Welcome to the most comprehensive and up-to-date Crypto Airdrops Tier List for 2023! As the world of cryptocurrencies continues to evolve at a rapid pace, airdrops have become a go-to strategy for both new and established projects to gain traction and reward their communities. In this insightful guide, we’ve meticulously ranked the top airdrops of the year based on their potential rewards, project credibility, and overall excitement. Get ready to uncover hidden gems, maximize your earnings, and be a part of the most lucrative crypto airdrops of 2023!

Crypto Airdrops Tier List 2023

We have compiled the top trending airdrops this year into a tier list based on four criteria:

- Project Credibility — Is the project backed by reputable investors or partnered with well-established, legitimate projects? Is there any public information available about the project team, and do they have prior experience in the blockchain industry?

- Security — Is it safe to connect my MetaMask or other crypto wallets to the project’s website? Has the project been audited by a third-party security firm?

- Cost — Does participating in the airdrop require any form of spending or investment, or is it entirely free?

- Effort — How much time and effort do I need to invest in completing the tasks that qualify me for the airdrop? Are these tasks simple or challenging? Does it require me to be a developer, validator, or just a regular user?

S Tier Airdrops

zkSync

- Project Credibility — zkSync is developed by Matter Labs, a well-known engineering team based in Europe. They have raised $458 million in financing across all rounds, backed by the likes of the Ethereum Foundation.

- Security — The project has been audited by several top smart contract security firms including OpenZeppelin, Halborn, and Code4rena.

- Cost — You will need to bridge ETH to the zkSync Era Mainnet via ZigZag Exchange or Orbiter Finance. Swap stablecoin pairs to minimize cost risk. You can also interact with the zkSync Era Testnet using free testnet tokens.

- Effort — The steps are easy to follow, but it’s recommended to perform them frequently and consistently to be included in the snapshot. Actions involve bridging your funds, swapping and trading tokens, or providing liquidity. The higher the aggregate value, the more $ZKS tokens you can potentially earn.

Grading Insight: zkSync is the most anticipated airdrop after Arbitrum. Over the past week, crypto users have bridged over $8 million in funds to the network in hopes of qualifying for the airdrop. Moreover, protocols on zkSync will also conduct their own retroactive airdrop, allowing you to earn additional rewards.

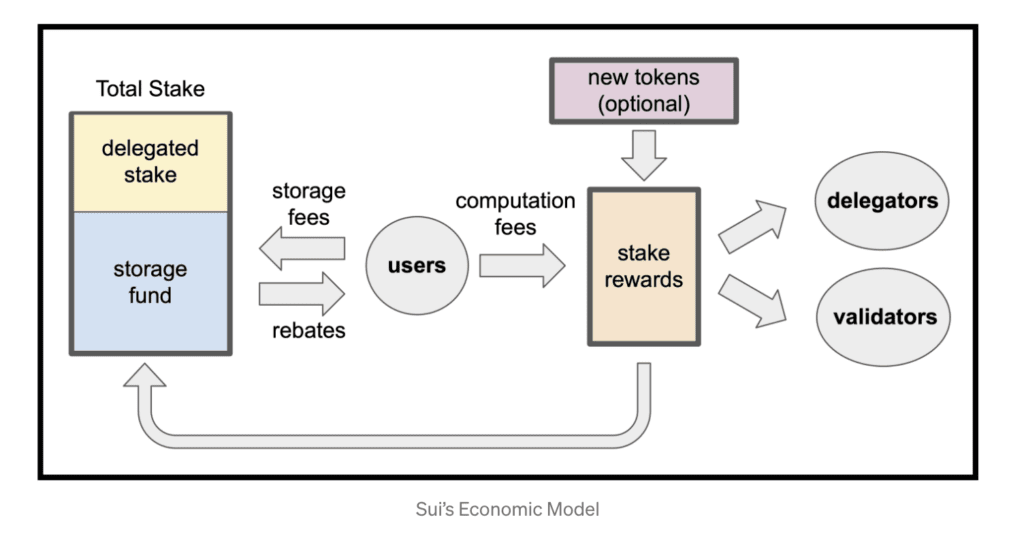

Sui

- Project Credibility — Sui is developed by Mysten Labs, comprising former Meta (formerly Facebook) executives and engineers. The company has raised $300 million, resulting in a valuation of over $2 billion, with backing from major investors like Coinbase and Binance.

