What is DCEP?

China’s national digital currency DCEP (Digital Currency Electronic Payment, DC/EP) will be built with Blockchain and Cryptographic technology. This revolutionary cryptocurrency could become the world’s first Central Bank Digital Currency (CBDC) as it is issued by the state bank People’s Bank of China (PBoC). The goal and objectives of the currency are to increase the circulation of the RMB and its international reach – with eventual hopes that the RMB will a global currency like the US Dollar. China has recently established an initiative to push forward Blockchain adoption, with the goal of beating competitors like Facebook Libra – a currency that Facebook CEO Mark Zuckerberg claims will become the next big FinTech innovation. China has made explicit that Facebook Libra poses a threat to the sovereignty of China, insisting that digital currencies should only be issued by governments and central banks. DCEP is not listed on cryptocurrency exchanges and will not be for speculation of value.

To learn more about Bitcoin, cryptocurrencies and generally how to get started. Check out my course created in collaboration with Jeff Kirdeikis of Uptrennd- Bitcademy: Learn, Invest & Trade Bitcoin – In Under an Hour

Why is China coming up with a digital currency?

The significance of DCEP is that it’s designed as a replacement for the Reserve Money (M0) system, cutting back the cost and friction of bank transfers. It is suggested that DCEP will alleviate the risks of offline paper money transactions such as anonymous counterfeiting, money laundering and illegal financing. This is because regulators can better monitor digital currency transactions, which some consider will greatly improve financial and monetary supervision. DCEP can also reduce the costs involved in maintaining and recycling banknotes and coins.

Basically, DCEP is poised to become a digital version of the RMB.

Furthermore, the issuance of DCEP is conducive to promoting the internationalization of the RMB and reshaping the current cross-border payment system. This is because prior to the RMB Cross-Border Inter-Bank Payments System (CIPS) going live in early October 2015, RMB cross-border clearing and settlement was mainly done through CHIPS (Clearing House Interbank Payments System) or SWIFT (Society for Worldwide Interbank Financial Telecommunication). However, some consider that both the CHIPS and SWIFT systems have fatal flaws. Firstly, CHIPS is a US company. Whilst SWIFT, in particular, is seen as a cause for concern to the Chinese because due to its foothold in the international banking system, it is almost essential to use SWIFT for inter-bank transfers across countries. Thus whoever controls SWIFT’s data center will have access to information on almost every cross-border remittance, which some in China posit is the US. This is because whilst SWIFT claims to be a neutral international organization, 12 of the 25 directors are either from the US and her allies. Also, its transactional data were found to have been supplied to the US. Hence it is thought that China is being held back by the US via the SWIFT system, and so, in internationalizing the RMB- China requires its own worldwide banking system- i.e. DCEP.

Hence the Chinese consider that it is a requirement to form a new currency clearing network.

According to Chinese media, DCEP is seen as the “3rd Wave” aimed at the US.

A mandate to adopt Blockchain

China has established a countrywide initiative to push forward Blockchain Adoption. President Xi Jinping has mandated that the ‘country’s development of blockchain technology should be sped up ‘ on Oct 24th in front of the Political Bureau. This speech has also been echoed by Li Wei, head of the People’s Bank of China. In April of 2020, China launched the Blockchain Service Network to unify all the Blockchain related projects in the Nation.

China has adopted the “Blockchain, not Cryptocurrency”, whereby the benefits of Blockchain is highlighted. On the other hand, cryptocurrencies that are native to Blockchain are suppressed as Cryptocurrency Exchanges and ICOs are banned in the country.

History and development of DCEP

Development of DCEP started in 2014 with the establishment of a research institute dedicated to digital currencies and looking at how to improve the Chinese Yuan system with blockchain technology. However during 2014 to 2018, the development process slowed down, probably because the decentralised nature of Bitcoin or blockchain is incompatible with the nature of the Renminbi as a legal national currency. Things rapidly picked up towards the end of 2019 however and this was directly attributable to Facebook preparing to launch Libra, particularly as partner members of the Libra Association and the currencies which Libra was to be backed by had consciously rejected China. Hence, feeling the heat of the competition, China’s central bank felt immense pressure to urgently speed up in the global competition towards a digital currency.

