Stacks ($STX) (formerly Blockstack) is an open-source network that allows developers to easily build decentralised applications (such as decentralised finance DeFi applications) and smart contracts. It also relies on Bitcoin as a backbone by reusing its computing power and blockchain for settlement and security with a new mechanism known as proof of transfer (PoX). Below, we look into PoX and everything you need to know about Stacks.

Background

Stacks is handled by a globally-distributed team that includes scientists from leading universities such as MIT, Stanford, and Princeton. On top of that, The project is a public company with its headquarters in New York.

Stacks’s place in the DeFi and broader crypto ecosystem is further cemented by being backed by notable names in the industry such as Y Combinator, Foundation Capital, Digital Currency Group, Winklevoss Capital, and LUX.

What is Stacks?

Stacks is a decentralized platform that leverages the Bitcoin platform’s security to power the creation of smart contracts and decentralized applications (Dapps). Interestingly, the network does not have to recreate the system’s PoW mechanism to connect to it. The project has four major layers; application, protocol, Stacks blockchain, and the Bitcoin system.

What is Proof of Transfer (PoX)?

Proof of Transfer (PoX) and the earliest Proof of Work (PoW) are requirements to define what a miner needs to do in order to create blocks on the blockchain. The purpose of mining is to verify a transactions’ legitimacy and in return miners are rewarded with cryptocurrencies. Proof of Work is the mechanism used for Bitcoin whereby miners compete to solve a puzzle using their computer’s processing power in order to add each block to the chain.

Learn more about what REAL cryptocurrency mining looks like.

However, Bitcoin has its fair share of drawbacks. It has a very low transaction speed and is not smart contract-friendly. Therefore, second-layer solutions like the Lightning Network have tried to provide fast Bitcoin transactions but failed to power smart contracts.

As such, it has lost in the competition to Ethereum who now powers most decentralized finance (DeFi) protocols. Yet, with Ethereum witnessing increased congestion, new projects are shifting from Bitcoin and Ethereum’s proof of work (PoW) to platforms using proof of stake (PoS) and other energy-friendly consensus mechanisms such as proof of burn (PoB). Now Stacks wants to take this a step further with their proof of transfer (PoX).

| Name | What miner needs to do to mint new cryptocurrencies |

| Proof of work (PoW) | Use electricity towards computations i.e. solving complex problems. |

| Proof of stake (PoS) | Dedicate an economic stake in a base cryptocurrency |

| Proof of burn (PoB) | Destroy a base cryptocurrency |

| Proof of transfer (PoX) | Transfer a base cryptocurrency |

Stacks Blockchain

As mentioned earlier, Stacks has four major layers; application, protocol, Stacks blockchain, and the Bitcoin system.

Stacks blockchain is the solid rock that holds the ecosystem together. It is a distributed layer by itself and allows users to create smart contracts and virtual assets. What’s interesting with this layer is that it’s not a layer two chain but connects to the BTC-powered network with a 1:1 block ratio.

This implies that whatever happens on the Stacks platform is easily verifiable on the Bitcoin platform.

How Do the Two Platforms Connect?

To interface the two independent distributed networks, the Stacks blockchain uses PoX instead of PoW. Generally, the mechanism enables miners to mine a new digital currency by transferring a base currency. In the case of Stacks, transferring BTC results in a new coin being minted on the Stacks protocol.

Apart from fronting a new consensus mechanism i.e. PoX, the decentralized platform allows its users to easily create virtual assets that are transferable, and ownership can be assigned. The assets can represent a wide range of use cases such as business models, funding, and governance.

However, to effectively cater to each of these use cases, Stacks, through the Stacks blockchain, supports different asset types such as fungible and non-fungible tokens.

Learn more about the differences between fungible and non-fungible tokens.

To power smart contracts, the Stacks blockchain uses a smart contract-centric programming language called Clarity, which provides enhanced security. Notably, the programming language is employed by leading decentralized platforms such as Algorand.

Protocol Layer

The protocol layer has the storage, authentication, financial, and naming service. Stacks’ storage system is called Gaia. It stores app data without the need for a third-party service provider.

It utilizes off-chain cloud systems such as a DigitalOcean or Azure to power super-fast data access by applications. Fortunately, the data is secured by its creator’s private key.

On the other hand, Stacks uses a decentralized feature to provide authentication. Authentication powers access to the network’s apps using a username and details on Gaia.

The financial aspect of the system supports DeFi platforms such as those providing decentralized exchanges and lending. The financial pillar is further strengthened by the protocol’s use of Clarity to drive smart contracts.

For instance, the smart contract-programming language can interface directly with the Bitcoin blockchain. Additionally, it’s reinforced to prevent security breaches and anticipate possible vulnerabilities.

Stacks has a unique naming feature called BNS (Blockstack Naming Service). Despite being decentralized, the service enables the platform’s users to give assets human-readable names. The names are secured with a combination of public and private keys.

$STX Token: What is is and tokenomics?

Activities on the Stacks blockchain are powered by a native currency known as Stacks token ($STX). It is used up as “fuel” when making transactions, interacting with smart contracts and using the BNS feature. It is also distributed as a reward to STX miners (see below).

