One notable challenge for every startup is finding the required capital to set up businesses. This is where concepts like venture capital help such businesses to meet the required level of capital to help them blossom. However, this has traditionally been a field accessible by funds and institutions with ample resources.

DAO Maker is here to improve the process for both parties by respectively creating growth technologies and funding frameworks for startups, and reducing risks for investors.

Background and Team

The Founder of DAO Maker is Christoph Zaknun who entered the cryptocurrency space in 2017. The idea of private permissionless money and the gains associated with cryptocurrency lured him further into the creation of ICO DOG, a platform that allowed for investing in token presales.

His Co-founder, Giorgio Marciano, also acts as DAO Maker’s CTO. Marciano has over 16 years of experience in developing software and products.

Other notable team members include Hatu Sheikh, who has overseen over 35 crypto assets marketing campaigns, and Malte Christensen, who works as the COO and Head of Sales, Dima, who works as the Head of Visual Communication.

What is DAO Maker?

DAO Maker is a provider of a participation framework that allows retail investors (small-scale investors) to participate in global retail venture capital. Essentially, the primary goal of DAO Maker is to raise a fundraising platform that would allow for equal participation of crowd equity and tokens.

The reality is that most of these small-time investors are likely unable to afford to invest large sums of money in venture capital. DAO fills the gap by enabling the average man on the street an opportunity to grow his own capital. This creates a win-win situation, the business is able to effectively provide a new source of funding while at the same time helping to improve the lives of many.

Achievements of DAO Maker

The platform has over time proven itself to retail investors. In the last 2 years, over 70,000 unique retail investors were signed up and allowed to participate in the funding of early-stage ventures. Apart from attracting investors, DAO Maker has also been able to attract startups with enormous potential to join the burgeoning ecosystem.

Advantages of DAO Maker

One major reason these startups join the DAO Maker ecosystem is simple: it provides them a safe, decentralized, and free environment that allows them to reach their potentials. In addition, the platform also has one of the leading solutions that would allow for the growth of these companies.

As a result, the ecosystem has seen a marked increase in the demand for its services, which enabled them to begin working on a permission version.

DAO Maker’s approach to fundraising stands out since not only does it connect startups with funding, it also assiduously works to assist them in facing challenges in the initial stages of their development.

This is why the track record of the fundraising platform has defied many market cycles.

DAO Maker’s Venture Bond

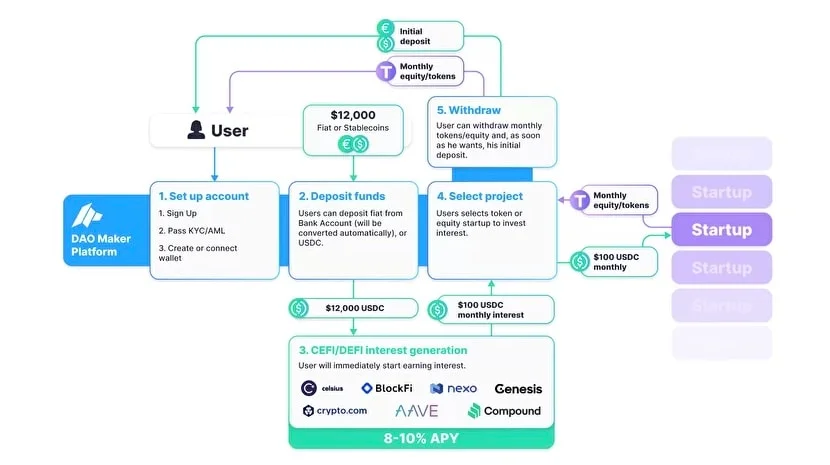

DAO Maker’s new flagship product is Venture Bond. It allows startups to issue bonds that users can access, whilst users benefit from close to zero-risk venture investments.

Venture Bonds work as follows:

- startups issue Venture Bonds;

- users purchase these bonds, giving the startups a principal sum of money;

- startups then use the principal sum generated by bond purchases to generate interest through insured margin funding activities in decentralised finance (DeFi) or centralised finance (CeFi);

- the generated interest serves as the funding for the startups;

- the startup will then deposit tokens/equity to the Venture Bond holders; and

- when the Venture Bond matures, the principal sum is returned to the buyer, so they are left with both their initial funding and also any newly acquired tokens or equity.

