Paralink Network is a platform built on Polkadot sourcing crucial real-world data for decentralised finance (DeFi) applications.

Blockchain technology has huge potential, but blockchain applications are limited by what real-world data they can access. Without this crucial real-world data, blockchain cannot be used in areas like prediction markets, insurance, litigation, or other coordination problems that rely on social institutions and corporations. This is commonly known as the oracle problem.

While several solutions, like Chainlink’s decentralized oracles, are already being used, Paralink has made its own headway through the development of a cheap and efficient solution.

Background

Jan Knezevic, Founder and CEO of Paralink, is a Slovenian auditor who had previously worked in financial units, such as KPMG, one of the Big Four accounting organizations, in 2018.

During his time there, he developed an appreciation of blockchain technology. Like many other cryptocurrency enthusiasts, he was able to recognize the restrictions of blockchain applications when exchanging real-world information.

He saw that for such applications to be useful for complex industries like the stock market, they had to have verified information flow from the real world. Realizing that the gambling industry also needed reliable data flow, especially for platforms like casino utan svensk licens, he set out to bring a scalable cost-effective solution to the problem. This led to the development of the project now known as Paralink.

What is Paralink?

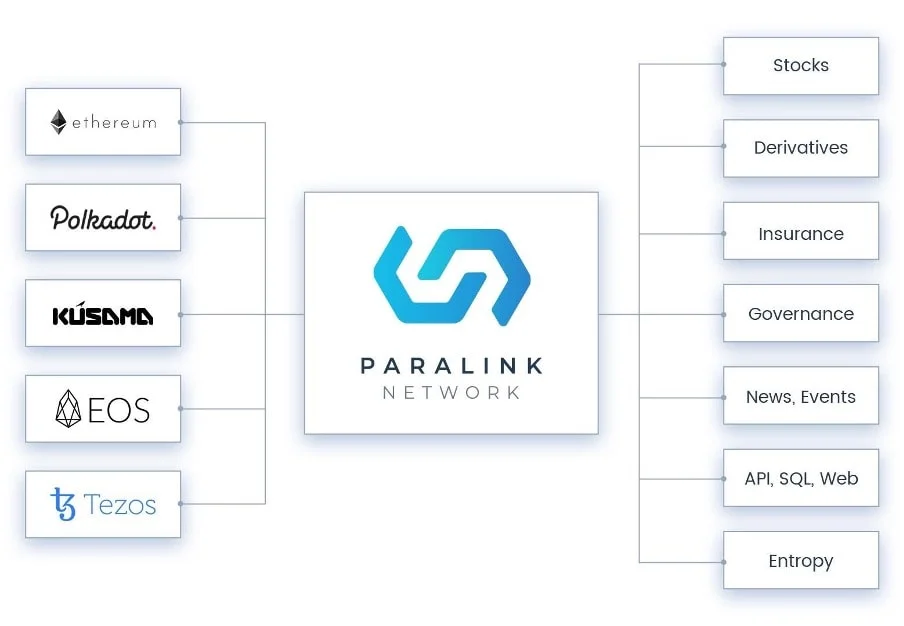

Paralink is an oracle platform that provides real-world data ingress across multi-chain networks. The platform makes it possible for applications built on blockchain networks like Ethereum and Polkadot to interact with traditional web interfaces.

It is developed to help distributed systems communicate effectively with each other as well as the outside world. With Polkadot providing the supporting architecture and framework for its integration, Paralink functions as a substrate.

In addition to collecting and organizing real-world data for Blockchain application, the platform also confirms their validity. The data could be anything from sports, weather, elections to financial data, stock, foreign exchange, etc.

It can carry out all these functions through an open-source software called the ‘Paralink node’. The platform is currently designed with a focus on financial applications like the stock market and insurance.

How the Paralink Node Works

The Paralink node is the center of the platform. As stated, the node is open-source software. It is built to access and collect real-world data that channels back to smart contracts via callbacks.

The node can be run independently as a centralized medium for real-world data into blockchain applications. That way, the solution is much cheaper. However, it is more practical for a node to be operated by self-organizing quorums to provide a strong, sustainable data ingress service.

The node is compatible with different data protocols including JSON, HTML, XML, SQL and Grpc. The creators are working to improve its interaction on different APIs actively.

Developers can then query data from sources outside of the Blockchain using Paralink Query Language (PQL).

Currently, the Paralink node is built to support just the Ethereum and Polkadot blockchain network. However, the long term goal is to build a flexible node compatible with any public chain, thanks to the node’s architecture and open-source model.

How Paralink is Secured

To achieve the goal described in its whitepaper, Paralink has to be effectively flexible enough to be compatible with a wide range of Blockchain applications and protocols. To this end, the platform is offered in three different security models, each with varying characteristics concerning cost, convenience, and security.

