Onchain Trade has deployed its beta on Arbitrum and zkSync, and users of the protocol can potentially qualify for an airdrop. In this article, we will explain what Onchain Trade is and what you can do to position yourself for the airdrop.

Onchain Trade ($OT) Airdrop Step-by-Step Guide

Here’s how to get a potential Onchain Trade ($OT) airdrop:

- Buy $OT on Onchain Trade Website

- Connect Wallet to Arbitrum or zkSync

- Claim Goerli ETH from Faucets

- Claim Testnet Tokens on Onchain Trade

- Trade on Onchain Trade

- Provide Liquidity on Onchain Trade

- Stake Assets on Onchain Trade

See below for more details.

What is Onchain Trade?

Onchain Trade is a new perpetual decentralized exchange (DEX) that offers single token liquidity pools instead of the traditional token pairs in automated market makers (AMMs). This is done by grouping deposited tokens with its native OSD algorithmic stablecoin to form a virtual pair. This approach reduces the risk of impermanent loss, allowing for better capital efficiency for traders, liquidity providers, and third-party projects.

What is Backing the Peg of OSD Stablecoins?

OSD is backed by all the assets in liquidity pools that have a positive OSD balance as well as the treasury. When users trade, they use a starting price to form a pricing curve, similar to Uniswap. However, unlike Uniswap, they only need to use one token instead of two. By essentially connecting all assets to OSD, the protocol aims to maintain stability and avoid sharp price fluctuations seen in other algorithmic stablecoin projects, most notably Terra Luna.

It is important to note that algorithmic stablecoins are still deemed unstable because of its dependency on strong liquidity and market mechanisms. If a large investor were to take actions that significantly impacted the supply or demand of the asset, it could potentially affect the stability of the algorithmic stablecoin.

Does Onchain Trade have a Token?

Yes, Onchain Trade has confirmed in its document that there will be an $OT token. $OT is the governance token of the protocol and it has a non-transferable staking counterpart called vOT. $OT has a total supply of 100 million tokens and it will be launched on Arbitrum.

According to the tokenomics, 50% will be allocated to liquidity/trading incentive and airdrops. Additionally, 10% will be up for public sale (IFO) from 10th March to 17th March 2023. $OT holders will also be eligible for an airdrop!

How to Receive $OT Token Airdrop?

The best way to receive $OT airdrop is to participate in the IFO and interact with their beta testnet. Here’s a step by step guide:

- Buy $OT on Onchain Trade Website

Public sale will take place on the Onchain Trade website between 10th March and 17th March 2023. $OT holders will be eligible for an airdrop.

- Connect Wallet to Arbitrum or zkSync

Go to beta.onchain.trade and connect your MetaMask. Switch the network to Arbitrum Goerli or zkSync Era Goerli (or Alpha Testnet if you added the RPC last year).

- Claim Goerli ETH from Faucets

Claim Goerli ETH on goerli.portal.zksync.io/faucet for zkSync and faucet.triangleplatform.com/arbitrum/goerli for Arbitrum.

- Claim Testnet Tokens on Onchain Trade

Click “Test tokens” at the top right side of the screen. Afterwards, you can see your account balance at beta.onchain.trade/portfolio.

If you want to see it in your MetaMask, you will need to import the contract address of the tokens to see your account balance. To do this, click the transaction hash and it will redirect you to the block explorer, where you can copy and paste the information to your MetaMask. - Trade on Onchain Trade

Go to beta.onchain.trade/trade to swap tokens including OSD stablecoins, enter long positions, and short positions.

