After our 2020 Roundup article where we reviewed this year’s biggest trends, let’s now dive deeper into what happened in the world of crypto exchanges.

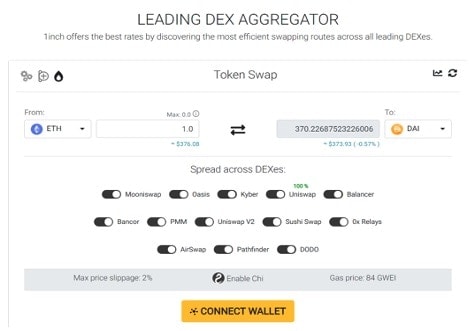

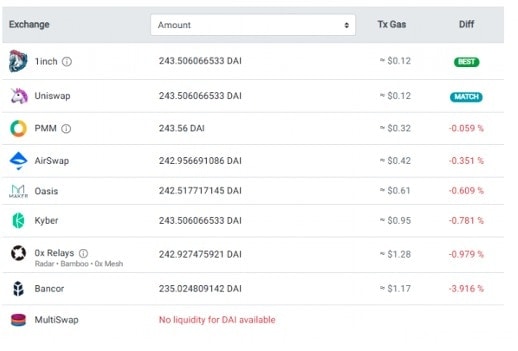

The surge of Defi and its DEXs (decentralized exchanges) has collapsed CEXs’ (centralized exchanges) volumes drastically. If Uniswap is the clear King of DEXs, the same we can probably say for Binance among CEXs, where it leads on both rankings for spot and derivatives. But the fight against decentralized exchanges has just started and new ideas and concepts are needed to keep up with the competition.

As we shall see, the CEXs that managed to better keep up against Defi are the ones that tried and innovated the most, sometimes directly inspired by DEXs.

Uniswap

Uniswap is the clear winner among all kinds of exchanges in 2020.

Its TVL (total value locked) has literally skyrocketed in the second half of the year, reaching more than $3 billion in November before dropping when $UNI pools ended giving rewards to Liquidity Providers.

Uniswap has constantly been the most used Dex in crypto and has terribly helped Defi’s growth. It is “The” place where to find new listings and the deepest liquidity on Ethereum. If you are looking for an existing ERC-20 token, you can be sure it is there. Anyone can open a new pool, it is as simple as providing some tokens plus some Ethereum on the platform, and it’s done.

