Polkadex is a new addition to the Polkadot ecosystem. Polkadex a decentralised cryptocurrency exchange (DEX) concentrating purely on tokens powering decentralised finance (DeFi) applications through a user-friendly interface and lightning-fast transactions.

Background

Polkadex is developed by a team of highly skilled professionals led by Matthias Hafner (cryptoeconomic advisor), Vivek Prasannan (executive director), Gautham J (CEO & tech lead), and Deepansh Singh (COO). In addition, the team comprises advisors on artificial intelligence, machine learning, and banking.

The project has struck key partnerships with notable firms such as CMS, Cluster, Blocksync Ventures, Existential Capital, Web3 Foundation, among others.

What is Polkadex?

Polkadex is a non-custodial decentralized platform powering the P2P exchange of tokens used in the DeFi ecosystem. The platform looks forward to building a financial-inclusive future through bridges that connect traditional and decentralized finance spaces.

The project leverages the power of the Polkadot platform.

The decentralized exchange is designed to solve liquidity issues plaguing many platforms in the market today. The root of the problem is the use of an orderbook on a decentralized protocol.

The introduction of automated market-maker (AMM) as the solution led to the birth of Uniswap and other DeFi protocols. Unfortunately, the approach had its own limitations.

For example, it can only be beneficial when there’s a price difference on exchanges using an orderbook. However, even though AMMs rely on orderbook-based platforms, these platforms don’t need AMMs for them to run.

To bridge the disconnect, Polkadex brought AMMs and the orderbook together. The project is unique because it uses on-chain bots for market making.

Key Components of Polkadex

To bring its vision into focus, the project is built on FIVE core components. They include:

Fluid Switch Protocol

The switch changes between the platform’s orderbook and automated market-making AMM. The shift ensures that the decentralized exchange (DEX) has seamlessly-flowing liquidity for traders and liquidity providers.

By utilizing professionally-designed AMM algorithms, Polkadex provides a fully-supported orderbook, which in turn eradicates impermanent loss and price slippage, which are the biggest ills in the DeFi sector.

Trading Bots

Polkadex powers high-frequency trading using trading bots. Notably, these bots handle both institutional and retail customers. They use a carefully manicured architecture that optimizes cancellation fees by managing traders’ entry and exit points depending on the situations in the market. (radiomusical.com)

The bots are also used to perform on-chain market making. This approach fuses AMMs with an orderbook. How does this work?

When the bots don’t find a match during a trade, they automatically place the trade in an orderbook adding liquidity to the network.

When a trade doesn’t find a match in the orderbook, the bots are tasked with finding a suitable pair. Note that trades on Polkadex are only completed using the best price.

Ethereum Bridge

With most DeFi networks running on the Ethereum blockchain, Polkadex employs a trustless Ethereum bridge to facilitate the movement of any token to the decentralized exchange. Consequently, it makes it possible to interact with other liquidity providers in a trustless way that allows users to maintain control of their virtual wealth.

High Performance

Currently, Polkadex is operating in a testnet capable of reaching a speed of 300 transactions per second (tps). Although this speed is enough in the current landscape, the project targets a throughput of 20,000 tps.

Polkadot Parachain

The exchange incorporates the Polkadot Parachain as an additional way to drive liquidity into the DEX. However, the parachain is only used to bring tokens from the Polkadot ecosystem to the Polkadex world.

During the movement, the security of the tokens is provided through an interoperability layer provided by Polkadot. In addition, the layer assumes a non-custodial approach letting token holders have full control of their digital wealth, effectively eliminating centralized service providers.

Types of Trades Supported by Polkadex

The exchange supports market and limit orders. Limit orders enjoy zero trading fees while market orders incur a 0.2 percent trading fee.

The main reason for the difference in trading fees is that limit orders add liquidity to the platform while market orders remove liquidity. Liquidity providers share the trading fee charged on market takers on a 50-50 ratio with the Polkadex team.

Since bot-based transactions aren’t viable on a decentralized exchange using smart contracts, Polkadex moves above this hurdle by removing network fees.

However, this presents another problem where malicious actors can attack the application through a DDoS (Distributed Denial of Service) attack. To guard against such incidents, Polkadex lets the blockchain anticipate such attacks and impose a network charge for specific trades.

The exchange uses several methods to determine a potential DDoS threat. For instance, if a trade has an invalid price, trading pair, order type, or insufficient balance, then it’s categorized as a likely DDoS attack.

Two Critical Polkadex Partnerships

Polkadex X KILT Protocol X Fractal

Polkadex joined hands with KILT Protocol and Fractal to bring decentralized know-your-customer (KYC) functionalities to the DEX. The partnership saw Fractal, an identification firm, and Polkadex leverage KILT’s infrastructure to manage KYC procedures needed by the exchange.

The move eases the onboarding process for the DEX’s users. Note that KILT stores customer information. Thus, with the collaboration, new exchange users are directed to the KILT platform, where they set-up a wallet that stores their data in a decentralized way.

Polkadex X Cryptecon.org

This partnership involved including Cryptecon’s Matthias Hafner into the DEX’s advisory board. Hafner’s experience in developing economic models helps the exchange effectively merge its orderbook with multiple AMMs.

Current status of Polkadex

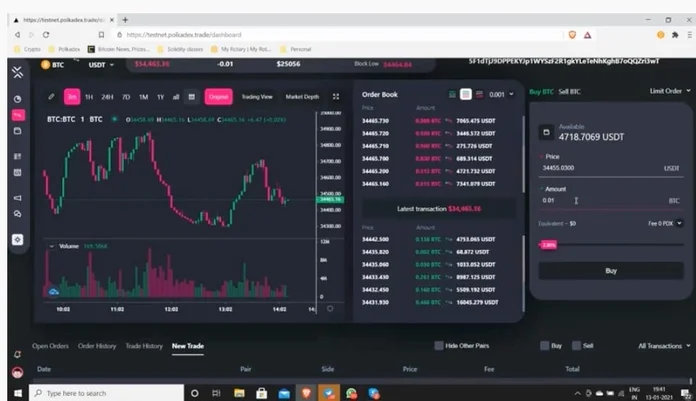

Polkadex is currently in the testnet phase and has recently released version 2.0. New features in this release include:

- ability for the public to use testnet tokens to submit trades; and

- ability to watch live trades being executed by the Polkadex engine.

To participate in the testnet, you will need to download the Polka Chrome extension and create an account. Then you can ask for testnet tokens in their official telegram group.

Roadmap: What’s next for Polkadex?

The next exciting phase for Polkadex of course would be its mainnet launch. It appears that they intend to be on track for mainnet launch in Q1-Q2 2021.

As for Polkadex’s token sale, they have indicated on their Telegram group that the community round will take place in March 2021.

Conclusion

Polkadex takes a superior approach in fusing AMMs with the orderbook through the inclusion of on-chain market-making bots. Notably, the provision of a user-friendly design, a high throughput, and a non-custodial approach add to the exchange’s uniqueness among other DEXs in the market.

Additionally, its partnership with KILT and Fractal eases the onboarding process while the Cryptecon collaboration enhances its Fluid Switch component.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.