- Provide Liquidity on Onchain Trade

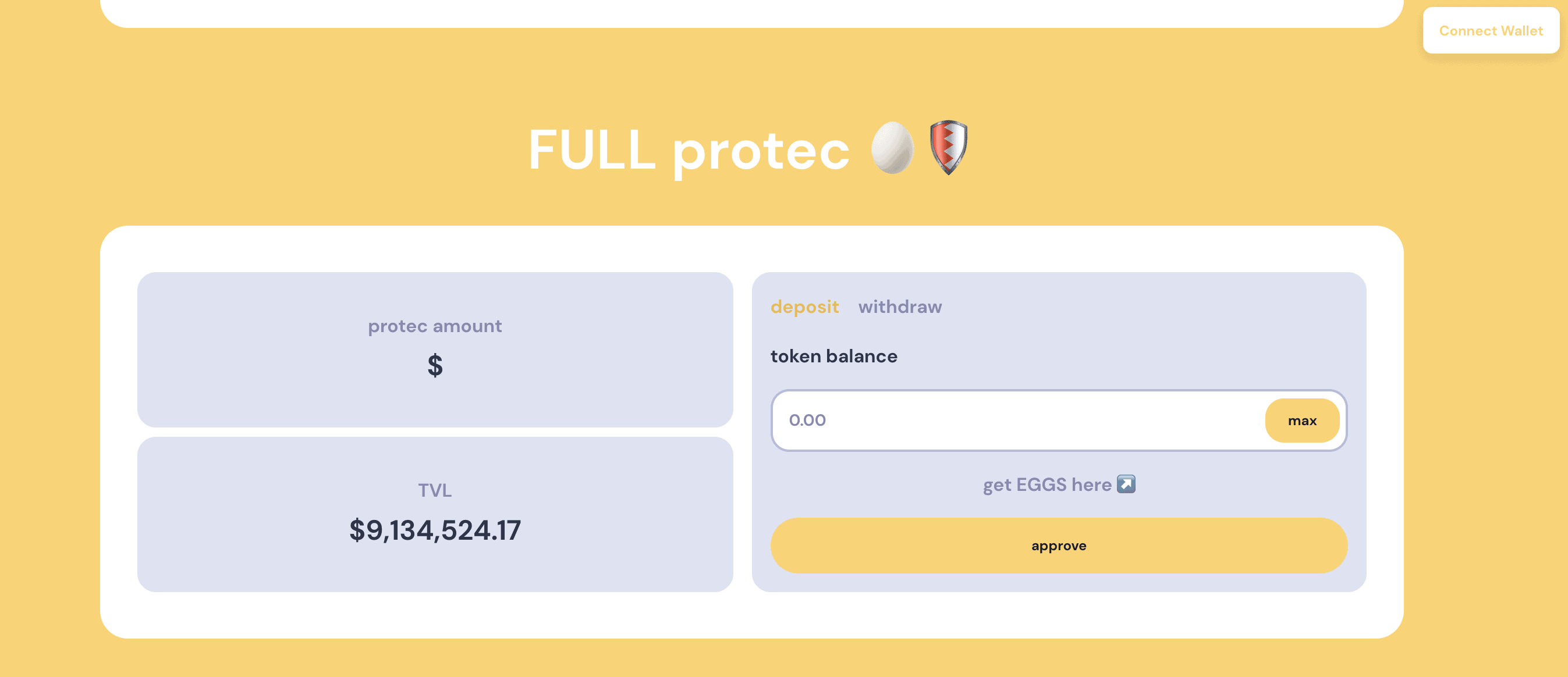

Go to beta.onchain.trade/pools and select any available asset you want to deposit. After depositing, you will receive a single LP token. You can also use the borrow and repay feature.

- Stake Assets on Onchain Trade

After providing liquidity, you can stake your LP tokens as well as $OT at beta.onchain.trade/earn. You can also use the borrow mining feature after borrowing assets.

Onchain Trade ($OT) Token Airdrop Review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: Onchain Trade has confirmed in its document that there will be an airdrop.

Airdropped Token Allocation: 50% of the total $OT supply will be allocated to liquidity/trading incentives and airdrop. An additional 10% will be airdropped to holders who buy $OT in the public sale from 10th March to 17th March 2023.

Airdrop Difficulty: The steps are relatively easy. You can buy $OT in the public sale for more airdrops or you can interact with their beta testnet to qualify for the snapshot.

Token Utility: $OT is the governance token of the protocol and it has a non-transferable staking counterpart called vOT.

Token Lockup: The $OT tokens allocated for incentives will follow a 2 to 5 year vesting schedule. The team is allocated 20% of the total supply, which will be locked for the first three months and then distributed linearly over the next 24 months, resulting in a total lock-up period of 27 months.