What happened?

On 16th October 2020 OKEx suddenly announced that one of their private key holders (later confirmed to be Star Xu, OK Group’s CEO and Co-founder) is cooperating with a “public security bureau” and is unable to contact them. Therefore the Exchange cannot complete authorisations for transactions and thus decided to suspend all withdrawals of digital assets/cryptocurrencies from 16th October 2020 at 11:00 (HKT).

The Exchange did this under clause 8.1 of their Terms of Service which provides that, “8.1 Service Change and Interruption: We may change the Service and/or may also interrupt, suspend or terminate the service at anytime with or without prior notice.”

In particular, their Terms of Service defines their “Services” as the services that OKEx offers through OKEx.com or its app. According to the Terms of Service, you must agree to be bound by it to use the Services, including of course their rights under clause 8. (Tramadol) 1 to suspend it at any time.

This abrupt suspension has shocked the cryptocurrency community and caused prices of both Bitcoin and Ethereum to plunge. In particular prices for Bitcoin dipped from over USD$11,500 to USD$11,235 within a half-hour period. As of the time of writing, prices have still not yet fully recovered.

Meanwhile, there are rumours circulating that there is more than what meets the eye and that this suspension was a cumulation of events that were already in motion a few days ago. Let’s take a look at some events today (16th October 2020) which may (or may not) be relevant to this:

- 1:00a.m.: Twitter user @whale_alert tweets: 5,000 #BTC (57,033,847 USD) transferred from unknown wallet to #OKEx

- 4:00a.m.: Twitter user @whale_alert tweets: 1,180 BTC (13,588,646 USD) transferred from OKEx to unknown wallet

- 9:00a.m.: Twitter user @whale_alert tweets: 50,000,000 TRX (1,317,074 USD) transferred from OKEx to unknown wallet.

11:55a.m.: Chinese crypto media platform 非小號 (Feixiaohao) and UAICOIN publishes notices from OKEx that withdrawals will be suspended from 3:00p.m. onwards. This was also reported in a tweet from Co-founder of Chinese crypto media outlet @redtheminer who also notes the rumours circulating in the Chinese crypto community that over 800 accounts from a “certain large crypto exchange” are involved in cross border money laundering. - 12:00p.m.: OKEx announcement that it would suspend withdrawals from 11:00a.m. onwards.

- 1:00p.m.: OKEx finally tweets their announcement on the withdrawal suspension.

- 2:00p.m.: OKEx CEO Jay Hao tweets, reassures that all other operations are unaffected and that, “The investigation concerns a certain private key holder’s personal issue only. Further announcements will be made.”

- 2:51p.m.: Someone asks OKEx support “Why is Star Xu’s Weibo page emptied?” and they replied, “The person you are referring to has no relation to our platform”.

- 3:51p.m.: Twitter user @whale_alert tweets: 998 BTC (11,333,911 USD) transferred from Huobi to OKEx.

*All times are stated in HKT unless otherwise specified.

What will happen to Star Xu?

Based on the news so far, the speculation is that Xu was detained since around 9th October 2020.

According to commentary from PRC lawyers, Xu who is in criminal detention would only be permitted to meet or communicate with his lawyers. This would mean that he cannot meet his family or other staff in OKEx to handle the situation at the Exchange.

PRC lawyers have also commented that under Chinese Law, Xu can be held in detention for a maximum of 37 days (i.e. until 15th November 2020). After this, the People’s Procuratorate (i.e. the prosecuting authorities) will need to decide whether or not to approve an arrest. If an arrest is approved then Xu would continue to be detained pending trial. However, even if an arrest is not approved, if the authorities consider that further investigation is required then Xu may either be released on bail or subject to home detention. According to the PRC lawyers, if Xu’s family does not hear anything further on 15th November 2020 then it can be assumed that an arrest was approved.

Updates from OKEx

According to a further announcement on 6th November 2020, withdrawals are STILL suspended. They, however, do clarify that the “concerned party” is only “actively cooperating with a public security bureau in an investigation” and NOT arrested under criminal detention.

In a new update, they do say that they have sought legal support and guidance and by doing this has “made contact with the concerned party”. OKEx has explicitly said they cannot disclose any further information. Notably the announcement does not say whether this will result in withdrawals being able to reopen.

This does appear to be a step in the positive direction though, since according to the commentary from some Chinese lawyers a detained person is only permitted to meet with his own lawyers, rather than that of a company he is the CEO of.

Nevertheless OKEx in its latest Twitter post continues to reassure affected users that there has been no withdrawals from the Exchange since 16th October 2020 and that 100% of funds can be withdrawn when withdrawals can be resumed.

A few observations

There are reports from Chinese media that Xu was in fact already taken in by Police for investigation a week ago, whilst 2 executives that were also detained have since been released on bail. His arrest is causing a stir because he holds the private keys to OKEx’s funds, and according to Glassnode’s data, OKEx holds around 200,000 BTC i.e. USD$2.3 billion worth of Bitcoin.

