Polygon recently launched its own zkEVM mainnet, and co-founder Sandeep Nailwal hinted on Twitter that there could be a MATIC airdrop for users! In this article, we will briefly explain what Polygon zkEVM is and what you can do to position for a potential airdrop.

Polygon zkEVM Airdrop Step-by-Step Guide

Here’s how to get the Polygon zkEVM Airdrop:

- Add Polygon zkEVM to MetaMask

- Bridge to Polygon zkEVM

- Interact with Polygon zkEVM DApps

- BONUS: trade on Satori Finance

- DOUBLE BONUS: Join in the zkEVM saga with Intract x Polygon to get free NFTs

See below for more in-depth details!

What is Polygon zkEVM?

Polygon zkEVM is a Layer-2 scaling solution for Ethereum that leverages the scaling power of zero-knowledge proofs while maintaining Ethereum compatibility, similar to zkSync and Linea. Developers and users on Polygon zkEVM can use the same code, tooling, and apps that they use on Ethereum, but with much higher throughput and lower fees. This allows Ethereum-based DApps to scale more efficiently, which is critical for mass adoption of DeFi.

What’s the Difference Between Polygon zkEVM and Polygon?

The original Polygon functions as a sidechain that runs parallel to the Ethereum mainnet, whereas Polygon zkEVM uses a ZK-Rollup architecture that is built on top of Ethereum. The key distinction is that Polygon is EVM compatible but Polygon zkEVM has total EVM equivalence. The latter is focused on being a near-perfect replica of Ethereum’s execution environment, which means it uses ETH instead of MATIC for gas fees.

Is There an Airdrop for Polygon zkEVM?

Yes, it is very likely there will be an airdrop for Polygon zkEVM users. Sandeep Nailwal, co-founder of Polygon, strongly hinted on Twitter that there will be a huge MATIC airdrop for zkEVM users. He also compared the current development of Polygon zkEVM to Arbitrum, which took more than a year to mature. This means that we are currently at the early stage, allowing users plenty of time to perform on-chain activities that would qualify them for the airdrop!

How to Get the Polygon zkEVM Airdrop?

The best way to get the MATIC airdrop is to interact with the Polygon zkEVM mainnet. Here’s a step-by-step guide:

- Add Polygon zkEVM to MetaMask

Go to ChainList and add Polygon zkEVM to MetaMask. It is launched on Mainnet Beta, which means you will need ETH for gas fees.

- Bridge to Polygon zkEVM

If you have funds on the Ethereum network, you can bridge ETH from Ethereum to Polygon zkEVM via the Native Bridge.

Alternatively, if you have funds on Arbitrum and/or gas fees are too high, you can also use other third-party bridges recommended by Polygon, such as Orbiter Finance. Using Orbiter Finance, in particular, refunds 60% to 70% gas fees back to you. - Interact with Polygon zkEVM DApps

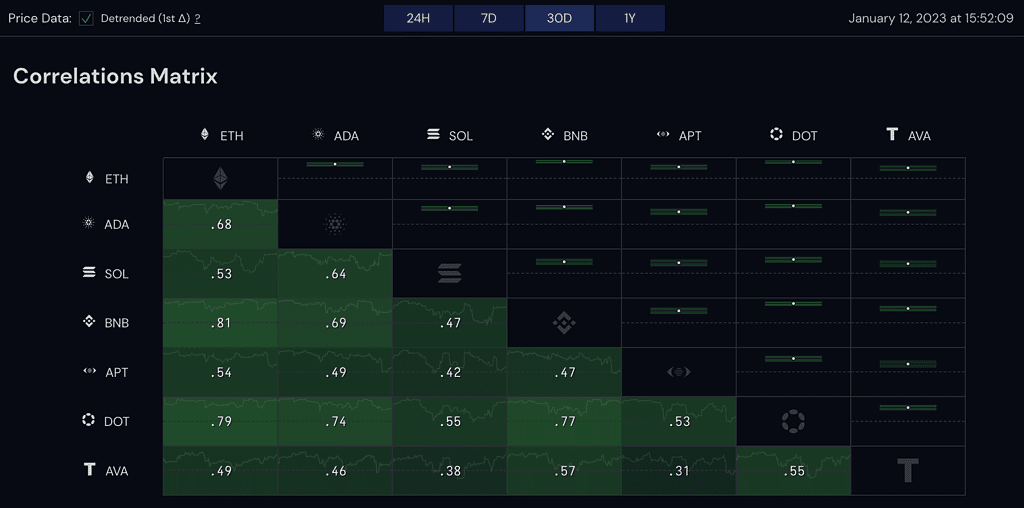

Here are the top DApps in Polygon zkEVM ranked by total value locked (TVL). Try to perform transactions consistently every week as frequency of smart contract interaction is an important criterion to qualify for the airdrop:

Decentralized Exchanges (DEXs):

1. Quickswap

2. Kokonut Swap

3. Dove Swap

4. Mantis Swap

Lending Protocol

1. 0vix - Interact with Quickswap

Here’s how to interact with Quickswap. First, connect your wallet to Quickswap Exchange. Make sure you have switched the network on Polygon zkEVM. Then, go to the Swap section and (1) Swap ETH for USDC; and (2) Swap the same amount of ETH for WETH. Afterwards, go to their Pool, select ETH and USDC tokens as the token pair, approve the tokens and add liquidity.

- Interact with Kokonut Swap.

Here’s how to interact with Kokonut Swap. First, connect your wallet to Kokonut Swap. Make sure you have switched the network on Polygon zkEVM. Then, go to their Swap page and swap ETH to USDC.

- Interact with Dove Swap

Here’s how to interact with Dove Swap. Connect your wallet to Dove Swap and make sure you are on the Polygon zkEVM network. Then, swap ETH for USDT.

- Interact with Mantis Swap.

Interact with Mantis Swap by going to their website. Then, connect your wallet and make sure you are on the zkEVM network. Finally, swap USDC to USDT.

- Interact with 0vix

To interact with 0vix, connect your wallet to their website and make sure you are on the Polygon zkEVM network. On the Supply Markets, supply a small amount of ETH and click “Supply”.

- BONUS: Trade on Satori Finance

Satori Finance is a protocol on Polygon zkEVM (as well as zkSync, Linea and Scroll). To trade on Satori Finance, connect your wallet to https://satori.finance/, making sure that you are on the Polygon network. Then, go to “Portfolio” and deposit some trades. Next, go to the “Trade” tab and do some trades.

- DOUBLE BONUS: Join in the zkEVM saga with Intract x Polygon to get free NFTs

Connect your wallet to the Quest Page and complete the tasks to get a free NFT. Tasks include signing messages, following social accounts and posting Tweets. Finally, click “Get your NFTs” and follow the instructions on your wallet to mint your free NFT. Note you will need to pay gas fees in ETH

Airdrop Review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: Although not confirmed, it is very likely there will be a MATIC airdrop for Polygon zkEVM users, according to Sandeep Nailwal.

Airdropped Token Allocation: There is no confirmation on the token allocation, but Nailwal said that it would be a “massive” airdrop.

Airdrop Difficulty: Simply bridge to Polygon zkEVM and interact with QuickSwap and other high TVL DEXes. You will need real ETH to perform these tasks.

Token Utility: MATIC is the native token of the Polygon blockchain. Although Polygon zkEVM uses ETH for gas fees, it is likely MATIC will be airdropped as rewards.

Token Lockup: No mentions of token lockup.