Former Vice-chair of the PBoC’s National Council for Social Security Fund announced on 22nd June 2020 that China had already completed the backend infrastructure of DCEP.

Uses for DCEP

DCEP will be the only legal digital currency in China

DCEP is a currency created and sanctioned by the Chinese Government. It is not a 3rd party stable coin such as Tether’s cryptocurrency token “CNHT” which is also pegged to the RMB in a 1:1 ratio. DCEP is the only legal digital currency in China (cryptocurrencies such as Bitcoin are not legal tender in China).

Huang Qifan (Chairman of the China International Economic Exchange Center) said they have been working on DCEP for five to six years now and is fully confident it can be introduced as the country’s financial system. It’s currently being rolled out, with the People’s Bank of China issuing the currency. According to a speech by Huang at the China Finance 40 Forum, “DCEP can achieve real-time collection of data related to money creation, bookkeeping, etc, providing useful reference for the provision of money and the implementation of monetary policies.”

DCEP is not for speculation

China has made it explicitly clear that its National Digital Currency is not for speculation. Mu Changchun, Head of the People’s Bank of China digital currency institute made it as “a digital form of the yuan” and that “The currency is not for speculation. It is different to Bitcoin or stable tokens”. This is to the disappointment of the online community in China, where some netizens commented “So there will be no fun in it” on Sina.com.

It is also not possible to mine DCEP or stake on the DCEP network.

Cross-border payments with m-CBDC Bridge

China has joined forces to explore cross-border payments for digital currencies alongside Hong Kong, Thailand, the United Arab Emirates (UAE), and the Bank of International Settlements (BIS).

According to a joint statement in February 2021, the People’s Bank of China and the UAE’s central bank are taking part in the Multiple Central Bank Digital Currency (m-CBDC) Bridge project initiated by the Hong Kong Monetary Authority and Bank of Thailand in 2019.

The m-CBDC Bridge project will explore the capabilities of distributed ledger technology, through the development of a proof-of-concept prototype. The project ultimately aims to facilitate cross-border, multi-currency, real-time transactions around the clock.

This move aligns with China’s long-term ambition to use DCEP to boost the use of RMB in international payments. While the project is currently an alliance between just Beijing, Hong Kong, Bangkok, and Abu Dhabi, it is strongly supported by the BIS, an organisation owned by 63 central banks.

The announcement also comes mere weeks after China’s joint venture with SWIFT, the dominant network facilitating international payments between banks. The new entity, Finance Gateway Information Service, was registered in Beijing on January 16 with €10 million (US$12 million) as incorporation capital, according to the National Enterprise Credit Information Publicity System, the Chinese government’s enterprise credit information agency.

Special features of DCEP

DCEP is a Centralized Currency

DCEP is a digital currency that is run on a centralized private network – the Central Bank of China has complete access and control of the currency. This is a huge contrast to Bitcoin, which has an open decentralized network where there is no centralized leader. In the case with DCEP, the Central bank of China has the ability to create or destroy DCEP.

NFC Contact based payment

According to Official Sina Blockchain, DCEP will have NFC based payment options that don’t require devices to be online during the transfer. This will be poised as a direct replacement of paper money, as DCEP will be usable in areas without internet coverage. In addition, DCEP doesn’t require the mobile device to be bound to a bank account – meaning the unbanked population will also have access to the digital currency.

With DCEP’s tap payment feature people can transfer money simply by tapping two phones together, without the use of the Internet. So DCEP is not exactly like blockchain either, rather it is their own variant.

China Construction Bank launches DCEP wallet

On 29th August 2020, China Construction Bank (CCB) had a soft launch of the DCEP wallet. Users of one of China’s big four state-owned commercial banks found a DCEP wallet feature was available inside their mobile app. Users were even able to navigate to the digital yuan wallet and activate it through registering their mobile phone numbers.

Finally, users can send/receive digital currency to others by inputting their unique wallet ID or the phone number associated with the bank account.

