Aptos, a repurposed blockchain initiative of Meta’s abandoned web3 project (formerly Facebook). Its mainnet and token launch were hugely anticipated owing to its revolutionary infrastructure that might just surpass all other layer-one protocols. All you need to know about Aptos is in this article, made simple to understand and updated in real time.

What is Aptos?

Origin of Aptos

Aptos also known as Aptos Labs is a web3 startup focused on building a scalable layer-1 blockchain. I know what you’re thinking, not another new smart-contract layer claiming to be more scalable than the others.

But Aptos is not a new entity of its own, in fact, the company was founded by developers who formerly worked on Diem, Meta’s blockchain initiative that was abandoned in January. This means that the project already has a solid foundation to build its products off of.

Key Features of Aptos Blockchain

Aptos utilizes key elements of the former Diem blockchain and Move, a Rust-based programming language independently developed by Meta. The company also claims the network will be able to process over 130k transactions per second using its parallel execution engine (Block-STM), which results in low transaction costs for users.

For context, most blockchains either execute smart contracts sequentially or require a massive parallel workload for improved performance, which requires a lot of power. Aptos differs from other blockchains because a single failed transaction will not hold up the entire chain. Instead, all transactions are processed simultaneously and validated afterwards. The ones that failed are aborted and re-executed, thanks to their STM (software transactional memory) libraries which detect and manage conflicts.

As a result, the combination of these technologies streamlines the entire network’s throughput capacity, which has been a major bottleneck for other layer-1 blockchains. This is a short summary of Aptos’ smart contract execution according to their white paper published in August 2022. Their model is based on cloud infrastructure as a scalable and cost-efficient platform for building widely-used applications.

Aptos enables DeFi projects to be built on its blockchain. So far, there are over 30 DeFi projects on the ecosystem. These projects include decentralized exchanges, lending protocols, and liquid staking. An example of this is Aries Markets– a margin trading protocol.

Who is the Team behind Aptos?

Aptos is co-founded by Mo Shaikh (CEO) and Avery Ching (CTO), both former Meta employees who have years of experience as a senior developer and engineer in the blockchain industry.

The team consists of a battle-hardened group of PhDs, researchers, engineers, designers and strategists. They are the original creators, designers and builders of Diem.

What’s Happening with Aptos?

Aptos Funding

Aptos has been securing a sizeable amount of funding from numerous crypto heavyweights despite the bear market. In March 2022, the company received $200 million in funding from a16z, Tiger Global, and Multicoin Capital, among many other venture capitalists.

In July, the company raised $150 million in a Series A financing round led by Sam Bankman-Fried’s FTX Ventures and Jump Crypto.

Moreover, during the Venture Round on 15th September, Binance Labs doubled down on Aptos, bringing up the blockchain startup’s valuation to a massive $4 billion according to Bloomberg. With the new funding from Binance, Aptos quadrupled its valuation in six months as per Crunchbase’s report.

A few days later on 28th September, an undisclosed amount was also raised during the Venture Round by Dragonfly Capital.

Being backed by Binance Labs is a good sign that the project shows promise. In fact, Yi He, co-founder of Binance and the head of Binance Labs, chose to invest in Aptos in part because of the Move programming language the company is using to build its blockchain.

Aptos Team and Ecosystem Expansion

Moreover, the team at Aptos has been actively hiring, most notably they have acquired several former Solana staff such as Austin Virts, former Head of Marketing at Solana.

Not only Solana staff but a lot of hardcore Solana proponents have jumped ship for Aptos as well. With the narrative of Aptos being the next Solana, people are speculating whether investors actually believe in their tech long-term, or it is simply a pump and dump for venture capital firms (VC) and whales to make back their money due to the series of liquidation across the market. VC-heavy projects should be considered a red flag, but in the case of Aptos, there is more than meets the eye.

Aptos Testnet

Aptos has been focusing on driving the growth of their ecosystem. Since May, Aptos has launched their testnet campaign named “Aptos Incentivized Testnet” (AIT) and is divided into four stages according to their roadmap: AIT1, AIT2, AIT3 and AIT4. The goal is to invite and reward node operators, developers, ecosystem builders, and auditors alike to deploy applications and stress-test the decentralized network, ensuring the community is ready to launch a production-grade Aptos mainnet. Each stage focuses on executing different deliverables that contribute to the overall function of the blockchain.

AIT3 concluded on 9th September 2022, preparing for the final testnet which will lead to the mainnet launch if successful. Throughout the series of testnets, millions of transactions have been carried out, tens of thousands of nodes have been put up, and more than 1,500 have forked the Aptos-core repository. The codebase is open-source and the project has onboarded well over 100 projects. Teams such as Pontem Network, Protagonist, PayMagic, MartianDAO, Solrise Finance and more have already been building and testing on the network.

