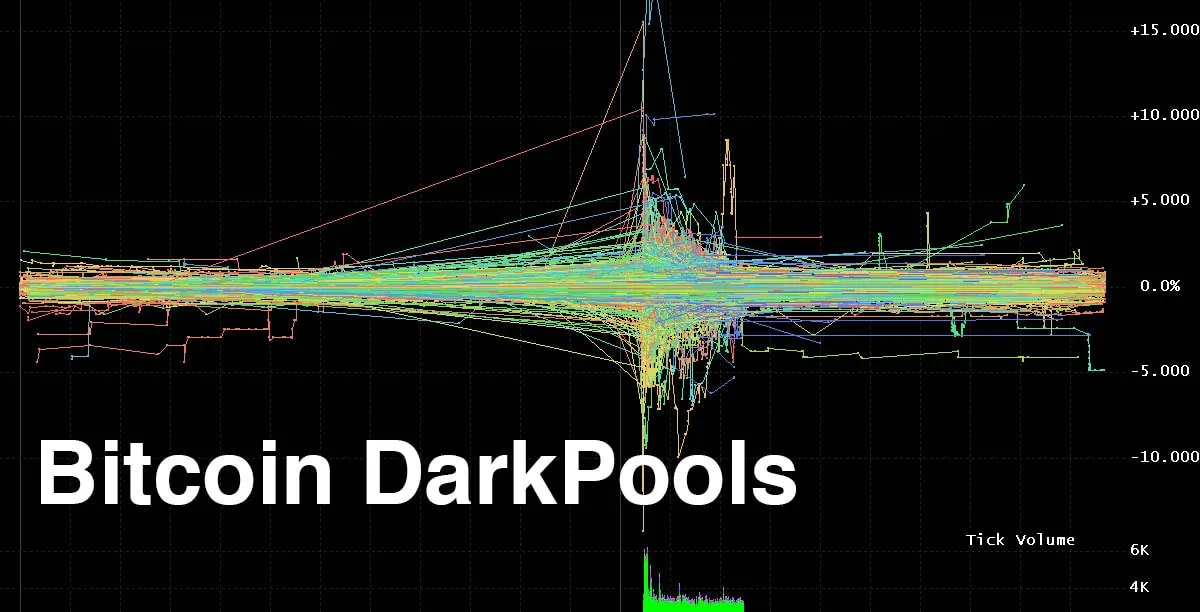

In Crypto, not all trade volumes are visible – in fact “Darkpools” account for a huge amount of crypto trading and has an enormous impact on cryptocurrency prices. Darkpools include peer-to-peer trading, such as on sites like localbitcoins.com and also Over the Counter (OTC) desks. The reason why it’s unreported is because deals are done privately, for example Peer-to-peer trading can be done in person and with cash, leaving virtually no trace of the transaction ever happening. Large volumes are also traded OTC – this is more organised as private buyers and sellers are matched, with some form of escrow to allow the transaction to take place. OTC desk sometimes even require minimum volumes, like $100,000+ USD to up to 1 Million.

First things first. What’s an Over the Counter (OTC) desk?

Traditionally, OTC desks facilitate trading of securities that are not listed on formal exchanges, e.g. the New York Stock Exchange.

The trading of cryptocurrencies on OTC desks is similar to those in traditional markets.

OTC desks have a network of buyers and sellers. The trades themselves are facilitated by OTC broker-dealer who will locate and negotiate directly with prospective buyers and sellers over computer networks or by phone.

This is contrasted from trading over exchanges where the prices and order books are publicly available. For OTC desks, their broker-dealers will negotiate the trade price for you. Trades are also not publicly listed giving the parties privacy.

Therefore, to fully understand what is going on in the cryptocurrency markets it is important to consider what is also happening at OTC desks. This is because large transactions happen on them on a daily basis.

What does a trader at an OTC desk do?

Traders at OTC desks are the broker-dealers mentioned above. Their role is to locate and match buyers and sellers, and negotiate the best deal for all the parties involved.

Therefore, it is important for traders at OTC desks to have a keen eye on the cryptocurrency markets and be knowledgable of the market trends.

I had the opportunity to interview Charles Yang, Head Trader at Genesis Block Hong Kong, an OTC desk. In my interviews we discuss what’s really happening at OTC desks away from the public eye. We also discuss his thoughts on the market sentiment.

Is Tether Safe? Will Bitcoin & Ethereum Recover?

Secrets and Insights from an OTC Trader

Here’s a summary of the key points from the interviews with Charles.

There is still interest in cryptocurrencies

Charles observes there is revived interest in cryptocurrencies despite this bear market.

