Scaleswap is a fully decentralized IDO (Initial DEX Offering) launchpad that aims to make fundraising and scale trading easier.

Harnessing the power of an advanced layer 2 blockchain scaling protocol, Scaleswap already boasts investments from several top tier venture capitalist firms such as Spark Digital Capital and Magnus Capital. The new platform is described as the most advanced way to invest with new and unique features, making investing in pools easier and more transparent.

What is an Initial DEX Offering (IDO)?

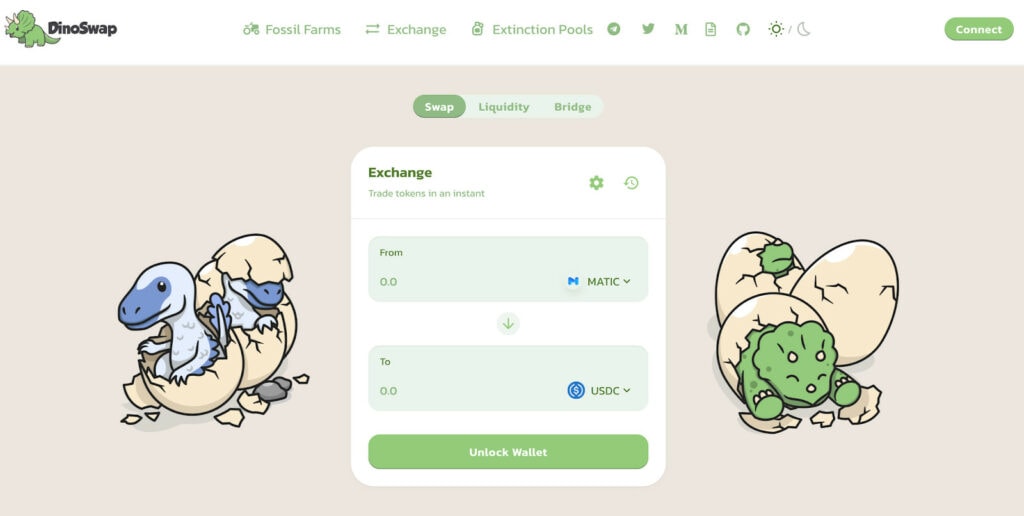

