Balancer ($BAL) is an automatic market maker (AMM) protocol that reduces the cost and slippage between trades of different cryptocurrencies. Balancer is a decentralized replacement for the traditional market-maker, a 3rd party entity that provides liquidity to traded assets. Balancer protocol can be called upon by different decentralized trading platforms to automatically figure out the best rates and trading prices using Smart Order Routing (SOR). The protocol also provides the funds necessary to complete the trade, using the funds from available Balancer Pools. Balancer Finance was Launched in September 2019 by Mike McDonald and Fernando Martinelli, since then the Company had a successful seed round with $3 million invested.

Balancer uses the N-dimensional invariant surface that is built upon the Uniswap dapp. They also use Automated Market Makers (AMMs), much like UniSwap, which are built off computer algorithms to regulate the market. Their Pools are doing away with portfolio management fees with users instead of collecting fees from traders, who re-balance the portfolio by “following arbitrage opportunities”.

Balancer has shifted itself into a prominent position within the Decentralized Finance (DeFi) hierarchy, as it’s BAL token caught the coattails of Compound Protocol’s governance tokens rise at the start of 2020. This saw increased attention on the exchange and has been earmarked as a competitor in the DeFi field. This perception coincides with an increase in popularity for DeFi projects and their mining qualities, something highlighted in a recent Forbes report on “DeFi Yield Famers”. So, if you are a budding or curious yielder or someone looking to understand the emerging DeFi market, this is the guide for you. In this article we provide a full breakdown of the project, what it is and explain the benefits of using this DeFi exchange and protocol.

To learn more about Balancer including its strengths and weakness, check out our video:

Balancer’s Pools Explained: What are they?

Balancer pools are collections of user supplied funds that are used to provide liquidity to trades and transactions. These pools can total up to more than $11 Million USD (eg, the USDT, BAT and COMP pool). This collection of funds will be called upon during cryptocurrency trades as the as the counter-party to the transaction, thus providing liquidity to traders.

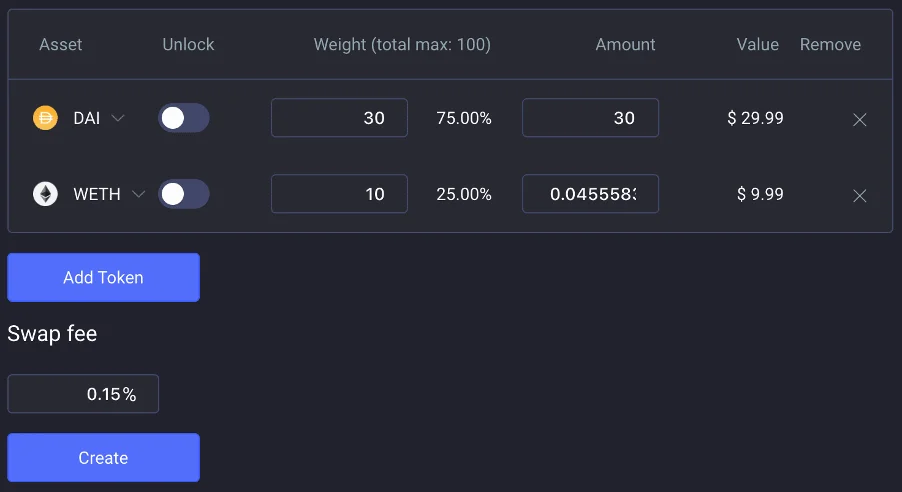

Controlled/Private Pools: These are when a fixed state is over the pool and the creator can set out the tokens and weights. This is usually done for private actors who don’t want outside liquidators, for example third party liquidators working with large quantities.

Finalize/Shared Pools: These pools are open for all actors to add liquidity and is a one way transition. They can not be amended and have a fixed parameter, unlike controlled pools and are usually for the general public to liquidate and make profits.

Alongside the two main subcategories of pools, there are other more specific smart pools that you can use. For example, Liquidity Bootstrapping Pools (LBPs) give the opportunity for teams to release a project token while at the same time building deep liquidity. Other examples include stablecoin pools with zero impermanent-loss, which founder Martinelli wrote an extended explainer here.

$BAL Token

In its initial launch, Balancer didn’t have their own native token but this changed this year, with the company revealing their governance token $BAL. The Company began distributing the token on June 23rd 2020 and will be distributed on a weekly basis for liquidity providers on the site.

However, there is no economic value to BAL tokens, rather they are currency for governance rights on the protocol. These rights allow the holders to have a say on the structure of Balancer protocol, with weight in terms of implementing new features, protocol fees, and larger structural changes like layer 2 scaling as well as contracts on other blockchains.

There are 100 million tokens created but 25 million of them have already been allocated to the founding members, core developers, advisers, and investors. The rest though are free to be mined by Balancer users who add liquidity.

According to Balancer’s website: “Every week 145,000 BALs, or approximately 7.5M per year, are distributed to liquidity providers. This means in the first year of BAL’s existence there would be 30% supply inflation off the initially allocated supply of 25M tokens.” So, how can you earn the weekly BAL allocation? This is done through BAL liquidity mining, which is discussed below.

BAL Liquidity Mining: How to earn $BAL tokens?

