Eigenlayer is a protocol built on Ethereum that helps people who own Ethereum to keep their money safe and earn more rewards. With EigenLayer, people can use their Ethereum to help many different services stay safe at the same time. EigenLayer have already taken the airdrop snapshot, announced the eligibility criteria and claim details. Here’s our guide explaining the eligibility criteria and how you can claim the EigenLayer token airdrop.

What is EigenLayer?

EigenLayer is a protocol that introduces a new primitive in cryptoeconomic security called restaking. This primitive enables users to reuse their ETH on the consensus layer and extend cryptoeconomic security to additional applications on the network. Users who stake ETH natively or with a Liquid Staking Token (LST) can opt-in to EigenLayer smart contracts to restake their ETH or LST and earn additional rewards.

What is interesting about EigenLayer is that they have raised $50 million in Series A funding led by Blockchain Capital. Other notable investors include Finality Capital, Electric Capital, Polychain Capital, Hack VC and Coinbase Ventures. With Coinbase Ventures backing EigenLayer, there is strong speculation that their token will be listed on either Coinbase or Binance.

How to get a potential EigenLayer token airdrop if deposits are paused

To get the potential EigenLayer token airdrop, simply connect to https://app.eigenlayer.xyz/ and connect your wallet. Then, click into your preferred pool, enter the amount of tokens you wish to deposit and click “Deposit”.

However, Liquid Restaking deposits are currently paused on EigenLayer because it is full. They sometimes reopen, but when it does, it is only for a few hours at a time. So it is importantly to SUBSCRIBE to Boxmining+ because we will be the first to let you know when it does!

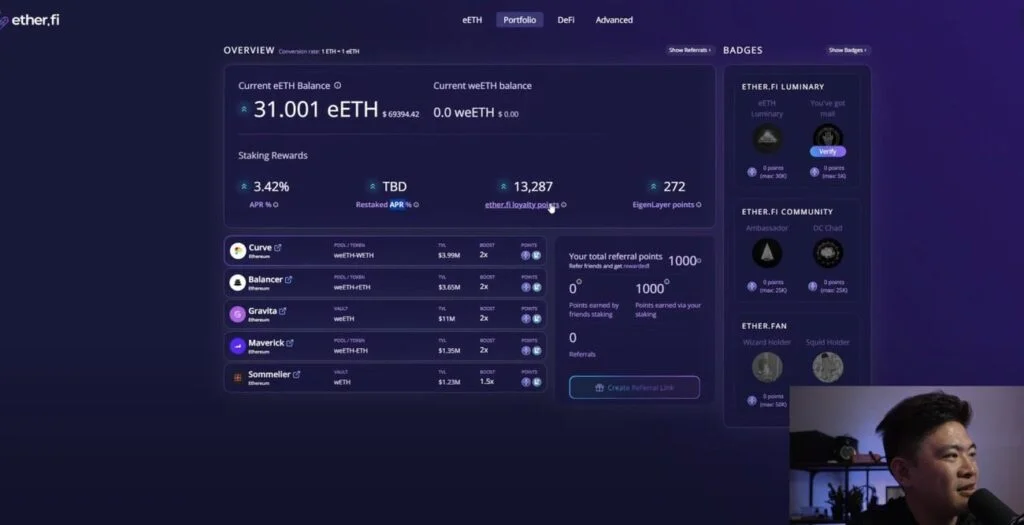

There is an alternative solution to getting the potential EigenLayer token airdrop if liquid restaking deposits are full. However, there is a risk of using Ether.fi as a backdoor to getting into the EigenLayer token airdrop. This is because EigenLayer has not officially supported this as an alternative to getting the EigenLayer token airdrop.

Here’s how to get a potential EigenLayer token airdrop if EigenLayer deposits are paused:

- Connect to Ether.Fi at https://www.ether.fi/.

- Use referral for EXTRA POINTS by clicking HERE.

- Stake ETH: Choose the amount of ETH you wish to deposit and click “Stake”. But make sure the transaction fees are not expensive when staking. This is because they could be more than what you may potentially get from this airdrop.

You will get eETH when you stake ETH on Ether.fi. - Earn rewards: You will earn the following rewards for staking on Ether.fi: APR, restaked APR, ether.fi loyalty points and Eigenlayer points.

- Withdraw staked ETH: Withdraw your eETH on the “Stake” tab. Note it takes around 7 to 14 days. Or if you don’t want to wait 7 to 14 days, you can immediately swap your eETH for an alternative cryptoasset using any DEX. However, you will need to pay exchange fees for this.

How to qualify for potential Eigenlayer airdrop: Cheapest method, no Ethereum

Time needed: 1 hour

Here’s how to get a potential EigenLayer token airdrop if EigenLayer deposits are paused:

- Withdraw Ethereum to Manta

Withdraw Ethereum on your centralized exchange account (e.g. Binance) to MetaMask using the Manta network. This is because it is extremely cheap to do this. For instance, Binance charged us 0.0001 ETH (around US$0.35) for this transaction, versus 0.003 ETH (around $10.48) for doing the same transaction using the Ethereum network. Note we chose the Manta network so we can get extra rewards on the Manta Renew Paradigm campaign. However, you can also use other networks such as Arbitrum, Base and Optimism.

Learn more about the Manta Renew Paradigm and our step by step guide HERE. - Join Manta’s New Paradigm

You need an invite to join Manta’s Renew Paradigm. Use the invite code HERE.

- Swap ETH for STONE

You will need STONE in order to stake on Manta. To get STONE tokens, connect your wallet to https://app.aperture.finance/swap?chainId=169 and swap your ETH to STONE. Note, do not swap all your ETH as you will need some ETH to pay for upcoming transaction costs.

