RAMP DeFi seeks to open more yield farming opportunities for users who have already staked their tokens on non-ERC20 platforms and thus enabling them to maximise their leveraged positions. Staking is the practice of locking-up funds in either smart contracts or by purchasing tokens from decentralised finance (DeFi) platforms for the purpose of earning profits at a later date. However, this also implies that the staked assets could not be used for whatever purposes users want unless they are willing to let go of their positions. RAMP DeFi aims to change this and let users continue to flexibly use their liquidity even when their capital is locked into staking arrangments.

Background

The explosive success of DeFi ecosystem, surpassing $13 billion market in value, has allowed multiple projects to flourish in response to its growing demands. However, the problem still exists in terms of convenience, accessibility, and flexibility.

Lawrence Lim, Co-founder of RAMP DeFi led the creation of an ecosystem that seeks to solve these problems. With the concerns of the DeFi space in mind, RAMP was conceptualized to provide users the opportunity to maximize the value of their staked assets with optimized flexibility.

As of now, RAMP has the potential to unlock $22 billion in assets staked in the DeFi space. However, its humble target by the end of 2021 is to reach at least $1 billion in Total Value Unlocked (TVU). TVU refers to the staked assets that RAMP seeks to open for potentially greater leverage.

Check out our interview with Lawrence Lim below:

What is RAMP DeFi?

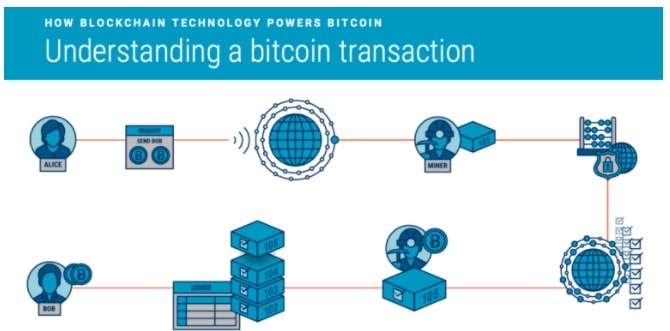

RAMP is a cross-chain liquidity on/off ramp platform focused on providing stakers of non-ERC20 tokens the opportunity to utilize these assets on top of the Ethereum blockchain. This is done through RAMP’s stablecoin, the rUSD, acting as a gateway bridge between non-ERC20 platforms and the Ethereum chain. Furthermore, users can also deposit their ERC20 tokens in RAMP’s liquidity pools to mint eUSD.

Both holders of rUSD and eUSD can access RAMP’s financial services such as lending, borrowing, and exchange between rUSD and eUSD. This on/off ramp allows users to make the most out of their staked assets even if they are locked in non-ERC20 platforms.

So far, its first private sale has been able to raise over $1 million. Some of its private sale investors include Alameda Research, Blockwater Capital, IOST, ParaFi Capital, Ruby Capital, Signum Capital, and Arrington XRP Capital.

RAMP Ecosystem

rMint and rStake

This is the platform where non-ERC20 tokens can be collateralized to mint rUSD. Collaterals designated to rStake are aggregated by different nodes on partner non-ERC20 blockchains. They also earn staking rewards for it.

eMind and eFarm

eMint allows the deposit of ERC20 stablecoins to create eUSD, a token that represents the value of the amount deposited by users. The deposited amount is transferred to eFarm in order to create yield farming opportunities for users.

rFinance

The platform’s lending and borrowing service is provided by rFinance. rUSD and eUSD holders can freely lend and borrow from each other. Moreover, oracles help keep the interest-rate setting at a fair level through formulas that revolve around demand-and-supply and market-relativity indicators.

rPool

RAMP has its own liquidity pool that allows users to build value for their assets, collateralization insurance, liquidation execution, and cross-chain swaps. rPool gains value from staking rewards, yield farming rewards, and revenues from fees, which are then later distributed to the holders of RAMP tokens.

