“Not your keys, not your crypto” — this decade-old mantra has taken full effect after the FTX collapse. Crypto users have lost faith in centralized exchanges (CEXs) and are migrating to decentralized exchanges (DEXs) instead. Though a non-custodial option seem to be an ideal solution, it would likely take a long time until price discovery shifts from centralized to decentralized platforms. Let’s take a closer look.

Impact of FTX Collapse on Centralized Exchanges

Almost every centralized platform in the crypto industry had done business with FTX, and some companies bore the brunt of the collapse such as BlockFi, Genesis Trading, and KuCoin. Crypto users around the globe found they could no longer withdraw assets from several crypto exchanges as the contagion spreads.

FTX’s collapse is a symptom of a problem inherent to centralized exchanges, also known as custodial exchanges. Customers’ tokens parked on the platform are exposed to the risk the exchange could go bust. Because crypto has no government depositary schemes to cover losses, customers of insolvent exchanges must wait for bankruptcy courts to regain what remains of their funds — if there is any left after other investors claim their share.

Given the circumstances, all crypto exchanges including Binance have been implementing proof-of-reserves to verify they have enough assets to cover all customers’ funds. Though it is a good transparency initiative, investors still fear for the safety of their funds. As a result, many CEX customers rushed to withdraw their funds, opting for non-custodial solutions. This is where DEXs come in.

Rise of Decentralized Exchanges after FTX Collapse

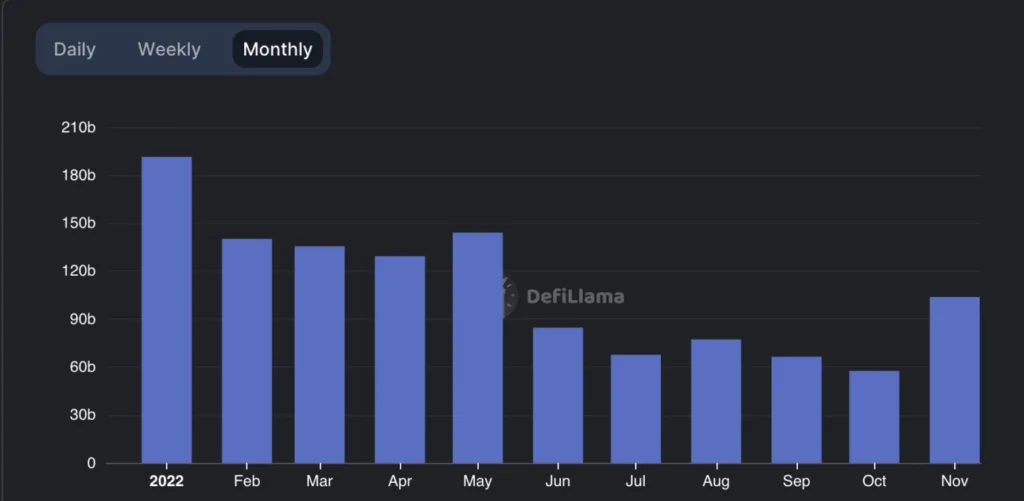

Soon after FTX’s downfall, decentralized exchanges saw a vertical spike in trading volume. According to DeFi Llama, the monthly DEX volume showed an increase of 80% from $57.6 billion in October to $103.8 in November. At the time of writing, Uniswap had the largest trading volume with 60%, followed by Curve (9.6%), PancakeSwap (9%), DODO Exchange (8%), and Balancer (3%).

Moreover, Uniswap also surpassed Coinbase in daily ETH trading volume on November 14 ($1.1 billion vs $600 million). This is significant as CEXs have always been dominant in trading large market cap coins given their deep liquidity. It strongly indicates traders are moving away from CEXs.

This is compounded by the fact that Bitcoin (BTC) has been exiting CEX wallets at a record pace. According to on-chain data analytics Glassnode, BTC withdrawals from CEX to self-custody wallets is unfolding at a historic rate of 106k BTC monthly. This accounts for $3.7 billion worth of Bitcoins over the past week. Simultaneously, hardware wallet providers such as Ledger and Trezor reported its highest sales day. Check out some of these wallets:

Advantages of Decentralized Exchanges

Decentralized exchanges, also known as non-custodial exchanges, are decentralized finance (DeFi) protocols that allow users to trade directly with other users via smart contracts, without handing over management of their funds to an intermediary or custodian.

They are non-custodial, which means users have full and exclusive control of their wallet’s private keys. This is the opposite of putting your assets on CEXs as they hold onto the wallets and keys on your behalf. This feature makes it impossible for centralized players to siphon user funds, and is why people are doing their trading on DEXs instead.