However, CCB has disabled the DCEP wallet feature from public access, but not before it gained huge attention. Users searching for this wallet now will only get an error message saying that the function is not yet officially available to the public.

Tencent to be a major partner of DCEP

Tencent’s Meituan Dianping has been in talks with the research wing of the PBoC on real-world uses for DCEP. Meituan Dianping boasts billions of dollars in daily transactions on their mobile app platform offering services such as food delivery (similar to UberEats), B&B bookings (similar to AirBnb), ride hailing services, bike sharing, grocery shopping and more. Basically for those in China, all your daily necessities can be met on the Meituan ecosystem.

The PBoC’s research wing is also in talks with another Tencent-backed company, Bilibili Inc. which provides video streaming services. So whilst the specifics of the partnership are yet to be finalised, it is likely that such cooperation is going to be huge for the mass use of DCEP in China.

Deployment and Distribution

According to Caijing magazine, the pilot institutions for DCEP will be the 4 major state-owned banks i.e. China Construction Bank, the Agricultural Bank of China, Bank of China and the Industrial and Commercial Bank of China. This initial deployment will serve as an official production test for the currency system, where the network and security will be validated. In the second phase, DCEP will be distributed to large fintech companies such as Tencent and Alibaba to be used in WeChat Pay and AliPay respectively.

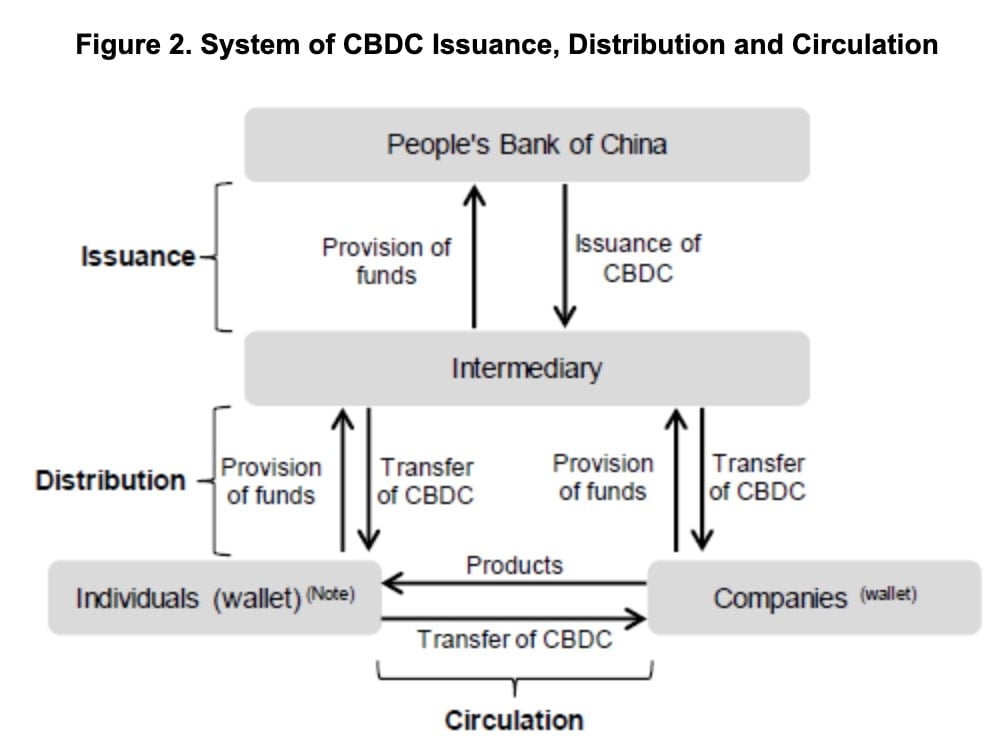

DCEP will operate on a two-tiered system

The issuance and distribution of DCEP will be based on a two-tiered system.

The first tier would be transactions between the PBoC and intermediaries. These intermediaries would be financial institutions (e.g. the 4 major state-owned banks i.e. China Construction Bank, the Agricultural Bank of China, Bank of China and the Industrial and Commercial Bank of China) and non-financial institutions such as Alibaba, Tencent and UnionPay. Here, the PBoC would issue DCEP to the intermediaries.

