Yield Farming is a popular method for cryptocurrency owners to gain passive income. It involves taking advantage of various incentives rewards for locking-up (aka staking) different cryptocurrencies. This article focuses on yield farming for the $YFI token which has become the highest performing yield farming pool.

Check out our video on how to potentially earn 600% returns through YFI Yield Farming!

The yEarn project has launched its own governance token – $YFI – this week, sending the Decentralized Finance (DeFi) Yield Farming scene into a frenzy. As of this article, staking stable coins (USDT, USDC, DAI, or TUSD) into the Y pool will yield an astronomical 896% Annual Percentage Yield (APY). This is due to the incentive token $YFI being distributed to staked token holders, making this the single best yield farming pool right now. This has sparked a huge amount of interest in both searches for the $YFI governance token (trending right now on coingecko). Since the token launch, more than $60 Million of new capital has been deposited into the Y pool. Calculate yield using the community made yieldfarming tool.

WARNING: Yield farming involves a high amount of risk due to the experimental nature of the Ethereum network with potentially undiscovered critical vulnerabilities. Never stake/farm more than you can afford to lose. This is not Financial Advice.

What is the yEarn (iEarn) Pool

The iEarn “Y” pool is a yield aggregator – it automatically invests its capital into different DeFi projects – selecting those with the highest yield and return on investment. As a DeFi protocol, a smart contract keeps the invested funds – which makes the project non-custodial. The pool itself is comprised of 4 different stable coins – USDT, USDC, DAI and TUSD – with a total of over $103 Million USD in currency reserves (Assets Under Management – AUM). These reserves are then lent out to different protocols that offer the best rates of return, including Compound, Aave, and dYdX. yPools are considered riskier than other DeFi products such as Compound because lend capital out to a series of protocols – which themselves could be vulnerable to critical vulnerabilities.

How to Earn the YFI Token

There are two pools that reward the YFI token for staking. The first and easiest pool to access is the Y Pool on Curve.Fi. This pool is a collection of stable coins that are automatically invested in different lending protocols. This type of pool is usually considered a higher risk due to possible vulnerabilities not just with its own smart contract, but with other smart contracts too.

How to to earn YFI tokens

Unfortunately “Yield Farming” for the YFI token has ended. When YFI first launched, all 30,000 tokens were distributed to stakers on the https://ygov.finance/staking platform. Although initially there were plans to distribute more tokens, attempts to come out with a plan to do so have all been voted down in the Y governance. This means it’s unlikely that new $YFI tokens will be distributed in the future. Other tokens such as YFII and YFV still have token distribution for yield farmers.

What is YFI token

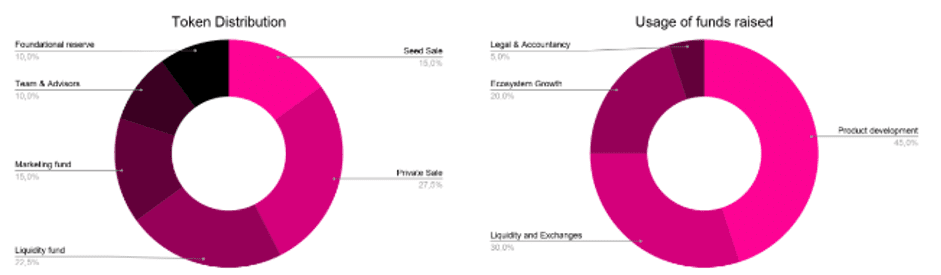

YFI is the governance token for yEarn (previously known as iEarn). Tokenholders are entitled to vote on upcoming governance decisions for the network – such as potentially stopping all-new distribution of the token. Creator of YFI, Andre Cronje (@AndreCronjeTech) has stated that the token has no intrinsic value.

“We have released YFI, a completely valueless 0 supply token. We re-iterate, it has 0 financial value”

Andre Cronje

This being said, the current wave hype wave and token dynamics have driven up the value of the token. The token follows the “Governance” model where it’s value comes from voting on where the protocol will go next. On top of this, the incentivized Balancer pool (YFI 2%, DAI 98%) requires the staking of $YFI, which locks up further supply. Simply put, DeFi farmers are locking up YFI and DAI in order to receive BPT tokens which could be staked on ygov.finance to gain an additional $YFI. This type of cyclic farming create pseudo ponzinomics and could lead to potentially disastrous results.

Balancer Warning & new coin minting risk

One of risks that was mitigated by the team was with token issuance. Currently there is a max cap of only 30,000 YFI tokens. Earlier this week it was discovered that there was a master key which permitted YFI developer Andre Cronje to mint new coins and potentially flood the market with new coins. If he did this, it would of been possible for him to take the entirety of Pool#2 and Pool#3 on Balancer, with a total of more than $150 Million USD. Luckily this did not happen, as he quickly created a multisignature address which requires 6/9 key holders to agree to minting new tokens. The purpose of this is to remove single party risk as 6 of the 9 keyholders are required to agree to create new coins. On top of this, even if they do agree, the community will have 3 days notice before anything happens.

Overall the long term objective of YFI is to leave control of the total supply of YFI and distribution up to the community to decide. The voting aspect of YFI will allow governance token stakers to decide who to do with the platform.

YFI distribution stop

Distribution of $YFI tokens will temporarily stop as new contracts are being prepared. Times for the pools stopping are as follows:

- curve.fi/y: 07/24/2020 @ 11:50am (UTC)

- http://balancer.exchange: 07/25/2020 @ 9:35am (UTC)

- http://ygov.finance: 07/26/2020 @ 3:38pm (UTC)

Resources:

yEarn documentation – http://docs.yearn.finance

yGovernance and staking – https://ygov.finance

Pool Information / Calculator: https://yieldfarming.info/

Curve Guide on Pools – https://guides.curve.fi/how-to-choose-the-right-curve-pool-for-you/

Coindesk Report: https://www.coindesk.com/troll-token-why-defi-yield-farmers-are-now-all-about-yfi

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.