The gaming industry has always been successful as participants yearn for escape into virtual reality. Add blockchain technology, non-fungible tokens (NFTs), and decentralised finance (DeFi), and voila! An explosive market model dubbed as play-to-earn (P2E) games.

Blockchain for gaming has long been thought of as the perfect combination. After all, blockchain solves many traditional problems of the gaming industry, in particular, transparency between developers and gamers, as well as ownership within the game’s economy.

Millions of gamers are adopting DeFi-based NFT games and spending several hours every day playing them, causing their popularity to shoot through the roof. Game developers are catching on and there is no shortage of new P2E games to play.

What is the Play-to-Earn (P2E) Model?

The play-to-earn trend is an emerging phenomenon in the gaming industry where players of NFT games get to collect lucrative rewards for playing. That’s right, you can make money while playing your favorite NFT game. How cool is that?

By becoming active participants in these games, players get to monetize their time and skill to receive rewards like in-game NFT assets and tokens which can be traded or sold if the gamer so chooses. The most interesting part of this model is that these in-game assets and tokens are not just limited to the game, they can be exchanged for real money and spent in the real world.

In normal video games, players are not given complete ownership of assets bought in-app, so they can not be traded for a higher value. The price of the NFT assets that blockchain gamers are rewarded can increase with market demand, giving players the option to sell their tokens at a much higher value.

Some examples of how gamers can make money in P2E games:

- Sell in-game NFT assets such as weapons, potions, avatars, cards, etc on the appropriate platform or open marketplace for real cash.

- Earn prizes by completing quests and daily or weekly challenges.

- Earn rewards by defeating their opponents in player-versus-player (PvP) matchups.

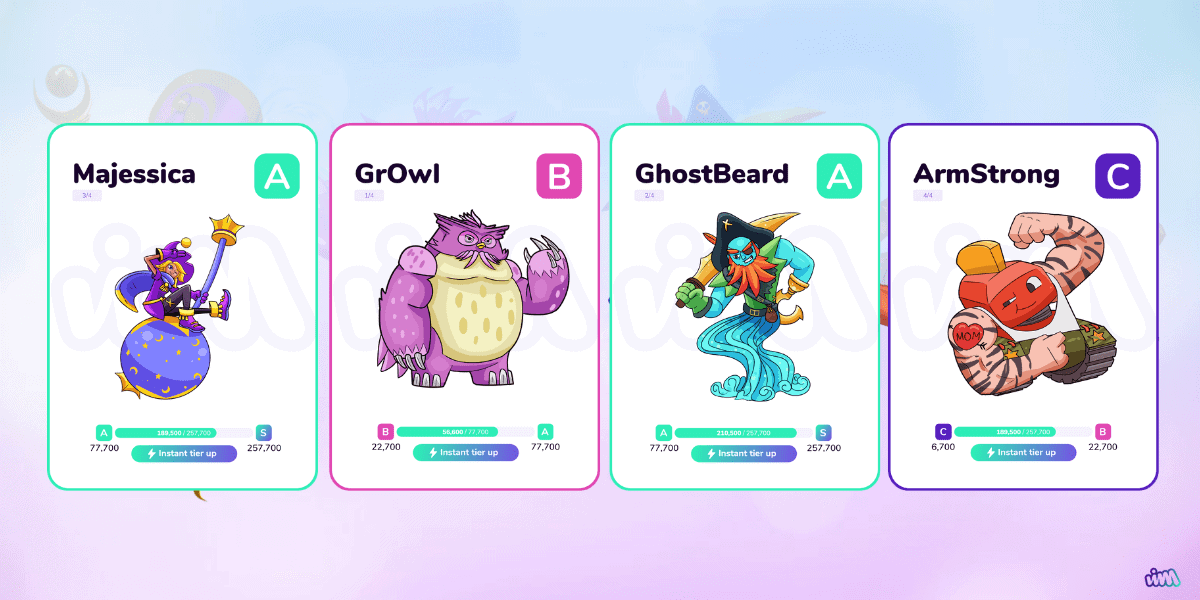

- Upgrade in-game characters to possess more unique features and subsequently sell them at a higher price in the marketplace.

