Shadows Network ($DOWS) aims to be a hub for people to issue, trade, lend and borrow synthetic assets. The protocol is built using the Substrate blockchain network and is compatible with the Polkadot ecosystem.

Background

Iror Chen and Bruce Lin lead the Shadows project. Apart from being the co-founders, they double as the CEO and CTO, respectively. The two have extensive experience in diverse fields. To elaborate, Chen previously worked for Amphenol Group while Lin worked for Baidu.

Other Shadows team members include Ted Shao (co-founder and COO), Claire Cai (co-founder and CMO), Sue Xia (overseas CMO), and Liang Li (risk control).

Shadows’ list of partners includes Consensys Lab, NGC Capital, Polka Fund, Blocksync, DuckDAO, OneMax Capital, Oasis Capital, among others.

What is Shadows?

Shadows is a distributed platform focusing on the issuance, borrowing, lending, and trading of synthetic assets. The project leverages the Substrate framework that powers other popular DeFi networks like Polkadot.

Note that synthetics are derivatives or clones of real-world assets. Derived assets can be of anything from cryptocurrencies, stocks, indices, fiat, and commodities. Also called synths, they enable holders to share in the profits and losses of an asset without necessarily having such asset in their portfolio. Doing so opens the DeFi scene to a global audience who would be locked out of the space.

The platform sits on the Polkadot network as a parallel thread. As such, it has inter-chain compatibility with other platforms leveraging EOS and Ethereum to focus on synthetic assets. Cross-chain support opens the network to more blockchain-based assets. For instance, users can use Ethereum (ETH) or Bitcoin (BTC) to create synths.

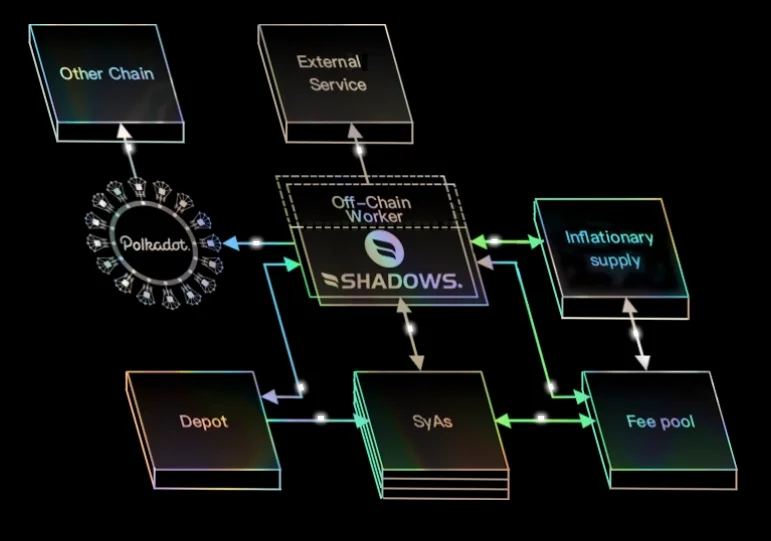

Shadows integrates an off-chain worker to help capture the system outside the blockchain. Note that the platform uses the worker to replicate trusted oracles. Furthermore, the oracles receive data from external decentralized platforms to trigger activities inside the blockchain. Unfortunately, traditional oracles suffer from security, efficiency, and scalability.

The worker employs Substrate allowing it to perform non-deterministic tasks such as encryption and web requests, and other long-running tasks. The Shadows network achieves the above features through a layered system, focusing on different aspects of synthesizing the assets.

Critical Areas on the Synthetic Network

Synthetic Asset Issuance Agreement

The platform secures the synths using its native asset, DOWS (more on this later). Users deposit the token into a smart contract for them to gain a right to create synthetics on the network.

Consequently, the created tokens are DOWS backed. To reclaim back their tokens, users have to burn their synths. Note that the platform needs a collateralization ratio of 800 percent.

Synthetic Asset Transaction Agreement

The agreements support the trading of synths. These agreements minimize slippage and insufficient liquidity. Also, they ease and provide efficient trading.

Debt Collateral Lending Agreement

The platform employs lending pools that hold users’ debt into the pool to facilitate lending activities. How this works is simple. To elaborate, the borrowers access the pool to place a synth debt.

Next, they pay interest and receive the loan in synthesized USD (xUSD). The need for xUSD funding is to provide flexible financing. This funding option offers a balance between demand, supply interest, and rates.

