Rarible ($RARI) is a platform that allows users to create and sell their digital collectibles secured with blockchain technology.

Traditional ways of marketing your own work as an artist, selling high-value collectibles, or even just finding the opportunity to show your work to the rest of the world can be a difficult endeavor. Apart from the operational and financial costs that these objectives may incur, there are always intellectual property risks on an artist’s or collectible owner’s end. Rarible offers an innovative solution for those concerns—and more.

Through the blockchain, Rarible has created a platform that allows artists and owners to reach a wider audience and find interested investors. All of these goals are achievable through the platform without risking an artist’s ownership of a particular art, or an owner’s claim over a collectible. But how are they doing this, and how did it all begin?

Summary

- Rarible is a platform that allows users to create, sell and buy non-fungible tokens (NFTs).

- RARI is Rarible’s native utility token. Users can earn these tokens from various activities on the platform such as buying/selling artworks or collectables- known as “Marketplace liquidity mining”.

- The RARI token gives holders the right to decide on system updates on Rarible and to curate what content is marketed on the platform.

Background

Rarible was founded by Alex Salnikov and Alexei Falin in early 2020. Their vision is to be able to create a successful blockchain application with a focus on helping artists and owners of collectables.

The team behind Rarible came up with a blockchain-based online marketplace where artists can find prospective buyers for their content.

According to Salnikov, community participation in terms of making decisions for the platform can help a lot moving forward. Charging fees for the use of the platform is one example of a community concern that Salnikov believes could be discussed, hence, their decision to implement a governance token for the platform.

These features have given Rarible a share of the attention that decentralized finance (DeFi) platforms were getting in mid-2020.

What is Rarible?

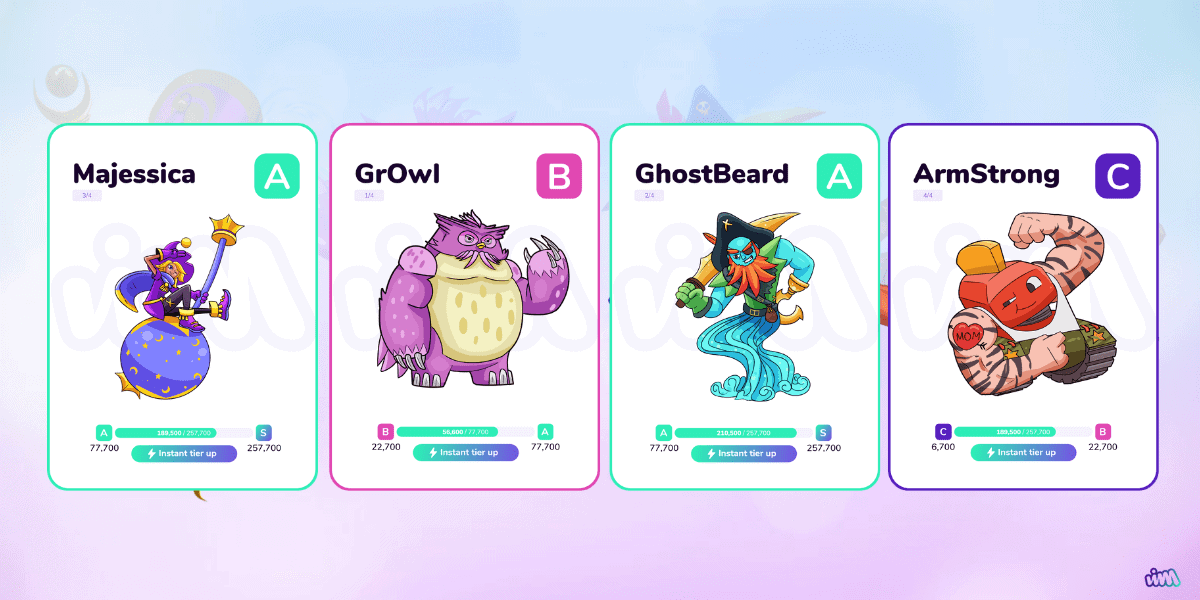

Rarible is an Ethereum-based decentralized application (dapp) focused on creating a marketplace for NFTs. It also enables a feature for users to make their own NFTs, which means tokenizing their collectables.

