain Compatibility

Binance Smart Chain was envisioned as an independent but complementary system to the existing Binance Chain with the idea being that users can seamlessly transfer assets from one blockchain to another. In this way, rapid trading can be enjoyed on Binance Chain, while powerful decentralized apps can be built on BSC.

Binance Smart Chain supports the BEP-20 token standard, which uses the same functions as its Ethereum counterpart ERC-20, while Binance Chain, supports the BEP-2 token standard. BEP20 is a developer-friendly token standard that allows anyone to deploy fungible digital currencies or tokens on Binance Smart Chain. What’s more, leading digital assets on other chains can be ported onto Binance Smart Chain in the form of pegged BEP20 tokens. For example, you could use Binance Bridge to swap bitcoin (BTC) for BTCB (BEP20) tokens backed by BTC. BTCB (BEP20) tokens can then be deployed in DeFi protocols to earn yield on bitcoin. The same goes for ETH, XRP, DOGE, and many more.

To move tokens from one chain to another, the simplest method is perhaps to use the Binance Chain Wallet, available on Chrome and Firefox. The cross-chain transfer is the key communication between the two blockchains. Essentially the logic is that the transfer-out blockchain will lock the amount from source owner addresses into a system-controlled address/contracts. The transfer-in blockchain will unlock the amount from the system-controlled address/contracts and send it to target addresses.

Ethereum-Compatible

Smart contracts, which are Ethereum-compatible, are supported by BSC. Through this feature, developers can build or migrate DApps, tools and other ecosystem components on the BSC network without much friction.

Proof-of-Staked-Authority

The platform runs on a proof-of-staked-authority consensus model. This combines both delegated PoS and proof-of-authority (PoA) to achieve network consensus and maintain blockchain security.

In this model, there are elected validators who take turns in confirming transactions on the network and are tasked to produce the blocks in a PoA manner, which puts the amount of their stake and their reputation in the community into consideration. To become a validator, a user must stake BNB.

This consensus model allows BSC to achieve around three-second block times. If a block proposed by the validator gets added to the chain, they receive the transaction fees incurred in that block as their reward. PoA is known for its capacity to thwart 51% attacks, as well as its tolerance for Byzantine attacks.

Validator Quorum

A validator quorum is required to secure the BSC network. The blockchain has 21 validators that are elected by BNB stakers every 24 hours. Anyone can be a candidate for election as a validator, but only those who belong to the top 21 highest-staked nodes will be chosen for the next validator set.

There is an “epoch” period for the platform, where validator sets can update the BSC network as needed. Every epoch period consists of 240 blocks, which is around 20 minutes. BSC also implements “slashing” to disincentivize malicious actors from validating inaccurate transactions or double signing. Slashing is designed to expose an attacker and make their attempts extremely expensive to execute.

