Before we begin

We’ve been closely following the events involving SushiSwap and its founder “Chef Nomi”. This article will not be making any comments or conclusions on Chef Nomi’s actions or how SushiSwap is or should be run. This article is simply an explainer on what SushiSwap is and how to use the platform. As with all yield farming projects, SushiSwap involves a huge amount of risk. Anyone intending to participate in yield farming should do full research and consider carefully the risks involved beforehand.

What is SushiSwap ($SUSHI)?

SushiSwap is the newest decentralised finance (DeFi) liquidity pool platform. With SushiSwap, people can add their tokens into the liquidity pools and earn. In this article, we’ll have a look at the Sushi Swap platform and how to participate in the liquidity pool. Anyone can participate.

Sounds interesting? Let’s dive into it.

Summary

- SushiSwap is a platform that allows anyone to provide liquidity. In return, the person gets rewarded with token(s) and SUSHI tokens.

- As of September 4, 2020, there are 1 billion dollars of locked liquidity.

- Possibility of very high APY (up to 1,000%) on some liquidity pools. You can check the current yields on SushiBoard.

Why is SushiSwap so popular?

Sushi Swap markets itself as an “improved and community-friendly” Uniswap. Unlike a traditional exchange like Binance where they employ market makers, SushiSwap is a community-oriented platform where users provide liquidity. In return, they get rewarded. Indeed, the users are the market makers.

SUSHI token

SUSHI tokens are given as rewards for liquidity mining. The token allows its holders to participate in the governance of the platform and entitles them to a portion of the fees paid to the protocol by traders. For the governance of the platform, SUSHI holders can submit a SushiSwap Improvement Proposal (SIP) which token holders can vote on with their tokens.

Of course, some people also speculate on the prices of SUSHI and the token can be traded on major exchanges such as Binance, FTX and OKEx exchanges.

Advantages of SushiSwap

There is no KYC (Know Your Customer) policy. This means anyone can trade and contribute to the liquidity pools. The platform is permissionless, meaning anyone can contribute millions of dollars without asking for permission.

Earn tokens from Sushi Swap. SUSHI is Sushi Swap’s native token. When you contribute to the liquidity pool, you earn sushi tokens. You can exchange SUSHI for ETH.

Sushi Swap model: 0.25% go directly to the active liquidity providers and 0.05% get converted back to SUSHI and is rewarded to sushi holders.

Sounds interesting? Let’s visit Sushi Swap’s home page.

SushiSwap beginners guide

When you first arrive on Sushi Swap’s home page, you’ll see this:

Click on “Unlock Wallet” or “See The Menu”, either way you will need to connect your ETH wallet in order to this platform.

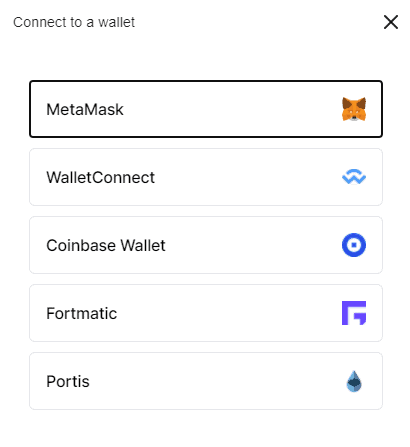

Sushi Swap has the option to use MetaMask, WalletConnect or many other non-custodial wallets. Pick the one of your choice.

Give permission for Meta Mask or Wallet Connect to connect to Sushi Swap. Once you’re connected, you’re ready to add your tokens into the liquidity pools.

You’re presented with various liquidity pools (LPs). Each liquidity pool has a different annual percentage yield (APY).

In this example, I’ll contribute to the ETH-USDT pool. I add my USDT into the liquidity pool. In return, I’ll get a percentage of USDT and SUSHI tokens. Think of Sushi Swap as a “community revenue share” model.

To contribute to the liquidity pool, click “Approve USDT-ETH UNI-V2 LP” and give your Meta Mask permission to move your tokens into the liquidity pool.

Now what? You wait. The “SUSHI earned” box should populate with your earned SUSHI. You can withdraw your SUSHI token anytime by clicking on “Harvest”.

2020 roundup and new roadmap!

Many things have happened within the Sushiswap ecosystem in the last months: it is now time for a quick recap and to look at what the future will bring to this project!

