e-Money is aiming to reimagine the stablecoin. Traditional stablecoins are cryptocurrencies designed to maintain a value that is pegged to a particular asset. But this has its drawbacks- for example, sudden market crashes of the underlying asset can result in the stablecoin being unable to keep up and maintain its peg.

e-Money distinguishes itself with its novel token- an interest bearing stablecoin that can shift in value to accommodate economic pressures.

Check out our interview with CTO Henrik Aasted Sørensen:

Background

The team behind e-Money is Block Finance A/S while their motive is to create a platform that can bridge blockchain with the traditional financial system. This way, stablecoins can find a stronger use case and attract greater adoption as it promises an alternative means of exchange, free from the interference of financial middlemen or large institutions.

The platform is built on top of the Cosmos chain, which is also the same network where some of the biggest decentralized exchanges are developed. Furthermore, e-Money promises a faster, easier, and cheaper method of making peer-to-peer transactions worldwide.

What is e-Money?

e-Money is a blockchain-based payment platform that aims to make peer-to-peer payments and money transfers cheaper and more accessible digitally. With e-Money, Block Finance A/S intends to do away with the intermediaries present in most traditional financial services by introducing ‘currency-backed’ stablecoins.

Later in this article, we will talk about the difference between this token class, as well as algorithmic and collateralized stablecoins. Basically, eMoney’s own currency-backed stablecoins serve as the backbone of e-Money’s frictionless digital asset for cross-border transactions.

The team behind e-Money established the coin to usher in a new model for stablecoins that has the following characteristics:

- Completely backed with actual bank deposits and government bonds;

- Can support multiple currencies;

- Lower transaction charges;

- Quick transaction settlement times; and

- Interest-bearing.

How does the e-money stablecoin work:?

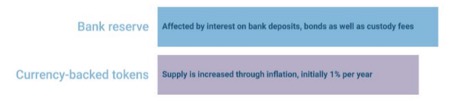

e-Money is an innovation from the original concept modeled for collateralized stablecoins. One of its differences, however, is that it can hold interest. This is similar to how savings accounts in traditional banks work, making them a viable alternative store of value compared to other stablecoins that also fluctuate based on the movements of the whole crypto market.

e-Money’s currency-backed token does not ensure a 1:1 peg with the fiat it represents. Instead, its price depends on the value held by the currency plus the interest accrued on the reserves of e-Money on the represented fiat.

Annually, the supply of the e-Money token will be inflated by 1%. And unlike algorithmic stablecoins, the value of a currency-backed stablecoin does not depend on the need to manage its overall supply, monitor the performance of its underlying reserve, or collect transaction fees.

Features of e-Money

Cosmos and Tendermint Deployment

e-Money is developed on top of the Cosmos chain, making it interoperable with other blockchain ecosystems. However, e-Money’s system maintains its independence from other chains through the implementation of a ‘sovereign zone.’

Cosmos is used to enable inter-blockchain communication (IBC), a feature known to many as the ‘internet of blockchains.’ Through the Cosmos Hub, e-Money’s platform can frictionlessly interact with other blockchain networks should they need to be implemented on different platforms.

Tendermint deployment is also another remarkable feature of the platform as it helps achieve faster transaction settlement times without compromising data integrity and security through a Proof of Stake consensus mechanism.

Validator Network

Since the platform secures blockchain consensus through stakers, validator networks are put in place to ensure the security of the network. Therefore, e-Money implements the validator service accessible in the Cosmos Hub and IRISnet’s IRIS Hub.

The main task of validators is to confirm the authenticity of blockchain transactions involving e-Money, as well as to ensure the integrity and health of the whole network. Currently, there are already over 40 validators working to maintain the security of the platform.

e-Money’s Decentralized Exchange

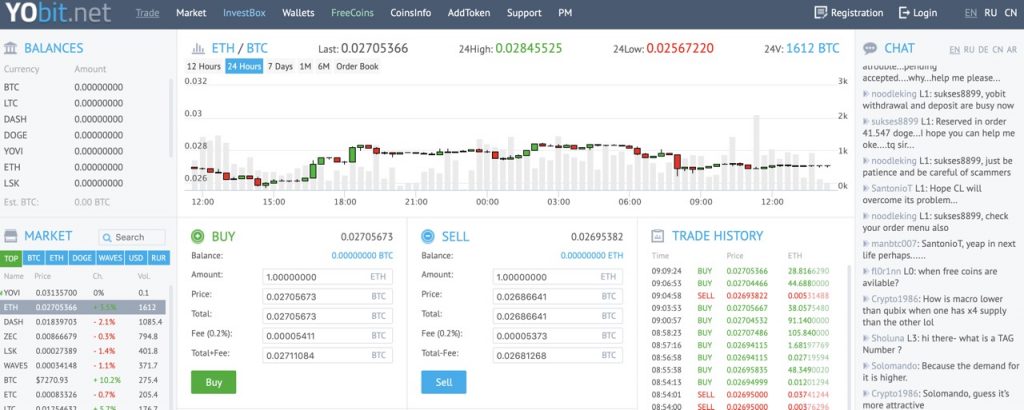

Along with the currency-backed stablecoin, e-Money also has a decentralized exchange platform where users can access cryptocurrencies available in the Cosmos ecosystem.