Transactions on DEXs are facilitated through the use of smart contracts, and liquidity pools are funded by other users. As such, there is significantly reduced counterparty risk — you do not need to trust other users, only the code. There are three types of DEXs that uses different protocols: automated market makers (AMM), order book DEXs, and DEX aggregators. But they are all programmed to determine the best price for an asset, all while offering a better rate for users compared to CEXs.

Moreover, anyone can earn passive income if they provide liquidity to the protocol. On the other hand, CEXs are managed by a centralized organization such as a bank or a small handful of professional trading firms or market makers. In this case, since liquidity is concentrated in these actors, CEX maker and taker fees are much higher than DEX swap fees. Additionally, they can also choose to withdraw their assets during periods of volatility, restricting trades when users need it most.

Challenges Facing Decentralized Exchanges

Despite the many critical advantages DEXs offer, it has several downsides that hinders widespread adoption:

Relies Heavily on Centralized Exchanges

Most DEXs are dependent on price oracles (i.e. Chainlink) that source data from CEXs. As such, an attacker can manipulate the price of an asset on a particular DEX, leading to inaccurate price data being fed to all protocols which rely on that DEX as a price oracle.

A flash loan attack is a common method to trick price oracles. In such events, attackers essentially create false arbitrage opportunities by instantaneously borrowing, swapping, depositing large numbers of tokens, tricking price oracles that the target token’s price is being moved on a single exchange.

This creates a disparity which can then be arbitraged, allowing the sale or purchase of assets at above or below market price. Polygon’s Quickswap was a victim of this attack in October 2022.

DEX Transactions are Slower than CEX

Trading on DEXs are often much slower because all trades take place on the blockchain. It takes time for blocks to be validated and transactions to go through. On the other hand, CEX trades are almost instantaneous because they take place on proprietary matching engines instead of the blockchain. These engines are complex software that synchronizes and combines data from thousands of trading pairs at the same time.

Liquidity Issues and Impermanent Loss

DEXs cannot yet compete with large CEXs in size as they cannot offer as much liquidity. When they do not have enough liquidity, large orders can incur slippages in which the buyer pays above-market prices on their order. As such, a lack of liquidity can deter institutional participation as large orders are likely to suffer from slippage.

On another note, liquidity providers are exposed to a risk of impermanent loss when depositing two assets for a specific trading pair. In most cases, liquidity providers end up withdrawing more of the token that lost value and less of the one that gained value because the ratio of tokens held in the pool changes as trades occur.

Smart Contract Vulnerabilities

Although there is significantly reduced counterparty risk when using DEXs, there is still the issue of smart contract vulnerabilities that can be exploited by hackers. Smart contract codes are publicly available and anyone can review their code. Therefore, exploitable bugs can still slip past audits and other code reviews.

This is a problem inherent to all DeFi protocols. Over the past two years, we have seen numerous hacks on cross-chain bridges, hot wallets, staking platforms, and even entire blockchain infrastructures.

Future Landscape of Crypto Exchanges

In the wake of FTX’s collapse, users’ confidence in centralized exchanges are waning and the crypto community expects a shift toward decentralized platforms. However, according to JPMorgan and several other financial analysts, centralized exchanges will continue to control the majority of global digital-asset trading volumes. Although DEX trading volume has surged over the past month, it is a possibility that it reflects the automatic liquidations following the FTX collapse, and does not indicate the start of a long-term trend.

DEX users are still confined to a relatively small base of niche traders and investors, and their interfaces can be difficult to navigate. At this stage, CEXs still provide a better user experience, fiat gateways, and deeper liquidity. To date, Uniswap has a total of 4.5 million users cumulatively, whereas Coinbase has a total verified user base of 108 million.

With that being said, DeFi is still in its infancy. Development in liquidity protocols, safekeeping mechanisms, and user interfaces is needed to fully realize the potential of non-custodial trading services. As long as DEXs can compete with CEXs in terms of liquidity and speed, we may start to see widespread adoption or even a full-on switch to DEXs. After all, decentralized infrastructures are key to preventing centralized collapses, something we, as the community, has had enough of for the past year.

ronalthapa

Ron achieved $60,000+ (peak PnL) in airdrop rewards in 2024. He is an expert in testnet airdrop farming. If there is a points system, he knows exactly how to min-max it. Ron is also a data-driven trader, proficient in LTF price action. He hopes one day to be in the top 10 of the Bybit WSOT leaderboard.