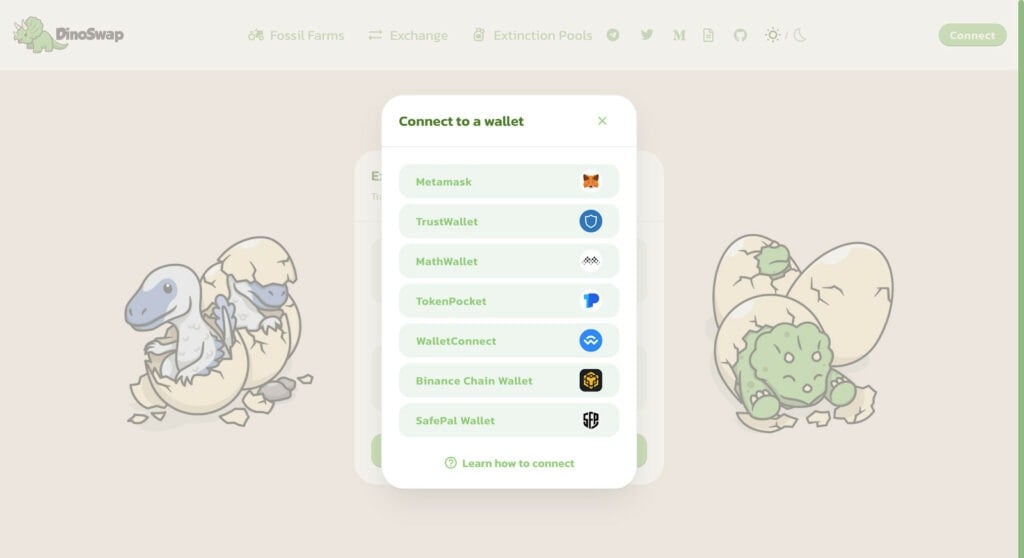

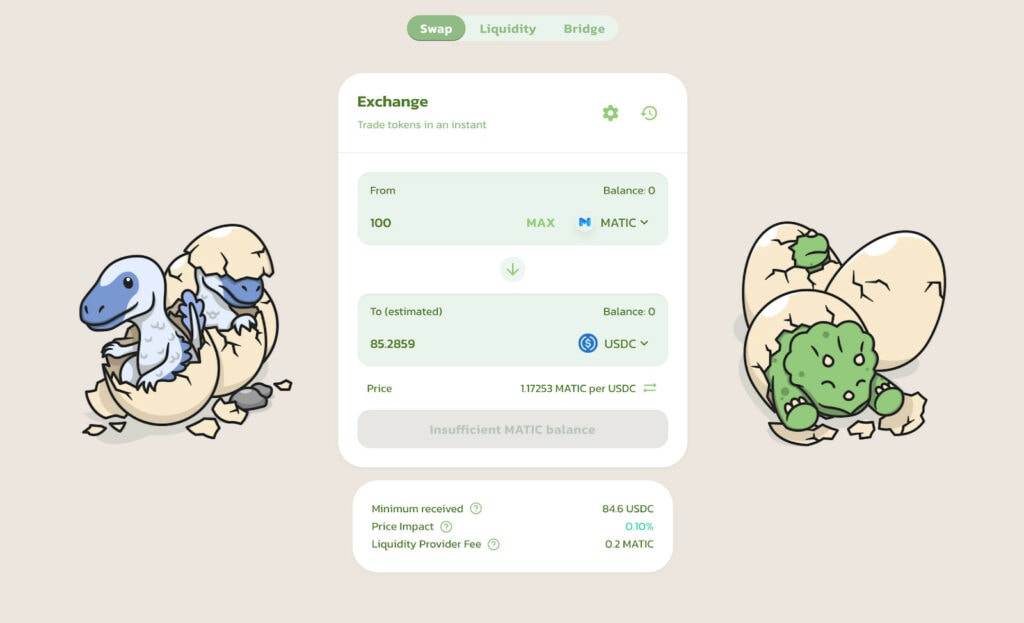

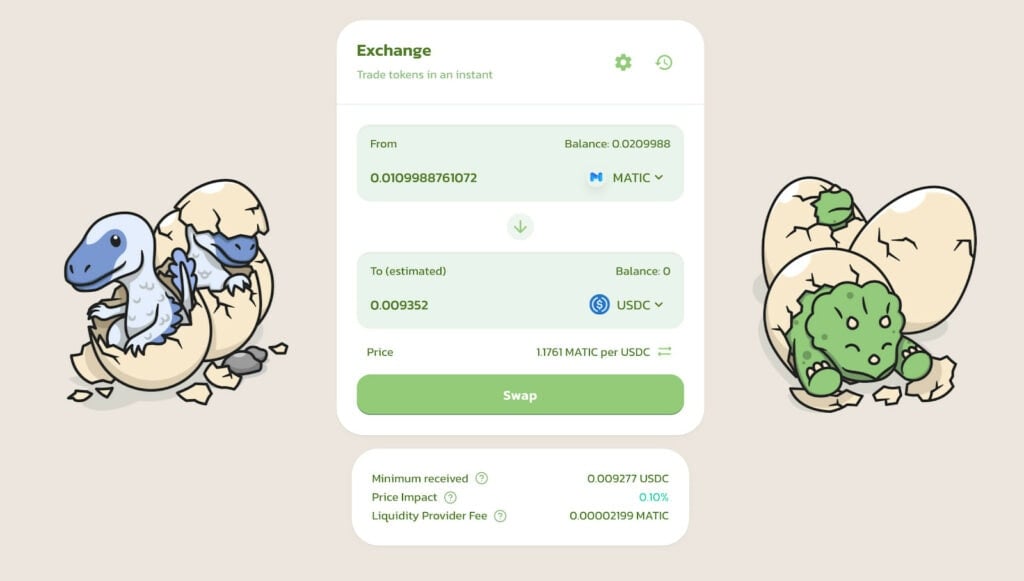

An Initial DEX Offering (IDO) is a type of decentralized and permissionless crowdfunding platform, which is opening up a new way of fundraising in the crypto space. If a project is launching an IDO, it means the project is launching a coin or token via a decentralized liquidity exchange or IDO platform. Traders can swap between different crypto assets and stablecoins based on market conditions. IDO platforms enable companies to launch a token and access immediate liquidity.