It bears some differences from a typical decentralised exchange (DEX). Here are some of them:

- Payments needed for trades are only for transaction fees;

- Transaction fees can be paid with your preferred token;

- There are no listing requirements to use the DEX, any token is already tradeable once supported by the platform;

- Higher liquidity since token balances can be sold on different orders; and

- Faster transaction throughput through an on-demand block generation method.

Risk Management

To manage the risks that are likely to be experienced by stablecoin holders, e-Money implements an interest mechanism that helps its currency-backed stablecoin maintain its value despite economic fluctuations.

To further mitigate the risks of partnering with single financial institutions to back their stablecoins, e-Money is collaborating with several banks. This spreads the risk that most collateralized stablecoins face when dealing with escrow accounts. e-Money is also putting a portion of their collateral into low-risk government bonds.

Regulatory concerns are also dealt with. In fact, e-Money’s team has already begun working with regulatory agencies in the EU to determine their status and plan their road ahead. They have legal counsels and advisors who are directly working on EU financial regulations.

Cosmos stacks, like e-Money, have already been audited and subjected to adversarial testnets. This ensures that the risk of users experiencing a problem with the platform is mitigated even before they are rolled out.

2 e-Money Tokens

There are two token classes supported on the e-Money platform. They are (1) Next Generation of Money (NGM); and (2) e-Money, a currency-backed stablecoin, which is a fiat currency represented onchain.

Next Generation of Money (NGM) Tokens

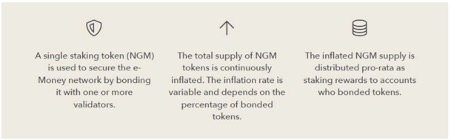

NGM token is primarily used for staking, as well as a reward incentive for users. Users can lock their NGM tokens on smart contracts for staking, or use them to nominate validators they trust to maintain the network. Annually, the NGM supply will be inflated by 10%, and then distributed proportionally to stakers.

NGM tokens will also be the backbone of e-Money’s operations, with token rewards being the only source of funding for the platform.

e-Money Tokens

e-Money, its currency-backed stablecoin, can represent several cryptocurrencies. Its main function is to support the exchange of currencies between e-Money users. They can be used for payments, remittances, and transaction fees.

Supported fiat currencies will have their own representation on the e-Money platform. These are currencies like EUR, CHF, SEK, NOK, JPY, USD, and GBP. Support for more tokens will be introduced soon.

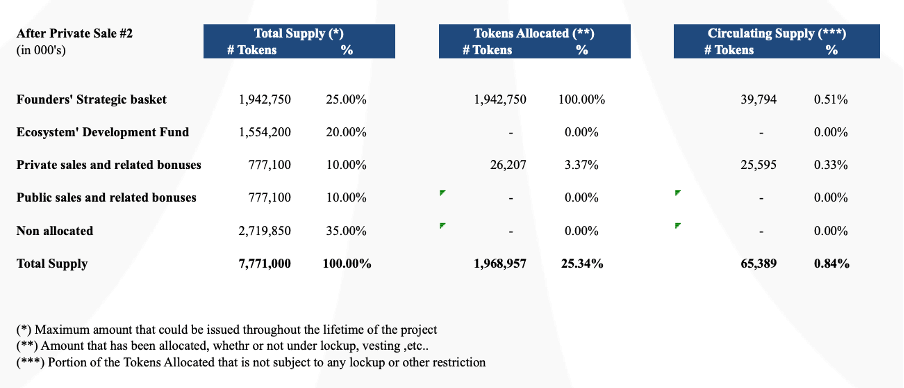

e-Money Token Metrics

The NGM token has an initial total supply of 100,000,000 $NGM and a circulating supply of 6,364,516 $NGM.

Funding Rounds

Seed Round (concluded) :2,285,000 NGM sold at 0.10 USD per token. 12 months vesting period.*

Private Sale (concluded): 6,700,000 NGM sold at 0.25 USD per token. 6 months vesting period.*

Public Sale (on 19th January 2021): 300,000 NGM to be sold at 0.50 USD per token. No vesting period.*

*The initial vesting date was 4th November 2020 at 1:00pm CET.

Token allocation

Marketing Costs: 280,000 NGM (0.28% of total supply)

Market Making Fees: 33,333 NGM. (0.033% of total supply)

Exchange Listing Fees: 600,000 NGM. (0.60% of total supply)

Liquidity Provisioning (Float): 1,193,026 NGM. (11.9% of total supply)

Customer Acquisition: 8,300,000 NGM. 8.3% of total supply)

Ecosystem Fund (Grants): 10,000,000 NGM. (10% of total supply)

Treasury: 60,000,000 NGM. (60% of total supply)

e-Money Token Sale

On 19th January 2021 at 12:00 CET, e-Money will launch the public sale of its NGM token on Polkastarter. This will be in the form of an Initial Decentralised exchange Offering (IDO). 300,000 NGM tokens will be available for sale at USD$0.50 each.

Conclusion

Stablecoins currently on the market have huge drawbacks. Problems with collateralization and the performance of their underlying assets can cause uncertainty on their value. For instance, MakerDAO’s DAI had encountered some problems when ETH crashed last March 2020, creating difficulties in maintaining its peg.

e-Money is proposing a potentially promising alternative. By being collateralized in its issuing currency and interest-bearing, they are resilient against the at-times volatile economic climate. It is also simplified as its underlying fiat reserve is calculated automatically, and transparent with the help of quarterly audits by Ernst & Young to ensure Proof of Funds.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.