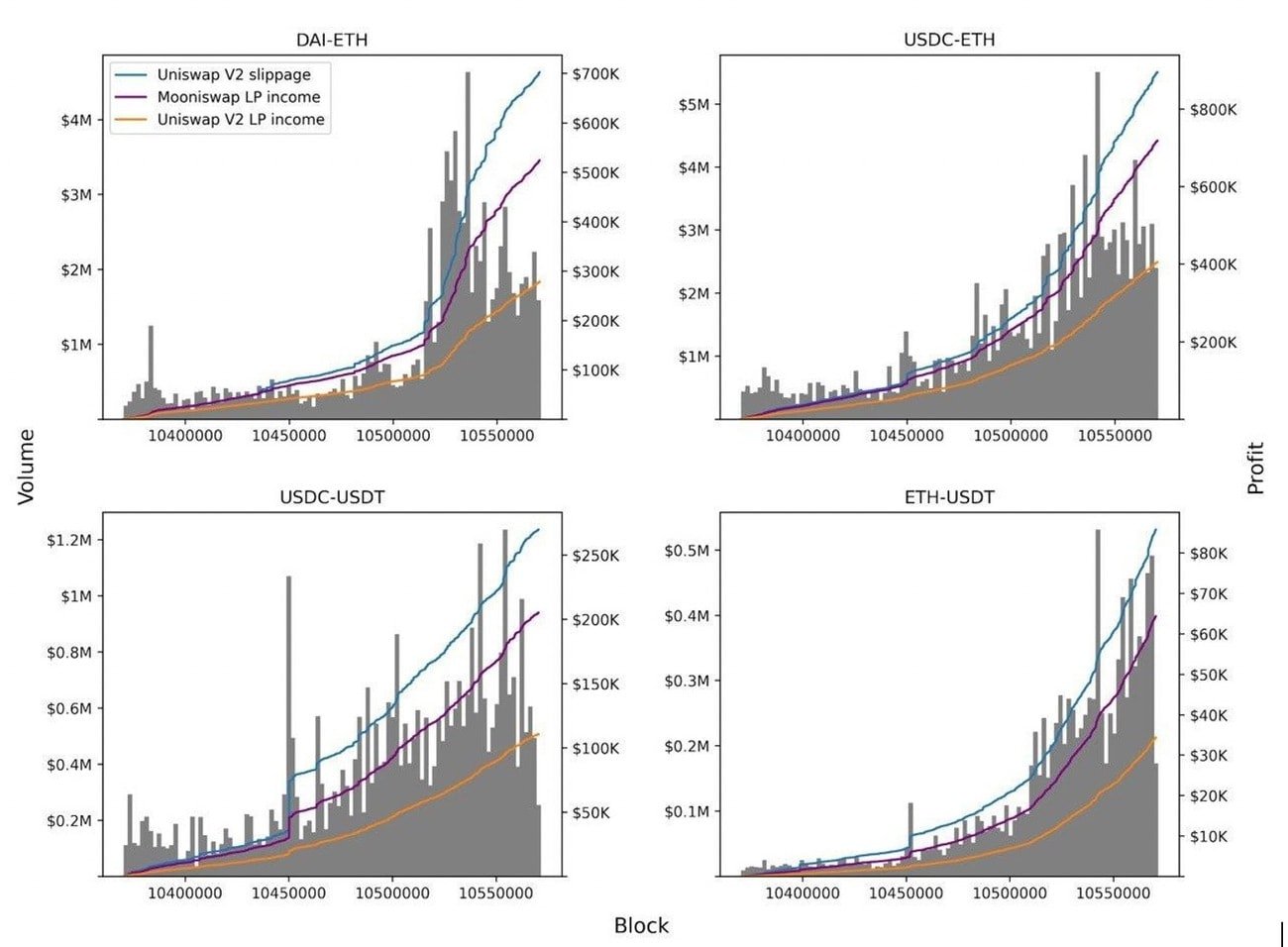

Uniswap doesn’t have a order book: the platform relies on an AMM (Automatic Market Maker) system to provide for trading liquidity. Although purists may miss order books, AMM has proven to be a new and successful way to swap tokens.

In September, the platform distributed 150 million $UNI (their new governance token) to anyone who came in touch with the website, whether just swapping or pooling liquidity. A minimum of 400 tokens were sent to each user, for a value of around $1500 in the first hours of its existence (for patient holders, the value tripled in during the day).

This airdrop attracted so much attention to the platform that other protocols did or are planning to do the same thing in the next future. With Uniswap V3 and all of its innovations expected to be released pretty soon, some can only wonder where $UNI can go!

If any of you has been sleeping throughout the last months and still hasn’t claimed his tokens, you can follow our video guide here!

Binance

Binance succeded at remaining the biggest Cex for volumes, with a daily ATH of $15 billion in spot trading and of $37 billion in futures (up by 34 billion compared to 2019!). It retains the first position on both rankings. (Ativan)

Part of their success is due to numerous initiatives that they introduced throughout 2020.

In April, Binance presented their Card (later on Binance also acquired Swipe, a multi-asset digital wallet and Visa debit card platform), which is now supported in more than 180 countries.

One of the most important innovation on the year is “Launchpool”, which lets users farm new tokens like in Defi. Stakers can accumulate rewards prior to a listing that will happen directly on Binance after a few weeks (usually). Moreover, Launchpool offers single-token staking so users don’t even have to be wary of Impermanent Loss. Projects like Bella Protocol ($BEL), Flamingo ($FLN) and $WING have were presented via Launchpool.

September has been a great month for Binance. They firstly launched Binance Smart Chain, a blockchain created to run parallel to Binance Chain where devs can create Smart Contracts and Defi solutions. The exchange then immediately introduced “Liquid Swap”, a new trading platform that allows users to reap the benefits of Defi, with the first AMM product in any CEX ever. Users can pool their funds on Liquid Swap earning trading fees like on a AMM DEX.

Simultaneously Binance Labs, the venture arm of the exchange, has continued investing in new projects to empower crypto. They helped, among others, 1inch, Dodo and Math.

On a side note, after the launch of Binance U.S. in 2019, the “.com” platform has now slowly been giving a 14 days notice to U.S. customers (both those who went through KYC and those who simply access the website from within the country) advising to withdraw funds before the account is blocked. It appears that customers who use VPNs are “safe” for the moment.

