YFV (YFValue) is a YEarn inspired governance token that is rewarded to cryptocurrency yield farmers (also known as liquidity miners). YFV functions as a DeFi Yield aggregator – they will release a “Vault” like product which will deploy different strategies to farm DeFi yields. $YFV in the governance coin on the platform which will be used to vote on Decentralized Autonomous Organisation (DAO) decisions. YFV sets itself apart by also minting two elastic supply coins, $vUSD, and $vETH – coins that will rebase to target the price of USD and Ethereum respectively. These tokens will function similar to “Ampleforth” in terms of rebasing functionality. The team behind the project has chosen to remain anonymous.

The official website for YFV is https://yfv.finance.

Summary

- YFValue functions as a DeFi Yield aggregator, releasing a “vault”-like product which will deploy different strategies to farm DeFi yields.

- There are 2 types of pools for $YFV farming: Seed Pool v2 and Balancer Pool.

- Farming $YFV also generates $vUSD, and $vETH – these rebase to target the prices of USD and Ethereum respectively.

- $YFV acts as a governance token for voting on decisions relating to the project. Some people also trade the token on exchanges.

How do you farm $YFV

Yield farmers can farm $YFV in two types of pools:

Option 1: Seed Pool v2. This your classic yield farming pool – tokens are staked into the pool and $YFV will be distributed over time. There is no risk of impermanent loss

- Log onto https://yfv.finance/

- Connect your wallet

- On the “Seed Pool v2” page, deposit either USDT, USDC, TUSD or DAI (i.e. stablecoins)

- Click the Stake token button.

Option 2: Balancer Pools. This is the higher risk pool, where funds are added to a Balancer liquidity pool. This means the funds will be actively used in automated market making and possibly risk impermanent loss. On YFV there is a total of 8 Balancer Pools. For the purposes of this tutorial, let’s look at the example of using the WETH Balancer Pool of WETH:YFV.

- Wrap Ethereum into $WETH using the ETH->WETH tool on the sidebar https://pools.balancer.exchange/#/pool/0x10DD17eCfc86101Eab956E0A443cab3e9C62d9b4

- Stake WETH & YFV in the Balancer Liquidity Pool https://pools.balancer.exchange/#/pool/0x10DD17eCfc86101Eab956E0A443cab3e9C62d9b4

- This will generate BPT tokens

- Stake BPT tokens on https://yfv.finance/stake in “Balancer (YFV-WETH)” Pool

How to claim your YFV

On the main page, you will easily be able to see how much you have staked into each pool, how much YFV is claimable and the ROI in USD.

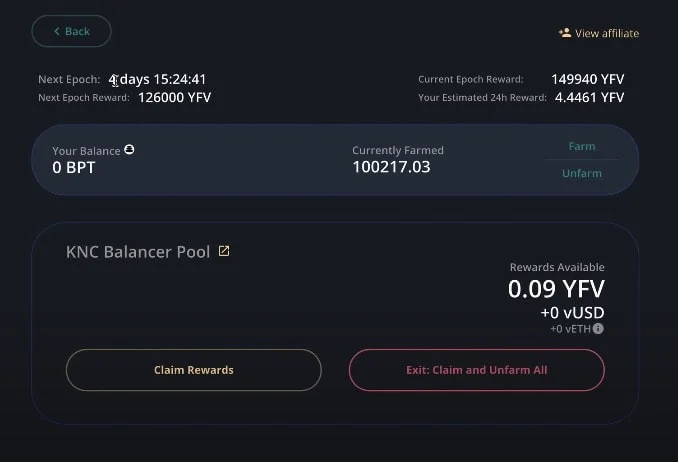

- To claim your rewards, click into the pool. There you will see several important items of information:

- Next Epoch: When your next rewards will be paid out.

- Your Estimated 24h Reward: Estimated earnings of YFV in 24 hours.

- Rewards available: How many YFV tokens are available for collection.

You can claim your YFV rewards by simply clicking “Claim Rewards”. However, this requires gas fees so you need to consider the gas fees paid to stake your tokens in the first place etc and decide if it is actually worthwhile to collect your rewards.

How are people profiting off YFV? What do I do with the YFV tokens?

So what is the purpose of farming all these YFV tokens? YFV is the governance token of YF Value protocol. This means holders of the YFV token can use it to determinate and update the functionality of YFV protocol and change or update the rate of distribution of YFV tokens. Those that stake in YFV pools has the right to vote on-chain for the distribution rate. At the end of each week, the total votes will be automatically counted and the distribution rate of YFV will be automatically changed.

On the other hand, you can also trade your tokens for ETH or USDT on exchanges such as Uniswap, Balancer, Hotbit, BKEX and Bilaxy. The below chart shows the value of YFV/USD.

What is vUSD and vETH?

As you can see in the above section “How to claim your YFV”, in addition to YFV tokens, staking YFV also gives you vUSD and vETH tokens. A total of 1,000,000 vUSD and 1,000 vETH will be distributed to all the yield farming pools according to their percentages. According to YFV, once all the pools have been exhausted of YFV, vUSD and vETH will use an oracle price feed to match the prices of USD and ETH. Similar to Ampleforth (AMPL), there will also be a rebase of vUSD and vETH every 24 hours.

YFV Farming risks

The biggest risk of YFV farming comes from potential vulnerabilities in the staking contract. on 30th August 2020 YFV announced that the audit of YFV Protocol had been successfully completed by The Arcadia Group. According to YFV, the audit identified a small number of low severity issues relating to code quality and health. No high or critical severity issues were found. The letter from Arcadia and a summary of the audit report can be found here.

There is also the question of the limited supply of YFV tokens. There is only ever going to be 21,000,000 YFV tokens so some of the (perceived) value of the token is because of its limited supply. But what happens when every YFV token has been mined or distributed? This is unknown and it is worth noting that YFV is currently backed by any other asset.

Minting Risks

One of the biggest concerns about YFV was the presence of minter keys – which could potentially mint an infinite number of $YFV tokens. Developers have stated that all minter keys are burned, and pools which could mint new tokens have also had minting features removed.

YFV had previously also confirmed and addressed community members’ concerns that there was a minting key oversight and exploit related to vUSD and vETH which would allow funds to be locked. What YFV did to remedy this was that they kept the minting keys until they were able to recover the funds that some users may have lost by farming in Pool 0. After that, the team transferred the governance keys of vETH and vUSD from YFV protocol to several members of the community to hold in safe custody. The community members selected were: Reuben Yap (COO of Zcoin), DeFi Dude, Matthew Neimerg (CEO of Cardinal Cryptography), TQT, Ian Ocasio and myself.

More Information

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

Michael Gu

Michael Gu, Creator of Boxmining, stared in the Blockchain space as a Bitcoin miner in 2012. Something he immediately noticed was that accurate information is hard to come by in this space. He started Boxmining in 2017 mainly as a passion project, to educate people on digital assets and share his experiences. Being based in Asia, Michael also found a huge discrepancy between digital asset trends and knowledge gap in the West and China.