Fundraising is a vital part of early project development – teams need to pay their workers and afford partnerships or new technologies. In the real world, this is done through public stock offerings that invite investors to buy shares of a company. That money goes toward employees who develop the business and increase share values.

This fundraising method has carried over into crypto, with tokens taking the place of stocks. Each project offers a set amount of tokens, broken up into different avenues like team payments, public use, and more.

Scaleswap’s IDO Launchpad

Scaleswap is a community-driven IDO launchpad focused on transparency with a long-term vision to transform the current IDO approach to a more sustainable, less market-dependent system that honors loyalty. It deploys an Ethereum layer 2 scaling protocol powered by Polygon that allows users to enjoy low fees and convenience.

What makes Scaleswap different from other launchpads?

- ScaleSCORE

One of Scaleswap’s major differentiators is that they shift from pure lotteries and valuing only the amount of tokens that are held to a multi-dimensional loyalty scoring system where users can earn guaranteed participation in pools over time. In contrast to their competitors, holding $SCA tokens is only one of six dimensions that are used to measure loyalty and participation. And not all criteria are $SCA token related. The system was designed to ensure that the most committed supporters of their mission are always rewarded (rather than simply favoring those with the biggest budgets).

ScaleSCORE will be the core element of the platform and the deciding factor for unlocking all of the wonderful benefits in the Scaleswap ecosystem — private pool participation, advanced platform features (ie. autopilot participation feature), determining voting power in their DAO, being considered in weighted airdrops from partners, and more.

- Transparency

The team knew that most IDO launchpads are not known for its fairness and transparency. As such, Scaleswap aims to change that in a major way by setting new standards in fairness, transparency and a fully community-governed launchpad (in a DAO that is legally backed by a foundation).

- Advanced Technology & Seamless UX

The Scaleswap platform makes use of the most advanced technical solutions, while simultaneously providing a state-of-the-art user experience that eliminates many of the common barriers to entry that DeFi users face. There will be no more getting priced out of network usage by the larger players. Scaleswap provides everyone with truly open access to an affordable, user-friendly, and fair IDO experience to support the successful launch of innovative blockchain-based projects.

- Ethereum Layer 2 Scaling

Scaleswap is powered by Polygon’s Ethereum layer 2 solution, fully customized with unique features to deliver IDO participants with lower fees, instant execution of transactions, and a drastically improved DeFi experience. Polygon, backed by Coinbase and Binance, is the leading Layer 2 Aggregator for Ethereum and is providing Scaleswap with full technical and marketing support. The team also actively researches and follows the development progress on additional cutting-edge scaling solutions and further protocols for possible future integrations.

- Security

The Scaleswap tech team is led by co-founder Stanislav Stolberg, who has an extensive background in information security, and places the strongest possible emphasis in that area. They use a security by design development approach and utilize several high-level external consultants who permanently review the code and the infrastructure.

Hacken, a premiere cybersecurity company and leader in the blockchain security sector, completed a code review and security analysis of Scaleswap’s Smart Contracts. Hacken assigned their smart contracts with the highest possible rating of “well-secured”, having uncovered zero critical issues. Their full findings can be viewed here.

You can also learn more about Hacken here.

- Cross Chain Integration

The team has positioned themselves as an Ethereum Layer 2 Platform, but they will indeed integrate vital multi-chain/ bridge opportunities in the future, thus enabling users to participate across multiple blockchain ecosystems. Scaleswap has already integrated with BSC and Fantom. Potential candidates for future integration include Solana, Avalanche, Polkadot, and CasperLabs.

- Strong Infrastructure for Deal Flow

Scaleswap has been diligent in assembling an elite backing of strategic partners to ensure a strong network (for Scaleswap as well as their launch partners), CEX listings, influencers, and most importantly, deal flow. In order to disrupt the current system and establish a more fair and sustainable approach, it was imperative to carefully select the best fitting partners who could provide the strongest networks and highest value-adds to ensure consistent deal flow of the highest quality projects.