FTX

Ftx, the known derivatives exchange led by the omnipresent Sam Bankman–Fried, has surely been on the cutting edge among CEXs this year. The team worked very hard trying to anticipate trends and they seem really good at giving their customers what they have been hoping for.

“Why should we trade crypto and stocks on separate exchanges?” That’s probably what Sam asked himself at a certain point. So, no sooner said than done, the answer arised: tokenized stocks. Two partnerships with CM-Equity (Germany) and Digital Assets AG, DAAG (Switzerland), were decisive for the accomplishment. Although trading stocks on FTX looks similar to trading crypto, it is important to notice the difference.

“CM-Equity is fully regulated in Germany, and is a licensed financial institution permitted to offer these products. All FTX users who trade tokenized stocks may also have to become customers of CM-Equity, and pass through CM-Equity’s KYC and compliance. Furthermore, all trading activity may be monitored for compliance by CM-Equity. CM-Equity custodies the equities at a third party brokerage firm. CM-Equity (not FTX Trading LTD) provides the brokerage services”.

Unlike in traditional markets, FTX’s Tokenized stocks will be tradable 24/7, and as of now they are more than 50, among which Netflix, Facebook, Apple and Amazon.

FTX.US (the american arm) also put themselves (and the legitimacy of cryptocurrency) in the public eye as one of the top donors of the Biden’s Democratic Presidential Campaign. In particular, Sam donated $5,22M. While the real reasons remain probably unknown, we hope it will mark a step towards crypto recognition by authorities.

Last but not least, we can’t forget to mention that the same team behind FTX is responsible for the creation of Project Serum, one of the most successful non-ETH order-book based Dex, running on the Solana chain (which handles around 50,000 tps).

Sushiswap

Sushiswap launched in August as a fork of Uniswap with added rewards by the anonymous founder Chef Nomi. We were then at the peak of the “Defi bull summer” and the success was sudden. Its TVL gained great traction but some drama was due to happen. A week after, the anonymous dev removed its liquidity and sold $14 million worth of $ETH, starting a 50%+ drop in price. At that point, an offer was made by Sam Bankman-Fried to step in and remove Chef Nomi from the project.

Highs and lows have followed since then, but Sushiswap is still the second DEX for TVL (around 33% less than Uniswap) and one of the most successful. Many are the partnerships and its advisors are among the best that crypto can offer. Even though some will neve forget that Sushiswap literally “stole” liquidity from Uniswap, migrating pools to their platform and thus reducing Uniswap’s TVL dramatically, many are ready to bet that this project is here to stay.

Mt.Gox

December the 15th was the due date for Mt.Gox exchange creditors to finally receive part of their loss funds after years. The exchange repeatedly lost cryptocurrencies between 2011 and 2014, when it filed for bankruptcy. 140,000 $BTC (almost $4 billion dollar worth as of now) have since then been found and should be sent to users as partial refunds.

As suspected by many, it looks like the deadline has not been respected and creditors are still waiting for their money. A few days ago, someone noted a transaction from a Mt.Gox wallet, something which led many believe that the distribution had actually started.

Unfortunately that was not the Mt.Gox rehabilitation plan wallet, but the F2Pool cold wallet. There has been no confirmation that the creditors had received any fund yet.

BTC Markets accidentally exposed their users’ names and email addresses

BTC Markets, an australian crypto exchange, has mistakenly send out a compromised marketing round of emails. During a routine operation, instead of individually sending out email to their customers, personal data was exposed in the “to” field. The emails were sent in batches so that each user data had been potentially seen by 999 other people.

The mistake didn’t directly compromise sensible info such as passwords so funds remained safe, but this type of error is something that can definitely worry crypto adopters and possibly make them change platform. Users don’t want strangers to know they own crypto, and we hope that this kind of mistake won’t happen again.

Kraken, the first to win Bank Charter Approval in the U.S.

Kraken is the world’s first Cryptocurrency Exchange to get approved as Special Purpose Depository Institution (SPDI) by the State of Wyoming. “Kraken Financial”, this the name, is the “first digital asset company in U.S. history to receive a bank charter recognized under federal and state law, and will be the first regulated, U.S. bank to provide comprehensive deposit-taking, custody and fiduciary services for digital assets”.

