Taiko is a ZK-EVM scaling solution for Ethereum, similar to zkSync and StarkNet. Taiko token airdrop has been confirmed and Phase 1 of the airdrop has begun! In this article, we will explain what Taiko is and how to position yourself for the $TKO airdrop.

Check out our EXCLUSIVE Taiko Airdrop trip to farm mainnet for FREE!

Taiko ($TKO) Airdrop Step-by-Step Guide

Here’s a step-by-step guide on how to get a potential Taiko ($TKO) token airdrop:

- Add Taiko Network to MetaMask

- Claim Faucet Tokens

- Bridge Testnet Tokens

- Deploy a Smart Contract to Taiko A1

- Run a Node on Taiko

- Complete Galxe Tasks

See below for more details.

What is Taiko?

Taiko is building a decentralized and Ethereum-equivalent (Type 1) ZK-EVM. Taiko’s goal is to scale Ethereum in a manner that emulates it as closely as possible – both technologically and ideologically. They have raised $22 million across two funding rounds and launched their latest testnet (Alpha-3) in their mission to build a decentralized and Ethereum-equivalent (Type 1) ZK-EVM.

The Taiko alpha-3 testnet is the latest update and is a significant milestone on the journey towards a decentralized, Ethereum-equivalent ZK-EVM. This testnet will be critical in testing much of the network design and components. It’s also known as Grímsvötn. The primary purpose of the alpha-3 test network is to evaluate the economic design and implementation of new protocols, including new fee/reward structures.

Technical Overview of Type-1 ZK-EVM

Ethereum-equivalent ZK-Rollups, also known as ZK-EVMs, are the ideal layer-2 scaling solution as they do not sacrifice security or compatibility. Taiko aims to be a type-1 ZK-EVM, putting perfect EVM/Ethereum equivalence over ZK proof generation speed.

The various types of ZK-EVMs can be distinguished by how closely they adhere to Ethereum’s architecture at the base layer, such as the Merkle Patricia Tree for the state trees, the execution client specification, and the gas costs for each opcode.

These ZK-EVMs make compromises between compatibility and proof generation cost, with Type 1 ZK-EVMs prioritizing compatibility over cost. This type is also known as “Ethereum-equivalent” because it does not alter any aspect of the Ethereum architecture, including the hash function, state trees, and gas costs. This allows existing execution clients to be reused with minimal modifications.

Who is the Team behind Taiko?

Taiko Labs is co-founded by Daniel Wang, the founder and former CEO of Loopring — an EVM DEX protocol powered and scaled by zero-knowledge proof technology. In July 2022, Wang brought in Brecht Devos, his former Chief Architect at Loopring, to lead the project’s zero-knowledge research and development team. As of now, the company has more than twenty people across thirteen countries with most people having an engineering and cryptography background.

Does Taiko have a Token?

Yes, Taiko Labs confirmed it in their white paper that they will have a Taiko Token ($TKO). The protocol mints $TKO to reward block verifiers. The token is transparent to L2 users, providing a seamless user experience equivalent to that on the Ethereum chain.

Users will pay transaction fees in ETH, and block proposers will receive these fees for each block they successfully propose. In return, block proposers must burn a certain amount of $TKO to participate in the protocol, and pay ETH to Ethereum validators for block inclusion in L1 blocks.

Taiko Alpha-1 Testnet – Confirmed Airdrop Strategy

Taiko launched their Alpha-1 Testnet in late December 2022. It consists of two networks: Taiko A1, a fully decentralized Ethereum-equivalent ZK-Rollup, and Ethereum A1, the latter serving as the L1 network. The testnet includes L1 and L2 nodes with the Taiko protocol contracts deployed and a mining interval of 12 seconds. In their user document, Taiko has a guide for what users can do in the testnet, which strongly hints at a potential airdrop strategy.

On 22nd May 2024, Taiko ($TKO) launched its Phase 1 airdrop, with 5% of the initial token supply up for grabs!

The best way to receive $TKO airdrop is to bridge tokens between Ethereum A1 and Taiko A1, deploy smart contracts, and run a node. Completing these steps puts you in a great position to be eligible for an airdrop. Here’s a step-by-step guide:

- Add Taiko Network to MetaMask

You can automatically add Taiko A1 and Ethereum A2 to your MetaMask at their wallet configuration page. If it doesn’t work, you can instead manually add the networks at their RPC configuration page.

