YF Link ($YFL) combines Chainlink’s $LINK token with Yearn Finance $YFI’s yield farming/liquidity mining mechanics. The premise of this project was so it would be adapted it for use by Chainlink enthusiasts, known as “Link Marines”. Considering the LINK token itself has done quite well in 2020 so far with prices going from $2 to $15, both Link Marines and other cryptocurrency enthusiasts, of course, are interested in what YF Link is and what it had to offer. So in this article, we will take a look at the background of YF Link, the functions of, and how to get their native $YFL token.

Background and History of YF Link

YF Link was forked from Yearn.Finance’s ($YFI) Yearn contract by switching it to accept LINK instead of yCRV tokens. It is a community-based project started by Chainlink enthusiasts, specfically, by a “Bobby Shaftoe” and 4 other anonymous developers who announced the existence of the project and its details in a Medium post “The Idea of YFLINK is Born” on 7th August 2020. Since LINK tokens were required to be locked up to generate yield, it is thought that the launch of YF Link had a positive influence on LINK prices as the demand for these tokens increased. Indeed in the few days following the Medium post, prices for $LINK almost doubled.

Precursor – Yearn.Finance ($YFI)

The precursor to YF Link, Yearn Finance (YFI), was launched by Andre Cronje on 17 July 2020 as an experiment in yield farming and liquidity mining. It works by allowing the users to provide funds to a smart contract, which are then automatically distributed between dYdX, Aave, and Compound lending protocols, optimized for maximum yield.

In return, the users earn yield profits and acquire YFI tokens. The YFI token is used for governance. The total YFI tokens in existence are 30,000.

Learn more about Andre Cronje’s insights on the DeFi space in his interview with FTX exchange.

How does YF Link work?

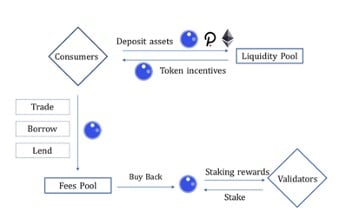

YF Link’s YFL token provides liquidity to LINK pools on multiple Decentralised Finance (DeFi) protocols such as Aave, Balancer, and Curve Finance. Users provide funds by depositing them into these protocols, which then generate yield profits for the depositors. These users i.e. liquidity providers also receive YFL tokens as a reward, in turn, these YFL tokens can be traded on exchanges such as Uniswap.

The amount of rewards depends on the amount of liquidity provided and the duration which they are staked. And although users funds are locked in, they can be withdrawn at any time.

Alternatively, some people simply speculate on YFL tokens and trade them on exchanges.

The Concepts

The two underlying concepts used in YF Link are yield farming and liquidity mining. They both work together in synergy to incentivize users to provide liquidity. As we will see later, these 2 concepts come together to enable farmers to earn rewards and potentially gain from these activities.

Yield Farming

Yield farming is a method of using otherwise idle assets for beneficial purposes. It involves taking assets from users, lending them to different protocols, in exchange for gaining more assets than initially provided.

Liquidity Mining

Liquidity mining is a variation of yield farming, which allows liquidity providers to gain another governance asset, alongside their usual yield rewards.

The YFL Token

The $YFL token is the native token for YF Link with a maximum supply of 75,000 tokens. It must be noted that even creators of YF Link have said that the token should be valued at ZERO.

The YFL token is supposed to be used for governance purposes, i.e. it lets holders submit proposals to vote and make decisions. For example, one of the first governance proposals is to have a LINK meme competition.

At the outset, a total of 6 pools were emitting YFL tokens, with various parameters. The emission of tokens will last around 15 weeks with most of the emissions occurring in the first 4 weeks. After the YF Link contracts were deployed, the creators burned the contract keys so that no one can change this emission schedule.

YF Link Pools: What’s the difference?

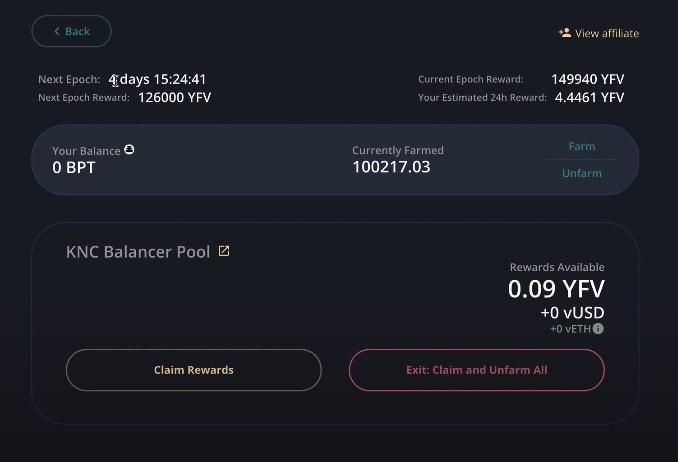

As mentioned in the above section, when the YF Link contracts were first deployed, a total of 6 pools would emit YFL tokens. Note that as at 22 August 2020, pools 0, 1 and 2 have exhausted their YFL rewards, this means you cannot mint any new YFL tokens by staking in these pools.

Pool 0 also called the Genesis pool (15,000 YFL tokens available)

Pool 1 LINK Balancer pool (15,000 YFL tokens available)

Pool 2 yCRV Balancer pool (15,000 YFL tokens available)

Pool 3 LINK Aave pool (15,000 YFL tokens available)— users provide LINK and deposit it to Aave.com to get aLINK tokens. Then you get those aLINK tokens and deposit it in an aLINK Balancer pool with YFL. From this, users will get BPT tokens which they can stake in the YFL pool. In the end, users can earn YFL, BAL and AAVE interest.

Pool 4 Governance staking pool (20,000 YFL tokens available) — This pool will go live at 26 Aug 2020 at 1400 (UTC). Users have to stake YFL, in order to be able to vote in the Governance contract for the duration of the vote. Users are rewarded with more YFL tokens.

Pool 5 Unintended pool (5,000 YFL tokens available)— the team deployed this pool accidentally. The creators will mine from this pool to fulfill their early mining program obligations and potentially other purposes which are to be announced.

Conclusion

YF Link is an interesting variant of Yearn.Finance. It is likely to enhance the utility and the liquidity of the LINK tokens as well. Some analysts are even terming it the “missing link” between the two most widely used DeFi protocols – Chainlink and Yearn.Finance.

Since its deployment, the project has functioned normally without any bugs or exploits. It has amassed an impressive Total Value Locked (TVL) in a short period of time. It may even become the go-to protocol for people looking to stake LINK tokens for rewards in the future.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.