Key Metric Comparison

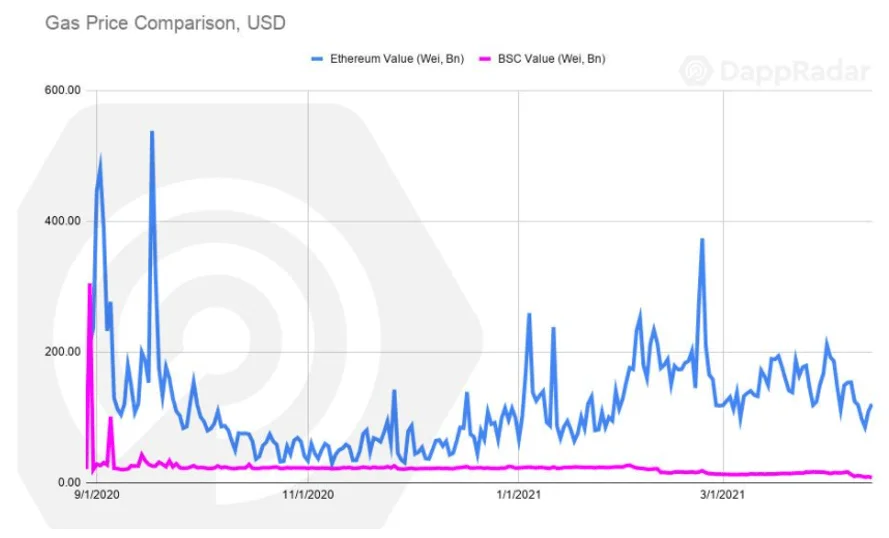

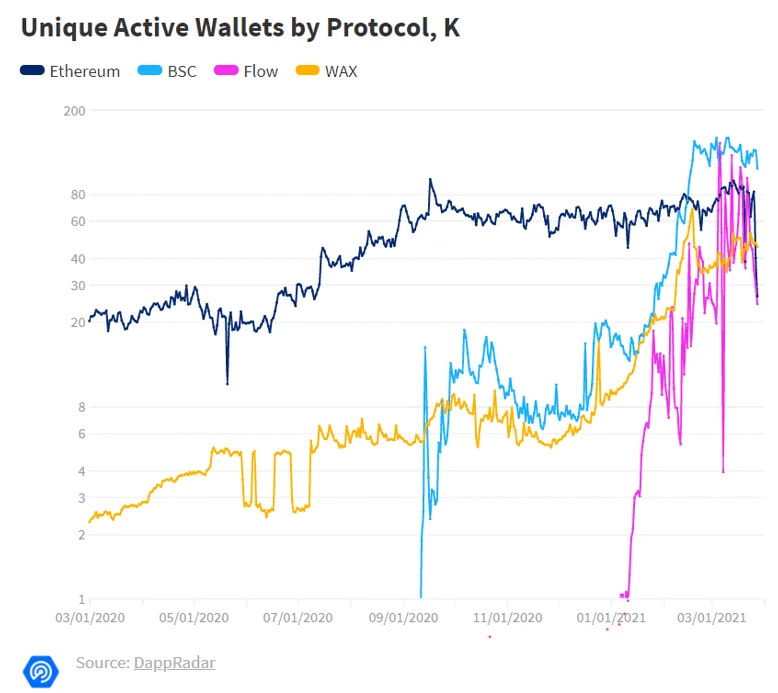

Binance Smart Chain has made immense traction in early 2021 so far partly thanks to Ethereum’s congestion and gas fee issues, which has caused developers and staking investors to look for other options.

According to “Binance Smart Chain: Q1 2021 Overview” published by DappRadar

- BSC is the most used blockchain in terms of unique active wallets averaging 105,000 in March 2021.

- Gas prices were almost 14 times lower on BSC if compared to Ethereum in 2021 Q1.

- Although Ethereum is still leading in terms of TVL with $54 billion. BSC TVL saw 121% growth month-on-month.

- BSC finance dapp Venus has surpassed Compound and Uniswap in terms of TVL reaching $6.3 billion at the end of Q1 2021.

The BSC community made the network even more appealing to new users as a cost-effective and stable alternative, by lowering its gas fee from 15 Gwei to 10 Gwei to counter Binance Coin (BNB)’s price jump to over $600 in April 2021. At the end of March 2021, BSC gas fees were 14 times lower than on Ethereum. As a result, in Q1 2021 BSC generated record-high figures.

According to the “DappRadar Q1 industry report”, in terms of key metrics, daily unique active wallets grew by 639% year-on-year from 62,000 in 2020 Q1 to more than 458,000 in 2021 Q1. BSC has led the pack with average daily unique active wallets of 105,000. In March, the chain also had the biggest increase in terms of unique active wallets by 50% month-on-month. The Ethereum and Flow blockchains generated an average of around 75,000 and 53,000 daily unique active wallets respectively.

Binance Smart Chain dAPPs

Some of the most popular decentralized applications on BSC are listed below with the full list of dApps available in DappRadar:

PancakeSwap is the number one automated market maker (AMM) on Binance Smart Chain. The ascent of BSC in 2021 cannot be described properly without mentioning the PancakeSwap exchange. The BSC-based decentralized exchange has seen remarkable growth in 2021, both for trading volume as well as its governance token CAKE. Like Uniswap or SushiSwap, you can do token swaps for BEP-20 tokens on PancakeSwap. Users can also earn passive income by providing liquidity, take part in lottery to win NFTs, participate in token sales, compete for spots on the leaderboard, and so on. PancakeSwap has become the second most popular DEX after Ethereum’s UniSwap.

BakerySwap is a decentralized automated market-making (AMM) protocol on BSC and its first NFT trading platform, ‘Bakery NFT Supermarket’. BakerySwap aims to be a faster and cheaper version of Uniswap. BAKE token is the native BEP-20 governance token of the platform and users can earn BAKE tokens by providing liquidity on BakerySwap. BAKE can be used to compose a random combo meal, which is a unique NFT(None-fungible token). Your unique NFT combo is not only a collectible item, but also a BAKE farming tool. Each NFT combo has a staking power and can be staked to earn BAKE.

