Ever wanted to be your own hero in ancient China and earn cryptocurrencies while you’re at it? Well, now you can. The Three Kingdoms is a highly strategic third-generation GameFi (blockchain game finance) that is based on the historical characters of the Three Kingdoms period in ancient China.

The play-to-earn metaverse allows players to immerse themselves in a gaming experience enriched with extensive history, well-developed characters, progression gameplay and more. Prepare your heroes for battle, siege cities, and win battles to expand your own land.

Learn more about The Three Kingdoms (TTK):

What is GameFi?

Combining the words Game and DeFi (decentralized finance) in one name, GameFi is the gamification of financial mechanisms where users can earn money by playing games. Another popular term for this industry is “play-to-earn.” On the surface, the keyword is “game”, but at its core, “finance” is the most important thing for blockchains.

The spike of popularity in GameFi plays a major role in cryptocurrency adoption on the whole. Blockchain gamification makes it easier for the DeFi ideology to be accepted, incorporated, and advanced.

The Next Generation of GameFi

CryptoKitties was the first to bring blockchain gaming to life, and games such as Axie Infinity have taken it to the next level. The Three Kingdoms team set out to build a blockchain game that features multiple methods never seen before in the GameFi market to earn tokens. Additionally, they are creating an authentic gaming experience that compares better to the games by major publishers that gamers have been accustomed to playing.

To achieve this, The Three Kingdoms will feature high-end graphics, the ability to collect NFT characters, complete quests, and join siege gameplays to earn NFTs. The Three Kingdoms will be the first play-to-earn game that incorporates the idea of battling and besieging cities through staking, complete with a deep and engaging storyline, providing a breath of fresh air to the GameFi landscape.

In the game, users will be able to build their base, expand their territories, upgrade their character’s attributes, win battles and emerge victorious in PvE (player versus environment) and PvP (player versus player) battles.

The History of the Three Kingdoms

The Three Kingdoms is based in 220 AD, during the final years of the Eastern Han dynasty. The Yellow Turban Rebellion broke out, with cities and regions forming their alliance for survival. Warlord Dong Zhuo seized control of the capital under the pretext of protecting the young emperor. Cao Cao, who had gradually taken control of territories in the North, saved the emperor and led the central government. Still, formed clans are already eager for the chance to rule over China.

The country broke into civil war, and soon, China was divided into three spheres of influence: Cao Cao dominating the North, Sun Quan the South, and Liu Bei, the West. The three kingdoms fought for sixty years to conquer China, and this is where the story for the user begins.

The Three Kingdoms land is modelled after the historical map of China split into Wei, Shu, and Wu regions. The land will be split into unique squares and within these lands, users can host, stake, and monetize events. Users can conquer and own their base of operations where they can fight and expand their territory.

Roadmap for the Three Kingdoms

The Three Kingdoms is well underway, with plans to begin passive gameplay in Q4 of 2021. Referred to as Phase 0, users will be able to earn NFTs by recruiting heroes via outskirts. The team plans to include additional gameplay features such as the ability to siege empty cities (stake NFTs) and occupy cities (earn APY, in-game currency, and NFTs) in 2022 (Phase 1).

Phase 2 will feature PvP, where users can attack and defend cities. The attacker and defender both stake NFTs, with the winner earning an APY, currency, NFTs, and attributes.

Finally, Phase 3 will be the introduction of active gameplay via Arena and Tournaments. Players will be able to stake their NFTs against other players in a winner-takes-all battle.

NFTs In The Three Kingdoms

Similar to popular gacha games with their randomized loot boxes, The Three Kingdoms utilises NFTs (non-fungible tokens) to bring added excitement to the gameplay experience. Players can recruit unique and powerful characters to build up their army to occupy cities and win battles.

Raffles – A raffle will be held every so often that will enable players to draw a character card at random, for a price. Players will be able to draw as many cards as they wish.

Characters – Characters will be randomly assigned six attributes: attack power, defence power, energy, luck, leadership, and intellect. The combination of these attributes determines whether a card is normal, rare, super rare or legendary.

