In the last months, we have witnessed the crypto space and blockchain industry go beyond the norm. With more decentralized finance (DeFi) projects than ever, it is clear that the next target should be greater adoption. However, the complexity of dealing with multiple (d)Apps interfaces in order to access a wide array of services, inevitably narrows down the number of participants. Reef Finance is built to change that.

The way Reef Finance works is by reuniting all blockchain services together in a single, unified interface. This makes the whole DeFi user experience seamless and convenient. In just a single dApp, anyone can buy crypto, perform trades, stake assets, take loans, farm, manage their portfolio and more without any fuss.

Tackling Defi’s Fragmentation

What Denko Mancheski, CEO of Reef Finance, and his team had in mind when they started working on the project, was to solve an inherent complexity. Mancheski believes that, while there have already been many useful innovations in crypto recently, mass adoption is still difficult to achieve. The reason he points out is the psychological barrier that dampens the DeFi communities’ growth. True enough, the DeFi space today seems very fragmented. There are features existing in a particular application that are unavailable in another, and there are contract functions that would complement each other, but only exist on separate platforms.

The space offers promising products, but they are too overwhelming to spur adoption, especially for beginners. This is why Reef Finance’s goal has been, according to Mancheski, to “abstract away complexities” and try to “onboard a simple non-tech savvy user.”

What is Reef Finance?

Reef Finance (“Reef”) is a non-custodial multi-chain smart yield engine and liquidity aggregator. Powered by Polkadot, it enables cross-chain integrations across various DeFi protocols.

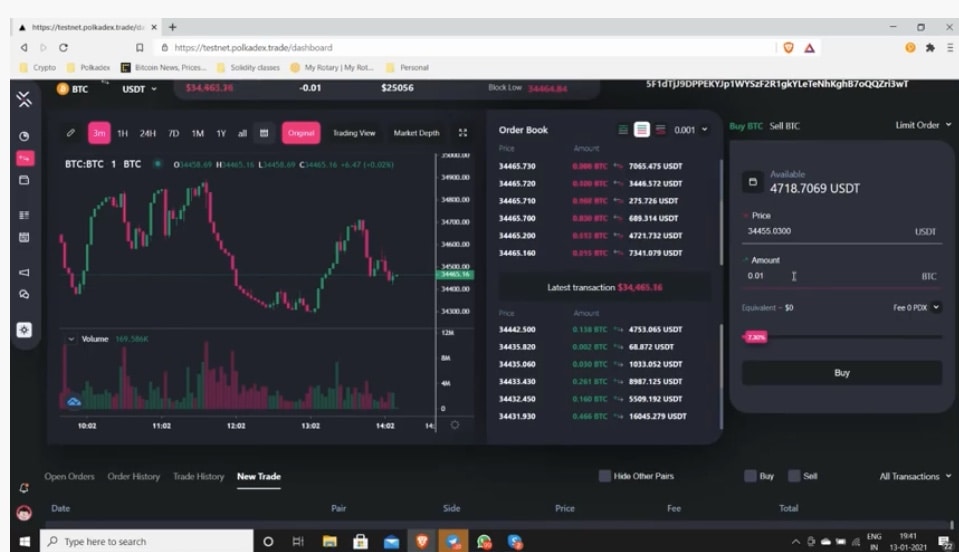

Essentially, it makes Decentralized Finance much easier to access, with the ability to diversify a portfolio in a single click. It functions as a one-stop-shop for DeFi projects that users can access without having to switch from different applications, one after another. Within its interface users can access different exchanges and, through the help of smart contracts, Reef combines the liquidity of these markets. Furthermore, trading can be easily done on the platform.

Reef Finance is the first Polkadot project ever launched on Binance Launchpool. The farming started on December the 23rd and will continue for 30 days. The platform will be beginner-friendly and will launch in Q1 2021, while the protocol has recently been audited by Halborn.

Why Polkadot?

Reef’s deployment on the Polkadot ecosystem will benefit users in terms of transaction costs and speed. As it is well known to many, the ‘traffic’ on the Ethereum’s network has often resulted in skyrocketing fees and long transaction times. This will continue at least until Ethereum 2.0 is fully deployed, which isn’t likely to happen for a while.

Polkadot, on the other hand, doesn’t suffer from the same issues. Parachains’ independence on the network prevents network congestion. It also powers Reef’s cross-chain functionality through the ‘Bridge’ protocol. By implementing this blockchain innovation, Reef can rely on products and services from different networks into a single interface.

The Reef platform is made of three major components that complement each other.

Global Liquidity Aggregator

Reef offers a simil-exchange service linked to some of the biggest trading platforms in the space. The uniqueness here is that the aggregated liquidity goes through CEXs and DEXs. In this way, users can hedge the downsides of the two types of liquidity sources, among which trading fees and high slippage.

The centralized exchange liquidity will be accessed through the use of brokerage services, such as Tagomi, Caspian or Quantreq. Conversely, decentralized liquidity will come from sources like on-chain order-books (0x) and AMMs (Uniswap, Balancer, Bancor….). Reef’s liquidity aggregation will also assist in protecting users from market manipulation and front-running attacks.

All of this will make trading on Reef not only easy and affordable, but also diverse.

Smart Yield Farming Aggregator

Reef Yield Engine enables staking in multiple asset baskets which can be automated through the help of an AI that users can configure based on their financial needs. Users can decide how much to allocate to each basket and the operating system will dynamically rebalance and adjust them, moving portions of the allocations to other more convenient assets/pools.

