Binance is a very popular cryptocurrency exchange. It has the largest trading volume and many different cryptocurrencies to trade. Binance also has powerful tools for trading, like leveraged trading and options trading. They also have a lending platform. Binance is always adding new features and this surprises many experts. The CEO of Binance is Zhao “CZ” Changpeng and he is very quick to respond to events. Binance has many different versions, including one for the US called Binance US. This review talks about all the different features of Binance and any problems they have had.

Sign up for Binance HERE!

Key Advantages of Binance

- World’s most popular exchange with the highest trade volume.

- Offers the largest range of products and services with some not even found elsewhere.

- Maintains insurance against theft and hacks.

Key Features and Functions

Binance (Binance.com

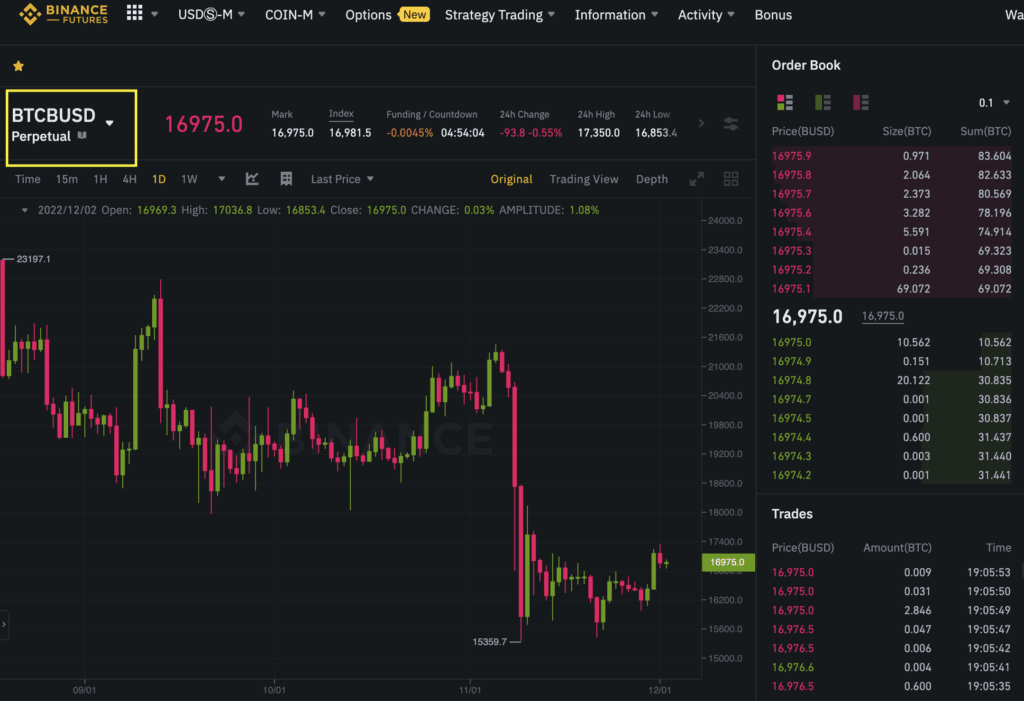

Binance.com is the main exchange and it is very popular. It has all the services that Binance offers. Some of the key features are:

- It supports over 1,000 different cryptocurrencies.

- It has the highest trading volume in the world because it is so popular.

- There is a platform called Binance Launchpad where new cryptocurrencies can be listed.

- There is a Stop-Limit Function. This means that an order will be carried out when the stop price is reached. Then the stop-limit order becomes a limit order to buy or sell at the limit price or better.

- Binance also has a lending service. Users can keep their cryptocurrencies on the exchange for a certain amount of time and earn interest.

Binance US (Binance.us)

Binance US (Binance.us) was Binance’s answer to US regulations barring citizens from trading on Binance. Key features include:

- US regulation compliant

- Has fiat to cryptocurrency trading pairs. Users can use USD to buy cryptocurrencies directly on the Exchange.

