Ethereum 2.0 (Formerly known as ETH2) is a series of upgrades to the Ethereum Blockchain which will improve its speed, efficiency, and scalability. This will allow Ethereum to handle significantly more transactions, improve smart contract stability and reduce network fees. Upon reaching the final phase of the upgrade, Ethereum will meet its goals of becoming a transparent and open network for Decentralized Finance (DeFi). This article breaks down the roadmap for this upgrade and key milestones of when they are released. The next big update coming in the second half of 2023 is the “Shanghai upgrade” which will have a significant economic impact.

What is Ethereum 2.0?

Ethereum 2.0 will involve sharding to drastically increase network bandwidth and reduce gas costs, making it cheaper to send cryptocurrencies and interact with smart contracts. There will be fundamental economic changes too, Ethereum 2.0 will allow support to stake nodes and to earn Ethereum as passive income. The Ethereum 2.0 upgrade will be done in 3 distinct phases starting with Phase 0 (after all, developers count from 0 instead of 1). Over the past few years, opponents of Ethereum have often criticized the network’s high transaction costs and fragility during peak usage. This guide will cover the timeline for the upgrade to ETH2.0 and the solutions proposed.

Key Features of Ethereum 2.0

- Efficiency – Ethereum will become 99.95% more energy efficient. It is estimated that after the upgrade, the network will no longer require an entire country’s worth of power.

- Sharding – Ethereum will be broken into 18 “Shards” that operate simultaneously. This will drastically improve efficiency.

- Staking – Ethereum will move to Proof-of-Stake Consensus, so everyone can stake and help secure the network.

- Security – Compromising the network will become much more expensive under Proof-of-Stake. 51% of attackers will also be easily identifiable with validator addresses and can be forked away from the network.

The 3 Phases of Ethereum 2.0

Ethereum 2.0 will be launched in 3 phases:

- Phase 0- Beacon Chain – Completed in 2020

- Phase 1- The Merge – Completed September 2022

- Phase 2- Sharding

Phase 0: Beacon Chain

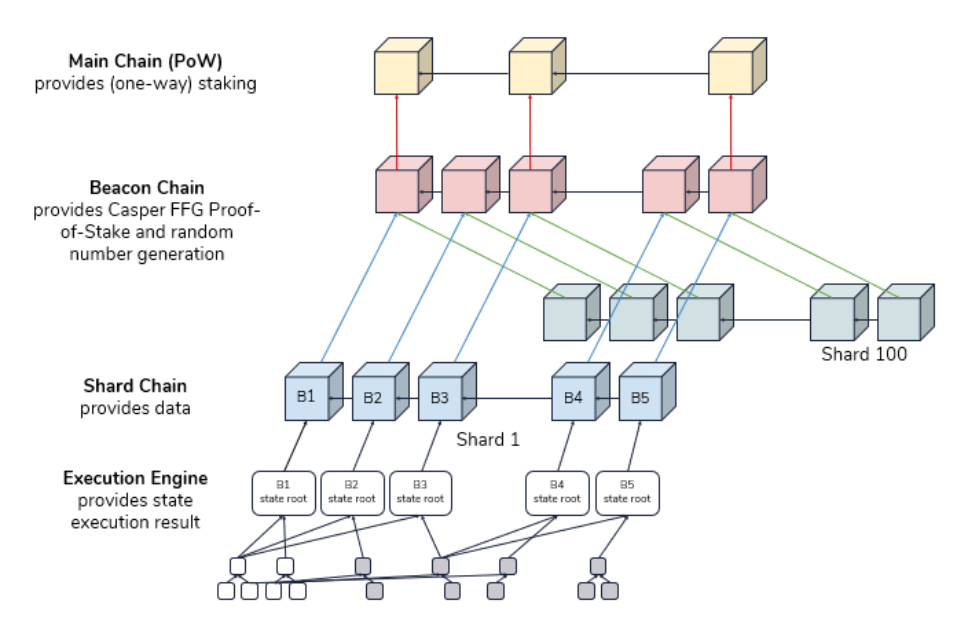

Launched on 1st December 2020, the Beacon Chain introduced Proof-of-Stake to the Ethereum ecosystem. The purpose of the Beacon Chain is to coordinate the Ethereum network and serve as the consensus layer. This Beacon chain is necessary to generate the randomness that actual proof of stake uses. It also acts as a crucial precursor to upcoming phases such as sharding.

Learn more with our Ethereum mining guide and learn how to stake Ethereum 2.0 on Allnodes.

