Thala Labs is a decentralized finance (DeFi) protocol that is building a yield-bearing stablecoin and a liquidity provisioning layer on Aptos. Thala is currently in testnet phase, and will eventually release its $THL token and airdrop. In this article, we provide the ultimate Thala Labs ($THL) token airdrop guide so you can be in the best position to maximize any potential airdrop.

Thala Labs ($THL) Airdrop Step-by-step Guide

Here’s how to receive a potential Thala Labs ($THL) token airdrop:

- Go to Thala and connect your wallet.

- Get testnet APT tokens.

- Create a vault

- Deposit $MOD to the stability pool

- Redeem $MOD for $APT

- Add to liquidity pools

- Submit bug reports

- Collect an exclusive Thala NFT

See below for more details

What is Thala Labs?

Thala is a decentralized finance (DeFi) protocol that operates on the Aptos blockchain. In its most recent funding round, Thala raised US$6 million in a seed round co-led by Shima Capital, White Star Capital and Parafi Capital. Thala offers two main products: Move Dollar and Thala Swap.

Move Dollar (MOD) is a decentralized, censorship-resistant stablecoin designed to facilitate transactions, interactions, and other activities within the Aptos DeFi ecosystem. It is backed by a basket of on-chain assets, including liquid-staked derivatives, liquidity pool tokens, deposit receipt tokens, and RWAs. Hence it provides users with a store of value, a medium of exchange, and a unit of account. MOD also offers users the opportunity to earn yield on their investments.

Meanwhile, Thala Swap is an automated market maker that enables users to create dynamic pool weightings. This protocol supports a variety of pools, such as weighted pools, stable pools, and liquidity bootstrapping pools. Thala Swap unlocks additional use cases for MOD tokens and provides deep, long-term liquidity. Additionally, Thala’s launchpad provides a secure and equitable way of distributing tokens for projects and market participants.

What is the Thala Labs ($THL) token?

THL is the token of Thala Labs- it is a governance token that is native to Aptos. The THL token allows holders to vote on proposals and make decisions about the future of the protocol. Through Thala Improvement Proposals (TIPs), token holders can initiate proposals, vote on issues, and suggest changes to protocol parameters. This allows holders to have a say in the direction of the protocol and transition it to a DAO model.

Will there be a Thala Labs ($THL) token airdrop?

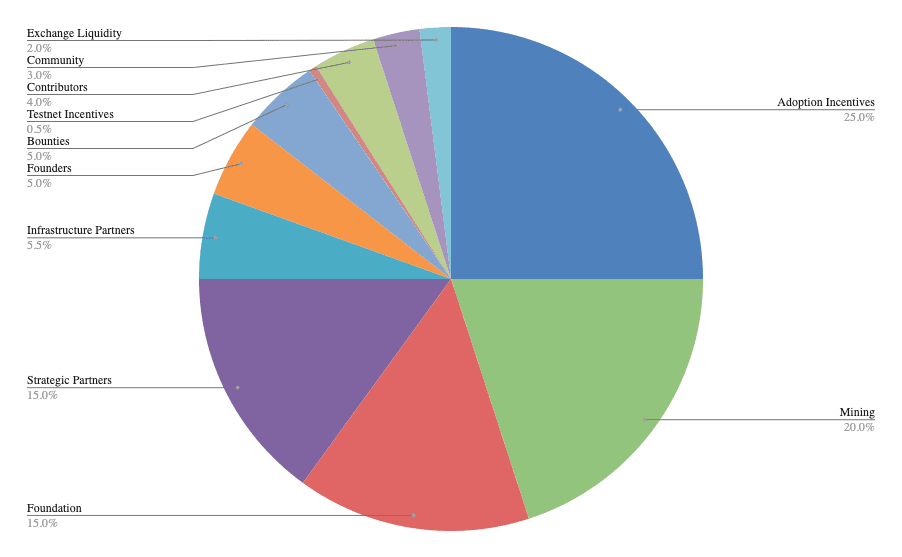

According to Thala’s Documentation, there will be a total supply of 100 million THL tokens. 35 million $THL (35%) is allocated to incentivize people to use the protocol and Thala’s other future products. It is worth noting that in their tokenomics, they specifically mention airdrops in their $THL emissions schedule and total circulating supply graphs. From these graphs, we can see that around 8.3 million $THL will be distributed via airdrops and that this will all be distributed within the first year of their Token Generation Event (TGE).

With the amount of funding that the project has raised, and the success of the Aptos airdrop in the past, it is highly likely that Thala will also do an airdrop in order to attract even more users onto their platform.

How to get a potential Thala Labs ($THL) token airdrop?

Thala Labs has recently launched Thala Swap on testnet for the general public to try out. It is hoped that using Thala Swap would make you eligible for any potential airdrop. Here’s how to get a potential Thala Labs ($THL) token airdrop:

- Go to Thala and connect your wallet.

- Get testnet APT tokens.

- Create a vault

- Deposit $MOD to the stability pool

- Redeem $MOD for $APT

- Add to liquidity pools

- Submit bug reports

- Collect an exclusive Thala NFT

Connect your wallet to Thala

Go to Thala and connect your wallet. Thala currently supports Martian, Pontem and Petra wallets. Note you will need to change to Aptos Testnet to connect to the site.

Get testnet APT tokens

Get testnet APT tokens on Thala by clicking “Faucet”, and “Collect to claim”. Then, choose your wallet and then click “approve”. You can also get APT directly from your wallet (we used Martian wallet). To do this, click “Airdrop”. Then, connect your wallet to Apotos Labs, verify the transactions on your Martian wallet, and click “Activate faucet”. You will then receive 1 APT in your wallet, but you can click “Activate faucet” multiple times to get more APT tokens.