- Claim Faucet Tokens

After adding the network to your MetaMask, you will need testnet tokens to interact with their protocol. Go to l1faucet.a1.taiko.xyz for Ethereum A1 ETH, and l2faucet.a1.taiko.xyz for Taiko A1 ETH. You will need to make a Tweet and put your wallet address in the post. Copy your Tweet’s link and paste on the request box as shown in the image below. This is to prevent bots from abusing the faucet.

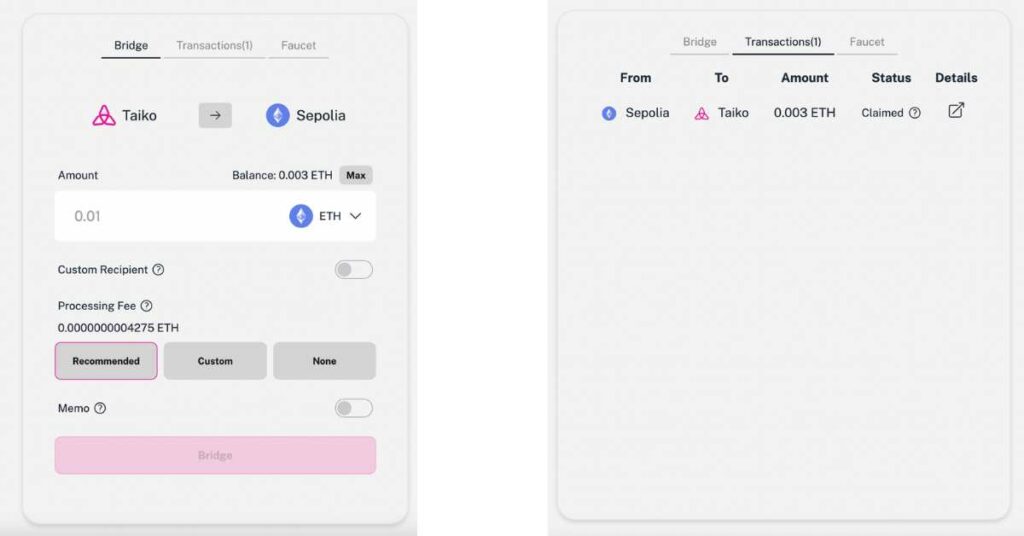

- Bridge Testnet Tokens

Now you can use the bridge to transfer assets between Ethereum A1 and Taiko A1. As a prerequisite, you will need some testnet ETH on either A1 networks. Some transfers may take a while, but you can check your transactions in their bridge contracts.

- Deploy a Smart Contract to Taiko A1

You will need to install Foundry to deploy a smart contract on Taiko A1. You only need to have the private key to an account that has some ETH on Taiko A1 to pay the small transaction fee for deploying the contract. It should only take about 15 minutes. Taiko has a complete guide on this here.

- Run a Node on Taiko

According to the team, this is the most important part of the testnet, as Taiko is a community-driven protocol. This step alone has the highest chance to get you qualified for a potential airdrop. The complete guide is on their user document. But if you are still confused, a contributor on their Discord channel posted a detailed guide on setting up a node for windows.

Taiko Alpha-2 Testnet – Confirmed Airdrop Strategy

Here’s how to potentially receive an airdrop in Taiko’s Alpha-2 Testnet:

- Add Sepolia и Taiko (Alpha2 Testnet) to Metamask.

- Claim testnet tokens using Sepolia Faucet and Horse/BLL.

- Add these 2 token contract addresses to your wallet: Bull Token — 0x6048e5ca54c021D39Cd33b63A44980132bcFA66d and Horse Token — 0xCea5BFE9542eDf828Ebc2ed054CA688f0224796f.

- Connect your wallet to Taiko bridge.

- Transfer tokens from Sepolia to Taiko A2. To do this, go to the “Bridge” tab, choose the Sepolia Network, and choose your token type and amount. Then, click on “Bridge”. Remember to also transfer the $HORSE and $BLL tokens!

- Transfer tokens from Taiko A2 to Sepolia. This is basically the same steps as point 5 above.

How to Receive Potential $TKO Airdrop for Taiko Alpha-3 Testnet

Here’s how to potentially receive an airdrop in Taiko’s Alpha-3 Testnet:

- Add Sepolia Network to Metamask.

- Add Taiko (Alpha-3 Testnet) to Metamask.

- Get Sepolia ETH at either https://sepolia-faucet.pk910.de, faucet-sepolia.rockx.com or sepoliafaucet.com.