The purpose of the ‘Reef Intelligence Engine’ is to enable the AI to manage assets on user’s behalf. This helps automate the nitty-gritty of trading and staking for Reef’s newcomers. Planning a profitable allocation of assets according to each trader’s risk level has never been much easier in Defi. The engine is machine learning-powered, enabling its growth over time.

Since the AI is data-driven, the information it holds is fed by an off-chain oracle (they have a partnership with Chainlink also). The oracle supplies data to proxy smart contracts that serve as the AI’s backbone. It monitors every pertinent information concerning services offered on the platform, whether they are social media data, latest news, or on-chain data.

Reef also integrates with some Defi insurance protocols to provide coverages for its users.

Smart Asset Management

The third founding element of the platform is its asset management option. Users can seamlessly rebalance their allocations between their baskets through an easy UI accessible from mobile devices or computers. The AI engine will also make intelligent recommendations to help with taking decisions.

The $REEF Token

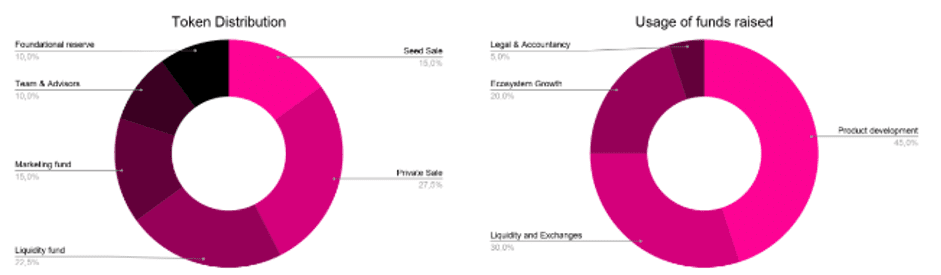

$REEF is the native, utility token of the Reef platform. It is mainly used to pay for transaction fees as well as support the protocol rewards structure.

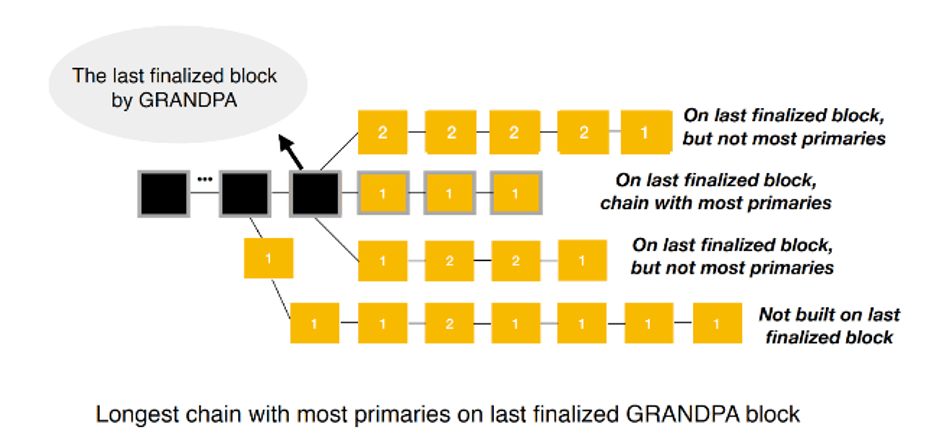

An important role for the platform is that of Network Collators. They assure that the network is healthy by keeping a copy of the full state of Parachains at a given time. They are similar to miners producing blocks, supporting the Polkadot blockchain. The Collators receive $REEF tokens as a reward for all basic operations such as processing transactions, deploying smart contracts, submitting a proposal and more.

Staking and Governance

Reef Protocol utilizes Polkadot’s Proof of Stake base consensus mechanism and it’s governed through a DAO structure. By holding and staking $REEF tokens, users can take part in important protocol decisions concerning the structure of the asset baskets, reserve limits, yield rewards, liquidity pools, and others.

Stakers have the freedom to choose how they want to receive their rewards, whether in ETH/USDC or $REEF. Opting for the native token will lead to better rates.

New Partnerships and roadmap

Even though Reef Finance launched in late September, its development has been in progress for long. The project secured over 20 partnerships in 2020 and more are coming this year. Among them, important were those with Matic, Kava, Covalent, Bluzelle and Chainlink. Reef’s integration with Binance Access Api will also allow a FIAT ramp for cryptocurrency purchases along with a decentralized trading opportunity within their platform.

In January, they secured a new partnership with OpenDefi, a platform that allows the tokenization of insured and physically backed real-world assets, held by custodians. Users can stake to receive instant loans against their assets and enjoy yield opportunities. More on the partnerships and on OpenDefi can be found here and here.

Another notable collaboration is the one with Manta Network, a cross-chain privacy devoted Defi platform and price-stable Dex. Reef users will be able to access the liquidity offered by Manta Network Dex, reinforcing the core aspect of Reef Finance: liquidity aggregation.

On January the 20th a two-week “zero gas fee” initiative started on OpenOcean, a trading platform, which has given traders the opportunity to receive a refund for all the fees spent while trading $REEF. The offer was limited to a total of 40,000 $REEF.

The official Roadmap is constantly updated and more information on future news can be found on Reef Finance’s Medium page. This project is definitely one of the most anticipated and rumored in 2021!

Conclusion

DeFi innovation has to attract a lot more people to keep creating a vibrant and supportive community. After all, it is adoption that helps sustaining all these blockchain developments in the long run. Simplifying access to multiple DeFi products and creating a unified platform is exactly what the space needs today.

Reef Finance’s target to abstract (?) DeFi looks promising. Not only do they make it easier for users to tap into other exchanges, but the platform also introduced AI technology to make it convenient for traders to manage their assets. The project may be young, but it has the tools users need to efficiently and profitably take control of their funds.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.