Collateral Pay is a decentralized payment system that merges decentralised finance (DeFi) with Traditional Finance (TradFi), enabling users to store, stake, loan, save, and pay with crypto.

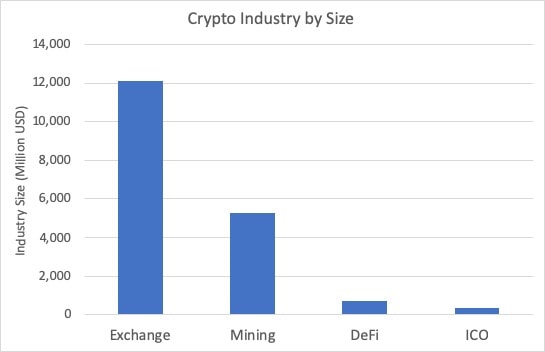

Since its inception, DeFi has aimed to give participants a better alternative to traditional financing. Reliance on centralized parties is being replaced with decentralized and transparent systems. This is achieved by building digital services in an open, secure, and permissionless manner.

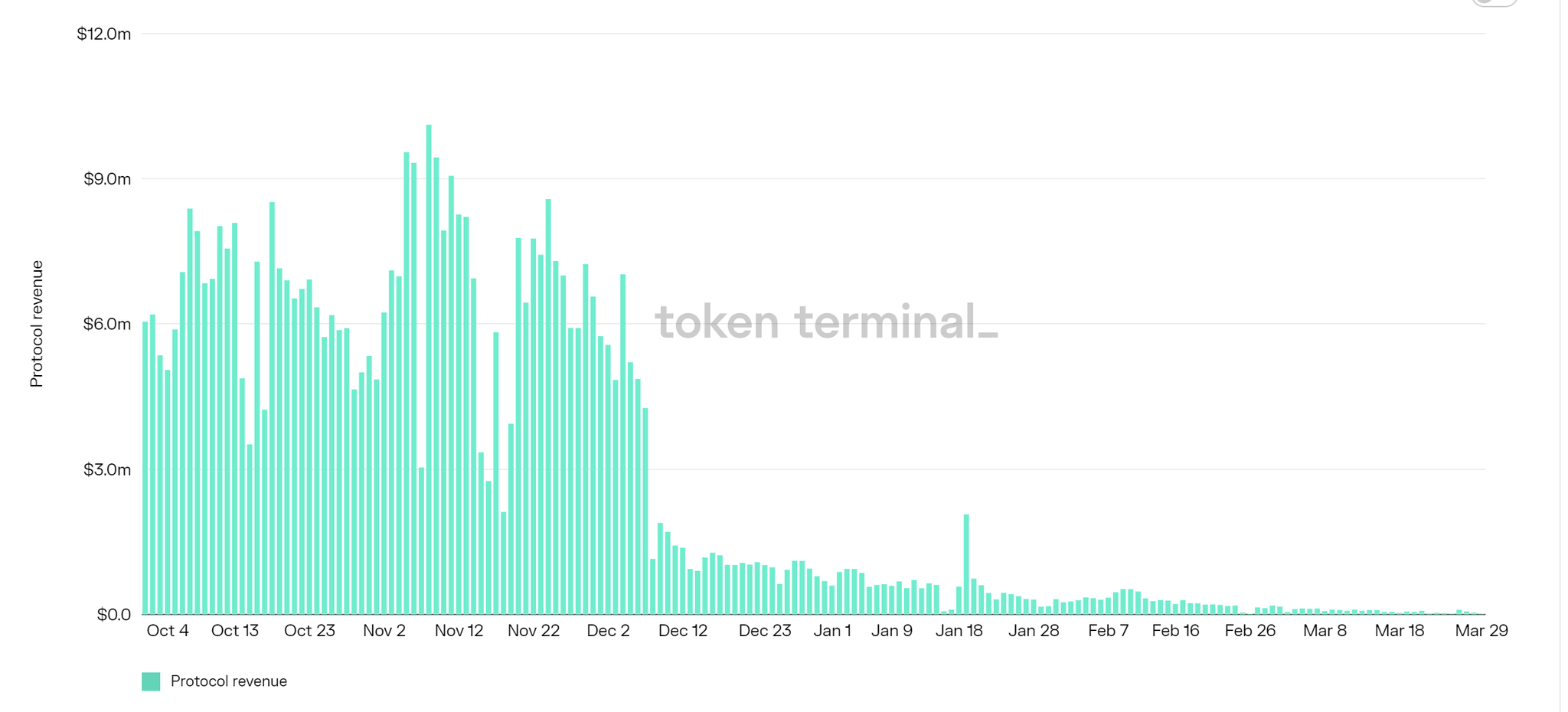

Additionally, the rise of DeFi has been nothing less than tremendous. DeFi has grown exponentially and has open the world to new financial opportunities. A year ago, the monetary value locked in DeFi projects was $276 million. As of today, it is a whopping $43.6 billion in value.

However, unlike fiat, it is a bit difficult to make use of crypto assets outside of their respective blockchains, as there is an absence of “gateways to the real world”. Collateral Pay is that gateway that facilitates this process by bridging DeFi and mainstream finance.

Background

Set to launch its marketplace this May 2021, Collateral Pay is an ambitious project supported by more than 12 well-known firms within the blockchain space. The team behind the project is composed of longtime veterans in marketing, blockchain technology, and finance. CEO and founder Chris Longden guarantees that the protocol offers users a much more tax-efficient opportunity.Collateral Pay is described as an ecosystem that works faster and better than any solutions in the market providing participants with an efficient implementation of blockchain.

What is Collateral Pay?

Collateral Pay is a Polkadot-powered decentralized payment method that merges DeFi with the traditional finance sector. The protocol enables users all around the world to store, stake, loan, save and pay. The crypto solution is a payment gateway accessed through an interoperable crypto wallet, granting access to spending power by using crypto as collateral at the point of sale.