Phase 1: The Merge

The Ethereum Merge was completed on the 15th of September 2022. This merged the Beacon chain from phase 0 into the original proof-of-work mainnet (i.e. the “execution layer”, formerly known as “Eth1”). After the Merge is completed, ETH1 and ETH2 become the same network that uses the same ETH coin. Why the merge is so important and such a difficult task because it involved switching consensus mechanisms. An analogy for this would be switching the engine of a car from a gas to an electric-powered engine – whilst the car is still moving.

The Merge made the Ethereum network substantially more energy efficient as it no longer required cryptocurrency miners that consumed a huge amount of electrical power. It is calculated that there is an incredible 99.988% reduction in the energy necessary to run the network, meaning that current Ethereum Staking Nodes are incredibly energy efficient. It will also set the stage for future upgrades to the scalability of Ethereum such as sharding.

Phase 2: Sharding

By then, the Beacon Chain has already been launched and merged with the Ethereum Mainnet. The next stage will introduce sharding to the Ethereum Network.

Sharding on Ethereum means the database would be split horizontally to spread the load. Sharding will work together with layer 2 rollups. This divides the burden of handling large amounts of data needed by rollups over the entire Ethereum network.

Ethereum Sharding is realistically expected to be released in 2024.

Main features of sharding:

- Everyone can run a node: Validators will no longer need to store all the data themselves. This drastically reduces the cost of storing data on layer 1 by reducing the hardware requirements.

- More network participation and security: With sharding, you will be able to run Ethereum on a laptop or phone. This means more participation, greater decentralization, and more security.

What are layer 2 rollups?

Layer 2 rollups are an existing “layer 2” technology. This allows decentralized applications (dApps) to “roll up” transactions into one off-chain for submission. The effect of this is that it reduces the data needed to execute a transaction.

The combination of layer 2 rollups and sharding is what will achieve a transaction speed of 100,000 tps.

Learn more: Understanding layer 2 & scaling solutions: Arbitrum, Boba, Optimism, Polygon, Ethereum 2.0

What is the current state of Ethereum 2.0?

3 upgrades have been introduced since the launch of the Beacon Chain on 1st December 2020: the Berlin upgrade, London upgrade, Altair upgrade and Shanghai upgrade.

The Berlin upgrade was launched on 15th April 2021 and optimized gas costs for some EVM actions and increased support for several transaction types. The London upgrade was launched on 5th August 2021 and reformed the transaction fee market for the ETH 1.0 chain via EIP-1559 and removed or reduced gas fees for specific functions (Learn more about the London upgrade). The Altair upgrade was launched on 27th October 2021 and is the first scheduled upgrade for Ethereum’s Beacon Chain. It added support for “sync committees” which enabled light clients, brought validator inactivity, and slashed penalties up to their maximum values.

The Ethereum network’s Shanghai upgrade (also known as Shapella) was successfully completed at 22:27 UTC on 12th April 2023. To celebrate this milestone, ConsenSys launched an NFT collection called “Ethereum, Evolved: Shanghai”. The NFT claim period begins on April 12, 2023, at 9pm EST and lasts for 72 hours. Find out how to claim this FREE NFT with our guide here.

The next major Ethereum upgrade is titled Cancun, which will feature proto-dank sharding, a feature that aims to improve scalability by improving fees and transaction times. The details of the Cancun upgrade have not yet been finalized.

Shanghai (Shapella) upgrade

The Ethereum network’s Shanghai (also known as Shapella) upgrade took effect at 22:27 UTC on 12th April 2023 and was very successful. This upgrade combined changes to the execution layer (i.e. Shanghai), consensus layer (i.e. Capella), and engine API at epoch 194,048. The Shapella upgrade is important because it finally enabled withdrawals of ETH stakers/validators from the Beacon Chain, ahead of the implementation of the Ethereum Improvement Proposal (EIP)-4884 related to The Surge. This will improve the security of Ethereum’s post-Merge proof-of-stake protocol.

Additionally, a set of EIPs that upgrade the Ethereum Virtual Machine (EVM) will be included in the Shanghai upgrade, such as EIP-3651: Warm Coinbase, EIP-3855: PUSH0 instruction, EIP-3860: Limit and meter initcode and EIP-4895: Beacon chain push withdrawals as operations. The EVM Object Format (EOF) may be removed from the Shanghai upgrade if it is not ready by the time of implementation. Once the Shanghai upgrade is complete, the network’s next major event is the Sharding upgrade, which is expected to take place between 2023 and 2024.