Venus can be seen as a hybrid of Compound and MakerDAO on BSC. It is a borrow-lending protocol like Compound or Aave on Ethereum. It’s a decentralized money market where you can borrow and lend BEP-20 tokens with algorithmically set interest rates. Venus also enables a decentralized stablecoin called VAI, which is backed by a basket of cryptoassets.

Autofarm is a leading DeFi yield aggregator on BSC that has 3 products as part of the Autofarm ecosystem, namely Vaults (yield optimizer), AutoSwap (DEX Aggregator), and farmfolio. The yield optimizer implements the most optimal strategies at the lowest cost to maximize users’ yields and AutoSwap implements optimizations to route users swap trades so that users can find the best price and swap rates. Lastly, farmfolio is an intelligent portfolio manager and tracker which helps users manage their assets across various DeFi farming projects. The AUTO token is the platform’s native token. Tokenomics are deflationary and AUTO holders get to benefit from fees from cross-chain vaults, DEX aggregator, and the token will also be used for governance.

Spartan Protocol is a synthetic asset protocol on BSC. It allows users to create liquidity pools for BEP-20 tokens like other AMMs. However, it aims to allow for the creation of synthetic assets collateralized by liquidity pools, as well as lending and on-chain derivatives moving forward. Spartan Protocol provides community-governed and programmable token emissions functions to incentivize the formation of deep liquidity pools. This strong base of liquidity will be utilized to provide asset swaps, synthetic token generation, lending, derivatives and more. The common base asset SPARTA provides an internal pricing mechanism without reliance on external oracles. Binance Smart Chain was chosen as the protocol’s home to allow for near-instant settlement and extremely low gas fees.

To interact with the applications on BSC we require a wallet. Two of the most used wallets are MetaMask and the Binance Chain Wallet. In addition to these, you can also use Trust Wallet, Math Wallet, Ledger, TokenPocket, Bitkeep, ONTO, Safepal, and Arkane.

Connecting MetaMask to Binance Smart Chain

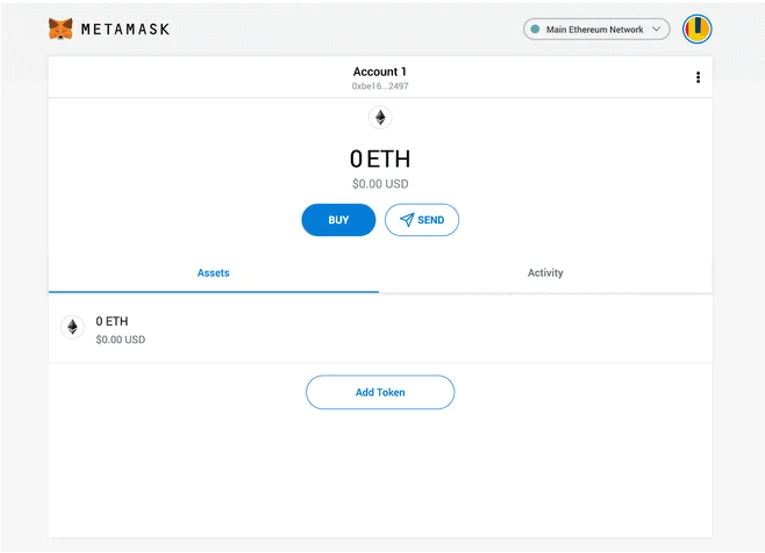

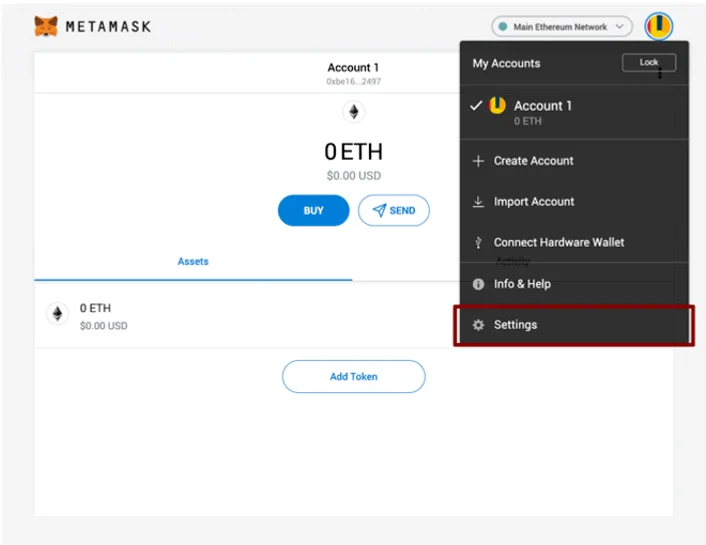

MetaMask can be downloaded on Chrome and Firefox, or on iOS and Android from the MetaMask Download page. From there, select whichever platform you’re using, and follow the steps to install it on your device and create a wallet.