- Bank account linking is available.

History of Binance

Binance was founded by Changpeng (CZ) Zhao in 2017. The name comes from a combination of the words “Binary” and “Finance”. Binance is originally from China. However, due to the harsh crypto regulation procedures in the country, the Exchange moved to more conducive jurisdictions outside China.

Currently, Binance is based in multiple jurisdictions. Their main site offers support in English, Chinese, Korean, Japanese, Russian, Spanish, and French.

[wp-compear id=”5176″]

Supported Countries

The international site Binance (Binance.com) is supported in most countries except the USA.

US citizens can ONLY trade on Binance US (Binance.us), except for those from the following states: Connecticut, Hawaii, Idaho, Louisiana, New York, Texas, and Vermont. Note however that Binance.us has fewer supported cryptocurrencies and features compared to the international site. This is so that Binance.us is compliant with US Laws.

Supported Cryptocurrencies and Payment Methods

Binance (Binance.com)

Binance supports trading over 1300 cryptocurrencies including its own cryptocurrency, Binance Coin (BNB). Learn more about Binance Coin (BNB).

Binance accepts payments using credit card (Visa and MasterCard), debit card and cryptocurrency. However debit and credit card payments are restricted in the following locations:

- US: New York, Connecticut, Hawaii, Georgia, New Mexico and Washington;

- Several Chinese banks; and

- Some countries entirely e.g. Afghanistan, Iraq and Libya.

Users can only pay USD or EUR to buy Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH/BCHABC) or Ripple (XRP) using debit and credit cards on Binance.

Binance is a crypto-to-crypto exchange only. So users must buy first the above cryptocurrencies using fiat, before they can trade with other cryptocurrencies on the Exchange.

Binance US (Binance.us)

Binance US only supports around 50 cryptocurrencies.

Users can use their debit cards to directly transfer USD from their bank accounts into their Exchange account via ACH or wire transfer.

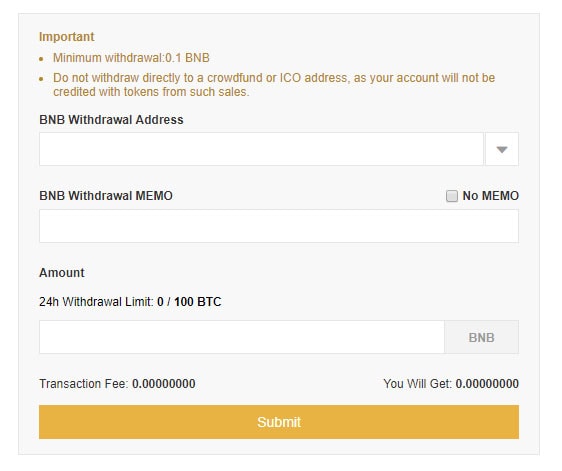

Deposit and Withdrawal Fees

On Binance.com fees are charged based on the cryptocurrency to be transferred. For example, Bitcoin (BTC) withdrawals cost 0.0005 BTC per transaction. There are no deposit fees.

For fiat transfers, on Binance US, USD wire withdrawals cost USD15/USD35 for domestic or international withdrawals respectively. Deposits generally and ACH withdrawals are free.

Click here for the fee structures of Binance.com and Binance US respectively.