Learn more about the Shanghai upgrade and how it is causing liquid staking derivative tokens to pump- Ethereum Shanghai Upgrade: Why Liquid Staking Derivatives are Pumping

How much ETH has been withdrawn since the Shanghai (Shapella) upgrade?

Since the Shanghai (Shapella) upgrade 228.82K $ETH has been withdrawn with 100.51K $ETH deposited (as of 10:00am HKT on 14th April 2023). At the same time, the current amount of $ETH being staked is 17.38M ($34.97B). And the pending withdrawal amount (including rewards) is 981K ($2.07B). Around 60.99K ($126.89M), is expected to be withdrawn in the next 11 hours.

You can see how much ETH has been withdrawn, deposited or staked since the Shanghai (Shapella) upgrade here.

Ethereum ETH prices since the Shanghai (Shapella) upgrade?

The Ethereum Shanghai (Shapella) upgrade took effect at 22:27 UTC on 12th April 2023 (06:27 on 13th April 2023 HKT). Before the upgrade, ETH was only trading at around $1,920 and remained the same a few hours after. However, the full effect of the Shanghai upgrade on Ethereum prices was seen around half a day and particularly 24 hours after the Shanghai upgrade. As of 11:30am HKT on 14th April 2023 (nearly 1.5 days after the Shanghai upgrade), Ethereum is trading at $2,109.87.

How to set up an Ethereum Validator Node

Check out our LIVE demonstration on how to set up an Ethereum 2.0 Node

I’ve also set up something called an Ethereum validator node for Ethereum 2.0. These nodes will be how Ethereum would run and how transactions are going to be validated in the future. So we’re going to explore all of these concepts as well in this guide.

Currently you can test out Ethereum staking on the ETH 2.0 Testnet set up by Prysmatic labs (aka Topaz). Since it’s a test, Ethereum will not be used, instead, it will use Göerli ETH, a free testnet version of ETH.

Time needed: 2 days

How to set up an Ethereum (ETH) Validator Node

This guide has been adapted from the Prysm ‘Topaz’ Testnet Guide

Göerli ETH is free to obtain and will be used to stake the 32 ETH required for the node. The easiest way to obtain the Göerli ETH is to use the social faucet.

You’ll need to be familiar with running a VPS server (you can use AWS, Hetzner or Linode). Recommended specs include an Intel Core i7 processor with 100 GB of SSD storage

Easiest way we found to do this is via Docker

docker run -it -v $HOME/prysm/beacon:/data -p 4000:4000 -p 13000:13000 \ gcr.io/prysmaticlabs/prysm/beacon-chain:latest \ –datadir=/data

docker run -it -v $HOME/prysm/validator:/data \ gcr.io/prysmaticlabs/prysm/validator:latest \ accounts create –keystore-path=/data