The MetaMask wallet inherently interacts with the Ethereum public chain as seen from the top right corner of the screen which mentions the “Main Ethereum Network”. At this stage, we would be unable to interact with the Binance Smart Chain dApps. To change this, we need to access settings and point the wallet towards Binance Smart Chain nodes.

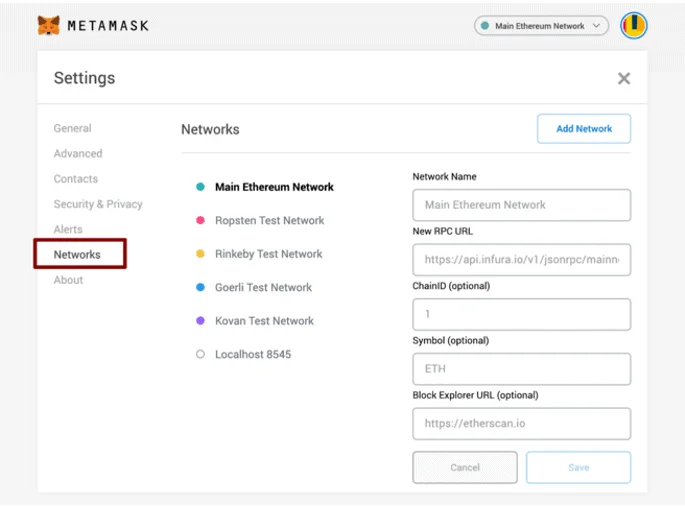

On the Settings page, locate the Networks menu.

Next click on Add Network in the top-right corner to manually add the Binance Smart Chain. It’s important to note that there are two networks we can use here: the testnet or the mainnet. Below are the parameters to fill in for both Binance Smart Chain Mainnet and Testnet.

Mainnet

- Network Name: Smart Chain

- New RPC URL: https://bsc-dataseed.binance.org/

- ChainID: 56

- Symbol: BNB

- Block Explorer URL: https://bscscan.com

Testnet

- Network Name: Smart Chain – Testnet

- New RPC URL: https://data-seed-prebsc-1-s1.binance.org:8545/

- ChainID: 97

- Symbol: BNB

- Block Explorer URL: https://testnet.bscscan.com

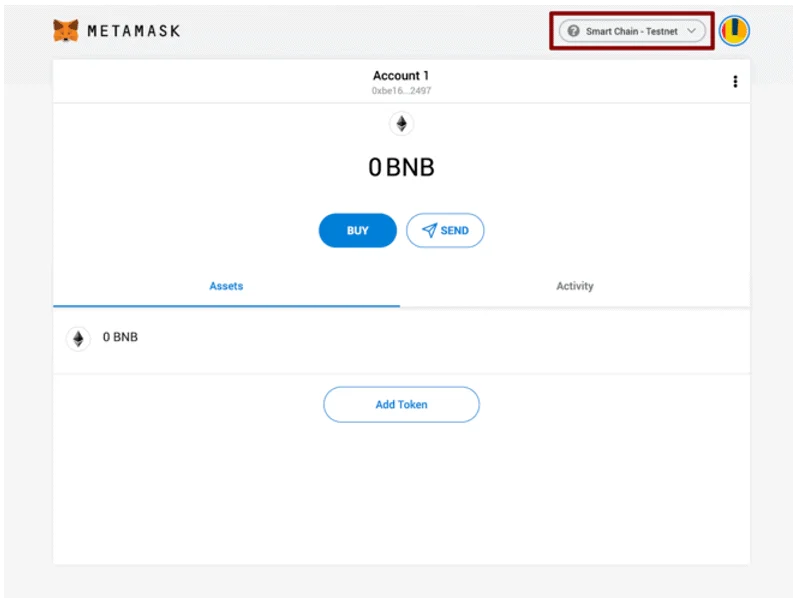

Once you Save the Network and return to the main view, you’ll notice two things: the network has automatically been set to the one you just entered, and the units are no longer denominated in ETH, but in BNB. You might still see the Ethereum logo, but we are now interacting with the BSC.