- Security — Sui’s security architecture is secured by Move, a Rust-based programming language independently developed by Meta. The smart contract code for Sui is publicly available for review and auditing.

- Cost — Similar to Aptos, you can interact with protocols on Sui with free devnet tokens.

- Effort — Building protocols on Sui requires coding experience. As a regular user, you can perform simple tasks like staking devnet tokens or minting NFTs until the mainnet launch in Q2.

Grading Insight: Aptos, also an L1 built by former Meta developers, conducted one of the largest airdrops last year. It is very likely Sui will also follow suit.

A Tier Airdrops

StarkNet

- Project Credibility — StarkNet is developed by StarkWare Industries, an Israeli software company that specializes in cryptography. They have raised $100 million that puts the company’s estimated value at $8 billion. They are partners with some of the biggest names in crypto including ConsenSys and Chainlink.

- Security — StarkNet is audited by numerous leading security firms like Consensys Diligence and OpenZeppelin.

- Cost — You will need to bridge ETH to the Starknet Alpha Mainnet via StarkGate. Swap stablecoin pairs to minimize cost risk.

- Effort — Argent X wallet is required. Bridge and swap assets frequently and consistently to be included in the snapshot. The higher the aggregate value, the more tokens you can potentially earn.

Grading Insight: StarkNet is one of the highest valued L2 project in the crypto market. More than half of its total token supply will be allocated to community incentives and ecosystem funds.

Shardeum

- Project Credibility — Shardeum is co-founded by Nischal Shetty and Omar Syed. Shetty is the founder and CEO of WazirX and Syed is a blockchain architect who previously worked for NASA and Shardus. The project has raised $18.2 million, backed by Jane Street and The Spartan Group.

- Security — Shardeum ensures security through dynamic state sharding, which makes it challenging to attack due to the random assignment of nodes to shards in the network.

- Cost — You can interact with the Shardeum betanet with free testnet tokens.

- Effort — Mint NFTs or swap assets frequently on different Shardeum protocols.

Grading Insight: Shardeum is developing an innovative sharding technology, and has a very large user base. They confirmed airdropping 25.4 million $SHM tokens to ecosystem users.

Scroll

- Project Credibility — Scroll is a globally distributed team filled with experts in zero-knowledge cryptography and distributed systems on blockchain technology. Backed by Polychain Capital, the project has raised a total of $83 million in funding rounds, bringing its valuation to $1.8 billion.

- Security — Scroll is a hierarchical zero-knowledge proof system, inheriting security from the Ethereum mainnet. The smart contract code for Scroll is publicly available for review and auditing.

- Cost — Scroll is currently in its Alpha Testnet phase, which means you can use free testnet tokens to interact with the protocol.

- Effort — Bridge testnet tokens between Goerli Testnet (L1) and Scroll Alpha Testnet (L2) frequently.

Grading Insight: Scroll is another highly popular Ethereum L2 scaling solution. The team has confirmed creating an incentive mechanism to encourage participation in the network. Start using the testnet now for free!

MetaMask

- Project Credibility — MetaMask is the most used Ethereum wallet in the world.

- Security — All user wallets are secured with client-side encryption. With proper user practice, MetaMask is a reliable and secure option for managing and interacting with Ethereum-based cryptocurrencies and decentralized applications. Their recent audit was conducted in March 2023.

- Cost — You will need ERC-20 tokens. You can also buy ETH directly on MetaMask using credit cards, Apple Pay or bank transfers.

- Effort — Bridge and swap ERC-20 tokens regularly with the built-in features in MetaMask.

Grading Insight: MetaMask is one of the foundations of the Web3 world, which is why its token can be very valuable.

B Tier Airdrops

LayerZero

- Project Credibility — LayerZero Labs is founded by a team of computer scientists from the University of New Hampshire. The project has raised $135 million from the likes of Coinbase and PayPal. LayerZero has a large ecosystem of DeFi protocols including Uniswap and Stargate Finance.

- Security — LayerZero has commissioned over 35 audits with the most recent audits on Github.

- Cost — You will need real funds to interact with the protocols on LayerZero. But you can also bridge Goerli testnet USDC between EVM chains using the USDC LayerZero Bridge.

- Effort — Make small transactions, deposit funds, provide liquidity, swap assets as frequently as you can.

Grading Insight: LayerZero has a large user base, and is backed by PayPal. It has the potential to be a core infrastructure of Web3 interoperability, which is why its token can be valuable in the future.