Complete the steps here to stake the ETH

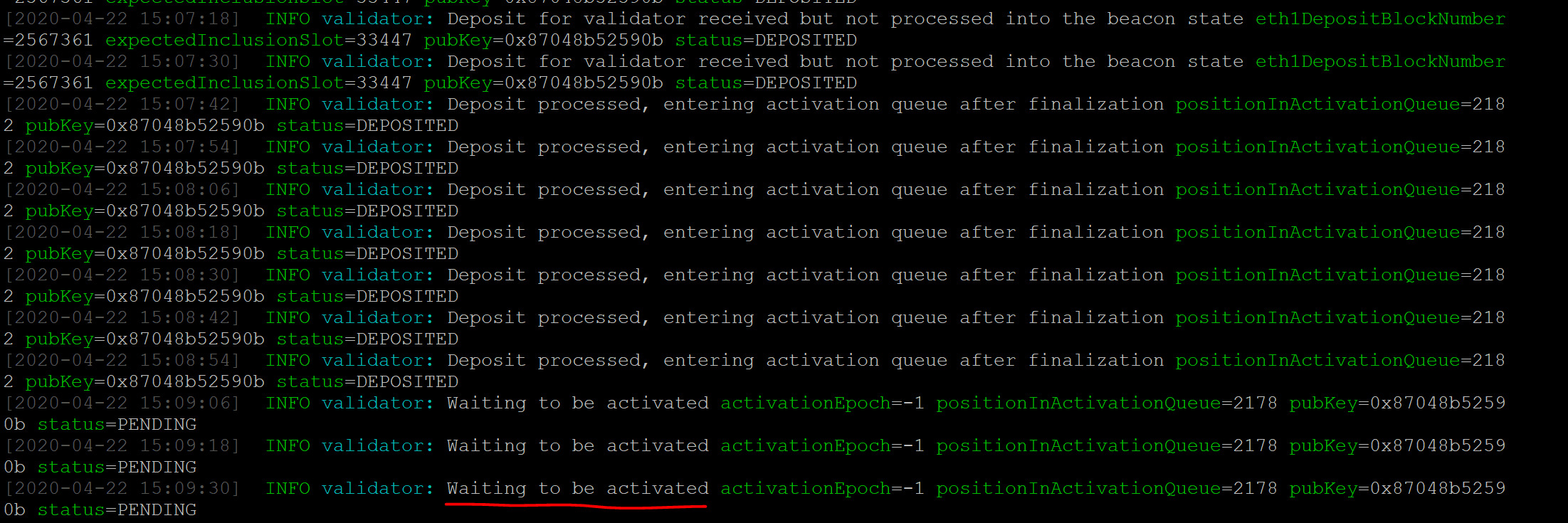

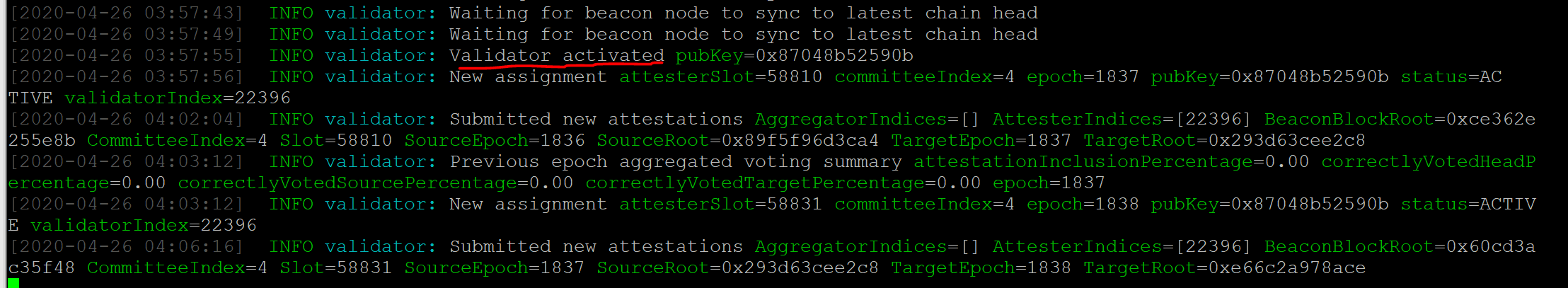

Finish the activation

Wait (roughly 2 days) to get activated, and then you’re good to go!

Finish the activation

Wait (roughly 2 days) to get activated, and then you’re good to go!

Staking Ethereum on a validator node

Ethereum 2.0 migrated the network consensus to a proof of stake mechanism. The staked 32 ETH2 is used to validate the transactions and states on the network. It also acts as a guarantee that the validator node will be honest and operational. In return, stakers will be rewarded with Ethereum.

This means that validators will generate Ethereum as passive income and receive ETH payouts slowly over time. Current calculations of Ethereum 2.0 staking show an annual 14.2% Return on Investment (ROI).

This will be great for those who stake ETH. This is because they can enjoy the benefits of passive income whilst personally holding their funds on the validator node. Analysts predict greater demand for ETH once proof of stake is implemented. This is due to additional demand for ETH from staking and validator nodes. Whilst at the same time, reduced demand for GPUs as Ethereum mining will eventually be phased out.

You can see the status of our Ethereum validator node in the image above. We had some initial downtime for the node, so we actually lost 0.01333 Ether. This was a penalty for missing our votes. So it is important to remember that votes are mandatory once a node is activated. An offline node will mean that votes are missed, resulting in a penalty of loss of ETH.

Ethereum Staking: Deposit contract address release

On 4th Nov 2020 the required specifications of ETH2 v1 and the Mainnet Deposit Contract Address for staking were released. This allowed ETH2 users to stake their ETH and become validators to help secure the network.

It’s important to remember that it is not possible to simply send ETH to the contract. This will result in your transaction failing. You need to go through the launchpad and follow the guide. Moreover, as we stated previously, staking and running a validator requires effort, time and technical expertise. Failing to meet requirements can result in loss of part of, if not all, your ETH as penalties add up.

Ethereum Staking Update: Yields?

