Visa on Ethereum Blockchain

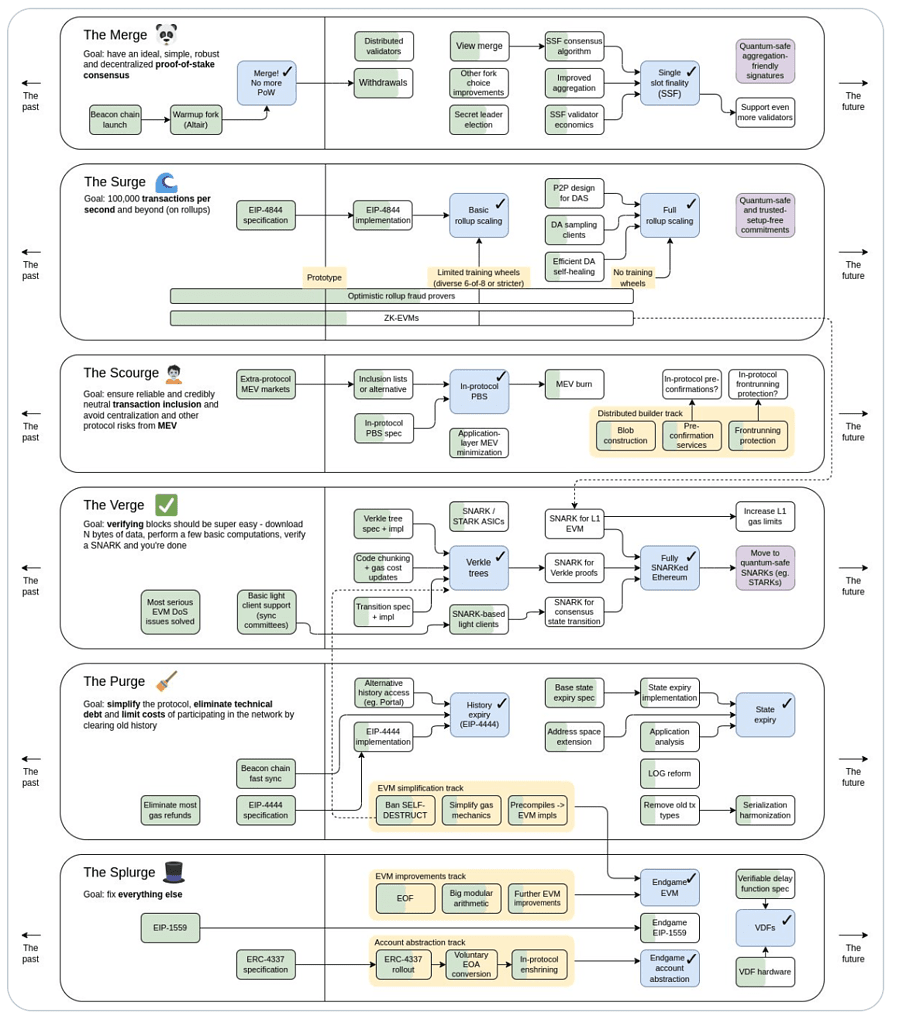

Visa payment is proposing to use Ethereum and Smart Contracts as an Auto-payments platform in order to increase efficiency and speed. The company published a technical paper detailing its plan to develop an automatic payment system for self-custodial wallets on the Ethereum network. This would enable Ethereum users to schedule auto-payments from their own self-custodial wallets, making online bill payments possible via blockchains. This comes at a very critical time as Ethereum is currently in a series of network upgrades, dubbed “Ethereum 2.0“, that will drastically increase its network efficiency and capacity.

Visa is also innovating using Ethereum’s account abstraction — combining Ethereum’s user accounts and smart contracts into one account type which allows smart contract functions including pre-scheduled executions for recurring payments. This not only progresses blockchain technology but also brings real-world applications for the general public.

Limited Payment Options on Blockchain Networks

Existing blockchain infrastructures do not have the core functionality for auto-payments. In order to send funds to another address, all crypto users must generate a cryptographic signature via their private key. This is an example of push payments, where a payment transaction is manually triggered by the payer. It requires time and attention from the payer.

On the other hand, there is pull payments, where a payment transaction is triggered by the payee. Automatic online bill payments are an example of this. Most of our recurring payments today are done directly on mobile banking applications or charged on our credit/debit cards. It is very convenient as users do not have to manually settle bills every month.

Large blockchain networks such as Bitcoin and Ethereum support push payments but do not natively support pull payments. Additionally, users might be unwilling to hand over their private keys to a third-party custodian for monthly bill payments. Therefore, Visa has found a solution to enable pull payments on Ethereum, giving users full control over their scheduled payments.

Smart Contract Auto-Payments

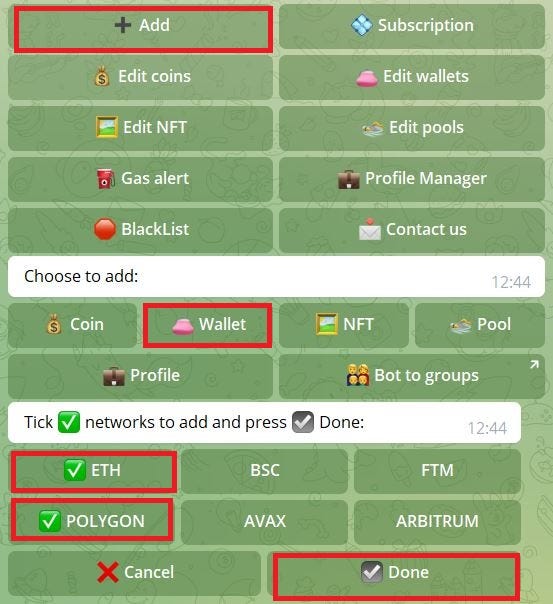

Visa leverages the concept of Ethereum’s account abstraction to provide self-custodial wallets with automatic recurring payment capability. Instead of hard-coding validity conditions into the Ethereum protocol that applies to all transactions, validity conditions can be programmed in a customizable way into a smart contract on a per-account basis. This means that users would be able to create a whitelist of pre-approved auto-payments on a “delegable account.” This would not require the owner’s signature every time a payment is made.