Quests – Another method to recruit NFTs is where players send out one of their characters to recruit other heroes. Each found hero is another NFT of varying quality, which could help strengthen their forces.

Farming – Special NFTs can also be farmed by staking $TTK, the game’s native currency.

The Native Token – $TTK

The game’s native token is $TTK, which will be the lifeblood of this ancient yet modern metaverse. Players will use $TTK to purchase new characters in the NFT marketplace, upgrade armies, and invest in land. It can also be staked to farm more valuable NFTs.

$TTK will also be needed to acquire $CHI, the secondary in-game token.

$TTK tokens should be viewed as powers originating from the spirits of the dead that perished on the battlefield, so attaining them will be important to gather energy that will help players on their journey.

The In-Game Token – $CHI

Inspired by the actual use of Chi in Chinese history as the energy that runs through all living things, The Three Kingdoms will have a secondary in-game token that will be important to the gameplay.

As players gather energy through $TTK tokens for their journey of The Three Kingdoms, they are able to convert the energy to $CHI through harmonization. Only through mastering the energy of $TTK can warriors advance ahead with their well-balanced Chi.

$CHI can be earned by staking $TTK-LP + NFTs to receive NFTs + $CHI as rewards.

Some future uses of $CHI include the ability to besiege cities, battle other players and even fuse new heroes. As a fair launch token, any player is able to ascend into their ultimate self and transform their $TTK into $CHI.

The Three Kingdoms Receives $3.2M in Funding

In October 2021, The Three Kingdoms successfully raised $3.2 million USD from supporting investors. The investors included DAO Maker, Magnus Capital, LinkPad, SMO Capital, CoinUnited.io, Double Peak, x21, ZBS Capital, ReBlock and CryptoDiffer.

The Three Kingdoms will be utilising the funds to innovate new projects and further the growth of the ecosystem, expanding the community and strengthening the foundation of the ecosystem for users to maximize the use of the platform.

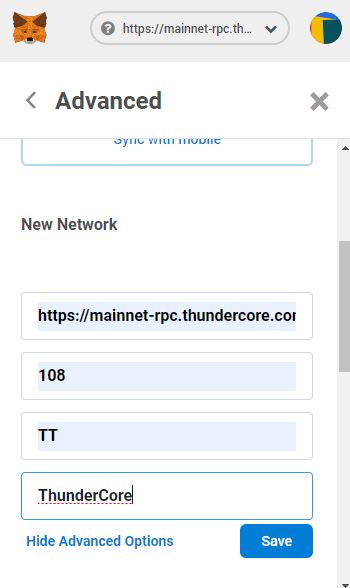

The game will be hosted on the Binance Smart Chain network and is currently underway. Passive gameplay is aimed to be released later this year.

To know more about The Three Kingdom and its future developments, visit their social media channels listed below.

Website — https://ttk.gg/

Twitter — https://twitter.com/PlayTTK

Telegram Announcements — https://t.me/TTK_Official

Telegram Official Community — https://t.me/PlayTTK

Discord — https://discord.com/invite/kg4SMdCCM5

Reddit — https://www.reddit.com/r/PlayTTK

Medium — https://medium.com/@PlayTTK

Sources:

https://latestnews.plus/gamefi-altcoins-are-growing-crazy-so-what-is-gamefi/ https://medium.com/@PlayTTK/the-three-kingdoms-introducing-the-new-era-of-play-to-earn-d569264ffb11

https://medium.com/@PlayTTK/introducing-ttk-and-chi-let-the-spirit-of-ttk-help-you-find-your-chi-2394d2895f7a

https://medium.com/@PlayTTK/the-art-of-chi-the-life-force-that-enriches-play-to-earn-in-the-three-kingdoms-274959efee24

https://news.bitcoin.com/the-three-kingdoms-the-new-era-of-play-to-earn-games/ https://www.crypto-news-flash.com/the-three-kingdoms-successfully-closes-3-2m-investment-round/