Create a vault

Go to the “Vaults” tab and click “Create vault”. To create a vault, you will need to deposit $APT tokens and borrow $MOD. Note you will need to borrow at least 500 $MOD, meaning that you must deposit at least 70 $APT.

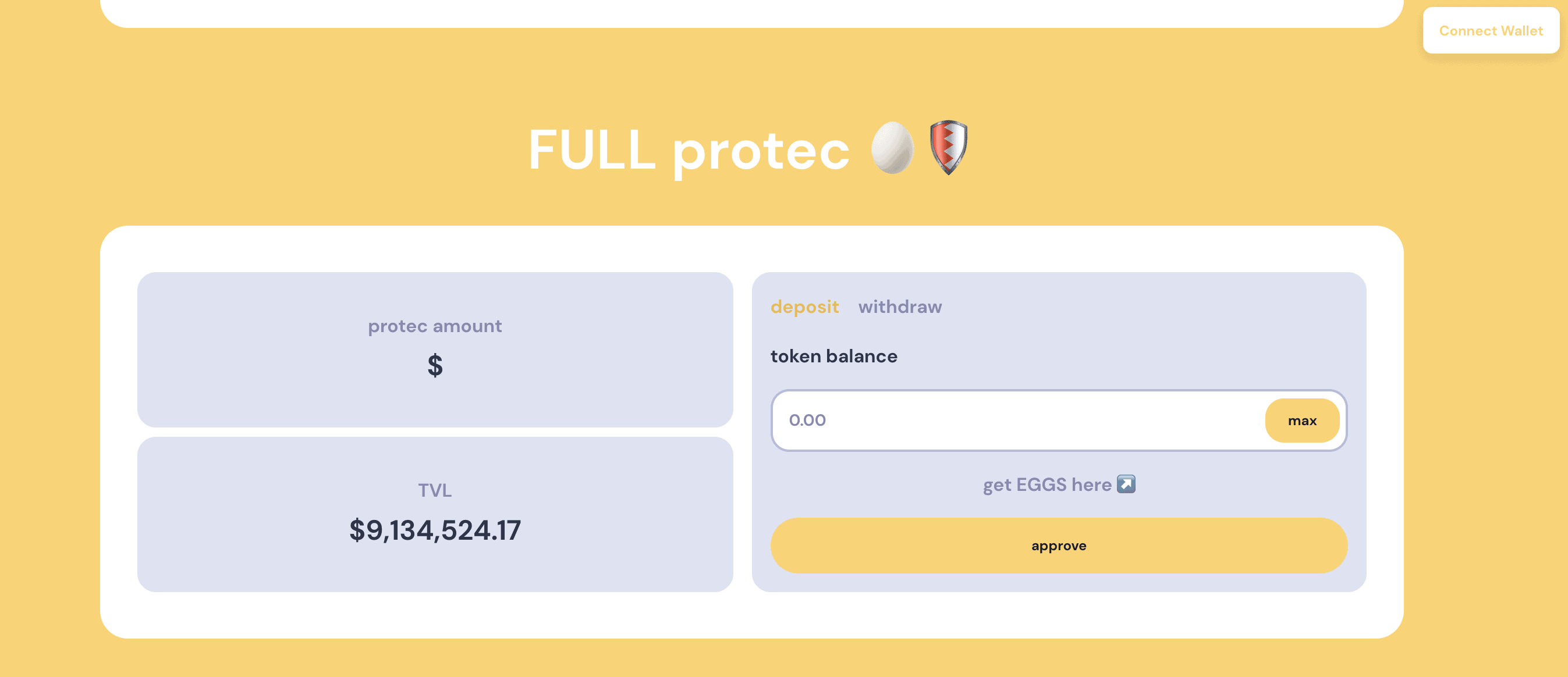

Deposit $MOD to the stability pool

Click on the “Stability pool” tab, choose the amount of $MOD you wish to deposit, and click “Deposit”.

Redeem $MOD for $APT

Click on the “Redeem” tab, choose the amount of $MOD you want to redeem, and click “Redeem”. Note you will need to pay a redemption fee.

Add to liquidity pools

Click on the “Liquidity pools” tab, choose which pool you wish to add liquidity to, then click “deposit”. Select the number of tokens you wish to add then click “Add liquidity”.

Submit bug reports

If you find a bug on the Thala platform, report it! Developers reward this! To do this, go on Thala’s Discord channel and submit a report there.

Collect an exclusive Thala NFT

To collect an exclusive Thala NFT, go to Thala’s Galxe campaign page and complete the 10 tasks to receive an OAT NFT. Tasks include liking and retweeting Thala’s tweets, using ThalaSwap, and joining their Discord etc.

Thala Labs ($THL) token airdrop review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: Thala Labs have confirmed they will have a $THL token and will be doing an airdrop. However, the team has not released details of the future airdrops yet.

Airdropped Token Allocation: We can see from their documentation that around 8.3 million $THL tokens will be allocated towards airdrops. Also, any airdrops will be within the first year of their TGE.

Airdrop Difficulty: As they are still in testnet stage, interacting with the protocol is free. So if they do an airdrop to reward early testers of the platform, you could potentially get an airdrop for free!

Token Utility: The $THL token will be used for governance.

Token Lockup: There are no details on the airdropped token lockup yet.