Simple Ingress

This is the most cost-effective model available. Here, Paralink nodes are available for use on multi-chain networks via any third-party data source. The model is simple to implement through PQL definition. It is also fast and can certify the authenticity of multiple data sources.

It has a major drawback, however, in that it requires trust in a centralized node operator. Furthermore, it is also ineffective for complex financial applications.

Trusted Ingress

This model is an upgrade to the first-described simple ingress, which utilizes encrypting PQL results with cryptography. The results are accompanied by private decryption keys from reputable data providers.

As a step-up from the rudimentary model, it is highly functional for financial applications. Other types of applications like prediction markets and gambling platforms can be also covered.

Trusted ingress is also cheap and effortless to implement. Moreover, callback support is also available to all chains without the need for a bridge. However, it is susceptible to being breached due to a single point of failure.

On-chain Security

On-chain security is the last security model available, which does not depend on a single source for verification. Hence, it is almost impossible to break. This is especially useful for money markets, derivatives, and other financial applications that involve high-stakes.

On the other hand, the model needs linking networks (bridges) like Ethereum and Polkadot, hence, requires more chain coordination to pull off.

Para Token ($PARA)

PARA is the native governance token of the Paralink platform. Users are incentivized to hold PARA tokens in order to enjoy governance rights and earn APY based on the amount they hold (which in turn must be staked).

PARA tokenomics

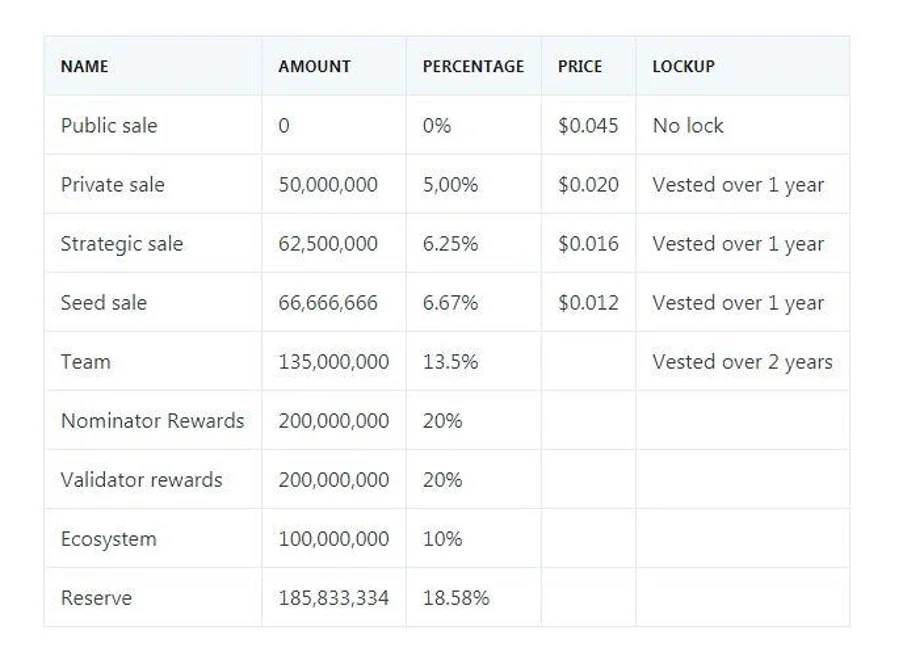

There is a maximum supply of 10 billion PARA tokens. The allocation and distribution of PARA tokens are as follows:

The distribution system is quite similar to other crypto protocols. 13.5% of the total would be shared among the developing team after a vesting period of two years. About 18% would be kept as reserve to as a buffer. 20% would be disbursed as nominator rewards, another 20% for Validator rewards.

10% would be deployed for the ecosystem. This will serve as incentives for early Paralink adopters and relayers.

Paralink Network ($PARA) token public sale?

In an update on 1 February 2021, Paralink have confirmed that they will not be holding a public sale of the PARA token. Their reason for this is due to the inherent unfairness of the auction process, and difficulties in completing the KYC process for purchasers.

However, Paralink still wants its eventual token holders (who can purchase the token when it is listed on exchanges) to have more incentives. So the tokens that were initially reserved for the public sale will now go into the lockup rewards pool.

Conclusion

Without a doubt, the cryptocurrency industry’s future depends on how well its application can integrate with the real world. To elaborate, financial applications need to be able to exchange real-time information with real-world entities to ensure an accurate, reliable evaluation of assets for buyers and sellers — which is the basis for Paralink nodes’ development.

Blockchain networks would require secure and cost-effective solutions like this for seamless communication among the various chains, as well as the outside world before it can unleash its latent potentials.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.