How to deposit cryptocurrencies on Binance Smart Chain using MetaMask

Once a wallet has been set up, we can withdraw from our Binance account or use the Binance Bridge.

To track our activity on the BSC blockchain, we can use BscScan which is made by the same team that made EtherScan.

Withdrawing from Binance Exchange to a BSC wallet

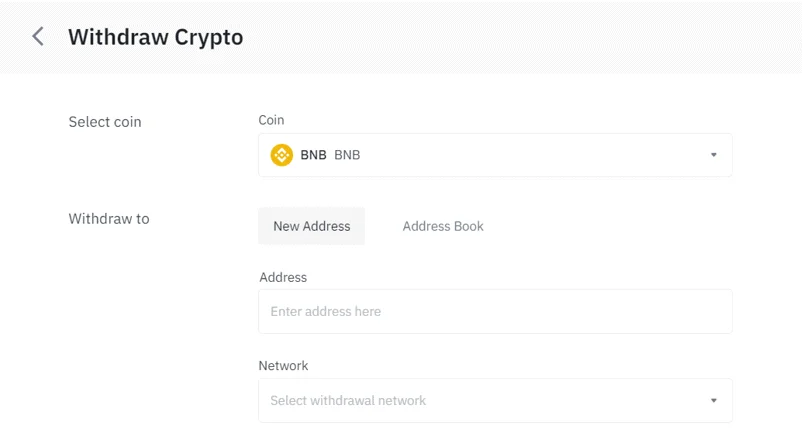

If you already have a Binance account, this may be the easiest option to simply withdraw from your Binance account to a BSC wallet.

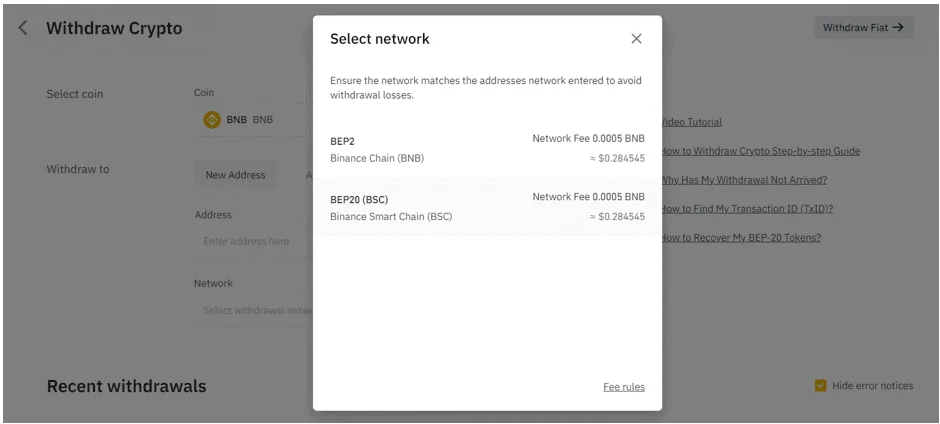

Select the BEP20 compatible token, here we have taken BNB as an example. Select Withdraw and you will land on this page

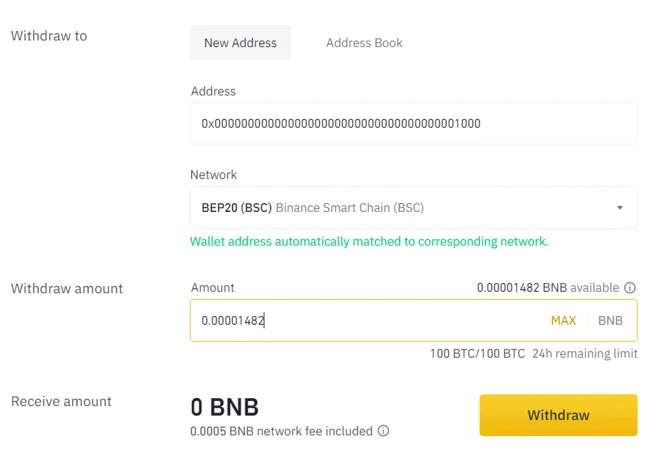

In the “Address” section, put in your BSC wallet address. Binance will automatically change the “Network” to “BEP20 (BSC)”. If it doesn’t, change it manually.

