Hot and cold wallets are used to store your cryptocurrencies, specifically your private keys which grant you access to your crypto assets. They are therefore a crucial element of the cryptocurrency space.

The major difference between hot and cold wallets is that hot wallets are connected to the internet whilst cold wallets are not.

For those holding cryptocurrencies, the choice between cold and hot wallets depends on factors such as the amount of coins you hold, the frequency in which you trade etc.

Hot Wallets

Hot wallets are connected to the internet and are generally more popular.

Examples of Hot Wallets

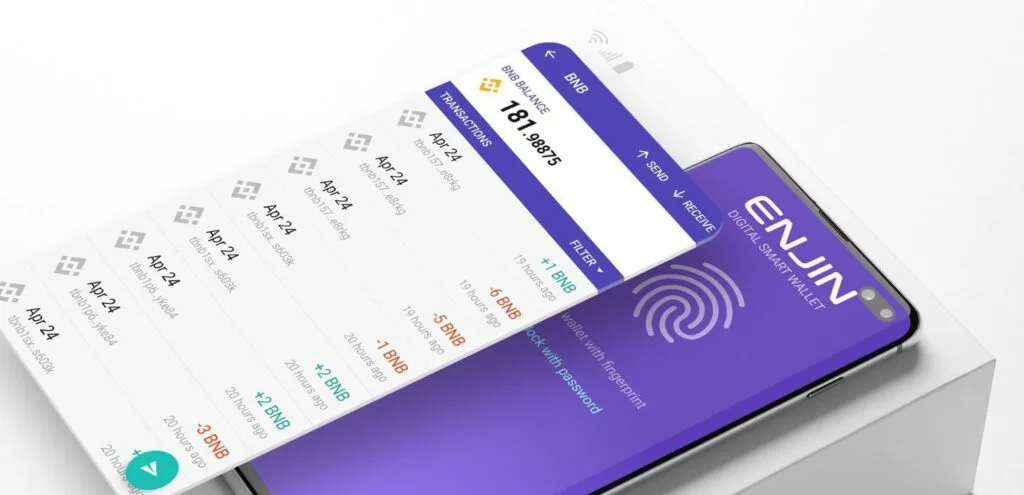

- Mobile wallets e.g. Enjin wallet – Check out our Enjin wallet review;

- Cryptocurrency exchanges – see our review of the best cryptocurrency exchanges;

- Desktop wallets e.g. Exodus wallet; and

- Wallet Extensions e.g. MetaMask, Coinbase, Phantom

Pros

- Easy to set up and use.

- Convenient to access funds for trading since it is already connected to the internet.

- Free.

Cons

- Vulnerable to hackers, as seen in the numerous hacks on cryptocurrency exchanges.

- If exchanges close, traders will be left with no recourse to recover their funds.

Cold Wallets

Cold wallets are also known as hardware wallets. They are physical offline storage devices that you plug into your computer to use.

Examples of Cold Wallets

- Ledger: Nano X or Nano S. Check out our Nano X review or Nano S review.

- Trezor: Model T or Trezor One. Check out our Model T review or Trezor One review.

- KeepKey: Check out our KeepKey review.

Pros

- Provide better security because your private keys are stored offline.

Cons

- Can be expensive; prices can range from US$59 for the Ledger Nano S to US$170 for the Trezor Model T.

- Extra steps are required for trading. Save for the KeepKey which is partnered with ShapeShift exchange, users must first send their cryptocurrencies from their cold wallet to an exchange before they can trade. And when cryptocurrency prices fluctuate by the minute, this can have a profound effect on your gains.

- Harder to use. They do require at least 10 minutes for initial set-up, and you will need to plug in your device every time before sending your cryptocurrencies. (www.speedclean.com)

- Inconvenient. Even with the Ledger Nano X’s mobile feature allowing you to connect the device to your mobile phone via Bluetooth, it’s still not as convenient as a mobile wallet, which is simply an app on your phone.

Conclusion

Whilst there is a longer list of cons for cold wallets, they are still highly recommended on the basis of significantly improved safety of funds.

Numerous people have suffered from hacks and closures of exchanges. These victims have no way to get their funds back, or at best, it will take a very long time. For example, Mt. Gox exchange was hacked in 2011 and 2014. To date, none of its victims have gotten any of their stolen funds back.

Meanwhile, hot wallets are very convenient — if you leave your funds on exchanges, you can trade with the click of a button.

We recommend keeping small amounts of cryptocurrencies in hot wallets for day-to-day trading or spending only. Whilst the bulk of your cryptocurrencies should be kept in cold wallets. If you obtain any gains from trading, you should also consider how much you want to retain for further trading and immediately transfer the rest to cold wallets.

Angela Wang

Angela loves cryptocurrency, technology that improves our lives...and food. Anything that merges these worlds together is even better.