There are reports that Xu was taken in for investigation in relation to matters unrelated to OKEx. In particular, it was in relation to funds he had borrowed from a Shanxi-based underground bank for the purposes of the backdoor listing of OKC Holdings on the Hong Kong Stock Exchange in 2019.

We’ve already mentioned this in our previous newsletter about the KuCoin hack. Please take your cryptocurrencies off exchanges and store them offline in a hardware wallet. If you don’t have one yet, please consider getting one. Check out our Ledger Nano X review or buy it here.

Withdrawals will resume on or before 27th November 2020

On 19th November 2020, OKEx announced they would reopen unrestricted withdrawals on or before 27th November 2020. They will also be launching significant loyalty reward campaigns for their users as a show of gratitude to their community and for the inconvenience caused to them.

We also note the announcement confirms that one of OKEx’s private key holders (likely to be Star Xu) has completed assisting investigation with authorities and has returned to his “normal business functions”. It is also confirmed that OKEx was not involved in any alleged wrongdoing or illegal activities. So for now we can all breathe a sigh of relief for Xu and OKEx.

JUST IN: Details of OKEx loyalty programs released!

As mentioned in the previous section, OKEx said they would launch loyalty programs for their users as a show to gratitude.

On 24th November 2020, OKEx announced the following reward and compensation programs after withdrawals open on 27th November 2020.

Users that made deposits, held tokens or traded during the withdrawal suspension period will be issued a one-time payment to users based on their assets and transaction conditions. The funds for this payment will come from 20% of OKEx’s total income from futures and perpetual swap transaction fees over the past 7 weeks which will be put into an incentive fund. The asset weight calculation will also be doubled for $OKB.

Users with assets exceeding 10,000 USDT before 4:00pm UTC on 23rd November 2020 will have part of their service fees waived and refunded once withdrawals resume in the form of a rebate card valued between 100 to 1,000 USDT.

For all users, there will be a Happy Friday Reward Program. This will start on 4th December 2020 and continue every Friday thereafter. To be eligible, users need to have daily average assets on OKEx or daily average trading volume greater than or equal to 100 USDT, and have KYC verification level 2 or higher. Users will get a BTC reward equivalent to OKEx’s futures and perpetual swap transaction fee income for that week * 10%* of the users daily average total asset value or trading volume (as the case may be)/ daily average asset values or daily average trading value of all users (as the case may be).

Note that for the purposes of calculating the rewards, if a user’s daily average asset value exceeds 10,000 USDT, it would be calculated as 10,000 USDT. Similarly, if the user’s daily average trading volume exceeds 30,000 USDT, it would be deemed as 30,000 USDT.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

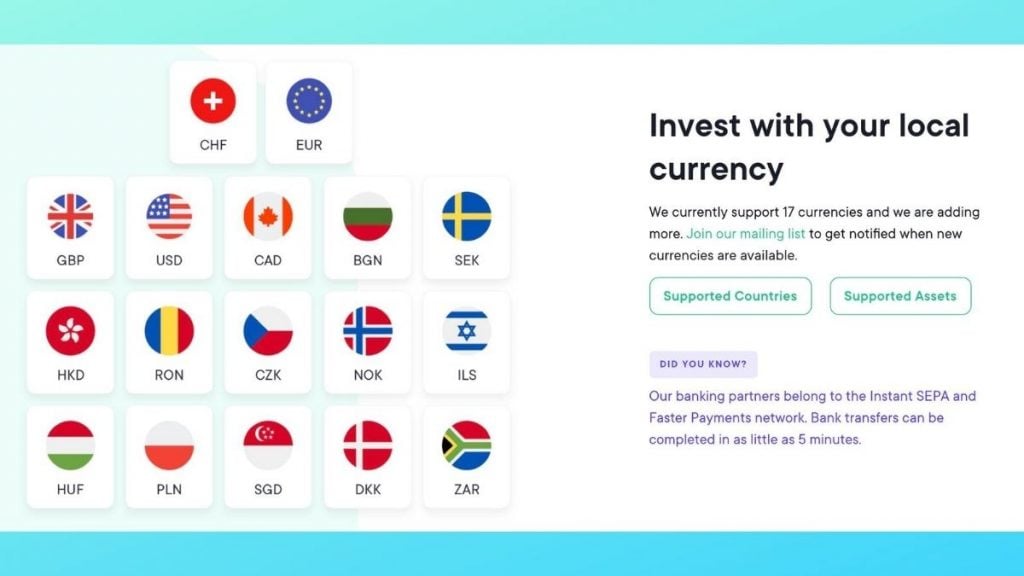

SwissBorg Network Token ($CHSB)

SwissBorg Network Token ($CHSB)