Then simply enter the amount you wish to send and click on withdraw. After a few conformations, you should see the funds arrive in your MetaMask BSC wallet.

How to use the Binance Chain Wallet Extension

Download the Binance Chain Wallet Extension from the web store. Binance Chain Wallet Extension is available ob Chrome and Firefox.

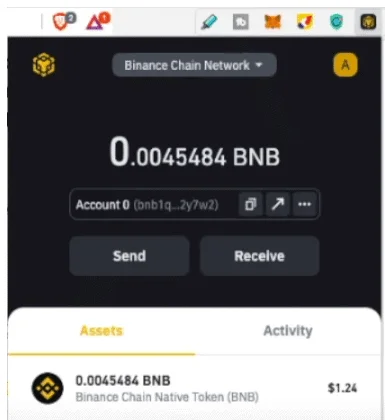

Transfer some funds from your Binance Exchange or MetaMask over to this Binance Chain wallet. We will use BNB as an example here.

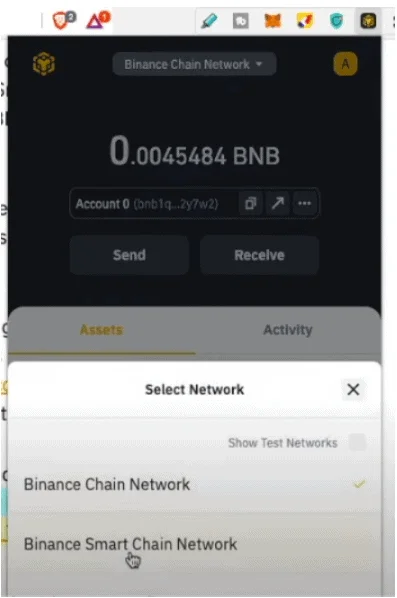

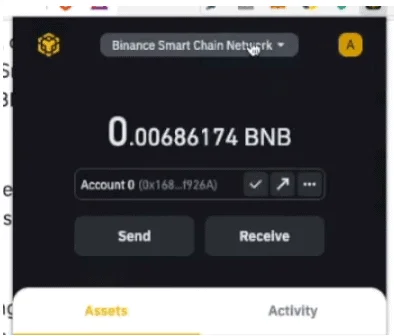

Click on “Binance Chain Network” on the top and change it to “Binance Smart Chain Network”. Copy the address and switch back to “Binance Chain Network”.

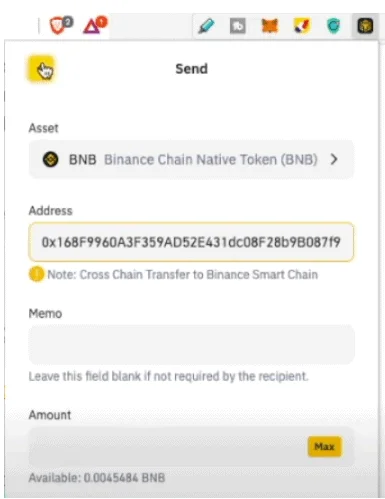

Click on Send. Paste the BSC address and click on the arrow next to send on the top left corner of the screen.

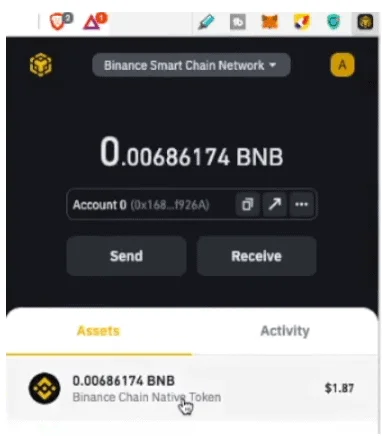

Change the network back to “Binance Smart Chain Network” and congratulations, your funds will near instantly be transferred cross chain.

How to use Binance Bridge

Another great way to bring assets to BSC is using the Binance Bridge. You can select many of the biggest blockchains, such as Ethereum or TRON, and convert their native tokens to wrapped tokens on BSC. The bridge works in both directions. You can monitor the on-chain reserve that ensures that the wrapped tokens on BSC are sufficiently collateralized by the native tokens in the Proof of Assets.