A notable feature of the platform, which has also caught the attention of many, is its governance set-up. Through its native utility token, users can participate in protocol governance decisions through a voting mechanism. This is what is referred to by Rarible implementing a decentralized autonomous organization (DAO).

Such a feature does not exist in most NFT marketplaces in the crypto space.

What are NFTs?

NFTs are part of the many blockchain innovations that allow anyone to create a digital counterpart of a real-world asset being held. In essence, this gives real-world assets the potential not only to be marketed worldwide but also to have the capability to receive international investments as long as they are connected to the network.

NFTs also ensure that owners of artworks, or any kind of work, can be assured that their products cannot be duplicated via a feature that allows for authenticity checks.

How Does Rarible use NFTs?

Anyone can create an NFT. An artist can easily go to the platform and create its digital counterpart. Whether or not they want to put their NFTs on sale is up to them.

The cost of transaction fees in purchasing a particular artwork can also be decided by the owner of an NFT. Through token transfer features, a collectible can be conveniently given to another person as a gift by just sending the NFT to the intended recipient.

If the owner of an artwork decides that they want to remove their work from the platform, they can freely do so. By “burning” the NFT, the artwork can be removed from the blockchain. Ultimately, every function that pertains to the ownership of a collectible is entirely under the control of the owners of NFTs.

The platform also implements a “royalty system,” which functions similarly to the traditional reward mechanism for an artwork’s original creator. Through this system, a creator is entitled to a certain percentage of the artwork’s selling price should it be sold again to others.

If users find that some artworks or collectibles were counterfeited, they can freely report them through the platform as well.

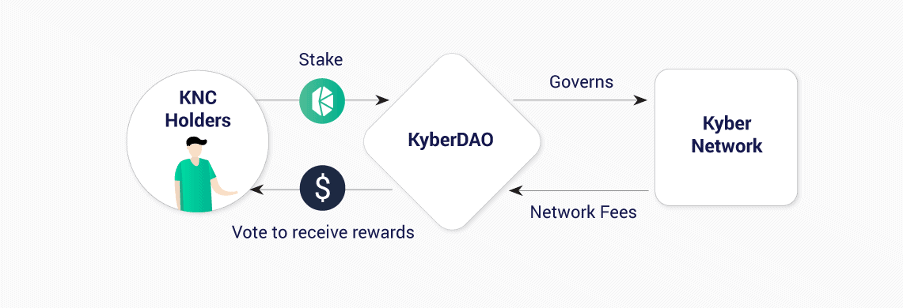

Rarible’s DAO

The future implementation of the DAO is included in Rarible’s roadmap. This is where its platform participants are given the right to participate in protocol governance. This means that they can propose platform upgrades and amend existing protocols as a community.

RARI is the token that backs the implementation of the DAO. But how can you get RARI?