Furthermore, Visa also believes account abstraction has other real-world applications beyond just recurring payment such as account recovery services, multi-owner accounts or even public accounts where anyone could make a transaction. But the technology is still nascent and a lot of research needs to be done around fundamental aspects important for digital payments such as security and scalability, which are crucial for crypto adoption.

Other payment competitors

As one of the world’s largest payment networks, Visa is actively getting involved in the crypto ecosystem, looking for ways to expand their capabilities within blockchain payments. This could be a huge step towards mass adoption as traditional financial leaders are seeing the potential of crypto in the long-term future of digital payments.

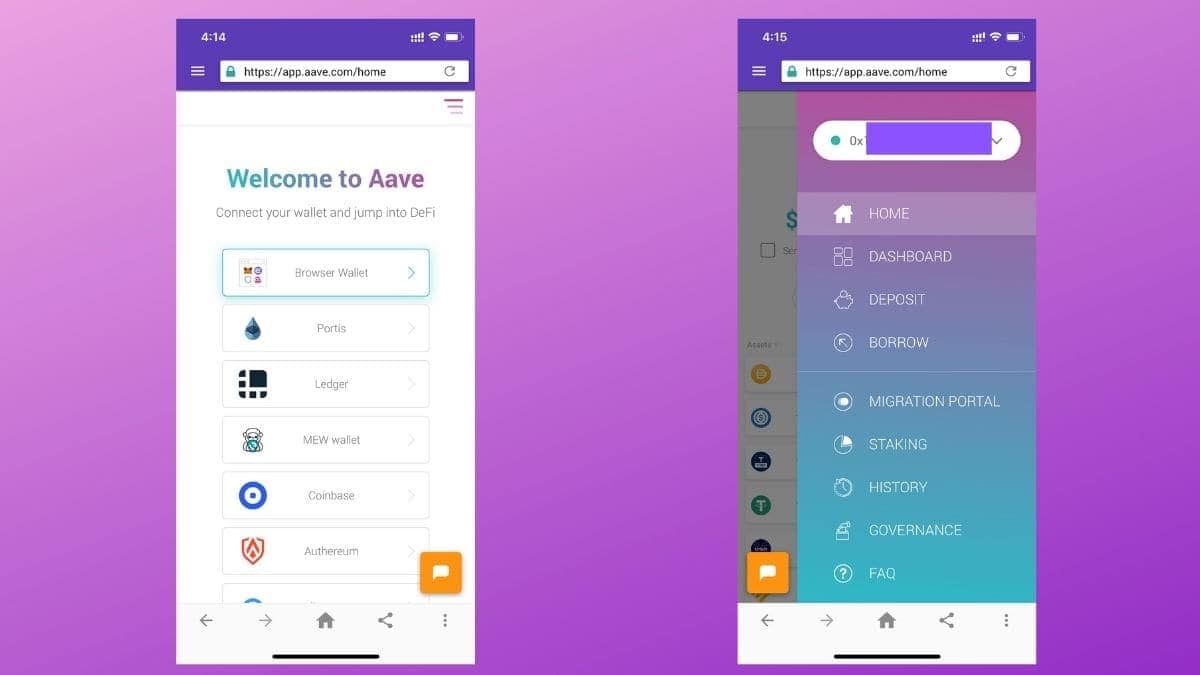

In fact, more and more global financial services are getting involved in the crypto ecosystem. Last week, PayPal is partnering with MetaMask to allow users to purchase ETH directly in their wallet via PayPal. On another note, Cash App, the number one finance app in the App Store, has also added support for transactions via the Bitcoin Lightning Network.

FAQ

Visa is proposing a technical paper detailing their plan to develop an automatic payment system for self-custodial wallets on the Ethereum network. This would enable Ethereum users to schedule auto-payments from their own self-custodial wallets, making online bill payments possible via blockchains.

Visa leverages the concept of Ethereum’s account abstraction to provide self-custodial wallets with automatic recurring payment capability. Instead of hard-coding validity conditions into the Ethereum protocol that applies to all transactions, validity conditions can be programmed in a customizable way into a smart contract on a per-account basis. This means that users would be able to create a whitelist of pre-approved auto-payments on a “delegable account.”

Visa’s solution would enable pull payments on Ethereum, giving users full control over their scheduled payments. It also has other real-world applications beyond just recurring payment such as account recovery services, multi-owner accounts or even public accounts where anyone could make a transaction.

PayPal is partnering with MetaMask to allow users to purchase ETH directly in their wallet via PayPal. Cash App, the number one finance app in the App Store, has also added support for transactions via the Bitcoin Lightning Network.

Visa’s solution could be a huge step towards mass adoption as traditional financial leaders are seeing the potential of crypto in the long-term future of digital payments. It could also open up more real-world applications for the general public.