The cryptocurrency industry has enjoyed rapid growth and adoption thanks to its accessibility and open-source nature. Different people from all over the world can participate freely in crypto projects, with the option of anonymity. And thanks to this ease of access, the total locked value (TVL) in DeFi grew to over $3 Billion in 2020 and $44 billion in 2021, according to DeFi Pulse.

However, as an industry based majorly on the internet with trillions of liquid digital assets, it is no surprise that it makes the perfect attraction for hackers hoping to run off with a score.

Luckily, in the decentralized finance (DeFi) corner, liquidity providers (LPs) can still protect their investment through insurance protocols, each of which is armed with their unique solutions – one of the more promising ones is InsurAce.

Background

InsurAce was created by Oliver Xie, a cryptocurrency enthusiast and computer programmer. The decentralized insurance protocol was developed during the peak of DeFi growth in the third quarter of 2020, launching officially in October of the same year.

The protocol is headquartered in Singapore, led by Oliver’s vision and steadfastness. After just two months of existence, the protocol was able to raise $1 Million in seed funding, from renowned institutions such as DeFiance Capital, Signum Capital, and Parafi Capital. Later, in February 2021, and an additional $3 Million was raised during its strategic round.

They currently run a tight team, with a few experts and professionals at the helm of affairs, most of which are based in Singapore.

What is InsurAce?

InsurAce is an insurance protocol that offers DeFi assets a reliable, decentralized, and flexible coverage. Users are also able to enjoy low premiums and a sustainable investment return.

InsurAce’s flexibility is its major highlight as it gives users the ability to cover their assets with a portfolio-based product design that optimizes cover cost. Users would also benefit from their cross-chain coverage and wallet accessibility, along with the protection of their assets and investments.

How Does InsurAce Protocol Work?

As both a DeFi and Insurance protocol, InsurAce runs two different arms that work synergistically to benefit all parties involved. As a decentralized platform, each role is filled by its users, each of which are rewarded with the INSUR token.

The protocol also offers a more streamlined experience with its permissionless feature, where users can enjoy full anonymity without the KYC process that complicates other DeFi Insurance platforms.

The Two Arms of InsurAce Protocol

The first part of the investment arm involves contribution by a first-party known as the investor. As the name suggests, investors finance portfolios, each portfolio with its own risk/reward ratio which investors can choose from.

The next party is the insurer, and these are participants that stake assets in the mutual insurance pool created by investors. The more direct class of users are the “insured” – they are the insurance customers, and they get the benefit of buying insurance covers, either in single or multiple pools.

Features

The InsurAce protocol will be responsible for providing a supporting architecture for the smooth operation and integration of the arms. To start with, the protocol will function to ensure adequate evaluation of risk to manage losses.

Two risk assessment procedures exist. One with experts analyzing potential assets and pools with thorough auditing and code analysis. After which, a community assessment is carried out by volunteer members for further analysis and to come up with a risk score.

It will also be in charge of claim requests, for insurers to check out their buys.

More important, however, is the availability of liquidity for all users. To ascertain this, InsurAce plans to develop an enriched product line that is capable of covering a diverse number of DeFi protocols. By providing insurance services to multiple DeFi projects the platform retains its flexibility, remains open to opportunities while keeping tokens moving.

The insurers would enjoy access to a wide range of asset pools in addition to considerably reduced cover costs and zero premium protection.

SCR Mining and Governance

When users bring in capital to stake into different mutual pools, they are rewarded with INSUR tokens as incentives. This process is known as Mining, and it offers rewards based on the magnitude of user contribution to the platform.

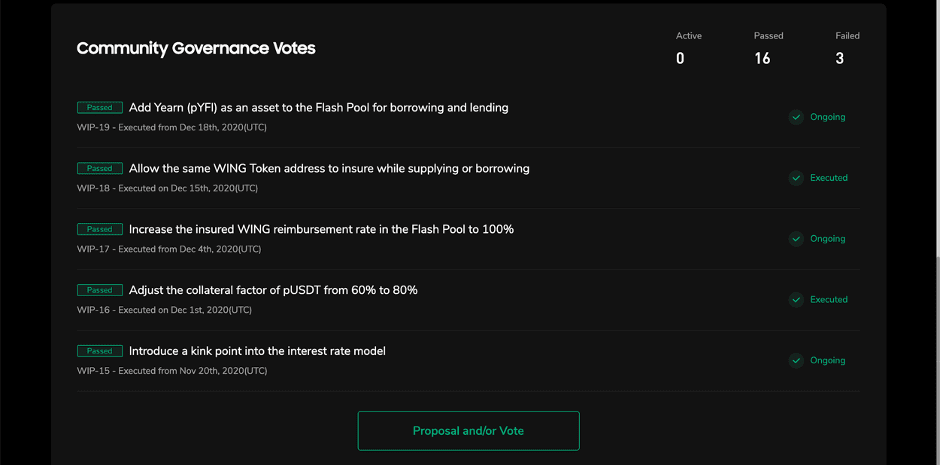

As with most other DeFi projects, a Decentralized Autonomous Organization (DAO) would be responsible for managing and regulating the activities of InsurAce protocol. To be eligible to become a member of the DAO, users must own INSUR Tokens.

An advisory board made up of InsurAnce employees and independent experts will oversee the affairs of the DAO community, provide guidelines for its operation, and provide a contingency plan if the decentralized voting mechanism should fail.

INSUR Token

The INSUR token is the standard token on the InsurAce platform. It is based on Ethereum’s ERC20 standards and serves a variety of utility functions.

As a governance token, it confers voting rights on its holders. Users who have the INSUR token can propose changes, vote on issues and proposals, and participate in claim assessments on the protocol. When a token holder participates actively in governance, he becomes entitled to a share of the fees generated on InsurAce.

The token also incentivizes involvement in all the different roles available on the protocol. It serves as the reward for mining through capital provision, liquidity support, staking in investment pools and products.

There will be a total of 100 million INSUR tokens in supply. And it is planned to be launched through a Liquidity Bootstrapping Pool (LBP) on Balancer from March 15th to March 17th, 2021. The proposal would see a total of 6,675,000 tokens vested after the LBP ends – with about 45% of the total token distribution kept in SCR mining reserves.

Conclusion

The sheer amount of fortune going into DeFi project and associated mining mechanisms is too much to leave to the whims of hackers and project developers. The impressive progress made by pioneer insurance projects like Nexus Mutual and Augur should not be taken for granted either.

However, these insurance protocols are still scarce in numbers and hardly enough to cover the ever-growing need of the DeFi sector. Which makes it difficult not to root for a platform like InsurAce that puts everything in place, taking the best out of existing protocols and adding a fresh detail.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.