The second tier would be between the above-mentioned intermediaries and participants in the retail market such as companies (e.g. retail stores) and individuals. In this tier, the intermediaries that have received DCEP will distribute it to retail participants so that it would circulate through the market e.g. through people purchasing items at stores etc.

The main difference in the issuance and distribution of DCEP compared to traditional cash however is the fact that DCEP would be transferred through electronic wallets, rather than bank accounts.

Merchants must accept DCEP

The central government has mandated that all merchants who accepted digital payments (such as Apple Pay, AliPay and WeChat) pay must accept DCEP. This will give DCEP a large nationwide acceptance in China, with every merchant obligated to participate or face a potential loss of their business license. This will make DCEP the most accepted digital currency in the world.

DCEP red packets to be launched for Chinese New Year

China’s DCEP app has launched a red packet gifting feature in time for the Chinese New Year on 22nd January 2023. The app will allow users to send the red packets i.e. “hongbao” containing DCEP to others. This is based on the Chinese New Year tradition of gifting lucky money during the annual festival. In fact, WeChat Pay and Alipay already have this feature for gifting CNY. However, it is the first time that e-CNY will be gifted in such a way, with hopes that this will further pave the way for the mass adoption of DCEP.

DCEP can be used to pay expressway tolls

On 28th December 2022, Chongqing Expressway Group announced it has completed the installation of equipment to accept DCEP for expressway tolls. From 30th December 2022, DCEP can be accepted as payment for tolls on the Chongqing Expressway. Users will need to download the e-CNY app and then simply present the payment QR code at the toll booth.

PBoC’s financial statistics reports now include DCEP/e-CNY

On 10th January 2023, the PBoC released its annual Financial Statistics Report for 2022. What is worth noting is that for the first time, the PBoC included statistics on DCEP/e-CNY. The Report states that as of the end of December 2022, the amount of digital currency in circulation was 13.61 billion yuan. This equates to around 0.13% of the total balance of yuan (13.61 trillion yuan) in circulation at the end of 2022.

Are people in China using DCEP?

According to a report on 28th December 2022, there has been over US$14 billion worth of DCEP transactions since its launch in 2020. Meanwhile, 261 million users have already set up an e-CNY wallet. However, this is considered low adoption since around 903.6 million people use mobile payments in China, according to a 2021 UnionPay report.

DCEP scams

Mere hours after DCEP has been announced, various (potentially scam) Chinese exchanges have listed IOUs or knock-offs clones of DCEP. It’s important to know that DCEP is currently only distributed to banks working with the PBoC and will not be available for the public. If you want to find out what are reputable exchanges, check out our top cryptocurrency exchanges guide. It is strongly recommended NOT to trade DCEP until it is officially released as there is no guarantee exchanges have access to the digital currency.

How to buy DCEP?

Currently, DCEP is only available to other banks working with the People’s Bank of China. This will eventually open up to the general public in 2020. There are currently no cryptocurrency exchanges that trade DCEP.

Implications of DCEP?

Is DCEP a challenge to the US monetary system?

The overwhelming view appears to be yes, both from the Chinese and the US perspective. According to statistics from the World Bank, 1.7 billion adults around the world use cash because they don’t have bank accounts. However, two-thirds of this population own a mobile phone, which can be used to make monetary transactions. This is what’s been happening in China, where mobile payments such as Alipay or WeChat Pay have more than 1.7 billion customers across China. Currently, the two online payment companies handle more payments monthly than Paypal did in the whole of 2017 (i.e. USD $451 billion). It’s very common in China to see street vendors accepting Alipay or WeChat pay.

With the mobile wallet payment infrastructure in place, their cooperation with the PBoC could be the answer to distributing DCEP overseas. This would fit China’s “Belt and Road Initiative”, the aim of which is to build a new trade route connecting Asia with Europe and Africa. The idea is that with DCEP being used by mobile wallets, populations along the Belt and Road can be connected, bypassing existing financial infrastructures completely and giving an opportunity for the unbanked to pay for online purchases and build their savings.