Furthermore, Aptos also has a grant program to offer project teams and individuals non-dilutive funding in order to further develop the ecosystem. One thing is certain that the earliest projects to develop on a blockchain are the ones that tend to moon if the blockchain is successful.

Aptos Mainnet Launch

Aptos Labs officially launched its mainnet “Aptos Autumn” on 12th October 2022, making it the first blockchain to debut Move technology. The mainnet is currently using the latest version of AptosBFT (version 4), which leverages a Byzantine Fault Tolerance (BFT) consensus protocol with responsive production optimization. To put it simply, this mechanism quickly minimizes the impact of failed validators on throughput and latency, significantly improving the blockchain’s performance. Aptos team has announced that they are developing AptosBFT (version 5) and will release it in a future upgrade.

The Aptos Bridge

The Aptos Bridge went live on 19th October 2022, powered by LayerZero, a trustless omnichain interoperability protocol. With this deployment, users will be able to move USDC, USDT, and ETH into Aptos from Ethereum, Arbitrum, Optimism, Avalanche, Polygon, and Binance Smart Chain. Users can also withdraw their funds out of the Aptos ecosystem, but as of now, there will be a 3-day transfer window to keep the network stable. According to LayerZero Labs, this will decrease as stability and time in production increase.

Another thing to note is that there is a rate limit to the bridge, starting at an outbound value cap of $1 million every 24 hours. As stability and time in production increase, this will also increase. Finally, since Aptos is an entirely new ecosystem, native assets outside of the APT token do not exist. This means that the only way to get other assets into the ecosystem is via “wrapped assets” from other chains.

Aptos Goes into Web3 Gaming

Aptos has recently announced its partnership with NPIXEL, a Korean Triple-A gaming studio. NIPXEL have been behind popular massively multiplayer online role-playing games such as Gran Saga, which boasts 4 million downloads since its launch in Korea and Japan.

Aptos and NPIXEL are joining forces to create METAPIXEL, a Web3 gaming ecosystem. This partnership sees NPIXEL creating games on the Aptos network. The goal of their partnership is to create a triple-A game that boasts true ownership of game assets.

Partnership with Google Cloud

Google Cloud and Aptos Labs have announced an expansion of their partnership, which now includes Google Cloud running a validator for Aptos. Additionally, Aptos has selected Google Cloud as the preferred infrastructure provider for its ecosystem, and the two companies will collaborate on an accelerator program through the Aptos Foundation that supports Web3 startups and developers working on Aptos.

Moreover, Aptos and Google Cloud will collaborate in hosting global hackathons and other events. The purpose of these hackathons is to bring decentralized developer communities together to collaborate and address common challenges. They will also invite both the Google developer community and the Aptos community to participate and work alongside engineers from both companies to deploy projects that can be quickly scaled globally. In line with their joint events at Bitcoin, Consensus, and Converge last year, they also plan to continue engaging their communities through happy hours and panels in 2023.

MoonPay Fiat On-Ramp Integration into Petra Wallet

Aptos Labs and MoonPay have teamed up to make it easier for billions of people to join the web3 space. This means that users can now purchase APT using Apple Pay. Aptos Labs’ wallet, Petra, now features an easy-to-use interface for exchanging value within the Aptos ecosystem. The partnership began in November 2022 when APT became available on MoonPay.

The integration of the MoonPay fiat on-ramp into Petra was a crucial step in enhancing the web3 user experience. The fiat on-ramp makes it easy for both new users and early adopters to get started on the Aptos network, as they can purchase APT using a variety of payment methods, including Visa, Mastercard, Apple Pay, and Google Pay.

Securing Move as the Underlying Programming Model

To ensure that Aptos is secure, their team has been developing bug-free code through a combination of disciplined software engineering practices and the right tools. This includes mandatory code review, continuous testing and integration, and best practices in the Rust ecosystem.

Moreover, Aptos has contracted auditing companies (Certik, Holburn), conducted community auditing, and worked closely with OtterSec. They also run a bug bounty program that offers rewards of up to $1,000,000 for critical bugs and $100,000 for crash bugs. Aptos has invested in fuzzing and added redundancy through a paranoid mode in the Move Virtual Machine.

Lowering Gas Fees with Community-Driven Feedback

Aptos is engaging with community builders to improve its ecosystem, with a focus on reducing gas fees. The team has analyzed on-chain data and interviewed builders to gather insights. Their three-stage plan includes reducing costs for dynamic NFTs, developing gas-efficient data structures, and creating a demand-driven gas model.