Trading Fees

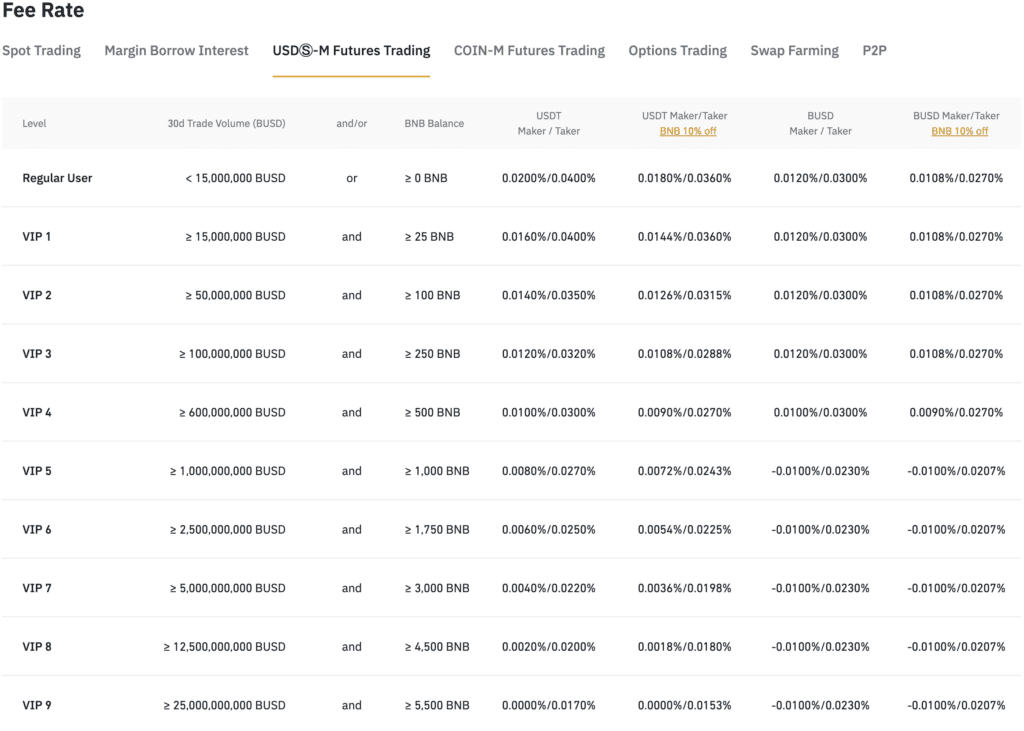

Trading fees for Binance.com and Binance US are generally 0.1% for makers and takers with the following exceptions:

- Binance.com and Binance.us: Users with larger trade volume or hold a specified amount of BNB are eligible to become VIPs. Higher VIP tiers give you lower trading fees. There is a 25% trading fee discount if fees are paid using BNB.

Binance has competitive trading fees compared to some other cryptocurrency exchanges. For example:

- Coinbase: 0.50% of the transaction plus a further Coinbase Fee depending on the transaction amount. Side note: did you know you can avoid their expensive withdrawal fees? Find out more at CoinBase Fees- How to Avoid Them?

- Kraken: 0.16% (maker) / 0.26% (taker)

- Bittrex: 0.25% (maker and taker)

- Poloniex: 0.15% (maker) / 0.25% (taker) (Note: Poloniex has discounted their fees to 0.00% until 31 December 2019)

- OceanEX: 0.10%, discounts are offered for payments with their OceanEx coin.

- KuCoin: 0.10%, discounts are offered for payments with their KCS coin.

- Huobi: 0.20%

- OKEx: 0.10% (maker) / 0.15% (taker)

- BitMEX: -0.025% (maker) (i.e. a rebate is given) / 0.075% (taker). This Exchange however only deals in margin trading.

- BitFinex: 0.10% (maker) / 0.20% (taker)

- BitMax: 0.085% (maker and taker) for larger market cap coins, 0.10% for other coins

Binance KYC

You don’t have to do the Binance KYC process to use the exchange. But if you don’t, you can only withdraw money, cancel orders, close positions and redeem. Binance has two levels of KYC: “Verified” and “Verified Plus”. To be “Verified”, you need to give your personal information and ID and do facial recognition. Then you can deposit and withdraw up to $50k a day. You can also deposit unlimited crypto, withdraw up to 100 BTC in crypto and do unlimited P2P transactions.

To be “Verified Plus”, you also need to show proof of your address. You can do everything that “Verified” users can do. Plus, you can deposit and withdraw up to $200k a day.

Controversies

Like any exchange, Binance is no stranger to controversies, making people question if Binance is safe. Let’s take a look at some recent controversies.

