Yaka Finance ($YAKA) is the native liquidity engine of Sei Network. They have already confirmed details of their airdrops (yes, multiple airdrops!). Most importantly, from our research, it is going to be a fair token allocation to all community members! Here is our Yaka Finance ($YAKA) token airdrop guide.

Learn more about the Sei Network token airdrop HERE

Check out our Yaka Finance ($YAKA) token airdrop guide

What is Yaka Finance ($YAKA)?

Yaka Finance ($YAKA) is Sei Network’s native liquidity engine. Here are some features of Yaka Finance:

- A liquidity hub within the SEI ecosystem: Yaka Finance aims to integrate the liquidity flywheel of VE (3,3) with a launchpad, creating an optimal environment for SEI trading and attracting protocol participation.

- A DEX with NFT utility: Yaka Finance introduces Yaka Voyager NFTs, which offer minters and stakers a share of the YAKA token airdrops and the DEX trading fees, aligning them with the long-term vision of Yaka Finance.

- A winner of the Code Sei Hackathon: Yaka Finance secured 1st place in the “Code Sei: Powering New Gaming and Defi Exchanges” Hackathon and received grants from the ecosystem, demonstrating its innovation and competitiveness.

- A protocol with a revenue-sharing model: Yaka Finance designs its NFTs to optimize minting quantities and incentivize early supporters, as well as allocating 50% of the funds raised for liquidity and liquidity incentives.

What is the Yaka Finance ($YAKA) token?

Yaka Finance’s native token is known as $YAKA. They also have a $veYAKA token. $YAKA will be Yaka Finance’s utility token, whilst $veYAKA will be their governance token in the form of an NFT.

The YAKA token has the following uses:

- Liquidity provision: Users can earn $YAKA tokens by providing liquidity to the protocol’s pools.

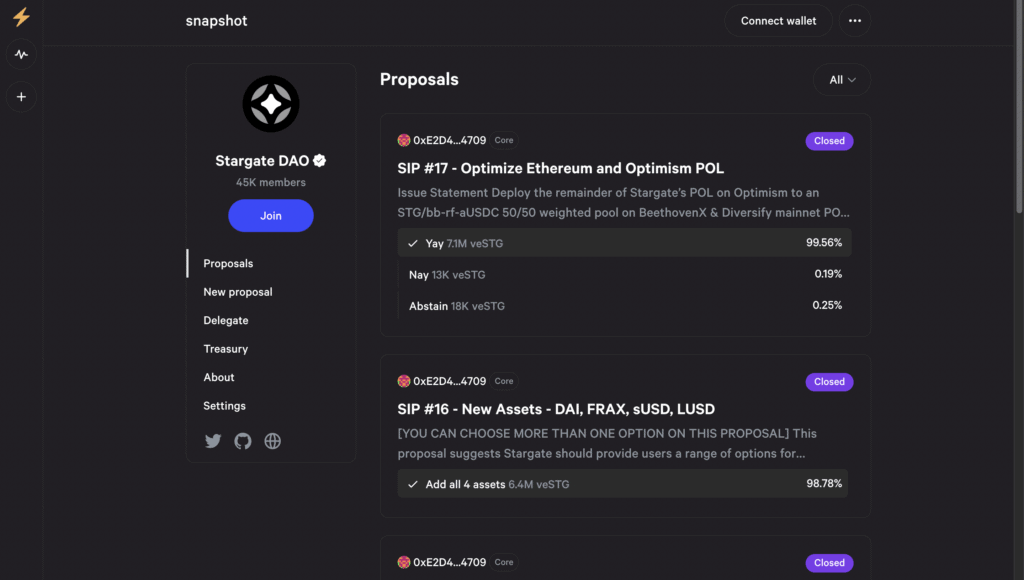

- Governance participation: Users can lock their $YAKA tokens for up to 2 years and receive $veYAKA tokens, which are NFTs that represent voting power and access to protocol revenue.

- Gauge voting: Users can use their $veYAKA tokens to vote for gauges, which are pools with dynamic rewards based on weekly allocation. Users can also receive bribes from third parties for their votes.

- Revenue claim: Users can claim their share of the trading fees and bribes from the gauges they have voted for after each epoch, which lasts for 7 days.

- Lockup: You can lock up 100 $YAKA for 2 years to become 100 $veYAKA. Meanwhile, 100 $YAKA can be locked up for 2 years to become 25 $veYAKA.

On the other hand, the $veYAKA token has the following uses:

- Protocol revenue access: $veYAKA token holders can vote for gauges every week, and access 100% of the trading fees and the bribes for the associated pool.

- Governance participation: $veYAKA holders can participate in governance and cast votes for the protocol improvement proposals.

- Voting benefits: $veYAKA voters can receive trading fees generated by the pool(s) they vote for, bribes deposited for the pools they vote for and weekly $veYAKA distribution.

How to get Yaka Finance ($YAKA) token airdrop?

Yaka Finance ($YAKA) have mentioned several tasks which could qualify you for their potential airdrop.