The current gas framework combines execution and storage fees, leading to an unbalanced gas price. The team will separate storage and execution fees and provide storage refunds to solve these issues. The team is committed to delivering these improvements in the coming months to better serve the network’s demand.

What is the APT token?

APT is the native token of the Aptos platform. The APT token is used to pay for transaction and network fees on Aptos.

Fees will be charged on all transactions on the network and are specified in Aptos tokens. Validators will have the opportunity to prioitise the highest-value transactions on the Aptos network, and to discard transactions of lower value. The result is that the blockchain would still be able to operate efficiently when the system is at capacity. Eventually, network fees will also be deployed so that the cost of using Aptos would be proportionate to the costs of deploying hardware, maintenance, and node operation.

In addition, APT can be used for governance voting on upgrades to the protocol and on/off-chain processes, and to secure the blockchain by way of a proof-of-stake model.

Validators holding a minimum number of staked APT tokens can participate in transaction validation on the Aptos blockchain. The benefit of being a validator is that they can decide on the division of rewards between themselves and their respective stakers. On the other hand, stakers can select any number of validators to stake their tokens with in order to receive a pre-agreed split of the rewards. Rewards will be distributed to validators and stakers at the end of every epoch.

At present, the maximum reward rate for stakers starts at 7% per annum and this amount is evaluated at every epoch. The maximum staking reward however will decrease by 1.5% per year until it reaches 3.25% per year. However, all reward amounts and mechanisms can be changed by governance voting.

Aptos Token Listing

Binance announced the listing of Aptos (APT) on their exchange and trading of the APT token commenced on 19th October 2022, 01:00 UTC. The spot trading pairs include APT/BTC, APT/BUSD, and APT/USDT, and withdrawals for APT will open on 20th October 2022, 01:00 UTC. Moreover, the listing fee for APT is at 0 BNB and users can now start depositing APT in preparation for trading.

In addition, Binance will add APT as a new borrowable asset on cross margin and isolated margin within 48 hours from 19th October 2022, 01:00 UTC. Both margin pairs include APT/BUSD and APT/USDT.

Where can I buy the Aptos ($APT) token?

Aptos and MoonPay have recently partnered up to allow Petra wallet fiat on-ramps. So users can now buy APT using Visa, Mastercard, Apple Pay and Google Pay.

The APT token can also be purchased and traded on the following exchanges: Binance, Coinbase Exchange, OKX, and Digifinex.

Start trading $APT on Binance and enjoy 20% off trading fees by signing up here.

Is Aptos Worth Investing?

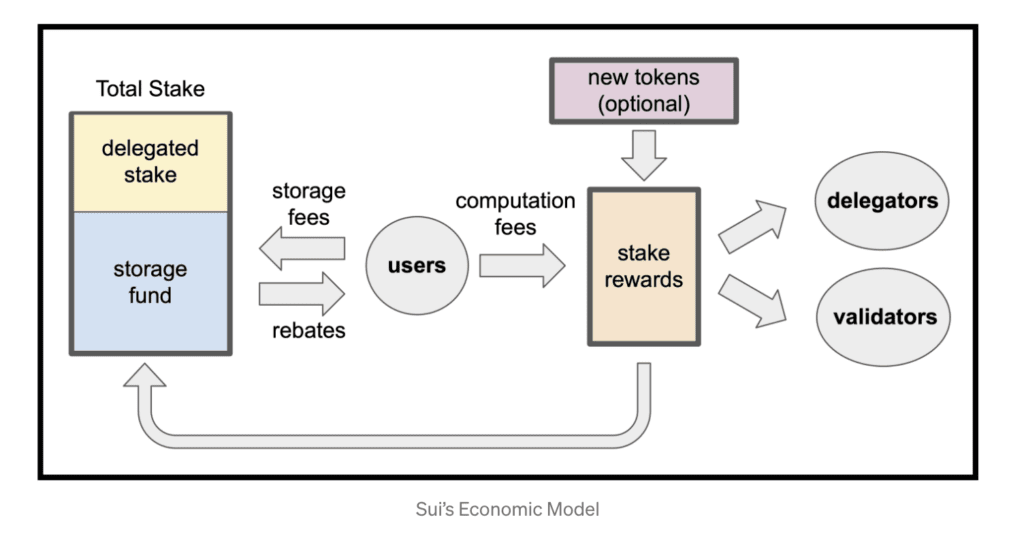

Aptos offers unique and promising features that cannot be found in other layer-1 protocols (except for Sui which is also a Diem-based blockchain). As such, Aptos has the potential to compete with Ethereum and Solana in terms of scalability and overall network capacity.