Binance hack: 7,000 Bitcoins stolen

In May 2019, Binance told the public that hackers took 7,000 Bitcoins. At that time, they were worth about $40 million. The hackers used different ways like phishing and viruses to get users’ login information.

Binance used its SAFU fund to pay back the users who lost money. The SAFU fund is an emergency insurance fund.

Binance KYC Data Breach

In August 2019, a hacker said they had a lot of Binance’s KYC data. They made Telegram groups to show the data. They wanted 300 Bitcoins from Binance or they would release more data. Binance said the data was from February 2018 when they used another company to do KYC. But some people say it was mostly Binance’s fault.

Binance offered a reward to find the hacker. But the hacker hasn’t been found yet. Binance gave lifetime VIP membership and better trading fees and services to users who were affected.

Binance accused of being a conduit for money launderers?

Reuters found that from 2017 to 2022, people on a Russian darknet drug market called “Hydra” used Binance to send and get cryptocurrency payments worth $780 million. The website is only on the Darkweb and takes cryptocurrency for payment.

Binance said the numbers were wrong and too high because they included indirect cryptocurrency flows. Binance also said they’re trying to get better at finding illegal activity on their exchange. They’re working with law enforcement to stop criminal networks that use cryptocurrencies.

Since August 2021, Binance made their KYC rules stricter. Both new and old users have to show ID to use most features on the exchange. Crystal Blockchain found out that since Binance made their KYC rules stricter, the monthly total of funds linked to Hydra Market that went through Binance went down a lot. It went from over $30 million per month to less than $1 million per month in the first quarter of 2022.

Is Binance safe in 2023?

Binance is the world’s biggest exchange, so hackers want to attack it. They did hack it twice in 2019. But Binance has an insurance fund and provided proof-of-reserves to pay back victims of the hacks. Binance showed they have enough money to cover users’ assets 1:1 plus extra reserves. You can learn more about Binance’s reserves audit by checking out: Binance Audited by Mazars, Confirms Bitcoin Reserves are Fully Collateralized.

Binance has been able to handle bad press and rumors. In December 2022, there were rumors that Binance didn’t have enough reserves for clients’ deposits. Many traders took their money out of exchanges. But Binance handled it well and paid everyone back.

Is Binance safe in 2023? It looks like it is. They paid back victims of hacks, showed they have enough money, and handled big withdrawals. But no exchange is 100% safe. That’s why it’s important to take your cryptocurrencies off exchanges and put them in offline hardware wallets. That way, you keep control of your cryptocurrencies.

Which hardware wallet should you get? Check out our comparison of the top 3 hardware wallets. Or read our reviews for the Ledger Nano X, Trezor Model T and KeepKey.

Conclusion: Binance Pros and Cons

Pros

- Exchange with the world’s largest trading volume.

- Track record of taking steps to remedy affected users when hacked.

- Competitive trading fees.

- Large amount of supported cryptocurrencies.

- Offers lots of unique services and features.

Cons

- Creating a basic KYC-verified account can take up to 13 days.

- Available in the US via Binance.US. But this has fewer supported cryptocurrencies and features.

Sign up for Binance HERE!

Binance Exchange Review

When reviewing a cryptocurrency exchange, it is important to consider several key factors to ensure that the exchange meets the needs and expectations of its users. In our reviews, we have evaluated a crypto exchange based on the services it offers, the cryptocurrencies it supports, its trading fees, and its security measures. These criteria were chosen because they are essential for providing a comprehensive and reliable trading experience for users. So by examining these aspects of an exchange, we can provide an informed and objective assessment of its overall performance and value to users.