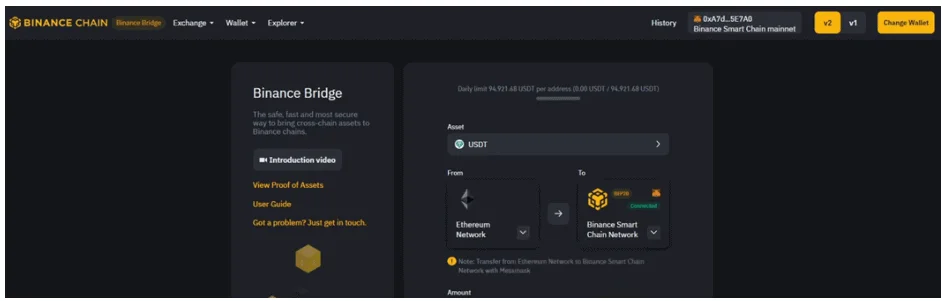

Go over to Binance Bridge and connect your MetaMask by clicking on “Change Wallet” in the top right corner of the screen. Make sure to change the settings over on MetaMask so that its pointing towards the BSC.

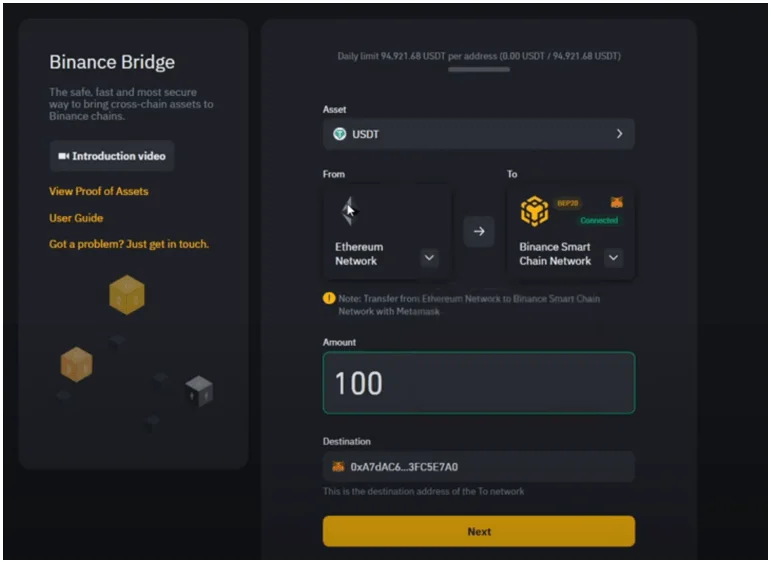

Once connected, pick you token you would wish to port over to your BSC. Here we have selected USDT as an example. Enter the amount you wish to send and click on next. Make sure to doublecheck the destination address.

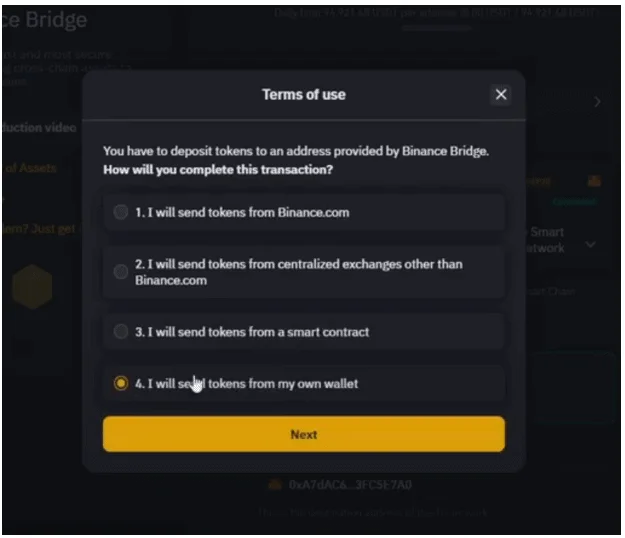

Next you will be greeted with options on how you wish to complete the transaction. Select “I will send tokens from my own wallet”