In the US, the government does not see a demand for digital currencies. In a letter from the Chairman of the Federal Reserve, Jerome Powell, he took the view that many of the challenges a digital currency intends to solve do not apply to the US. In his view, the US payments landscape is already highly competitive and innovative, with plenty of digital payments options for consumers. Powell also commented, echoing the sentiments of those US lawmakers opposing Libra, that a digital payment where you would know and be able to track each and every payment would be unattractive for the US.

Whilst the House Committee on Financial Services also sees Libra as potentially raising national security concerns, observers consider the challenge from China is not being taken seriously. Because on the other hand, China is worried that Libra will reinforce the dominance of the US Dollar and is therefore working on fast-tracking the launch of DCEP. And it is likely that China will outrun the threat from Libra.

From a wider perspective, some take the view that DCEP can be used as a weapon against the US in an economic war. This is because as DCEP becomes accepted across the Belt and Road, China will have the power of total surveillance and control over the economic activity of potentially half the world’s population. DCEP will allow China to track everyone’s spending and transactions, and can seize or lock customers’ digital assets in their mobile wallets. We’ve already seen this in China, where together with its “social credit system”, millions of individuals have already been barred from purchasing airline tickets using their mobile wallets.

Appearance on Chinese television debate show “Tiger Talk”

On 29th August 2020, I appeared on China’s Phoenix Television show “Tiger Talk” (一虎一席談). Tiger Talk is one of Phoenix TV’s longest-running shows, each week they feature a debate on a major societal issue or event, and would invite experts, academics and guests to participate in the discussion. I was invited by Phoenix Television as an overseas analyst to discuss the topic of the week, namely, “DC/EP: China’s release of digital currency, will it shake the US Dollar’s hegemony?”. You can watch the episode here.

Implications of DCEP on Bitcoin and cryptocurrencies

In the first instance, it should always be borne in mind that DCEP and Bitcoin/cryptocurrencies are vastly different. Key differences are that DCEP does not necessarily use blockchain technology and that it is a centralised currency under the control of a centralised authority. Learn more about the differences between DCEP, Libra, Bitcoin and Cash.

However, the large scale promotion of DCEP on national television in August 2020 is certainly bracing and preparing Chinese citizens for a digital version of the RMB. The gradual rollout of DCEP will also get the average citizen accustomed to the actual usage of digital currencies.

As a result, many people are excitedly speculating on the possibility of a bridge between DCEP and various existing blockchain projects- with some projects proclaiming they will be the first project to launch on DCEP. However it must be borne in mind that we do not know the full technical details of DCEP, so we do not know how this bridge between blockchain and DCEP will work, if at all. Also, the fact is that China is currently very hostile towards cryptocurrencies, this is mostly due to a number of cryptocurrency scams- such as Plus Token. As a result, the Chinese government have closed several bank accounts found to be involved in cryptocurrency transfers and banned all ICOs, several major cryptocurrency exchanges such as Binance and OKEx and some Over the Counter desks. Hence a lot of cryptocurrency circles and discussions occur underground, such as in private WeChat groups.

In a confusing twist, however, the CCP’s official media outlets 参考消息, Xinhua and CCTV have been pushing out headlines that crypto assets are the best-performing asset year to date. Dovey Wan, Founding Partner of Primitive Ventures has observed that the real intent behind this media push is difficult to interpret, but so far the Chinese cryptocurrency community see this as a signal that crypto has reached its top. Meanwhile, on the Western front on Twitter, people have been seeing this as a bull signal. Currently, without any further moves or news in China about DCEP or on the cryptocurrency front, we can only wait and see what China’s next move will be.

Will DeFi push governments to finally adopt CBDCs?