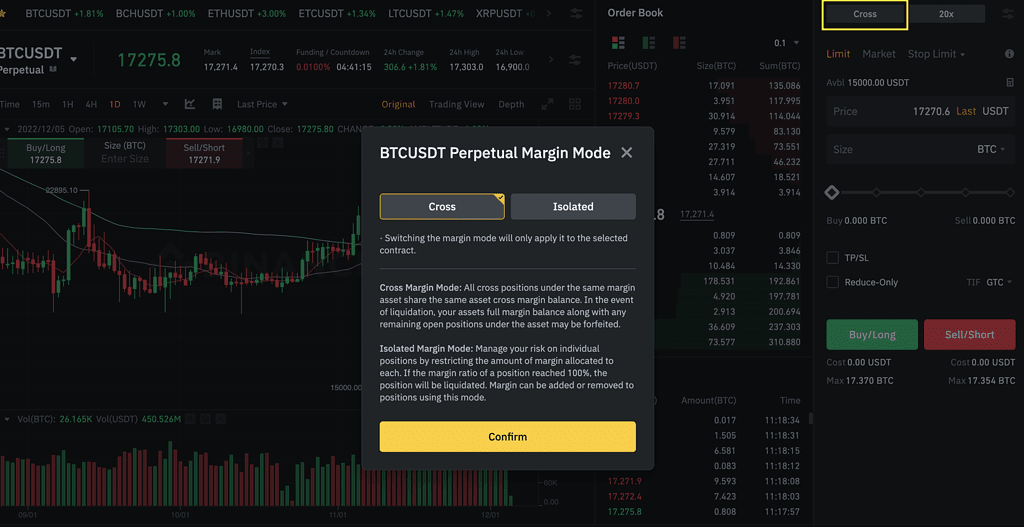

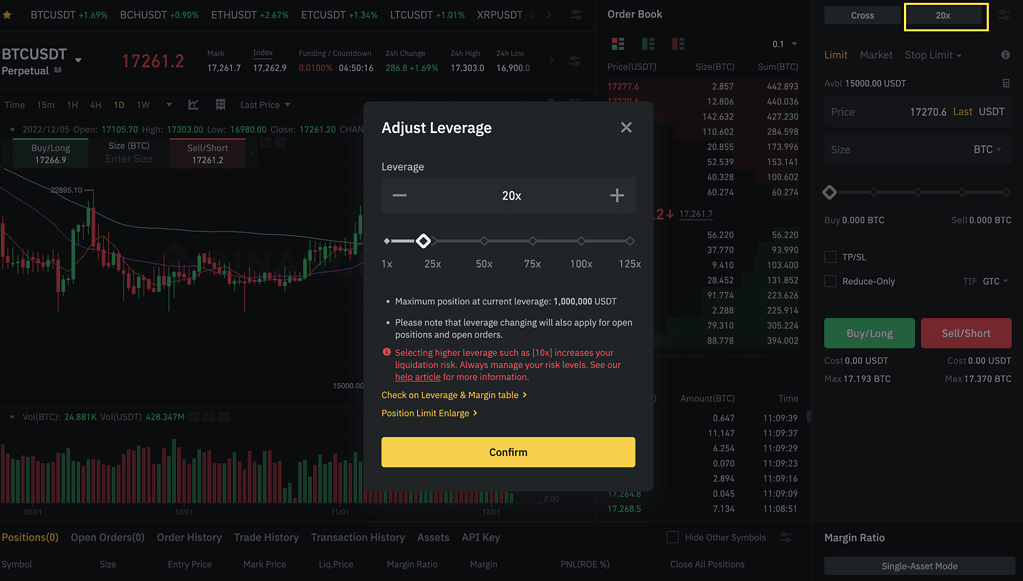

Services offered: Binance offers a wide range of products and services, including powerful trading tools such as leveraged trading, options trading and a lending platform. Binance is always on top of adding new features and is able to respond quickly to events.

Cryptocurrency support: Binance supports trading over 1,300 cryptocurrencies on its main site (Binance.com), including its own cryptocurrency, Binance Coin (BNB). However, Binance US (Binance.us) only supports around 50 cryptocurrencies. Although it is fewer than some other exchanges, Binance does have a strict vetting process before deciding whether or not to list a cryptocurrency.