- Stake STONE on protocols

On the staking dashboard, select your validator and stake your ETH. Make sure that you select a validator that offers Eigen Layer Points. For example Shoebill, LayerBank and ZeroLend offer LayerBank/ Shoebill/ ZeroLend rewards, Manta rewards, Stone Stake ETH rewards and Eigen Layer Points. You can choose to stake all your ETH on one or split your ETH between several protocols. We chose which protocol to supply and stake our STONE depending on the Supply APY offered. You can check the Supply APY on the protocol’s page. As at the time of writing, Shoebill offers 4.53% and ZeroLend offers 0.012% Supply APY. Whilst LayerBank offers 3.46% Supply APR.

See steps 5-6 for supplying and staking STONE on Shoebill.

See steps 7-8 for supplying and staking STONE on ZeroLend.

See steps 9-10 for supplying and staking STONE on LayerBank.

Note that token unstaking on Manta New Paradigm will only be enabled in May 2024. - Supply STONE on Shoebill

Connect your wallet to https://manta-stone.shoebill.finance/#/ and click on the “STONE” market. Uder the “Supply” tab, choose the amount of STONE you wish to supply and confirm the transaction. This will give you sbSTONE.

- Stake sbSTONE on Manta

Go to the Manta Renew Paradigm staking dashboard and click on the down arrow under Shoebill. Stake your sbSTONE to get Shoebill rewards, Manta rewards, Stone Stake ETH rewards and Eigen Layer Points. Note that token unstaking on Manta New Paradigm will only be enabled in May 2024.

- Supply STONE on ZeroLend

Connect your wallet to https://app.zerolend.xyz/. Click the down arrow to change to the Manta market. Click on “StakeStone Ether”. Choose the amount of STONE you wish to supply and click “Approve STONE to continue”. This will give you z0STONE.

- Stake z0STONE on Manta

Go to the Manta Renew Paradigm staking dashboard and click on the down arrow under ZeroLend. Stake your z0STONE to get Zerolend rewards, Manta rewards, Stone Stake ETH rewards and Eigen Layer Points. Note that token unstaking on Manta New Paradigm will only be enabled in May 2024.

- Supply STONE on LayerBank

Connect your wallet to https://manta.layerbank.finance/bank. Click “STONE” under Markets. Choose the amount of STONE you wish to supply and click “Supply”. This will give you lSTONE.

- Stake lSTONE on Manta

Go to the Manta Renew Paradigm staking dashboard and click on the down arrow under LayerBank. Stake your lSTONE to get LayerBank rewards, Manta rewards, Stone Stake ETH rewards and Eigen Layer Points.

AltLayer airdrop for EigenLayer restakers and ecosystem partners: How to claim?

AltLayer announced details of their Airdrop Season 1. A total of 300 million $ALT tokens (i.e. 3% of the total supply) will be airdropped. They have taken a snapshot at 12:00:11 on 17th January 2024 (UTC), and the AltLayer airdrop will be available to claim from 25th January to 25th February 2024. Of the $ALT tokens to be airdropped, 13.05% (i.e. 39.15 million) $ALT will be airdropped to EigenLayer Restakers. And 4.49% (i.e. 13.47 million) $ALT will be distributed to EigenLayer Ecosystem Partners.

For EigenLayer Restakers, you must have at least 720 Restaked Points to be eligible for the AltLayer airdrop.

AltLayer $ALT token claims are now open and can be claimed HERE. To claim your airdrop, enter your Ethereum address and click “Check”.

EigenLayer airdrop eligibility criteria

The EigenLayer token airdrop snapshot was taken at Block #19437000, on 15th March 2024, at 01:11:35 UTC.

EigenLayer has announced there are 2 airdrop seasons. In particular, Season 1 will be split into 2 phases. In Phase 1, 90% of Season 1 tokens will go to those who staked directly in EigenLayer or via Liquid Restaking Tokens (LRTs). For Phase 2, the remaining 10% of Season 1 tokens may go to those who engaged with EigenLayer in more intricate ways, where identifying the appropriate EigenLayer end user was either impossible or necessitated a subjective judgment.

EigenLayer have confirmed there will be they will give an additional 100 $EIGEN to all users who have interacted with EigenLayer before 29th April 2024 and passed the Sybil filtering. Therefore, Season 1 airdrop participants will receive a minimum of 110 $EIGEN (i.e. a floor amount of 10 $EIGEN plus the additional 100 $EIGEN). Meanwhile, Season 2 participants who started staking between 15th March and 29th April 2024 will also receive a minimum of 100 $EIGEN.

How to claim your EigenLayer airdrop?

To check your eligibility for the EigenLayer token airdrop, click HERE and enter your EVM wallet address. You can then claim your EigenLayer token airdrop on 10th May 2024. HOWEVER, airdropped $EIGEN will be unlockable (i.e. non-transferrable) until new features are live and further decentralization is achieved. This is targeted to be on 30th September 2024.

EigenLayer airdrop review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of airdrop: The EigenLayer airdrop is now live. Participants are already doing tasks and getting points!

Airdropped token allocation: The EigenLayer airdrop allocation is unknown.

Airdrop difficulty: The EigenLayer airdrop requires users to deposit ETH onto their platform. But deposits are currently closed. We have an alternative which is to deposit on Ether.fi instead, but EigenLayer have not confirmed this is an official method to getting their token airdrops.

Token utility: The EigenLayer token utility is unknown.

Token lockup: There is no information on the EigenLayer token lockup yet.

Angela Wang

Angela loves cryptocurrency, technology that improves our lives...and food. Anything that merges these worlds together is even better.