As of April 2023, I have earned around 4.373 ETH since setting it up 3 years ago. Note that results may vary. Those who set up their node earlier (as was in my case) were able to enjoy 16% APY. The current APR yield for staking ETH is around 5.16%. You can check the current APR, total ETH staked, and number of validators here.

Ethereum staking since the Shanghai Upgrade

The APR yield for staking ETH since the Shanghai Upgrade is still very good at around 5.16%. So I am planning to continue staking ETH so I don’t miss out on this opportunity to earn more yield.

Progress of Ethereum 2.0 so far

More than 17.3 million $ETH is currently staked. Since the Shanghai Upgrade on 12th April 2023, over 107K $ETH has been deposited in the contract address. There are currently 568,291 validators and a Participation Rate of over 99%. The Participation Rate is a measure of ETH2’s network health as it shows the number of validators actively participating in the consensus mechanism. A good rate would be always above 80-90% to ensure the security of the chain.

Unlike before, Ethereum 2 proceeds in epochs (32 blocks), every 6.4 minutes (if no abnormalities are detected). You can always check this metric here: beaconscan.com/epochs.

What’s next in the development of Ethereum 2.0?

Phase 0 – Beacon Chain is already completed, and development would move onto building Phase 1- The Merge and Phase 2-Shard Chains.

Currently, we are in Phase 1 of the roadmap the road towards Ethereum 2.0. The Ethereum network is now around 55% complete following the Merge of the Beacon Chain with the Ethereum mainnet in September 2022.

After the Merge, Ethereum will have further upgrades which Vitalik calls the “surge”, “scourge”, “verge”,”purge” and “splurge”. This refers to Ethereum’s scaling, cleanup and evolution.

What is the “surge”, “scourge”, “verge” “purge” and “splurge” in the development of Ethereum 2.0?

After the Merge, Ethereum will undergo further upgrades known as the “surge”, “scourge”, “verge” “purge” and “splurge”.

The “surge” in the development of Ethereum 2.0 refers to adding Ethereum sharding. The purpose of this is to enable more affordable layer-2 blockchains, reduce the cost of rollups, and make it easier for users to operate nodes to secure the network. Once the surge is completed, the Ethereum network is expected to be able to process transactions faster. Ethereum could process up to 100,000 transactions a second once sharding is completed. This is much faster than traditional payment systems such as Visa which can handle around 1,667 transactions per second.

The “scourge” is a new phase announced by Vitalik on 5th November 2022. The purpose of this stage is to ensure reliable and credibly neutral transaction inclusion. Also, to avoid centralization and other protocol risks from MEV.

The “verge” will introduce “stateless clients” and “Verkle trees”- which are a form of mathematical proof. This enables users to become network validators without storing lots of data on their machines. This is a further step in the move toward a Proof-of-Stake consensus model as any validator with staked ETH can confirm and verify transactions. This will be hugely beneficial for decentralization.

The next stage, the “purge” will involve cleaning up old network history. This is to reduce the amount of space required on your hard drive and remove the requirement of nodes to store historical information.

The “splurge” would be several smaller upgrades and fine-tuning in order to ensure that the network operates smoothly. Or as Vitalik calls it, “all the other fun stuff”.

What will happen after ETH 2.0 is launched?

Currently, the Ethereum network can only process around 12 to 25 tps with an average confirmation time of 6 minutes. The result is that the Ethereum network is heavily congested with people all vying to process transactions, resulting in high gas fees.

Many “Ethereum killers” have therefore been launched. These are alternatives people can use for processing transactions. Some Ethereum alternatives include Solana, Avalanche, Polkadot, Algorand, and Cardano. They are a direct competitor to Ethereum as they offer similar features but at lower cost and higher speed.

Eventually, the number of transactions per second will drastically increase to over 100,000 tps. So the question would be, what would happen to the competition i.e. the “Ethereum killers”? Find out more in our article: Ethereum Merge is coming, is this the end of Ethereum killers?

Frequently Asked Questions (FAQ)

Ethereum 2.0 will not replace Ethereum. Rather, Ethereum and Ethereum 2.0 will be merged together into 2 layers of the same blockchain. Ethereum as we know it will be the execution layer, whilst Ethereum 2.0 will be the consensus layer.