ZetaChain

- Project Credibility — ZetaChain is built by former Coinbase and Basic Attention Token (BAT) developers. It is backed by Coinbase, Binance, Polygon, and more.

- Security — ZetaChain employs a novel omnichain approach to mitigate the risks of asset fragmentation and reduce the chances of 51% attacks. The project has been audited by PeckShield, Veridise, and QuantumBrief, and offers a bug bounty of up to $100,000.

- Cost — The incentivized testnet currently involves testnet tokens.

- Effort — Request ZETA tokens and swap assets between different chains frequently.

Grading Insight: ZetaChain is featured on CoinGecko’s list of top airdrops to look out for in 2023. Its points-based system makes it easy for users to track their contribution to the network.

Mantle Network

- Project Credibility — Mantle Network is incubated by BitDAO, one of the largest DAOs and partner of Bybit.

- Security — Its architecture adopts a modular approach to create a seperate, decetralized data availability layer in collaboration with EigenLayer. Smart contract code is regularly audited by the BitDAO community.

- Cost — The incentivized testnet currently involves testnet tokens.

- Effort — Bridge Goerli ETH to Mantle Testnet frequently. You can also complete Mantle Quests on Crew3 and Guild for a Discord role.

Grading Insight: Developed by BitDAO, Mantle is a fully community-driven project. As such, value to the project is rewarded back to loyal supporters and users.

Polyhedra Network

- Project Credibility — Polyhedra Network is built by leading engineers, developers, and researchers from UC Berkeley, Tsinghua University, and Stanford University. The project recently raised $10 million in funding, backed by Binance, Animoca Brands, and Polychain Capital.

- Security — Its infrastructure uses zero-knowledge proof (ZKP) to provide privacy extensions for Web3 with stealth address models.

- Cost — Only testnet tokens are needed to cover gas fees.

- Effort — Use Polyhedra CreatorTool to mint your own NFT and bridge them to other testnet blockchains. Repeat the process on different chains to enhance visibility of your on-chain activities.

Grading Insight: Polyhedra just recently launched its testnet, which means early users are in a good position for a potential airdrop.

C Tier Airdrops

Fuel Network

- Project Credibility — Fuel Network raised $80 million in funding, backed by Blockchain Capital and Stratos Technologies.

- Security — The system is based on a fraud- or validity-provable computation system that leverages a modular blockchain for data accessibility.

- Cost — Their Beta-2 Testnet is live. No real funds are used.

- Effort — Fuel Wallet is required. Swap and trade tokens on SwaySwap frequently. You can also interact with other ecosystem DApps.

Grading Insight: Fuel has not confirmed a token launch yet. But it is likely it needs a token to support its ecosystem and facilitate the functioning of the platform.

Celestia

- Project Credibility — Co-founder of Fuel Network, John Adler, also co-founded Celestia. The project has raised $55 million in funding, backed by Coinbase and Polychain Capital. Its total valuation is over $1 billion.

- Security — Modular architecture is similar to Fuel Network. Celestia offers shared security to blockchains deployed on it by providing consensus and data availability inherited by all utilizing chains.

- Cost — Its incentivized testnets require a node with decent internet connection. You will need to set up a development environment to run the Celestia node.

- Effort — This is more suitable for developers or validators rather than users.

Grading Insight: Limited access to general users.

D Tier Airdrops

Blur

- Project Credibility — Blur is the fastest growing NFT marketplace on Ethereum, backed by Paradigm. Many Bored Ape holders and NFT whales have moved from OpenSea to Blur.

- Security — Blur is audited by Code4rena and Dedaub. It uses multi-signature contracts for token transfers. However, Blur has a smart contract risk in its execution module, which only checks if the caller can transfer tokens. Contract owners may add addresses as callers for token transfers, so users must trust Blur before trading NFTs on it.

- Cost — You will need ETH to bid or list on Blur. The more the better.

- Effort — The difficulty for the Season 2 airdrop may increase due to heightened competition.

Grading Insight: Since Blur tends to favor NFT and ETH whales, it might not be the most suitable choice for those looking for cost-free airdrops.

Key Takeaway

It is important to note that lower tier rankings does not mean that the airdrop is not good. It is simply because they are not as accessible as the higher tiered ones to everyday users. All of these crypto airdrops are the most trending this year, offering high value to early users.