Trading fees: Trading fees for Binance.com and Binance US are generally 0.1% for makers and takers. However, users with larger trade volume or those who hold a specified amount of BNB are eligible to become VIPs and receive lower trading fees. Additionally, there is a 25% trading fee discount if fees are paid using BNB. Overall, Binance has competitive trading fees.

Security: Binance has had some security breaches in the past, including a hack in which 7,000 Bitcoins were stolen and a KYC data breach. However, Binance maintains an asset fund as insurance and used it to fully compensate victims of the hack. Binance has also provided proof of reserves and has taken steps to improve its ability to detect illegal activity on its exchange. Overall, Binance is safe but it is important to avoid storing more cryptocurrencies than needed on exchanges.

Frequently Asked Questions (FAQs)

Binance Jersey closed on 31st December 2020 at 23:59 UTC.

Users with remaining funds on Binance Jersey can contact Binance’s Customer Service Team to retrieve their funds.

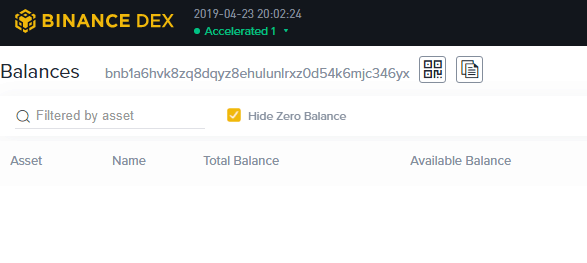

Binance DEX (Binance.org) is also known as Binance Chain.

Key features include:

It is a decentralized exchange developed on Binance’s own Binance Chain blockchain;

Users maintain custody and control of their private keys and funds. This means that users’ funds are much less vulnerable to hacks or exchange closures; and

Only limit orders are accepted. Unlike other exchanges, Binance DEX does not match orders continuously. Rather, it matches open orders received using a periodic auction.

Learn more about Binance DEX here.

Users must complete the KYC process in order to access all the features on the Exchange. Those who have not completed the KYC process are limited to fund withdrawal, order cancellation, position close and redemption functions on the Exchange only.

For “Verified” status, users will need to submit their personal information, and government-issued identification document, and pass facial recognition. Verified Plus requires additional proof of address, but in return will be entitled to higher fiat deposit and withdrawal limits.

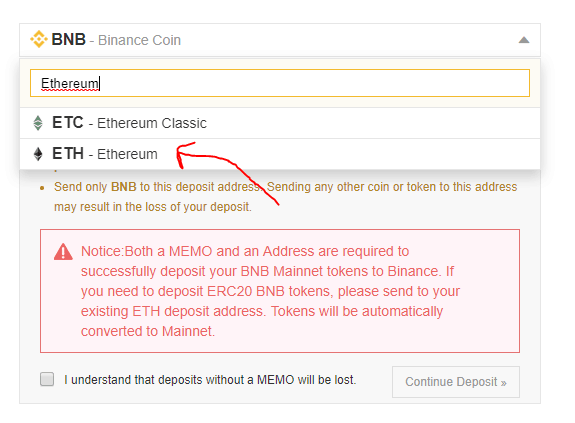

In your Binance account, go to “wallet”, then under “deposits” click on “crypto deposits”. Select “Bitcoin” and the network you wish to use. Note that different networks may charge different fees. You will see a string of numbers and letters which is your deposit address. Copy and paste this deposit address into the platform or wallet you want to send your Bitcoin from and follow the instructions there.

Your Binance account will have different wallet addresses for different cryptocurrencies. On your Binance account, click “wallet”, and under “deposits” click on “crypto deposits”. Select the cryptocurrency you would like to deposit and the network you wish to use to process the transaction. Copy and paste the deposit address into the platform or wallet you want to send your cryptocurrency from and follow the instructions there. Before sending, CHECK carefully the deposit address, amount, and network so as to avoid any losses.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

Key Features of Binance

Key Features of Binance