In the event that rUSD suffers from a crash, rPool is first utilized to support its value. If the value of a user’s collateralized position drops below the allowed collateralization ratio set within the specific parameters, their positions are liquidated to the rPool.

rSwap

Users can swap ERC20 stablecoins with any other non-ERC20 token provided that these tokens are part of RAMP’s blockchain partners. They do this by facilitating the exchange of ERC20 stablecoins with the cryptocurrencies stored within the rPool. The conversion rate is set by price oracles.

RAMP Token

RAMP is the native utility token used to power the whole ecosystem value, as well as align the well-being of all network participants. On RAMP DeFi’s public sale, 10 million RAMP tokens will be sold to participants. The date of this public sale is not yet announced. After the sale, RAMP is slated to be listed on Uniswap.

RAMP is powered by an ecosystem composed of different DeFi projects that also enables its cross-chain value accretion. Parts of its ecosystem are designed to respond to every transaction interaction between the users and the blockchain.

RAMP Token public sale

The RAMP token public sale date has not been announced yet. Check their official telegram for the latest news.

rUSD Stablecoin: What is it?

rUSD is RAMP’s stablecoin backed by non-ERC20 tokens designed to interact with ERC20 stablecoins like USDC, USDT, and TUSD. Minting rUSD follows a collateralization ratio similar to MakerDAO in order to ensure that they are fully-backed.

The minimum collateralization ratio is at 200%. For example, a $200 worth of non-ERC20 token can be used to mint $100 worth of rUSD.

The liquidation ratio starts at 120%. If liquidation is triggered, the collateralized tokens are then sold to the rPool. Then, these tokens will be used to buy back the rUSD minted by the user whose position is being liquidated.

Benefits of holding rUSD and eUSD on RAMP

For rUSD holders:

- Leverage value from non-ERC20 tokens staked in other blockchains without giving up their existing positions.

- Access ERC20 opportunities, such as yield farming or trading, without having to put in more of their assets.

- Receive staking rewards even when they have minted rUSD.

- Maintain potential revenue from existing positions and collateralized portfolios.

- Farm RAMP tokens after collateralizing their cryptocurrencies to mint rUSDs.

eUSD holders can enjoy:

- Interest fees from lending their assets.

- Participate in multiple yield pools to farm.

- Opportunity to farm yields from other DeFi projects partnered with RAMP.

- Farm RAMP tokens by providing assets to RAMP’s liquidity pool.

Advantages of RAMP DeFi

RAMP offers some unique advantages over other cross-chain DeFi platforms.

rUSD Has a Clear Purpose

The RAMP team has recognized that initiating adoption for a stablecoin is no easy task. For instance, it took a substantially long time for Makerdao to drive DAI’s broad market acceptance.

For that reason, they have issued the stablecoin rUSD with a core utility as a value stability bridge.

rUSD Requires No Stability Fee

Paying stability fees is common among DeFi protocols as it helps in cushioning from massive market plunges. And we’ve witnessed the fees to go ultra-high, especially during a bear market.

Fortunately, the RAMP DeFI platform does not incur a stability fee when minting rUSD. This enables users to access RAMP with less friction and save more.

Has Contingencies in Place in the Event of a Flash Crash

A flash crash is an unlikely occurrence where the value of assets drops significantly in a very short period of time, resulting in the under-collateralization of rUSD. In such an event, RAMP will utilize the universal liquidity pool as collateralization insurance for the stablecoin.

Rapid Scaling Integration Layer

Being a bridge to isolated blockchains, the value of the RAMP network increases with every new chain added to it. For this reason, the RAMP ecosystem has been made accessible to various developers from different blockchain foundations to encourage its adoption.

This enables the foundations to easily integrate their native stablecoins onto the RAMP ecosystem, which would result in RAMP’s fast growth.

Conclusion

The purpose of DeFi is to unlock the potential of the blockchain and the power of money to the benefit of the community and its users. RAMP is a promising development in that particular aspect.

Its feature opens up possibilities for ERC20 and non-ERC20 tokens to interact with each other to provide a new opportunity for users to earn from the assets that they are putting into DeFi protocols. Not only does it attract existing stakers into the platform, but also expands the channels where crypto users can do yield farming.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

Decentralised Finance (DeFi) series: tutorials, guides and more

Decentralised Finance (DeFi) series: tutorials, guides and more