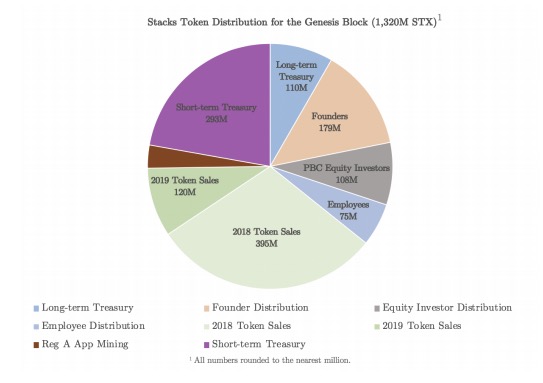

The genesis block minted 1.3 billion Stacks tokens. Minted coins were shared among the founders, treasury, equity investors, employees, two token sales, and app mining.

App mining is Stacks’ way to reward developers for building high-quality applications on the Stacks network.

Stacks is available on Binance, HashKey, Crypto.com, and Kucoin. Unfortunately, its availability has been set for non-US persons only.

Stack Network’s Use Cases

From the start, the platform is built to enable privacy and allow users to control how their data is used in a world where user data is treated as a commodity for sale. And with Stacks’ use of PoX, Clarity, and other qualities, developers can ensure data privacy when creating apps, eliminate central authorities in financial products, and build fair games.

Stacks 2.0 and use cases

Stacks 2.0 blockchain is a layer-1 blockchain utilising the Bitcoin blockchain as a secure base-layer to bring apps and smart contracts to Bitcoin. Stacks 2.0 is currently in the testnet phase. The team have confirmed they are on track to reach code completion for the Stacks 2.0 blockchain by 15th December 2020 and have set a launch date for 14th January 2021.

Stacks implements proof of transfer (PoX) as a consensus mechanism and natively connects to Bitcoin. Therefore developers can ensure data privacy when creating apps, eliminate central authorities in financial products, and build fair games without the need to modify Bitcoin.

There will be 2 types of participants on Stacks

STX miners

They can spend BTC to elect leaders by sending transactions on the Bitcoin blockchain, where a Verifiable Random Function (VRF) will randomly select the leader of each round. The leader then writes the new block on the Stacks chain.

As a reward, STX miners get STX tokens, transaction fees, and the Clarity contract execution fees of each block.

STX holders

Holders can participate in consensus by locking up their STX for a cycle, running a full node, and sending useful information on the Stacks network as transactions.

As a reward, STX holders can earn Bitcoin rewards and unlike in the proof of stake mechanism, there is no risk of slashing for STX holders.

Conclusion

With an increasing number of security breaches on smart contracts and blockchain platforms, leveraging Bitcoin’s security when building smart contracts puts Stacks at the top of the game. Using Clarity at the base of every smart contract keeps hackers at bay, especially in the DeFi scene where malicious actors are always on the prowl for vulnerabilities in protocols.

Additionally, Chainlink oracles provide a trusted source of off-chain data for developers, while PoX allows for a one-on-one connection to the BTC-powered blockchain.

We are certainly curious to see what the team come up with in Stacks 2.0 and whether they can live up to their aims.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

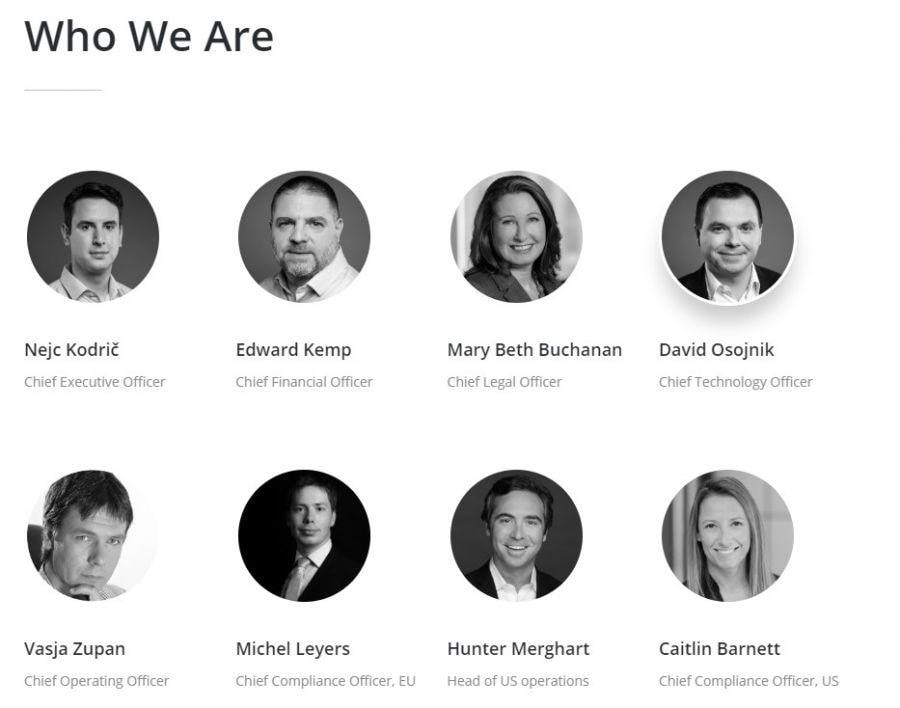

SwissBorg Network Token ($CHSB)

SwissBorg Network Token ($CHSB)