What Drives the Shadows Network?

Four significant aspects power the platform.

- Rewards system – Users are rewarded when they use the native token to create synths. However, the rewards only apply to those who have reached the needed collateralization ratio.

- Governance – In the DeFi scene, governance is everything. On Shadows, the native token gives holders a voice when making governance decisions. Some areas falling under community governance include upgrading.

- Staking – The base asset does more than just governance, the token can be staked as collateral and at the same time benefit from staking rewards.

- Trading bonus – This goes to DOWS holders and is generated by those trading on the platform.

How Does Shadows Work?

First, note that the platform is compatible and connects to Polkadot.

It works as an off-chain enterprise that connects to various parts such as inflationary supply, fee pool, and external services. It connects to Polkadot as a single service.

The Protocol Offers Three Types of Incentives.

The first type of incentive is where a user is charged 0.3% as the trading fee. How is this an incentive? It’s because they can send it to a fee pool and receive a mortgage in terms of DOWS.

However, the trading fee incentive’s applicability varies between users because it’s dependent on the amount of debt that the user has and the amount in the debt pool.

The second type of incentive goes to mortgagors who benefit from holding the base asset on a weekly basis. Notably, the amount of bonus received depends on how much debt the mortgagor has in the debt pool.

Third comes rewards for lenders in the lending pool. These incentives have a weekly timeline.

The Shadow Token ($DOWS) tokenomics

DOWS is the backbone of the Shadows network. Apart from governance, casting synths, lending, and distributing rewards, the token can also be used to power the token destruction mechanism.

The destruction part utilizes the transactions and debit pool fee. And, it follows a fixed ratio of 30% per week. Note that the token’s destruction is automatically driven by a smart contract. Observe that this makes the native token a deflationary base asset.

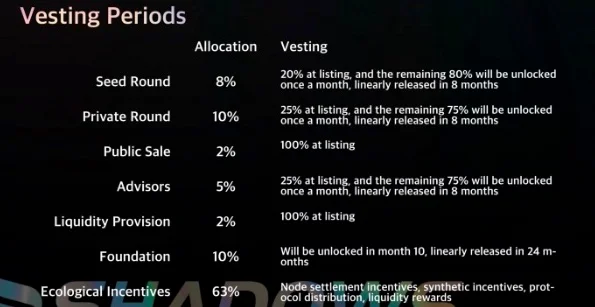

Shadows did a double Initial DEX Offering (IDO) on Ignition and DuckSTARTER. The allocation of tokens were as follows:

- Ecological Incentives: 63% — 63,000,000

- Early Investors: 20% — 20,000,000

- Foundation: 10% — 10,000,000

- Advisors: 5% —5,000,000

- Liquidity Provision: 2% — 2,000,000

The vesting periods for various allocations are as follows:

Is Shadows Network safe?

Recently the Shadows project faced some accusations because they are allegedly connected to another project that recently suffered an alleged “hack” of their smart contract.

On 6th March 2021, the Team Tweeted to address the concerns, saying that their smart contract codes were audited twice by Certik. And on both occasions the contracts were found to be secure and met the highest security standards.

The Team in their Tweet on 7th March 2021 also said that Shadows Network uses a proxy contract to upgrade its smart contract and deliver key functions such as issuing, trading, borrowing or lending synthetic assets on the network. Most notably, the proxy contract will deploy incentive DApps for users such as LP staking and DAO governance etc. From these Apps, 63 million $DOWS (representing 63% of the total supply of $DOWS) will be minted as a reward to the community. Once all 63 million $DOWS have been released, the Team will permanently remove the mint function from the Shadows smart contract. This has the effect of stopping the Team from producing any more $DOWS and most importantly, to potentially prevent the price of $DOWS from being diluted.

Further, this proxy contract and ERC20 contract are kept secure through multisig and is on Openzeppelin- an open-sourced protocol. The Team also notes that other popular names in the cryptocurrency scene i.e. Compound and Coinbase also use Openzeppelin.

Conclusion

Shadows helps bring traditional assets onto the blockchain. In doing so, the platform opens the conventional assets to more users. For instance, it brings these assets to DeFi users and those who don’t want to hold real crypto assets.

Notably, the platform takes on a layered-approach to bring these possibilities to life-enhancing functionalities. Furthermore, the DOWS token helps power different aspects of the Shadows network.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.