Time needed: 50 minutes

Here’s how to get the Yaka Finance ($YAKA) token airdrop

- Download and set up your SEI Network wallet

Download and set up your Compass Wallet. Connect your wallet to Yaka Finance

- Connect to Yaka Finance

Connect your Compass wallet to Yaka Finance

- Get testnet $SEI tokens

Go to https://atlantic-2.app.sei.io/faucet. Connect your wallet and Discord account. Then request some testnet $SEI tokens. This will give you 5 $SEI tokens daily on your wallet. If you want to get more testnet $SEI tokens, join Yaka Finance’s Discord.

- Swap on Yaka Finance

Go to https://app.yaka.finance/#/swap. Swap between testnet SEI, YAKA, USDT, and USDC. Every transaction you make on the testnet gains you 10 points towards the airdrop.

- Add liquidity

Go to https://app.yaka.finance/#/pools. Select a pool and add assets to the pools.

- Galxe quest

Go to Yaka Finance’s Galxe page and complete the tasks. These are social tasks such as joining and interacting with Yaka Finance’s social media pages. Note, one of the tasks will require you to join the Yaka Finance’s Discord and obtaining the Yaka Blast role by going to #special-roles and clicking the crown emoji.

- Obtain roles on Yaka Finance Discord

Join Yaka Finance’s Discord and get the Yaka Blast role by going to #special-roles and reacting to the crown emoji. Then, engage with the community and earn roles on Discord like Yaka Lad, Yaka Gent, Yaka Aquaman or Meme Master. You will be required to obtain these roles in order to get whitelist access.

- Complete Whitelist Tasks

Once you have joined Yaka Finance, participate in their whitelist round to secure a spot for the public sale. There are different roles you can choose from, such as Twitter influencer, meme creator, or community member. Follow the instructions for each role and complete the required tasks to earn points.

- Engage with the Community

Being an active member of the Yaka Finance community can also help you earn points. Join their Discord channel or other community forums. Interact with other community members, contribute valuable insights, and participate in discussions. Yaka Finance values community engagement and they reward active members accordingly.

- Check your airdrop points

Connect your wallet to Yaka Finance and go to the “Airdrop” page to check your airdrop points.

- Mint Yaka Voyager NFT

Once you have obtained the Yaka Blast role, go back to their Galxe page and connect your SEI wallet. Then mint your Yaka Voyager NFT. Note you will need to have some $SEI to pay transaction fees. But it is quite cheap.

- Stake Yaka Voyager NFT

Once the SEI EVM mainnet is live, you can stake your Voyager NFT on the Yaka Finance DEX to earn a portion of the trading fees and royalties from secondary sales.

- Earn rewards!

Yaka Voyager NFT holders and stakers are entitled to receive $YAKA token airdrops, with a fixed total airdrop of 6 million YAKA. In addition, Yaka Voyager NFT stakers will receive a share of the YAKA DEX trading fees.

- Participate in Yaka Finance Testnet Season 2

To participate in Yaka Finance Testnet Season 2, connect your Compass Wallet to https://v2.yaka.finance/campaign, and you’ll see a UI that allows you to approve the EVM version for Yaka Finance. Locate both your SEI native address (you can find this in your SEI wallet) and EVM address.

- Get testnet SEI and YAKA tokens

Go to the SEI Arctic 1 faucet and paste your EVM address which will give you two testnet SEI tokens. Afterwards you will be able to claim some testnet YAKA tokens. Note you will need to sign a transaction in your Compass wallet to claim the YAKA testnet token.

- Complete swaps

Using your testnet tokens, swap the SEI/USDT, SEI/YAKA, YAKA/USDT, SEI/SEIYAN and USDC/USDT pairs.

- Add liquidity

Add liquidity to the SEI/USDT, SEI/YAKA, YAKA/USDT, SEI/SEIYAN and USDC/USDT pairs.

- Lock $YAKA

Click “Go” and create a lock, you can put as little as 0.1 $YAKA and there are no requirements on how long you must lock for. Then, click “LOCK” and approve the transaction.

- Vote using $YAKA

Go to Vote and select any pair. Make sure you enter 100% and cast your vote. Finally, approve and verify the transaction.

- Invite friends

Once you have completed at least 1 swap and added liquidity to at least 1 pool you will be able to unlock the invitation link. Then, use your invite link to invite friends for extra points. However, your friends must complete at least 1. swap, deposit, lock or vote in order to earn points.

Yaka Finance ($YAKA) airdrop review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of airdrop: Yaka Finance ($YAKA) airdrop is now live!

Airdropped token allocation: Yaka Finance have confirmed they will reserve 12 million (6% of their token supply) for the airdrop campaign, with a 1-month lockup period.

Airdrop difficulty: The Yaka Finance airdrop requires participants to interact with their testnet and complete simple social tasks on their Galxe page. The only real assets you will need is a small amount of $SEI to pay gas fees to mint NFTs.

Token utility: The Yaka Finance ($YAKA) token will be for liquidity provision, governance and entitlement to rewards.

Token lockup: Airdropped Yaka Finance ($YAKA) tokens will be locked for 1 month after the Token Generation Event.