- In-game staking for crypto rewards

The Top 5 Play-to-Earn NFT Games

Below is our list of the top 5 play-to-earn games. Each of the games listed use different mechanics to earn, while some will require an initial investment, and some are still in early development stages.

Axie Infinity

Launched in 2018, Axie Infinity has experienced massive growth and is currently on the list of top-ranked blockchain-based games judging by its daily, weekly, and monthly active users.

The game is a Pokemon-inspired metaverse where players battle, collect and raise their Axies in a land-based universe, Lunacia. No two Axies are the same as each is very unique, with varying strengths and weaknesses based on their genes.

The game provides more than 500 Axie body parts, allowing players to have a limitless number of body part combinations to use. The categories of Axies include the Beast, Plant, Bug, Reptile, Aquatic, and Bird, and their characters can be common, rare, ultra-rare, or legendary.

There are two game modes in Axie Infinity: battle mode and adventure mode.

- Battle Mode – This game mode entails a real-time battle between two players on the platform and their Axies.

- Adventure Mode – This game mode consists of players traveling around the map and completing tasks to defeat rogue monsters (Chimera) they encounter in their journey.

To participate in the game, players are expected to have at least three Axies, which requires an initial investment. However, they can quickly make back their investment depending on how active they are on the platform.

Gamers earn money in the Axie Infinity game by completing activities in the Axie universe and getting rewarded with Smooth Love Portion (SLP), the platform’s native ERC-20 utility token.

Players use SLP to breed more Axies. However, this token is in high demand so they can sell it to other players and make a profit. SLP can be traded on a decentralized exchange (DEX) or centralized exchange like Binance.

Another way for players to generate income is by competing in player-vs-player (PvP) battles to win leaderboard prizes, breeding their Axies, selling them on the provided marketplace, and collecting and speculating on rare Axies.

The game also allows players to earn or buy Axie Infinity Shards (AXS), another native ERC-20 token while playing. The AXS tokens serve as governance tokens and give players the right to vote for key decisions. The team are currently considering increasing AXS rewards for their Leaderboard winners with a view to, in future, directly distribute AXS as a battle reward.

Axie Infinity has generated more than 15,000 ETH in revenue since it was launched. Its popularity exploded so much that many individuals in the Philippines quit their day jobs to focus fully on playing the game and earning rewards.

The team is continuing to develop the Axie Infinity gameplay and will soon launch a new generation of battle experiences (Origins) and a land-based gaming experience known as “Project K”.

Gods Unchained

Gods Unchained is a tactical free-to-play card game that seeks to integrate certain elements of non-fungible tokens (NFTs) into traditional card gaming. The platform gives players true ownership of their in-game assets. Gods Unchained is a very competitive game that requires players to strategically outwit their opponents and win cards.

Players can accumulate the cards either by purchasing them from other players or winning player-versus-player (PvP) battles where the winner is often determined by the quality of cards and the gaming skill of players. The game operates in a rank setting which ensures that players in the same ranks are paired together in PVP matches.

To win a match, players will have to ensure that their gameplay causes their opponent’s life to drop to zero before theirs. Every time a player wins, they receive experience points that move them to the next level and a pack of cards to add to their collection.

Each card is an NFT based on the Ethereum blockchain, precisely an ERC-721 token, which allows players to have full ownership of their in-game assets the same way they own cryptocurrency.

Players can choose to trade their cards on the platform’s native marketplace or the open market. Those who choose to sell their cards within the gaming ecosystem will be paid using the platform’s native token, $GODS. The $GODS token has not been officially launched but is expected to go live very soon.

MetaWars

MetaWars is a science fiction multiplayer strategy and roleplaying game with a vast metaverse set in space. Players can monetize and earn from the game’s war economy while participating in a highly immersive space exploration through the MetaWars galaxy.

The game offers infinite universes where players can choose their own path using a wide collection of NFTs, and even cooperate with other players in missions to impact major events across the metaverse.

The gameplay also allows players to widen their army with unique ships, classes, and various optimization options. Players can combine modules, weapons, devices and equip perks, helping their characters level up their strength, rank up and receive attractive rewards.