Furthermore, under Collateral’s unique algorithm, users are allowed to unlock and make use of their crypto assets without the need of selling them. Interestingly, crypto assets will be used as collateral against merchant payments by users for liquidity.

Overall, Collateral’s secure ecosystem is supported by a P2P network of borrowers and lenders where all transactions are conducted on-chain. Here, lenders stake crypto assets in staking contracts and receive generous APYs in return.

This thorough process is quick and easy, giving users access to instant spending power where assets are used as collateral from the very first point of sale. Precisely, Collateral Pay automatically evaluates at the point of sale the specific amount of digital currency to be bound in a smart contract. This facilitates the payment, and once locked, the fiat equivalent is instantly sent to the seller, legitimizing the transaction.

Ultimately, Collateral users will be able to leverage crypto assets autonomously, not needing loan drawdown facilities, saving time, and facilitating everyday crypto transactions. The platform is set to be a market leader through its efficient protocol that facilitates purchases in-store and online using crypto as collateral through its worldwide network of merchants. The platform aims to soon compete with prominent solutions like Worldpay, Visa, and Mastercard.

By leveraging Polkadot’s cross-chain technology, Collateral is set to also seamlessly connect with Ethereum, Bitcoin, and Binance Smart Chain by Q3 2021, with the possibility of additional blockchain compatibility over time

Decentralized Payment Gateway

The platform offers clients several special tools, allowing users to enjoy their crypto experience in total security under Collateral’s ecosystem.

Save

Collateral Save provides clients with a continuous flow of passive income by staking digital assets in smart contracts that are lent to borrowers, where up to 60% of APY rewards are earned. Overcollateralized crypto assets are used to ensure the security of all staking contracts. Furthermore, powered by chainlink, the platform’s oracles monitors all collateral crypto prices to ensure the collateral-to-value (CTV) level is maintained, protecting both borrowers and lenders.