Scaleswap’s IDO Process

Scaleswap’s IDO consists of 2 pools- a public sale pool and a private pool. The private pool is only for their loyal members who have a certain amount of scaleSCORE. To gain access in the private pool, you need to have yourself ranked within the top few hundreds of the scaleSCORE ranking. The team will investigate the blockchain to calculate and rank each of the whitelisted participants using their scaleSCORE metrics. An excel sheet for the rankings will be published a few hours before the IDO starts. The top few hundreds will have a guaranteed place in the IDO but they will need to participate in the IDO within the first 15 minutes of the sale, or the spot will be given to the next 50 rankers.

$SCA Token

$SCA is the native ERC-20 token of Scaleswap. It is a pure utility token that will enable and empower a multitude of use cases.

- Pool Participation

$SCA token holders will obtain allocation in pools based on their ScaleSCORE. Achieving a high enough score will guarantee max allocation in all preferred pools.

- Governance

$SCA token holders will build the governance organization within the ScaleDAO, which is planned to be built on the latest layer 2 DAO platform of MetisDAO. Voting power in the DAO will be weighted based on ScaleSCORE.

- Platform Fees & Token Burns

Scaleswap pool fees are required to be paid in the native $SCA token and will subsequently be burned after the utility is used up. This is an organic way of burning tokens similar to consuming a voucher and stays within the framework of a real utility token. Therefore, it is easier to avoid any additional “buy-back and burn” activities.

- Airdrops

Airdrops have always been a popular way for projects to accelerate early growth. Airdropping to $SCA token holders takes all of the guesswork out of the equation since distributions are weighted by ScaleSCORE. This ensures two things: the most loyal community members are always rewarded, and the project airdropping tokens is onboarding the most proven and strongest of supporters.

Potential for Growth

Polygon has grown massively in late 2021, with more daily active users than the Ethereum network for the first time. This would mean greater potential for $SCA as user growth would attract more protocols to launch on Matic and work with launchpads such as Scaleswap.

Scaleswap has recently entered a partnership with Nasdaq listed firm, WISeKey International Holding Ltd, to successfully launch the NFT platform, WISe.Art. The NFT platform and technology stack allows tokenization of digital and physical assets in the form of NFTs with platform governance and utility managed by WISeKey’s own TrusteCoin utility token (TEC DAO Token).

Scaleswap will also become the first market player to implement wrapped NFT technology in their new product: multi-chain wNFT pre-IDO Launchpad.

At the same time, Scaleswap is working on integrating crucial multi-chain or bridge opportunities in the future, allowing the community to engage in different blockchain ecosystems which will expand their reach beyond the Polygon ecosystem. Scaleswap is consistently working on building behind the scenes with their partnerships and technology integration, promising a lot of potential growth to come.

Conclusion

The IDO landscape is riddled with unsustainable motives, non-transparency, exploitation of community members, and pure luck-based lottery mechanisms. Being able to participate in IDO launches is strongly budget-driven, often mirrored in tier structures — with one basic principle: The more of the native token you hold/stake, the more rights you have.

Scaleswap is the first truly fair IDO launchpad, focused on transparency and a long-term vision to transform IDOs into a more sustainable, market-independent, and community-driven launch strategy where fair treatment and remuneration of loyal community members is of the highest priority.

To follow their development and news, check out Scaleswap’s official channels:

Website – https://scaleswap.io/

Twitter – https://twitter.com/scaleswapio

Telegram – https://t.me/scaleswap

Medium – https://scaleswap.medium.com/

Sources:

https://scaleswap.io/launch-ido.html

https://coinmarketcap.com/alexandria/article/what-is-an-initial-dex-offering-ido-and-why-do-we-need-them

https://egorithms.com/scaleswap-what-is-it-what-are-sca-tokens/#What_is_Scale_Trading

https://chaindebrief.com/scaleswap-next-generation-ido-launchpad-layer-2/

https://morioh.com/p/42fc05c8c6c9