The number of all the partnerships finalized by the protocol is countless, but one of the most important ones, if not the most important, is certainly the merger with Yearn. The news also sparked controversies: Sushiswap was still considered a sort of “copycat” of Uniswap by some, and when Andre Cronje (Yearn’s father) wrote an article on how it is difficult to build in Defi and how conversely it is easy for anyone to just copy other people’s code, this wasn’t seen as really coherent. The collaboration was born to allow the two teams to cooperate on Deriswap.

Nevertheless, Sushiswap has been evolving so much that, according to Mira Christanto (one of Messari’s data analysts) they have “put their past behind” and, not being backed by Venture Capitals, they can move faster than competitors. January has seen a real growth in Sushiswap’s TVL (now at $2.1 billion), mostly at the expense of Uniswap’s.

Among the important milestones in 2020, we find Onsen, the new Sushiswap liquidity mining incentivization program which replaces the old Menu of the week. It brings communities together into the ecosystem and allows voted tokens to become accredited and participate in the mining program. The website also has a new layout of and a lite version.

2021 Roadmap

As the new year has already begun, it is also interesting to have a look at what Sushiswap is working on for 2021. The team released a long and detailed roadmap in early January. Notable upgrades are the following:

- Mirin will be the new upgraded version of Sushiswap’s V3 protocol. It will include many new features like franchised pools, double yield, dynamic yield rebalancing, and many more as you can read here.

- Bentobox (which should have launched in January) was born in the team’s mind as a new Lending Platform. While they were was working on its code though, it became something more. In simple terms, it will be a single vault that holds all tokens for any protocols and future extensions. It will support several oracles and it will also benefit all the $SUSHI holders.

- Miso (Minimal Initial Sushi Offering) will be a sort of token launchpad, designed to drive new projects’ launches on the platform. It will include crowd sale options, IDOs (Initial Dex Offering), auctions, and more. We could think of it as something similar to Binance’s launchpad.

- As Ethereum fees are and will keep growing in the next future until ETH2 will be a reality, most platforms are studying alternative solutions for their users such as Layer 2 possibilities. Unlike Uniswap, which is working on Optimistic Rollups, Sushiswap decided to move in sync with the greater Yearn ecosystem and thus will probably offer Zk-rollups options.

Together with all these big news, Sushiswap is also planning to move to a new domain as the old one, in their view, is not enough to describe the diversity of the platform anymore. A transition to a fully decentralized governance structure is also planned by the end of 2021. Last but not least, Sushiswap has created a proposal page for people to express their ideas on what they would like to see on the platform. Everyone can be a chef is the place where you can voice your opinion if you like to suggest new ideas.

FAQs

The pool could get hacked if the code isn’t audited. There have been cases of hackers draining funds from smart contracts. It helps if the code is audited by a reputable firm. In the case of SushiSwap, it has been given a “security review” (not an audit) by Quantstamp. 10 issues were identified but they do not appear to be fatal. Subsequently, Peckshield had completed an audit on SushiSwap. They found no critical or high severity issues relating to business logistics but 2 high severity opsec issues that need to be fixed through extra care with deployment.

0.25% go directly to the active liquidity providers and 0.05% gets converted back to sushi and is distributed to active SUSHI holders.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

SushiSwap is not a DEX. It literally is a centralized website that connects to a wallet. Sorry, but anything that is pointing to a website is just simply not a DEX. I true layer 2 DEX is local to someone’s phone or computer. I suggest you look at the only true layer 2 DEX in the world that is able to trade BTC on the LN and ETH on the RN.

How do you add ETH to the liquidity pool? Every pool says it accepts an LP token, not ETH directly. How do you obtain LP tokens?

You can interact with Sushiswap through the Etherscan contract directly numbnuts

Hi there I’m not sure if this is the correct platform to ask this question but here goes. I was in the process of staking on sushiswap two days ago but when I approved staking, nothing happened for several hours. This I did continually but it did not stake. The amount of tokens I tried to stake was 2.7 sushi but has now disappeared from sushiswap. How do I retrieve it?

When do you get the sushi tokens? I staked $4500 of weth-wbtc for days and took it out but i see no sushi in my wallet. it said .25 sushi per day per thousand. I should have some sushi?

Are you retarded? Sushiswap is literally a smart contract on Ethereum, its as decentralized as Ethereum is.