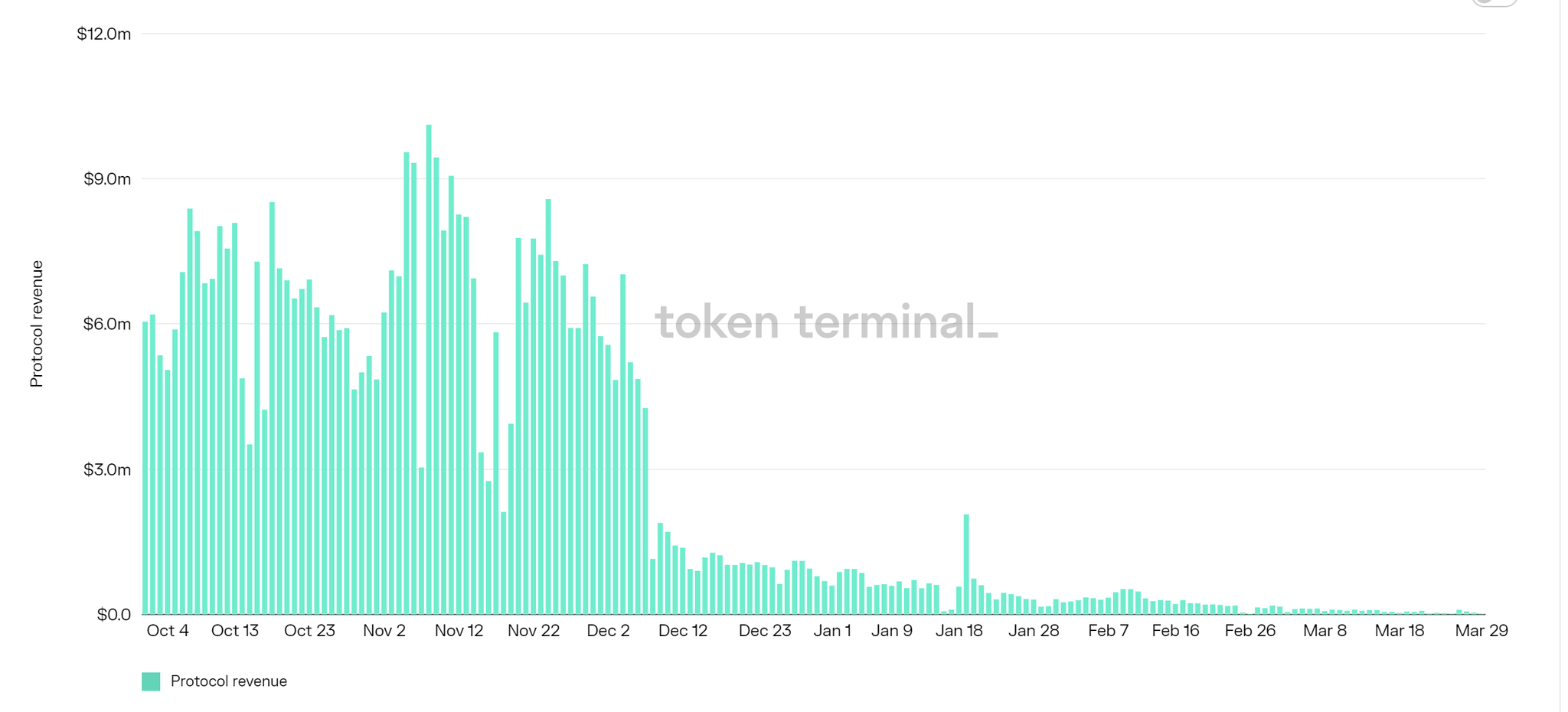

Decentralised Finance (DeFi) can be considered the cryptocurrency and blockchain star of 2020, having revived the cryptocurrency market and bringing some much-needed revival and positivity. But what is DeFi? In short, DeFi attempts to bring traditional banking to developing industries, but with a twist: it would be open-source, decentralised, cheap and will cut out the middlemen. (Xanax)

So what can central banks and government do to maintain their dominant status quo whilst benefitting from the technology that DeFi can bring? An answer could be to create a CBDC. In a Forbes article, the author suggests that CBDC would be a positive move for governments since it tokenises money whilst allowing users to enjoy the advantages of cheaper, faster transactions.