Other DAO Maker Services

Other notable services of DAO Maker are Refundable Strong Holder Offering and Dynamic Coin Offering.

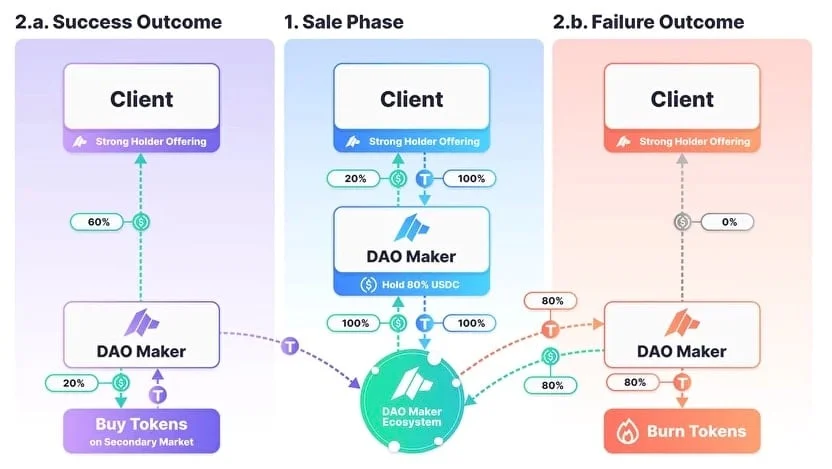

Strong Holder Offering

Strong holder offerings are designed to build a community that would actively participate in providing an increased level of awareness for a company, and at the same time, induce confidence by imposing a strict refund policy.

Dynamic Coin Offering

For dynamic coin offerings, 100% of the circulating supply is backed by a notable portion of the funds raised during the sale.

DAO Maker then escrows this fund through a trusted and insured custodian, allowing the platform users the opportunity to claim a refund within a specified period.

Social Mining

One of the earliest offerings of DAO Maker is Social Mining, which has played a pivotal role in the successful launch of some tokens in the space. The software was conceptualized in 2018, and since then, it has seen various upgrades and usage, which made it an essential part of the DAO Maker community.

What social mining does is simple; it enables any project to create token-based incentives that encourages community members to offer value. In other words, it helps energize a project’s community to participate in its growth and development.

The first use of this software was with LTO Network, where it served as a core component in the community creation of the project, and subsequently enjoyed tremendous growth despite the bear market of 2018. Despite the notable success of this first project (LTO), there were still some notable lapses like the dependence of the software on centralized involvement, which negated the core idea of building a decentralized and self-organizing community in the first place.

However, since then, the team of developers have developed the software to allow pluggable DAOs and also allowing for stake-based voting. The voting allowed the community to determine the value each token holder contributed to the project. This voting system became a quite effective distribution network that was decentralized as token holders were the ones in charge.

As it stands, work has already begun on the two key pathways social mining is being geared to: granting permissionless support for tokenized startups and permissioned access for equity startups.

DAO Maker Token ($DAO)

DAO, the protocol’s native token currently allows its holders to stake in the platform and enjoy governance power in submitting proposals, as well as vote on them.

By participating in governance, stakers would also receive a part of the fee generated from the source. And in order to promote long-term participation, the staked DAO tokens are locked for a period of time.

As can be seen below, more utilities for the DAO token are in the works.

Conclusion

The idea behind DAO Maker is to create a platform where startups can enjoy early stage exposure from retailers. Thus, DAO Maker could be a single platform that elevates the capabilities of ordinary retail investors. The platform would also enable them to be issued with equity, while others are issued with tokens. All in all, the platform will enable varying levels of downside protection as early-stage startups face inevitable risks in their early days.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

Angela Wang

Angela loves cryptocurrency, technology that improves our lives...and food. Anything that merges these worlds together is even better.