The exchange will enable its clients to bank seamlessly between digital assets and national currencies and will be regulated in similar manners to other U.S. banks. The SPDI is a “custody bank” but for digital assets (such as cryptocurrencies) and it’s required by law to always maintain 100% reserves of its FIAT deposits.

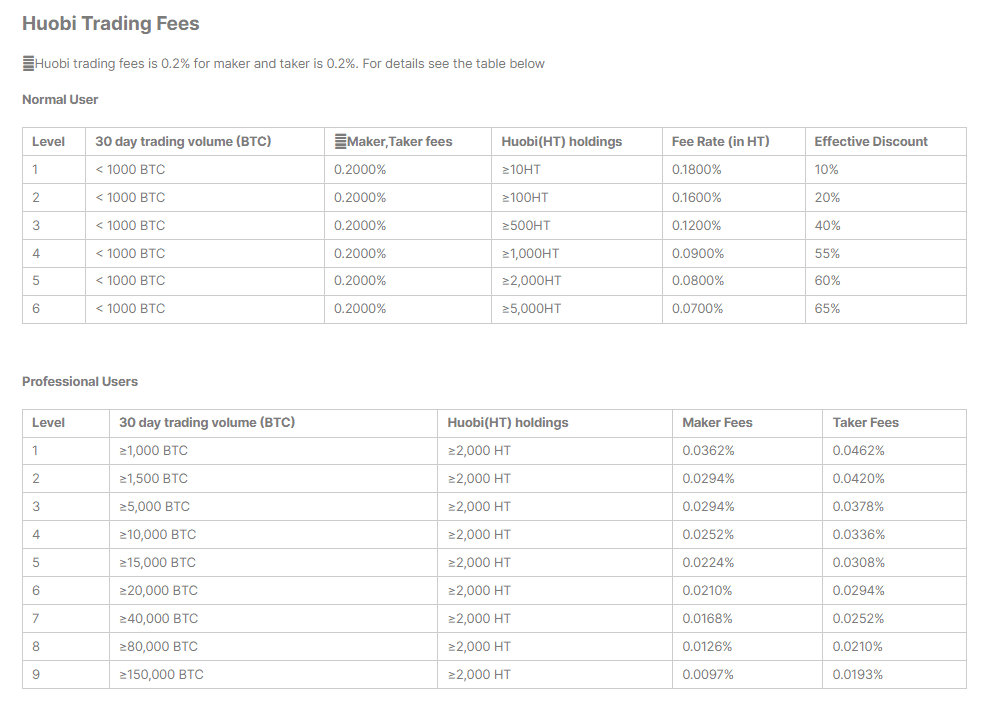

Huobi exchange

It all started with big $USDT (and other currencies) transactions spotted moving in and out of the exchange, the largest in China, on November the 2nd. At the same time, rumors of one of the Chairman being arrested increased the FUD which led to a sharp dump in price of $HT, the Huobi token, and to a rush in withdrawing $USD out of the platform. The exchange then denied all the allegations and the situation returned back to normal in the next days.

More info can be found in this article.

Okex

We have extensively covered the Okex story in our developing article.

On October the 16th, all the withdrawals were suddenly halted on the platform and the suspension has lasted until November the 27th when all operations were reopened without restrictions. As confirmed later on, the original cause was one of the exchange’s private key holders cooperating with the authorities. He was therefore unable to complete the authorization processes needed to allow external transactions.

Star Xu, the person held in custody by the police, has been investigated for matters that have nothing to do with the exchange. Xu was allegedly assisting the authorities (he is now back to normal business activity) about funds he borrowed from a Shanxi-based underground bank in 2019.

Kucoin

Kucoin, one of the leading crypto exchanges based in Hong Kong, suffered a security breach on September the 26th. The total amount stolen, a whopping $281 million in $BTC,$BSV $LTC and other coins, is one of the largest in crypto history. The hacker (or hackers) was somehow able to take possession of the centralized exchange’s hot wallets private keys, achieving the ability to move funds around. He then withdrew and started dumping them on DEXs. Kucoin immediately transferred the rest of the funds to new wallets and suspended all deposits and withdrawals.

It appears that Kucoin hot wallets’ private keys hadn’t been changed for over 3 years at the moment of the breach, which is another confirmation that the famous saying “not your keys, not your crypto!” is an evergreen.

We must hope that all these attacks will be helpful in the long run, enabling stricter security procedures by exchanges and platforms, necessary if crypto final goal is mainstream adoption!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.