If you hold stablecoins on Ethereum or other EVM platforms, you must be aware of this smart contract feature…

Token Issuers on Ethereum Can Freeze Your Funds Without Notice

In order to issue tokens on EVM platforms including Ethereum and Polygon, the first step is deploying a smart contract, which is then used for transferring tokens. However, the token issuer can define support for transaction censorship and token freezing in the contract. This is how Circle, the issuer of USDC, froze 75,000 USDC in user funds with ties to Tornado Cash, in compliance with U.S. sanctions.

Not many users are fully aware of this feature. This can be compared to how traditional banks have the authority to freeze your funds without notice. If the stablecoin ecosystem depends on a centralized entity for issuing tokens, it could prove to be risky for all crypto users.

USDT and USDC — Regulatory Compliant Stablecoins

Paxos and Circle, the issuer of USDT and USDC respectively, are required to comply with regulators in order to be allowed to tokenize US dollars on blockchain platforms. One of the major regulators is the Office of Foreign Assets Control (OFAC), who not just sanctioned Tornado Cash, but also oversees Ethereum block validations.

It is important to note that regulations for the crypto industry is not necessarily bad. They protect the interests of investors and prevent fraudulent activities. However, this is in conflict with the basic principles of decentralization, especially when user funds are on the line.

How are Transactions Censored on Ethereum?

Although a deployed smart contract can never be stopped or otherwise manipulated by a third party, token issuers, however, can write whatever they want in smart contracts, including censorship features. Here’s how:

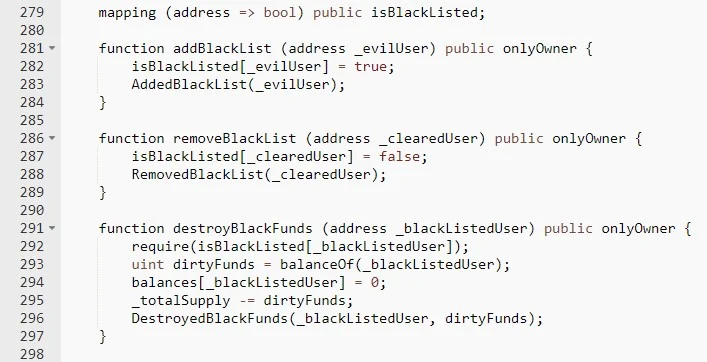

In order to mint fungible tokens on Ethereum, developers must follow the ERC token standards including the ERC-20 (token), ERC-721 (NFT) or ERC-1155 (multi-token). These standards define a common list of rules that EVM tokens should adhere to. A customized and deployed smart contract is then used each time tokens move from address to address. However, a smart contract can define any behavior that the EVM will allow, which includes the ability to censor transactions based on a blacklist or freezing an account. As a result, any Ethereum user may lose the ability to spend or use the tokens in any way. This is what the smart contract for USDT looks like:

As shown in the image above, Paxos has the power to blacklist token owner accounts and burn their funds. Of course, one could argue that this is for our safety, freezing the account of someone who has been involved in criminal activity. After all, the blockchain industry should not be a way for criminals to circumvent the law. But herein lies the dilemma: how is decentralized finance (DeFi) different from traditional finance if we still have to trust the system?

Key Takeaway

It is true that certain censorship features in place help protect investors’ interest, but the blockchain industry is meant to be different from the traditional financial world. Take the Tornado Cash incident for example, one of the developers was arrested for simply writing code, and several users who used Tornado Cash without malicious intention ended up having their funds frozen.

If we blindly accept the rules of the existing system, we will not be able to create anything innovative. It is not true self-custody if a third party can control the tokens you have in your own wallet. Nevertheless, the blockchain industry is still in its infancy, and if we are being pragmatic, a common ground must be reached between crypto users and regulators. For DeFi to move forward, we can only construct a system that remains decentralized and that regulators have no objections to.

ronalthapa

Ron achieved $60,000+ (peak PnL) in airdrop rewards in 2024. He is an expert in testnet airdrop farming. If there is a points system, he knows exactly how to min-max it. Ron is also a data-driven trader, proficient in LTF price action. He hopes one day to be in the top 10 of the Bybit WSOT leaderboard.