- Connect your wallet to the Taiko Faucet and mint 50 Bull ($BLL) and 50 Horse ($HORSE) tokens. If you don’t see these tokens in your Metamask it may be because you have not added the token address. Click “Import tokens” on your Metamask and input the token details.

- Go to Taiko Bridge and bridge $ETH, $BLL and $HORSE from the Sepolia to Taiko network. You may need to increase the gas in order to avoid the transaction failing.

- Claim your transfer by going to the Transaction page and clicking “Claim”. Then, confirm the transaction on Metamask.

- Complete tasks on Taiko’s Galxe page. Tasks include answering their quizzes, bridging and swapping funds.

Taiko Quiz Answers

Here are the answers for the Taiko Quizzes on their Galxe page:

- Quiz: Bridging and swapping questions (Eldfell L3)– Answers: D, A, A, B, C

- Quiz: Proposer questions (Eldfell L3)– Answers: A, C, B, B, D

- Quiz: Prover questions (Eldfell L3)– Answers: D, C, B, C, A

- Quiz: Bridge and swap questions– Answers: B, B, A, C, D

- Web3 Infrastructure Layer 2 Quiz: Type 1, 2, 3, and 4 ZK-EVMs– Answers: B, C, C, B, B

- Quiz: Taiko alpha-3 testnet questions– Answers: C, C, B

- Watch “Run a Taiko L3 node” and subscribe to Taiko YouTube channel (Eldfell L3)– Answers: C, B, C, D, C

- Quiz: A Concise Dive into Taiko questions– Answers: C, B, C, D, C

- Quiz: Cross-chain communication exploration questions– Answers: C, B, B, D, C

Exclusive: How to farm Taiko Mainnet for free!

Taiko is currently running Season 1 of their Trailblazers campaign which will end on 16th September 2024. As Taiko has launched its mainnet, you would usually need to use real funds to complete the tasks for the potential airdrop. However, with our EXCLUSIVE tips and tricks, you can farm the Taiko airdrop for FREE! Here’s how to farm the Taiko potential airdrop for free:

- Connect wallet to https://crackandstack.com/

- Play Crack & Stack. Crack & Stack is a PvP game that rewards you in ETH for mining as quickly as possible and avoiding the goblins. You have 10 free games per day.

- With your earned ETH, transact on platforms such as World of Dypians and 0xAstra.

- Transact on World of Dypians by claiming the free boxes.

- Transact on 0xAstra by collecting daily logins.

- You can also use the ETH earned in Crack & Stack to cover any transaction fees on Taiko mainnet. This way, you will not need to bridge your ETH to Taiko or deposit real funds to the platform.

TIP: On Crack & Stack, the objective is to mine as fast as you can. However, do not be greedy until you have around 20 seconds on the timer as you want as much movement speed as you can. Your inventory space will start flashing yellow so your movement speed will be a little bit slower, but not slow enough for people to kill you. It also does not matter if you die in the game because you will still earn ETH on your wallet.

Taiko token airdrop eligibility criteria?

Taiko proposers, provers, bridgers, users (including Galxe users) and developers are eligible for the Taiko token airdrop. GitHub contributors and Loopring community members that meet the specified conditions are also eligible. Note however the activities are weighted and a score is assigned to them. You will only be eligible if you meet the minimum score and any conditions set by the Taiko team.

How to check your eligibility for the Taiko token airdrop?

Here’s how to check your eligibility for the Taiko token airdrop:

- Go to https://claim.taiko.xyz/

- Click “Check eligibility” at the top of the page

- Connect your wallet (e.g. MetaMask) and GitHub account, if any.

- Bind your wallet and GitHub account.

Note that users have 7 days i.e. until 30th May 2024 to check their eligibility. Once the claim window is open, eligible users will have 1 month to claim their TKO tokens.

Airdrop Review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: Taiko has a guide for what users can do to interact with their testnet, which strongly hints at a potential airdrop strategy.

Airdropped Token Allocation: Taiko confirmed they will have a token known as $TKO, but the tokenomics are unknown.

Airdrop Difficulty: The latest Taiko Alpha-3 Testnet only requires you to use testnet funds to bridge, which is relatively simple. Deploying a smart contract and running a node on Taiko however, may need a bit more technical knowledge.

Token Utility: The $TKO utility is unknown.

Token Lockup: The $TKO token lockup is unknown.