There are 3 parts to the game: Exploration, Fleet Formation, and Combat.

- Exploration – Players embark on a journey of discovery, traversing the vast MetaWars galaxy that is constantly evolving and shifting from the collective actions of every player. Players will unveil mysteries and defend valuables against enemies.

- Fleet Formation – Players have the option to customize their fleet of ships and robots in order to build a perfect fleet. To succeed in this segment, players would have to strategically combine modules, weapons, and devices to fit their strategy.

- Combat – Planet is a player-versus-player (PvP) mode of gameplay that awards $WARS tokens as a reward to the winners. Missions are player-versus-environment (PvE) games which are necessary to upgrade strength, rank and reward rations.

$WARS token is the in-game and governance token within MetaWars. There will also be a secondary token called $GAM. Further details will be released during the game’s next phase of development.

Read more in our article MetaWars ($WARS, $GAM): NFT Gaming in Space.

The Three Kingdoms

The Three Kingdoms is a strategic third-generation NFT game that is based on the historical characters of the Three Kingdoms period in ancient China. The game features high-end graphics, the ability to collect NFT characters, complete quests, and join siege gameplays to earn NFTs.

The gaming experience is enriched with extensive history, well-developed characters, progression gameplay and more. In the game, users will be able to build their base, expand their territories, upgrade their character’s attributes, win battles and emerge victorious in PvE (player versus environment) and PvP (player versus player) battles.

Similar to popular gacha games with their randomized loot boxes, The Three Kingdoms utilises NFTs to bring added excitement to the gameplay experience.

- Raffles – A raffle will be held every so often that will enable players to draw a character card at random, for a price. Players will be able to draw as many cards as they wish.

- Characters – Characters will be randomly assigned six attributes: attack power, defence power, energy, luck, leadership, and intellect. The combination of these attributes determines whether a card is normal, rare, super rare or legendary.

- Quests – Another method to recruit NFTs is where players send out one of their characters to recruit other heroes. Each found hero is another NFT of varying quality, which could help strengthen their forces.

- Farming – Special NFTs can also be farmed by staking $TTK, the game’s native currency.

$TTK is the game’s native token, used to purchase new characters in the NFT marketplace, upgrade armies, and invest in land. It can also be staked to farm more valuable NFTs.

The secondary in-game token, $CHI, is inspired by the actual use of Chi in Chinese history as the energy that runs through all living things. Some future uses of $CHI include the ability to besiege cities, battle other players and even fuse new heroes.

Learn more about The Three Kingdoms in our article The Three Kingdoms: The New Era of GameFi.

CryptoKitties

CryptoKitties is one of the earliest blockchain games in existence. Launched in 2017 by Dapper Labs, the game allows players to collect and breed virtual kittens.

Every Kitty is unique, possessing characters that distinguish it from other Kitties living on the Ethereum blockchain. Players can obtain a CryptoKitty by buying one in the provided marketplace or by breeding two Kitties together. Breeding the Kitties enables players to unlock rare attributes that are not present in either of them.

CryptoKitty players earn rewards by creating a collection of Kitties. Once they have a collection, they can either decide to take them to KittyVerse where they participate in catfights and win prizes or sell them on the platform’s marketplace or on leading NFT marketplaces.

This game was so popular that it caused the unforgettable congestion of the Ethereum network. It is currently among the top play-to-earn games in the market.

Conclusion: The Future of P2E

Play-to-earn NFT games have created an avenue for gamers to be rewarded for doing what they love. While some see it as a thing to do in their leisure and earn some cash, several others view it as a day job and can earn up to $300 every day.

P2E games are set to completely revolutionize the gaming industry as we know it. It has integrated the concept of an open economy which ensures that all participants of the game are financially rewarded. While NFTs have already taken a dominant position in the collectibles trading scene, their presence in these games and the P2E model is set to take the market even further.

As with some trends in the crypto space, P2E games might outlive the hype and become one of the leading aspects of the entire crypto industry. As it stands, many gamers worldwide are simply ecstatic to earn as they play.