CREAM Finance ($CREAM) stands for Crypto Rules Everything Around Me. The project began with a vision to establish a financial system more accessible than its traditional counterparts. So CREAM has created an ecosystem that can be linked with other Ethereum platforms to efficiently provide a spectrum of services for its users. The liquidity mining trend, which is currently the most talked-about aspect of the decentralised finance (DeFi) space due to its potential high returns has also helped CREAM establish its popularity and footing in this field.

Background

Jeffrey Huang, the Founder of CREAM Finance, believes in the capacity of cryptocurrencies to create an open and inclusive financial system. And through the help of smart contracts, Huang’s team went on to create a DeFi ecosystem that would link together multiple products and services that many users need today.

In recent weeks, the team has been continuously working on expanding its listing and preparing for the launch of its CREAM token. The launch of their beta liquidity mining on 12th August 2020 has been the subject of discussions in some social media platforms.

What is CREAM Finance?

CREAM Finance is a DeFi ecosystem focused on providing lending, exchange, payment, and asset tokenization services. It also claims to operate a permissionless and open-source protocol so any other internet participant can be a part of the development of the network, instead of just using it or locking up funds in smart contracts for staking rewards.

Financial inclusion is among the team’s primary goals. And the objective is to be able to achieve it without compromising the safety and security of each user and their assets.

Since CREAM is established on the Ethereum blockchain, it can take advantage of smart contracts that can be used to run Ethereum Virtual Machines (EVM). Such a set-up also allows the CREAM project to have better composability than other DeFi projects.

EVMs can also help community users develop their own decentralized applications (Dapps) on top of the network. However, there is very little detail on the community’s plans for such at the moment.

CREAM plans to launch its own algorithmic money market protocol on top of Binance Smart Chain (BSC) in the weeks to come. When it is finally deployed, it might ensure that the platform can take advantage of the transaction throughput and cost-efficient servicing available only on the BSC and other similar chains. In addition, linkage with the Binance Chain can provide them with better liquidity through its access to the biggest cryptocurrencies.

There has not been any report yet on the audits being done for CREAM’s smart contracts. But according to a recent release they made, they recently hired a security adviser to work on the necessary platform developments.

The first monthly payment the team has made to the new adviser totaled to 37,500 CREAM. Some of the more prominent crypto advisers on-board is Robert Leshner, CEO of Compound Finance. Leshner acts as one of the team’s technical advisers.

CREAM’s Lending Services

The emerging trend of DeFi projects facilitating peer-to-peer lending services enticed the team behind CREAM to work on a protocol that can do something similar. Available assets that users can borrow from the CREAM ecosystem include BAL, COMP, ETH, CRV, LEND, REN, BUSD, USDC, USDT, and YFI.

CREAM is looking forward to the launch of BSC. When it is already available, users can take advantage of CREAM’s link with Binance through the BEP2 standard, or pegged tokens, to make the transfers of XRP, BCH, LTC, and TRX much easier.

Without having to wrap tokens, CREAM transactions on BSC can be performed faster and more affordably.

CREAM Token and Liquidity Pools

The CREAM token, i.e. the CREAM platform’s native asset is available on Uniswap and Balancer. As at 25th August 2020, the CREAM token market cap is over $11.8 million, with a circulating supply of 149,927 CREAM. The total supply, however, is at 9 million CREAM.

CREAM was recently launched in August 2020 yet the platform already has a total of roughly $48 million in total value locked (TVL). Although it certainly wasn’t able to emulate Yearn Finance’s ($YFI) meteoric rise, it is still a notable DeFi protocol since it has gained a lot of traction after only being in the market for a few weeks.

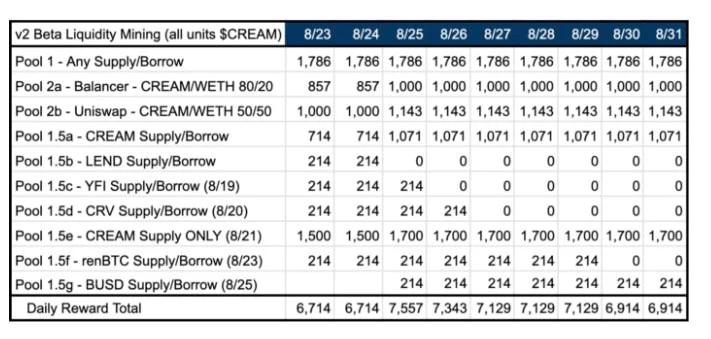

Since there is a growing number of crypto users participating in liquidity mining or yield farming, the team behind CREAM also launched their own liquidity mining program. On 24th August 2020, CREAM also announced their v3 Beta Liquidity Mining program, some of their updates include increasing the rewards for 3 of their pools.

Conclusion

CREAM is a relative newcomer to this space and we can see that they are continuously building and listing more assets onto their platform. They have recently updated the rewards available on their liquidity mining pools and are transparent on their liquidity mining distribution. So be sure to check their Medium where they provide announcements and updates at least once a day. The team behind CREAM are also very responsive on social media in terms of answering people’s queries about them.

Finally, considering the inclusion of some very prominent crypto personalities and their linkage with the biggest exchanges and protocols in the space, the future of CREAM looks promising so far. Looking at the service they are offering, it sure seems that it fits into what many cryptocurrency users need from the market.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.