He notes that a lot of the customers from the OTC desk who were previously dormant have recently contacted them wanting to buy and sell cryptocurrencies.

The risk of Tether is exaggerated

Firstly, what is Tether? Refresh your memory with our Tether Explained guide below:

We’ve seen in recent news that USDT is not fully backed by cash. Instead, Tether is around 75% backed by cash, and the remaining 25% by other securities or loans.

Confused with what’s happening in this Tether scandal? Check out our video below which explains what is happening and the latest legal action surrounding Bitfinex.

Despite this, there is still demand for USDT in Asian countries such as China, where they are buying USDT at a premium.

This is because China bans cryptocurrency exchanges, so retail investors cannot buy cryptocurrencies such as BTC. What they do instead is they first buy USDT through peer to peer merchants, and then enter the cryptocurrency market at a later time when conditions are right.

Right now, Bitfinex who is being accused of “losing” customers funds is more at risk. Bitfinex will have to go bust first before people question USDT.

Charles believes that fundamentally short trading would have less losses because if USDT is at 97% and your prediction is wrong, then your loss would only be 3%. Whereas the opposite would be to bet that it goes to 0.

Mining is still profitable

The recent “official news” in China was that cryptocurrency mining has been banned.

Despite this ban, Bitmain is coming up with new models and generally summer is big for mining because electric costs falls.

There may be miners who start accumulating and building to maximize their margins

Charles notes there is news that big players are scrambling to get cheap damaged mining rigs. They are not the newest models but there are still returns from using them to mine cryptocurrencies.

So despite the official news about China banning mining the word on the street is that people are buying rigs and locking in contracts for the summer months.

Initial Exchange Offerings (IEOs) are risky, but need not be avoided completely

If you participate and get allocation you would benefit. But ultimately it is the exchanges that benefit because you need to buy their token to participate.

For example Binance requires you to buy into IEOs with their BNB token. Of course it’ll be great for you in the short term if you get allocation and the coin pumps. However your risk is that you would be left with the exchange token if you don’t manage to get any allocation after the lottery.

It may be better to trade with OTC desks than exchanges

Charles notices that there is quieter trade flow, so big players looking to buy or sell cryptocurrencies need to offer better prices. Therefore the margin between the buy and sell price is much less. Bigger players also can offer better quotes because of volume. Therefore it may be cheaper to trade with OTCs who deal exclusively with larger orders than exchanges.

And whilst exchanges require you to have the funds ready at the time of transaction, OTC desks allow you to lock in the prices and settle later. This gives people more flexibility .

However, depending on who you are, one upside or downside of OTCs is that they are not transparent. So while you can try to gauge whether there is a lot of trade flow through an OTC desk by reading their reports (if any), there is no way you can verify if they are being truthful. On the other hand you can conduct trades privately compared to on exchanges.

What coins to hold? Bitcoin Bitcoin Bitcoin (BTC)

Unlike other coins, Bitcoin (BTC) has a 10 year history. There is no founding team or leader. For this reason it is not affected by company politics and is the most decentralised.

We can see the prices for a lot of tokens crash during the Initial Coin Offering (ICO) crash. Some may be due to the project running out of funds, failing to deliver on its promises or in worse cases the founders and key personnel leaving the project altogether. Studies were shown that over 80% of ICOs in 2017 were scams.

We also see that the ICO game was not fair, some people were able to purchase tokens for a more favourable rate or terms even before the token was listed to the public. This however would never happen with BTC.

Is day trading profitable? No (sorry)

For retail investors, day trading is not profitable even for traditional markets.

This is because retail investors would be bogged down by trading fees, but not all trades are profitable.

Retail investors are also unprotected from market manipulation. This is especially true for cryptocurrency investing, which is generally an unregulated space.

Conclusion

Ultimately, trading cryptocurrencies requires exercising caution and doing your own research. One can look at OTC desk reports to have a good grasp of what may be quietly happening with some big players, but at the end of the day, question everything. Also, whilst you may stand to gain several times your initial investment by going into highly volatile IEOs, bear in mind it is designed so that exchanges ultimately win. The most prudent thing to do is to never invest more than you can lose.

Links

Buy Bitcoin in Hong Kong – https://buybitcoinhongkong.com/

Michael Gu

Michael Gu, Creator of Boxmining, stared in the Blockchain space as a Bitcoin miner in 2012. Something he immediately noticed was that accurate information is hard to come by in this space. He started Boxmining in 2017 mainly as a passion project, to educate people on digital assets and share his experiences. Being based in Asia, Michael also found a huge discrepancy between digital asset trends and knowledge gap in the West and China.