However, Aptos is heavily backed by venture capitals (VC), and in light of the VC bankruptcy domino effect toppling across the industry, investors should be cautious when dealing with VC-heavy projects. In fact, according to Aptos Explorer, its total supply is over 1 billion and more than 800 million of the tokens are actively staked, suggesting that early investors, private buyers, and the Aptos team collectively control 80% of the token supply.

Nevertheless, at the end of the day, Move technology is most likely here to stay as it is a revolutionary programming foundation for blockchain scalability and security. And with decades of experience in the blockchain industry as well as Meta, Aptos Labs stakes its reputation on the long-term success of the blockchain.

Frequently Asked Questions (FAQs)

What is Aptos?

Aptos is a layer-1 blockchain that uses key elements of the former Diem blockchain and Move, a Rust-based programming language independently developed by Meta.

How to buy Aptos?

Binance announced the listing of Aptos (APT) on their exchange, and will be available for spot trading at 19th October 2022, 01:00 UTC.

Does Aptos have a coin?

Binance announced the listing of Aptos (APT) on their exchange, and will be available for spot trading at 19th October 2022, 01:00 UTC.

When is Aptos ICO?

Binance announced the listing of Aptos (APT) on their exchange, and will be available for spot trading at 19th October 2022, 01:00 UTC.

Who is the Aptos team?

The Aptos team consists of researchers, designers and engineers of Diem, Meta’s blockchain initiative that was abandoned in January 2022. Aptos currently has 60 employees on their team.

Who is the founder of Aptos?

Aptos Labs is co-founded by Mo Shaikh and Avery Ching, both former Meta employees who have years of experience in the blockchain industry.

Is Aptos funded?

Aptos Labs has raised $350 million in total from FTX Ventures, Jump Crypto, a16z, Tiger Global, Multicoin Capital, among many other capital ventures. Currently, Aptos Labs has 28 investors. Aptos Labs also received an undisclosed amount in strategic investment from Binance Labs, bringing its valuation to $4 billion.

What is the Aptos testnet?

Aptos has an incentivized testnet program where the Aptos team welcomes community members to help with testing. The first testnet was Aptos Incentivized Testnet 1 (AIT1) where the community and the Aptos team created and deployed a decentralized network for over a week. Those who met a 95% participation rate were rewarded. Eligible individuals who were unable to meet the original expectation, but still participated in at least 5% of the testing rounds were also offered 50% of the rewards.

Aptos Incentivized Testnet 2 (AIT2) was concluded in late July 2022.

The latest Aptos Incentivized Testnet 3 (AIT3) opened for registration on 19th August 2022 and will launch on 30th August 2022. Participants that meet the team’s success criteria will receive 800 Aptos tokens. For more details and signup, check out the Aptos blog.

Is Aptos Labs listed on any stock exchange?

Aptos Labs is a private company and is not listed on any stock exchange.

What is the price of Aptos Labs (APTOS) cryptocurrency?

Aptos Labs (APTOS) does not currently have a cryptocurrency token. Binance announced the listing of Aptos (APT) on their exchange, and will be available for spot trading at 19th October 2022, 01:00 UTC.

Is Aptos the same or related to Sui?

No, Aptos and Sui and completely different and unrelated projects. The only connection between the two projects is that both teams have previously worked in blockchain development at Meta (formerly Facebook).

Is Aptos worth investing?

Aptos shows a lot of promise but investors should be cautious as the project is heavily funded by venture capitals. But at its core, Aptos’ programming language, Move, is most likely here to stay as it offers better scalability and security compared to other layer-1 blockchains.

Is there any Aptos $APT token airdrop?

Early Aptos network participants were given an airdrop of APT tokens. A total of 20,067,150 APT tokens were airdropped to 110,235 participants.

How do I participate or be eligible for an Aptos APT airdrop?

Previous Aptos users who had completed an application to join the Aptos Incentivized Testnet or minted an APTOS:ZERO testnet NFT were eligible to claim APT tokens. Those who were eligible to receive APT tokens were notified by the Aptos team via email. There are no plans for further airdrops for the time being.

Which wallet support Aptos?

Petra Wallet and Pontem Wallet are native non-custodial wallets for the Aptos ecosystem, and can integrate with many Aptos DApps.

Why is Aptos dumping?

Aptos’ price usually comes under pressure whenever there is a token unlock event. This is because early investors will typically sell those unlocked tokens to take profit. The next one will unlock on February 12, 2023.

What is the price prediction for Aptos in 2023?

Aptos will most likely increase in value, as the narrative for layer-1 blockchain scaling solution is trending in 2023.