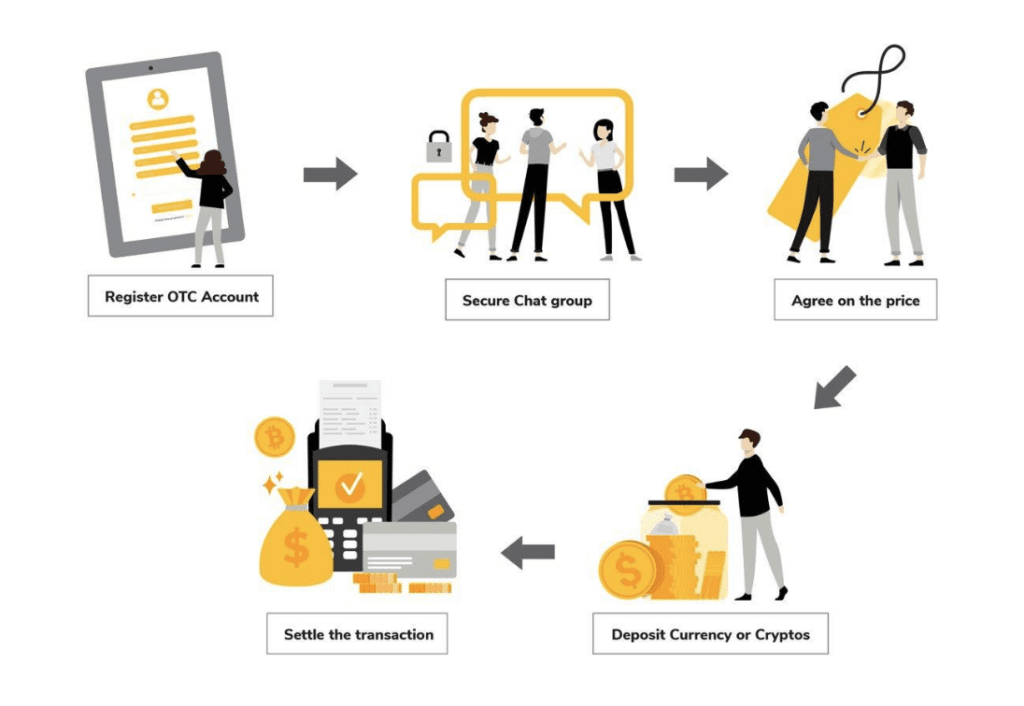

Pay

Under Collateral pay, participants can pay for services by using the platform’s application or online. Users can simply scan a QR code and lock crypto as collateral. Then, merchants will receive funds directly from Collateral in fiat. The fiat will then be repaid at any given time to unlock the digital assets again.

Loan

Through loans, Collateral pay gives users the possibility to finance larger purchases, where sellers or merchants are not involved in the transaction. In general, these larger purchases tend to have the lowest CTV on the market. Hence, users simply have to select the amount they seek to borrow, then lock up the required cryptocurrency to receive funds in a native currency of their choice.

Merchant

The Polkadot-based protocol will provide merchants with a brand new market of crypto holders who once were unwilling to take the risk of losing potential upside. The platform will allow merchants to sell goods and services, and receive native currency payments safely within the Collateral pay ecosystem.

Govern

The blockchain platform will almost be entirely run by token holders who will have an active role in the protocol’s governance system and decision-making processes.

Collateral Pay Tokens ($COLL) and ($COLLG)

COLL is the utility token for the Collateral protocol while COLLG is the platform’s governance token. Both tokens work hand in hand, as users can earn COLLG tokens by staking COLL tokens. This will allow them to participate in the platform’s governance and influence Collateral Pay’s future.

Additionally, staking COLL also allows users to receive more COLL as token rewards from the product fees generated on the platform while liquid provider tokens can be staked to provide liquidity to the ecosystem and earn additional COLL.

There is currently 2,800,000 COLL circulating in the market, with a total supply of 50,000,000 and an initial market cap of USD$1,120,000.

Conclusion

Collateral Pay is a unique payment method, that relies on the efficiency of the Polkadot ecosystem to successfully bridge DeFi and the traditional financing sector. Through this decentralized algorithm, users are sure to gain upon every crypto transaction, offering potentially 100% satisfaction to all customers.

Upon its imminent expansion, Collateral Pay is sure to disrupt the DeFi space and further blockchain adoption worldwide. The platform’s key features ensure a smooth and secure blockchain experience for all participants.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.