What’s are Bitcoin Over-the-Counter (OTC) brokers?

Over-the-counter (OTC) are entities that allow the buy and sell of large quantities of Bitcoin and other cryptocurrencies. OTCs offer more private and personalized services to institutions and high net-worth individuals who need a high degree of liquidity and privacy. The key advantage to an OTC is that they handle large trading volumes, such as trading $100,000+ USD without price slippage. OTC traders will normally quote a strike price for the entire order block with immediate execution. This is contrasted with trading on cryptocurrency exchanges where large orders will cause the price to decrease due to a lack of buy orders. OTC desks allows institutions and high net-worth individuals to buy Bitcoin without a having dedicated trading desk.

OTC offices can be either regionally located, serving local clients or global. Often major cities such as Hong Kong, Tokyo or New York have OTC brokers servicing local clients. These brokers can provide very personalized services and even in person meetups. In contrast, global OTCs such as Binance OTC handles transactions over the internet.

Traditionally in the stock market world, OTC desks facilitate trading of securities that are not listed on formal exchanges, e.g. the New York Stock Exchange.

Benefits of trading via an OTC broker

- High Liquidity – Dedicated traders from OTC desks will help increase the liquidity of the overall market. This means they can handle large order blocks

- Fixed Price – OTC brokers will over a quotation for the entire order block. This means orders are not affected by price slippage.

- Easy Fiat Options – Brokers will have local bank accounts and can sometimes even accept cash.

Disadvantages of trading via an OTC broker

- Limited range of cryptocurrencies – Often OTC brokers specialize on a few cryptocurrencies. This means unlike exchanges, they will not offer 100+ trading pairs. Instead, they will focus on the major popular cryptocurrencies that have high trading volune and interest such as Bitcoin, Ethereum or some stablecoins.

- Manual trading process – Traders are executed by a human counter-party. This trading times will often be limited to regular office hours.

- Large order size required – Brokers often have a minimum order size, such as $100,000 USD traded within a certain period of time.

How do OTC Brokers work

OTC desks have a network of buyers and sellers. The trades themselves are facilitated by OTC broker-dealer who will locate and negotiate directly with prospective buyers and sellers over computer networks or by phone. This is contrasted from trading over exchanges where the prices and order books are publicly available. For OTC desks, their broker-dealers will negotiate the trade price for you. Trades are also not publicly listed giving the parties privacy.

Therefore, to fully understand what is going on in the cryptocurrency markets it is important to consider what is also happening at OTC desks. This is because large transactions happen on them on a daily basis.

Bitcoin OTC vs Exchanges

The choice of whether to use a Bitcoin OTC or Exchange depends largely on the volume of orders. Big players looking to buy or sell large quantities of cryptocurrencies are better off using an OTC broker. This is because a single exchange (no matter how large) will not have the liquidity necessary to fill large order blocks. Research has shown that sell orders of US$30 million can significantly suppress the price of a cryptocurrency, hence causing slippages of 5-10%. This amount is much larger than the fees charged by OTC brokers. The second advantage of using OTCs is that they can offer to lock in a particular quotation with the option to settle at a later time. This gives people additional flexibility to move funds from banks or cold-storage (such as the Ledger Nano X).

However, depending on who you are, one upside or downside of OTCs is that they are not transparent. So while you can try to gauge whether there is a lot of trade flow through an OTC desk by reading their reports (if any), there is no way you can verify if they are being truthful or giving you the best price. On the other hand you can conduct trades privately compared to on exchanges and the price will be “locked-in” and not subject to any fluctuation between the time of agreement and the time of settlement.

How to trade Bitcoin with OTC Brokers

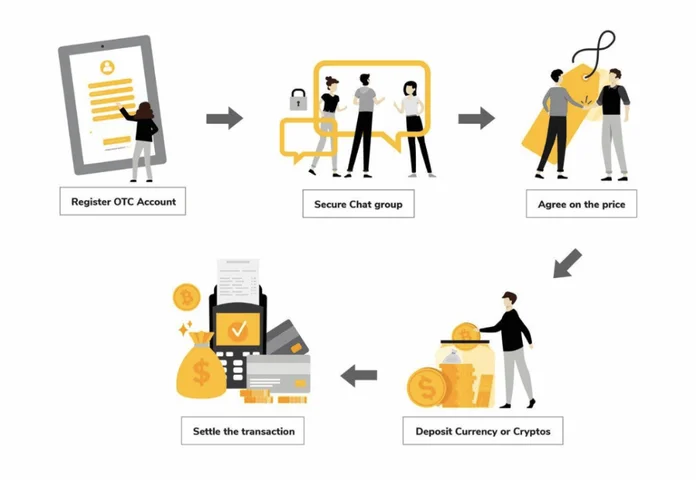

This guide outlines the general steps involved in trading with Over-the-Counter Brokers. Generally speaking, brokers provide similar on-boarding and trading experiences. It is important to remember all brokers will require verification of your identity, known as Know-Your-Customer (KYC) registration. On top of this, brokers will verify the source of funds to prevent money-laundering.