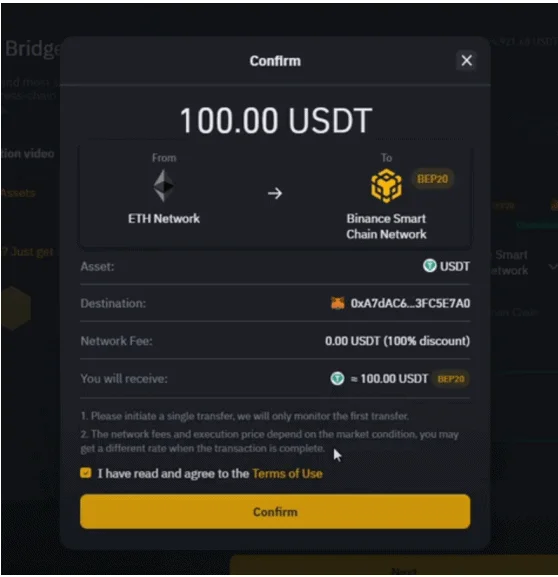

Once selected, a popup will appear with the truncation summary and confirmation. Click on Confirm.

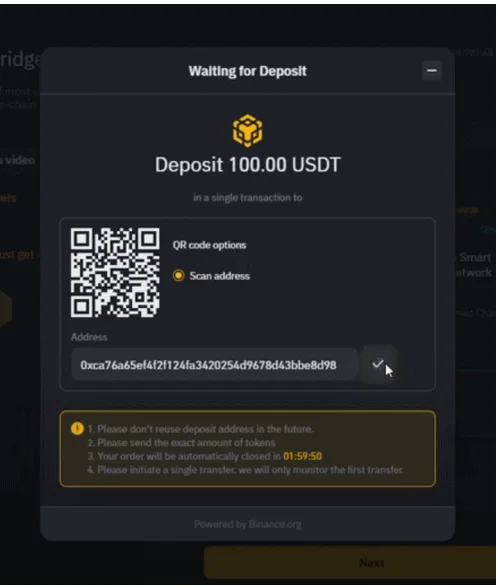

Next there will be a popup asking you to send the selected token and amount to an address.

Go back to your MetaMask, switch back to your Ethereum network, and send the funds from your Ethereum wallet to the address mentioned above. Switch the network back to BSC and after a few conformations, you should see your funds arrive in your MetaMask BSC wallet.

Closing thoughts

Binance Smart Chain greatly extends the functionality of the original Binance Chain. Though still in its infancy, the promise of BNB staking alongside EVM compatibility makes the platform an ideal engine for developers building powerful decentralized applications. And as long as the most popular smart contract-based blockchain, Ethereum, continues to struggle with congestion, slow transaction speeds, and exorbitant transaction fees, we can expect to see the increased adoption of more affordable alternatives like BSC, Polkadot and Cardano to continue.

However, we must keep in mind that the centralized nature of the BSC is a problem for its DeFi narrative. The only way to get onto BSC is via the central crypto exchange Binance or the central Binance Bridge. Here, the central provider has full control and can stop deposits and withdrawals on BSC at any time creating a direct bottleneck that centralizes BSC. Binance suspended withdrawals from the Binance Smart Chain to prevent a fraudster from laundering stolen cryptocurrencies. Although victims were happy about the measure, this intervention highlighted how centralized BSC ultimately is. Ethereum advocates, therefore, see BSC as more of a centralized database.

Regardless of the increasing demand for BSC and other options, Ethereum remains on top. Numerous detailed and tested documentation makes life easier for developers and the existing infrastructure, security, decentralization, and network effects adds to its appeal. The high transaction fees are an imposition, especially for smaller market participants, but at the same time show that the Ethereum network is more popular than ever before. Serious developers and companies still choose to develop their applications on Ethereum with the EIP-1559 update planned for July 2021 and Ethereum 2.0 in the horizon. Second layer solutions, such as Optimism, which promises faster and cheaper transactions, are also supposed to eliminate the scalability problem.

So, can Binance Smart Chain dethrone Ethereum? While the size and influence of the Binance exchange and the market cap of the BNB coin make it a strong contender, its centralized nature runs counter to the central ethos of the crypto economy, so it’s unlikely to replace Ethereum anytime sson. Ultimately, though, the crypto economy is not a zero sum game so a more likely scenario is that both will flourish, with the competition between them driving innovation on both networks. A deep dive into the BSC technical side can be found in the whitepaper.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. (https://attap.umd.edu/) Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

ronalthapa

Ron achieved $60,000+ (peak PnL) in airdrop rewards in 2024. He is an expert in testnet airdrop farming. If there is a points system, he knows exactly how to min-max it. Ron is also a data-driven trader, proficient in LTF price action. He hopes one day to be in the top 10 of the Bybit WSOT leaderboard.