Liquidity mining has become one of the most popular topics of conversation in the space of decentralized finance (DeFi) in recent weeks. At its core, liquidity mining is essentially when users supply liquidity of assets to a DeFi protocol in exchange for some kind of reward. That reward may be various tokens, including governance tokens of the underlying DeFi protocol (which may end up having monetary value – like COMP). It basically offers a way for users to earn money on assets that they hold.

The main way to earn $BAL tokens is through Liquidity Mining. Essentially, Balancer rewards liquidators who pay into their pools in the form of $BAL tokens. The Company’s proposal is to give out BAL tokens in proportion to the amount of liquidity each address contributes relative to the total liquidity on Balancer.

Another way to make BAL is through creating a pool and reaping the benefits of trading fees. These are handed out in the form of $BAL. This system also incentivises the pool creator to lower fees as the lower the fees are, the more BAL they receive. Balancer’s fee gives pool creators a short term or a long term option, and they hope it will encourage lower fees so that traders are lured onto the exchange.

Speaking on the issues concerning distribution of BAL and governance rights, founder Martinelli said: “By far the most important factor or reason why we are doing that is because we want this thing to be decentralized. We believe in a decentralized, trustless future, and we want Balancer to do that. We need the distribution to be in a healthy way.”

Balancer Yield Farming & Best Pools

Top liquidity pools on Balancer are currently returning up to 30% APR on Return on Liquidity. These rates have drastically improved after the Cap Factor update on July 5th 2020.

- sETH 50% WETH 50% | $7,000,000 USD Liquidity

- sUSD 50% USDC 50% | $7,400,000 $7,000,000 USD Liquidity

- USDC 50% mUSD 50% | $18,878,747 USD Liquidity

- MKR 60% WETH 40% | $13,219,311 USD Liquidty

The best way to find the current best rates and return on liquidity is via the Predictions Exchange Chart.

Balance Coin Whitelisting

In order to quality for airdrops of $BAL Balancer Governance token, pools need to have at least two coins that are on the whitelist. Coins are added to the balancer whitelist on a weekly basis. The amount of $BAL being distributed depends on the trade volume and total liquidity, with a maximum of $

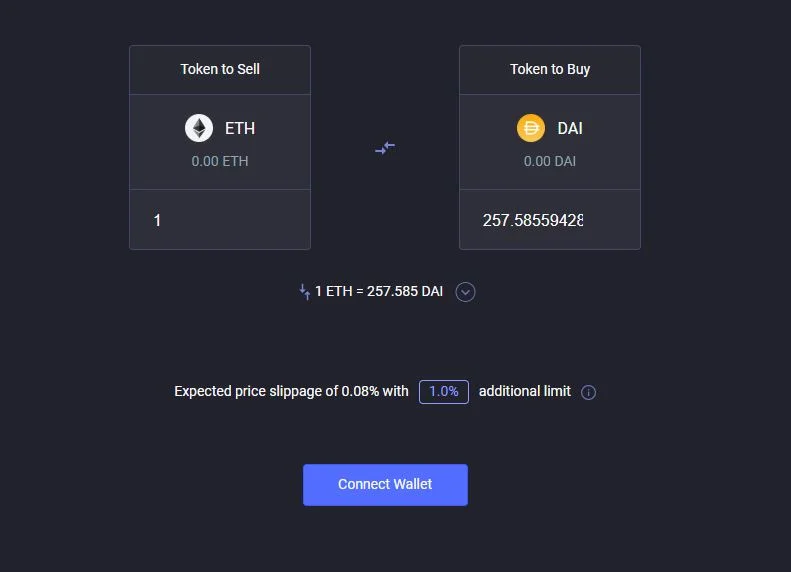

Trading on Balancer’s Exchange

Alongside their liquidity and pools, Balancer is first and foremost a decentralized exchange. With no KYC or signups, the anonymity and privacy is upheld. All you need to start trading on there is a wallet like MetaMask. Learn how to set up a Metamask account here.

The Exchange has a number of tokens available to trade. These include: Ethereum (ETH), DAI, MKR, USDC, REP, BTC++, WBTC, WETH, BAT, SNX, ZRX, LINK, DZAR, UMA, LRC, REN, LEND, KNC, COMP, OCEAN. The Exchange also has a number of tokens without pools such as tBTC, ANT, cUSDC, cDAI, imBTC, pBTC, sBTC, sUSD, PNK, AST and RPL.

Balancer: are there any risks?

Decentralized exchanges are often associated with high risks. This sort of ability to trade so easily with high interest rates is a concern. This was highlighted more recently by Ethereum founder, Vitalik Buterin, who cautioned that they were “flashy DeFi things” which sometimes come with “unstated risks attached”.

Balancer has acknowledged the risks, with their website warning users that: “Balancer is a very new protocol. Although we are taking every precaution and doing extensive audits, this is still very much a beta product. Use small amounts of funds to start.”

Conclusion

Overall, Balancer has position itself as a powerful tool to automate marketing making and reduce transaction fees for different cryptocurrencies. It’s leading the liquidity pool market with the ability to create n-dimensional liquidity pools which is a market first. With their unique formula which negates and actively discourages large fees, Balancer has created a decentralized project that could potentially be a self-sufficient system with a community emphasis.

For now though, the main target for Balancer is to create stiff competition for UniSwap and make themselves the industry leaders in the AMM field on Ethereum. Many believe this is possible as the DEX functionality on Uniswap is the same as Balancer, as one Uniswap token-for-token pool is equal to the Balancer pool with two tokens set to 50/50, or 1:1, value.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.