$RARI Token

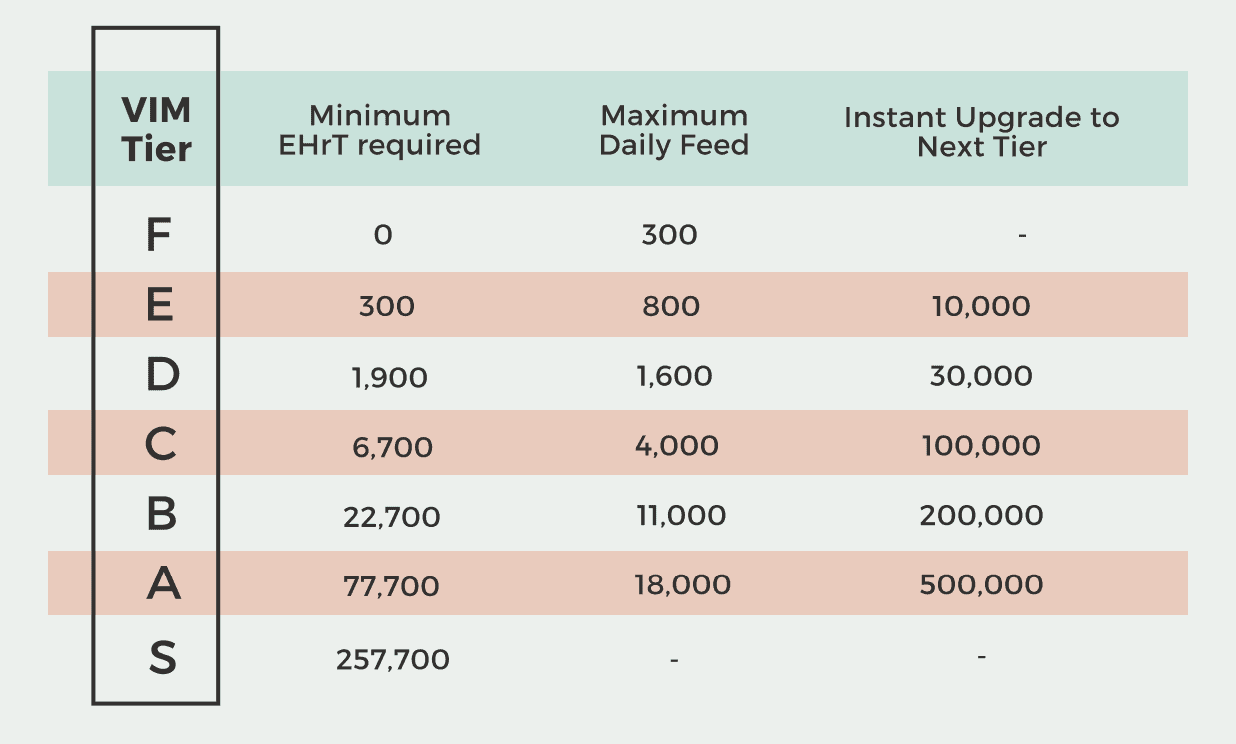

As already mentioned, RARI is Rarible’s native utility token. It cannot be bought from the platform and can only be earned by participating in platform activities, such as buying and selling artworks and other collectibles. This is called “Marketplace Liquidity Mining.”

Marketplace Liquidity Mining started on 15 July 2020 and issuance of the token held every Sunday from 19 July 2020 for 200 weeks consecutively. Exactly 75,000 RARI is distributed to users weekly, proportional to the volume of their sales and purchases from the preceding week. Both buyers and sellers equally receive half of the distributed amount.

Holding RARI entitles a user to certain rights. Apart from decisions on system updates, RARI holders can also be part of Rarible’s community-based platform moderation.

RARI is also used in helping curate the content marketed on the platform. The community can vote on which artwork belongs to its weekly pick, giving them an added boost in the reach that they need.

In the future, RARI will be rolling-out its NFT market index, which features a portfolio of the most sought-after NFTs that investors could be interested in supporting.

Other future implementations include:

- Price Discovery Mechanism

- Mobile App

- Social Features

- More Types of Content (AR+VR+Metaverse+3D)

- DeFi NFTs

- Fractional Ownership

Conclusion

Blockchain has unlocked the potential of the digital world, which would greatly benefit users. Traditionally, it is difficult to market an artwork without having to find middlemen to help you connect to a wider audience. The operational and financial costs of doing so are also a different discussion altogether.

And through blockchain, these may not be so much of a concern anymore. Rarible is one of the innovations that will ensure that collectible owners and artists can be completely independent in making decisions for their own assets.

Rarible also makes sure that the platform is as decentralized as it can be by leaving protocol governance decisions to the discretion of its community. With that in mind, the road ahead appears to be promising.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.