Time needed: 3 days

How to trade with Bitcoin OTC Brokers

Signup Sign up to the broker via website, email, call or in-person meetup. They will usually ask about the type and quantity of cryptocurrencies you would like to sell.

Every broker will require you to fill in onboarding documents and legal disclaimers. They will also ask you to provide various types of documentation such as a Government ID, Proof of Residence and Proof of Income.

Once on-boarded, they will give you a communications channel. Typically this involved a messaging platform where you can request quotations for orders such as:

You: “I would like to buy 100 Bitcoin”

Trader: “We can offer 100 BTC at a price of $8123 USD per BTC”

You can choose whether to accept the price quotation or not. If you agree, the trade is immediately confirmed and the trade will provide you with a deposit address.

Once the deposit is received, the order is no fully executed and you will receive your trade

Top OTC Brokers around the world

When trading with OTC brokers, it’s important to only use trusted and regulated brokers. This is important because of the large transaction sizes involved – you don’t want to get delayed or even scammed out of a transactions. We compiled the list of the biggest OTC brokers around the world

[wp-compear id=”5277″]

Bitcoin OTC in China and Hong Kong

Bitcoin OTC brokers play a very important role in China due to a government ban on cryptocurrency exchanges. In China, it’s no longer legal to operate a cryptocurrency exchange due to a legislation change in 2017. This has left large Chinese exchanges and OTC desks such as OKex, Binance, Genesis Block and Huobi operating overseas or as OTC brokers.

Currently Bitcoin OTCs brokers are legal in China. They operate by directly connecting buyers and sellers of Bitcoin. However, Chinese financial institutions such as Alibaba’s Alipay have distanced themselves from OTC transactions, stating that they will “immediately stop relevant payment services“.

There’re several reports about @Alipay being used for bitcoin transactions. To reiterate, Alipay closely monitors over-the-counter transactions to identify irregular behavior and ensure compliance with relevant regulations. If any transactions are identified as being related to bitcoin or other virtual currencies, @Alipay immediately stops the relevant payment services.

AliPay official statement

Interview with OTC Brokers

Travel with me to Genesis Block in Hong Kong to see what’s happening with trading behind the scenes and Over the Counter (OTC).

OTC money laundering and criminal activity

One of the biggest concerns of OTC brokers and trading is the risk of exposure to criminal funds. This is because OTC desks who do not perform proper due diligence on source of funds can come into contact with tainted coins. In a 2020 report, cryptocurrency research company Chainalysis released a report on money laundering in the exchange and OTC space. The report accused some OTC desks of illegally taking laundering funds for private clients. In order to protect yourself from such activity, ensure you are trading with legitimate brokers who have proper KYC. On top of this, never buy “discounted” Bitcoins offered on social media such as Instagram or Facebook.

Frequently Asked Questions (FAQ)

Often OTC brokers will have a cash option – for both buying and selling Bitcoin. It’s important to remember for large quantities of cash, KYC registration is required. On top of this, proof of funds may also be requested.

To comply with anti-money laundering laws, OTC brokers will require you to submit official documentation such as Identity, Proof of address, bank account statements, proof of income or proof of funds. The type of identification required however would depend on the OTC brokers own company requirements and any information as required by the laws of the relevant jurisdiction.

ost OTCs do not have a maximum limit on the amount of Bitcoin you can buy or sell. Order sizes of 100 or above BTC are commonplace for these brokers. However, some brokers will have a minimum order size, such as $100,000 USD.

The best way to buy Bitcoin without a record is via cash or peer-to-peer transactions. It is important to remember this contains inherent risk as you’ll need to do your own KYC and potentially offer proof of funds in the future. You should also check that your counterparty is a legitimate trader and not a scammer as there are incidents of people being robbed during these “trades”.

There are OTC services for altcoins and even coins that are not yet listed on exchanges. These OTCs will function similar to a matchmaker – matching sellers and buyers of a particular asset. One such example is Silverway – an OTC deal platform and deal aggregation platform.

OTCs are not obliged to provide trading data such as daily volumes, prices, or order books. However, some OTCs provide annual reports or blog posts that contain aggregated volume data.

Security and legitimacy are very important with thinking of which OTC desk to trade with, especially since huge sums of money are involved. Prospective customers could for example, check if the OTC desk is registered with the relevant government authorities, ask any peers if they have traded there before and their feedback, check online reviews or social media, or even go to their physical offices to make inquiries before signing up and trading.

Michael Gu

Michael Gu, Creator of Boxmining, stared in the Blockchain space as a Bitcoin miner in 2012. Something he immediately noticed was that accurate information is hard to come by in this space. He started Boxmining in 2017 mainly as a passion project, to educate people on digital assets and share his experiences. Being based in Asia, Michael also found a huge discrepancy between digital asset trends and knowledge gap in the West and China.