The article also touches upon our coverage of DCEP and discusses China’s progress in testing DCEP contrasted with the progress of introducing a CBDC in the US. It suggests that governments and institutions, however, will need to be quick to catch up as new DeFi solutions in payments, mortgage, insurance etc. are being created weekly, and this legion of fintech innovators are growing. These innovators challenge the status quo, and with the mounting advantages of DeFi, there may soon be a real contender vying for the attention of citizen-consumers.

FAQs

The simple answer is u0022Nou0022. On a recent episode of Kitco News, journalist Max Kaiser claimed that China will launch a gold-backed cryptocurrency, with the intention of destroying the USD as a reserve currency. He added that China has already amassed as much as 20,000 tons of gold. However this is mere speculation – China has no plans to return to the Gold Standard nor issue gold-backed cryptocurrencies.

There are many plans to build gateways that allow the swapping of DCEP to other cryptocurrencies. Projects such as Algorand have stated they want to support DCEP and build possible bridges to swap these currencies. However, as the technical details of DCEP have not been fully revealed, such bridges have not been built yet.

There are 7 Chinese commercial banks that can provide e-CNY. They are: ICBC, Agricultural Bank of China, Postal Savings Bank of China China Construction Bank, Bank of China, Bank of Communications, and China Merchant’s Bank. There are also 2 online banks that can provide e-CNY i.e. WeBank (WeChat Pay) and MyBank (Alipay).

Currently, there are 12 cities and areas in China which can sign up and use the e-CNY app. They are Shenzhen, Suzhou, Beijing Xiong’an, Chengdu, Shanghai, Hainan, Xi’an, Changsha, Dalian, Qingdao, and Zhangjiakou.

No, DCEP is not fully rolled out yet and is only available in select cities in China.

According to a report on 28th December 2022, there have been over US$14 billion in transactions since the launch of DCEP in 2020 and October 2022. Meanwhile, 261 million users have already set up an e-CNY wallet. However, this is considered low adoption since, according to a 2021 UnionPay report, around 903.6 million people use mobile payments in China.

Whilst there is ongoing DCEP/e-CNY testing on in increasing scale, there is no official announcement as to when and how China will fully roll out DCEP/e-CNY.

Sources:

https://www.forbes.com/sites/lukefitzpatrick/2020/10/06/defi-may-push-governments-to-adopt-cbdcs/#2d2c1f6f3f5e

https://www.asiacryptotoday.com/how-china-and-the-world-reacted-to-xi-jinpings-blockchain-comments

https://venturebeat.com/2019/09/15/wake-up-us-federal-reserve-china-just-showed-how-digital-currency-is-done/

https://www.reuters.com/article/us-china-blockchain-idUSKBN1X704A

https://u.today/just-in-chinese-central-bank-to-launch-digital-currency-called-dcep

https://beincrypto.com/chinas-dcep-to-be-worlds-first-national-digital-currency-says-ccie-vice-chairman/

https://qz.com/1710850/chinas-central-bank-could-gain-from-a-digital-yuan-cbdc/

https://www.asiacryptotoday.com/news/china-digital-yuan-dcep/

https://news.bitcoin.com/over-3000-atms-in-beijing-offer-digital-yuan-withdrawals/

https://www.coindesk.com/china-industrial-commerce-bank-digital-yuan-cash-convert

https://www.theblockcrypto.com/post/95266/beijing-digital-yuan-cash-atm

https://www.scmp.com/tech/policy/article/3122924/beijing-exploring-digital-yuan-cross-border-payments-joining-hong-kong

https://www.coindesk.com/central-banks-of-china-uae-join-hong-kong-thailand-cbdc-payments-project

https://www.scmp.com/economy/china-economy/article/3135886/china-digital-currency-when-will-e-yuan-be-launched-and-what

https://www.scmp.com/economy/china-economy/article/3120582/chinas-swift-joint-venture-shows-beijing-eyeing-global

https://www.scmp.com/economy/china-economy/article/3135650/china-digital-currency-hong-kong-shenzhen-proposed-expressway

https://www.coindesk.com/china-cbdc-wage-pilot

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

Decentralised Finance (DeFi) series: tutorials, guides and more

Decentralised Finance (DeFi) series: tutorials, guides and more