Aavegotchi ($GHST), powered by Aave, is the combination of DeFi staking and non-fungible tokens (NFT) that possesses three attributes, determining their value and rarity: collateral stake, traits, and wearables.

Aave, one of the biggest DeFi protocols today, developed NFTs that function within the DeFi framework. The project shows a promising alternative to the way many stakers perform yield farming.

Background

Launched in July 2018, the team behind Aave created Aavegotchi to offer new alternatives for yield farming. This project puts entertaining gaming mechanics on the platform to support a new type of DeFi experience for its users.

Daniel Mathieu, the lead developer for Buillionix.io, and Jesse Johnson, co-founder at Bullionix, lead the team of builders working for the Aavegotchi team. Their work centers on the main goal of “gamifying DeFi experience” through NFTs.

What is Aavegotchi?

Aavegotchis are Ethereum-based crypto-collectibles powered by NFT technology. The Aavegotchi NFTs follow a similar set-up that other blockchain-based games such as Cryptokitties implement on their own gaming economies.

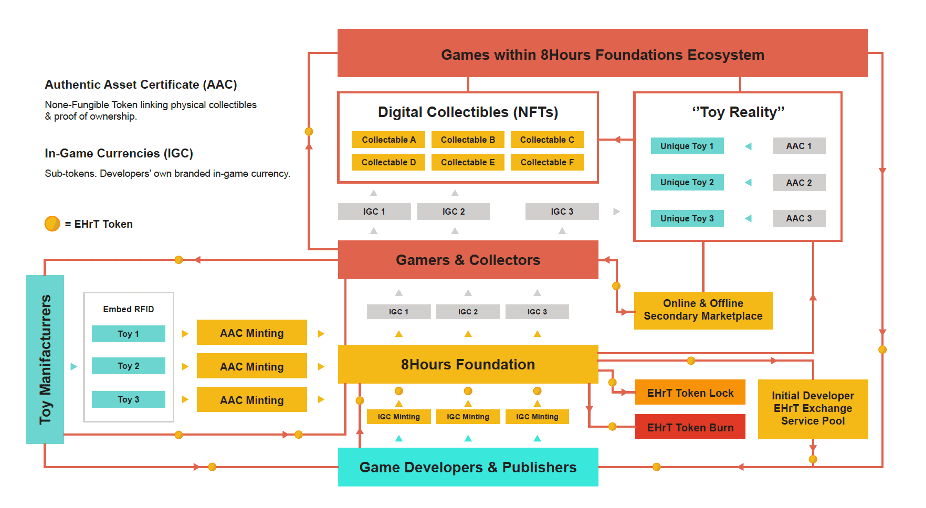

What Aavegotchi offers to the blockchain gaming space are DeFi models such as collateral staking, dynamic rarity, rarity farming, decentralized autonomous organizations (DAO), and smart contract implementations. Simply put, the objective is to use DeFi and yield farming concepts in creating NFTs that can hold value and appreciate over time.

The team behind Aavegotchi sought to liken the project to the Tamagotchi. Aavegotchis can be considered as the blockchain counterpart of digital pets that we play within Tamagotchi. Aavegotchis are playable NFTs that can hold digital economic value.

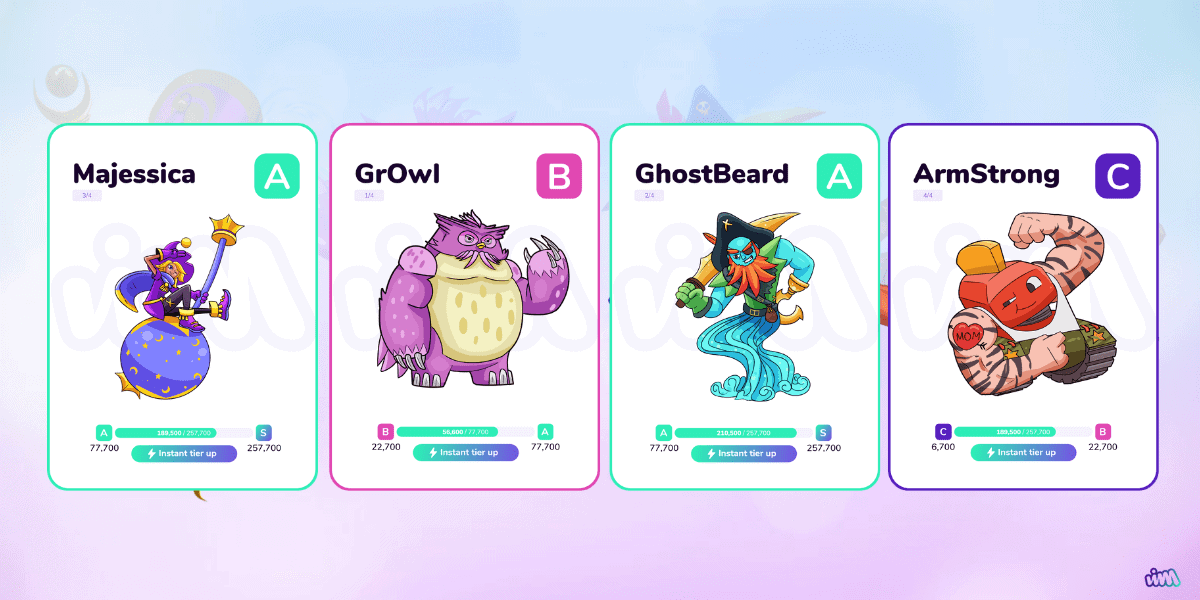

There are three elements to the Aavegotchi NFT that help define its value and rarity. They are:

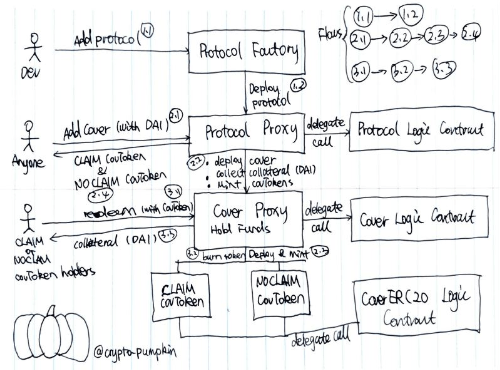

- Spirit Force – Putting it in DeFi terms, this means “collateral stake.” Aavegotchi has an escrow account where every owner’s Aave-backed ERC20 tokens are held as collateral. These collateralized tokens are called “aTokens,” and are accessible to Aave’s lending pool. Since these are assets can generate yield over time, this helps increase the value of aTokens kept in Aavegotchi’s escrow account. Today, there are many aTokens supported by the platform such as aDAI, aLEND, aLINK, and aUSD, among others.

- Traits – Aavegotchis can have different attributes that make up their identity as NFTs. These traits affect their rarity, performance, and compatible wearables. While most of these traits are given to Aavegotchis randomly the moment they are created, they can be affected by user interactions that their holders make.

- Wearables – Through the ERC-998 composability standard, Aavegotchi can be used to manage child NFTs as well. These child NFTs back the wearables that users can attach to Aavegotchis. If worn on compatible Aavegotchis, they can affect their traits and value.

Where do Aavegotchis gain value?

Aavegotchis derive their value from two sources: intrinsic value and rarity value.

Intrinsic Value

Their intrinsic value originates from the amount staked by users on the NFT behind the Aavegotchi. The collateral stake, along with the interest it has accrued from Aave’s lending pool, becomes an Aavegotchi’s intrinsic value. For example, a 10 aLEND stake in an Aavegotchi will mean that it can hold that value as well, along with the interest accrued.

As of now, the only collaterals that can be staked on Aavegotchis are ERC-20 tokens listed on the Aave platform. As soon as the AavegotchiDAO is launched, the number of acceptable collaterals can be expanded. (lakeforestgc.com)

Rarity Value

The rarity of an Aavegotchi influences its value as well. This introduces the concept of “rarity farming” on the ecosystem as well. Users get rewards for training rare Aavegotchis and trading them with other players on its platform.

Aavegotchi Ecosystem

Portals

Users can only summon or create Aavegotchis through the Portal. This is backed by a smart contract that allows for the creation of new NFTs. Portals can be bought from the Aavegotchi dapp or from an external marketplace.

In claiming Aavegotchis, users have to stake the collateral required for it. Portals can only support the summoning of one Aavegotchi.

What is $GHST Token?

$GHST is the native utility token for the Aavegotchi platform. They can be used as a medium of exchange, fees payment for purchasing stuff like portals and wearables, voting functions, and rarity farming. $GHST is also required to mint REALM.

$GHST’s can be freely transferred to other users or swapped with supported tokens on the Aave platform.

$GHST Tokenomics

$GHST will be distributed in 3 main phases – i) Initial token distribution event, and ii) Governance rewards and iii) Rarity farming.

The Token Distribution Event is planned to begin in late Q3 2020 or early Q4 2020, split into 3 phases: Private Round, Pre Sale Round, and Token Bonding Curve.

- Private Round – 5,000,000 GHST tokens will be distributed, at a price of 0.05 DAI / GHST. Open to participants with KYC validation with a minimum of 20K DAI to be redeemed for GHST tokens. The total vesting period is 365 days, with an initial release of tokens on the 180th day after the close of the pre-sale round, followed by a release over the subsequent 185 days thereafter.

- Pre Sale Round – 500,000 GHST tokens will be distributed, at a price of 0.1 DAI / GHST. Open to participants with KYC validation with no minimum contribution. The vesting period is the same as the Private Round. Funds raised during the Pre Sale will be used as liquidity in the Token Bonding Curve reserve pool.

- Token Bonding Curve (TBC) – Open to participants with KYC validation with no minimum contribution. No maximum supply of GHST distributed via the bonding curve. No lockup or vesting period.

During the Pre Sale Round, $GHST will also be created and distributed to the Ecosystem Fund (1,000,000 GHST) and Team Fund (1,000,000 GHST). Both funds are locked according to the same schedule as the Private Round.

AavegotchiDAO

The community-governance model of the platform will be supported by the AavegotchiDAO. This protocol will allow the users to decide on the list of collaterals that can be staked in NFTs, amend gaming parameters, and even limit the number of Aavegotchis that can be created in the future. To incentivize token holders on community governance, they are rewarded with GHST.

Aavegotchi Realm

This refers to the metaverse for Aavegotchis. The Realm is the digital world where Aavegotchis can interact with each other and join games, execute smart contracts, and call for governance functions.

Users can purchase parcels of land, or REALM, in the Aavegotchi world by staking GHST tokens. Aavegotchi’s Realm is also the social layer for the AavegotchiDAO, aimed at creating a more visual experience for community voters. Within this digital experience, Aavegotchis convene in a 2D town square to discuss platform proposals and cast votes.

Conclusion

The DeFi space seems a bit too complex for many newbies. This reality can be daunting for someone who is just newly-introduced to the world of blockchain, which unfortunately presents psychological barriers to adoption. Platforms that help users ease themselves onto DeFi could be helpful additions to the crypto space in general.

Aavegotchi is a valuable concept on that end since it has a promising model in making it easier for anyone to participate in yield farming. Gamifying the DeFi space for anyone who wants to dip their toes on interest-earning products is likely to help foster adoption later on. Overall, the project shows huge potential in proving the capacity of different blockchain innovations, such as NFTs and collateral staking, to provide reliable financial products and services.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.