No, ETH1 will continue as it is with no differences. ETH2 is setting up on a parallel line and the two will merge in the future. The merge will happen without ETH users being able to notice it

Ethereum mining will not end for quite a few years. Ethereum will retain mining on the main chain until at least 2020. The main ETH1 chain will continue to use mining and run parallel to the ETH2.0 chain. This is to ensure stability during the migration

It does not cost any money to set up a validator node to stake ETH for ETH2. Staking ETH will allow you to generate passive income. However, you will need to stake at least 32 ETH, and if your node suffers downtime your ETH will be partially deducted as penalties. Also, your staked ETH cannot be unstaked until after the Ethereum Shanghai Upgrade.

Following this list on Prysm website to install the client:

Minimum specifications

Operating System: 64-bit Linux, Mac OS X 10.14+, Windows 64-bit

Processor: Intel Core i5–760 or AMD FX-8100 or better

Memory: 8GB RAM

Storage: 20GB available space SSD

Internet: Broadband connection

Recommended specifications

Processor: Intel Core i7–4770 or AMD FX-8310 or better

Memory: 16GB RAM

Storage: 100GB available space SSD

Internet: Broadband connection

Yes. The 32 ETH staked for the validator node is designed as an insurance that the validator node is operational and online at all times. Penalties will be given if the node is offline, and small amounts of ETH will be deducted over time.

The current APR yield for staking ETH is 3.7%. Here you can have an idea of the APR (in ETH) as it varies with the number of ETH staked (source).

Staking ETH for ETH2 is safe and does not have any significant risks. However, stakers will not be able to withdraw their staked ETH until after the Shanghai hard fork in March 2023. Also, if your validator node goes offline, you will be penalised by a deduction of your staked ETH.

If you want to participate in ETH2 staking but you don’t own the minimum amount required to become a validator, or you don’t want to stake an exact multiple of 32 ETH, don’t worry. There will be possibilities through Centralized Exchanges (like Binance and Coinbase) and not only. A big advantage in this case, is to receive liquidity for your staked ETH.

RoocketPool ($RPL), now in beta, will correspond rETH (1:1 with ETH), a tokenized asset that you will be able to trade freely. Lido Finance will do a similar thing through their stETH. LiquidStake will instead let you borrow USDC for your staked ETH collateral. Many other solutions will arise as ETH2 will start its journey; for example, Cream Finance ($CREAM) has recently released an article explaining that user will receive the ETH2P token when joining ETH2 staking through them

In Phase 0, ETH2 cannot be withdrawn back to regular ETH. Once converted, ETH2 will only be usable on the Staking Chain until Phase 3.

At the moment you cannot do anything with your ETH2. They are just “digital receipts”. Transactions or other features we have now on ETH won’t be available on ETH2 for probably years. There are rumors of a possible secondary market where to trade them though.

You cannot buy or sell ETH2 yet. ETH2 will only be available for trading or transfer until Phase 3 when the upgrade of the Ethereum protocol is complete.

ETH2 is not available for sale yet, so users should be careful of any places that offer ETH2 for sale. ETH on the other hand can be bought and traded at almost every cryptocurrency exchange.

ETH on testnets do not have any monetary value. They essentially allow developers to test and troubleshoot DApps and protocols before going live on the Ethereum mainnet. As a result, there are no markets for testnet ETHs.

The Merge will not make Ethereum gas fees cheaper. This is because The Merge is only a change in the consensus mechanism from Proof-of-Work to Proof-of-Stake. Only an expansion of the Ethereum network capacity and throughput would lower the gas fees. However, this is still in development.

There is currently locked staked ETH (stETH) on the Beacon Chain. stETH is backed 1:1 by Ether (ETH). However, developers have confirmed that users will not be able to withdraw their locked stETH after The Merge. Withdrawal of stETH will instead be possible after the Shanghai Upgrade which is expected to be in second half of 2023.

Ethereum developers believe that transitioning to Proof-of-Stake will result in a 10% increase in block production. However, users are unlikely to be able to notice this slight improvement.

No. There will not be a new ETH coin after the launch of Ethereum 2.0. Therefore, existing ETH holders, users of dApps, and traders do not have to do anything in anticipation of Ethereum 2.0.

Therefore, users should be wary of websites or services claiming that they will allow users to trade, invest, mine, swap, or stake the ETH2 token. This is because the ETH2 token doesn’t actually exist.

If The Merge does not result in a hard fork, then there are no tax implications because no new tokens would be created.

However, if the Merge results in a hard fork, ETH holders would be sent duplicate tokens which may have tax implications. If the ETH is held in user-owned wallets, new proof-of-work ETH tokens would be considered as income, and its valuation calculated at the time the user comes into possession of the tokens. On the other hand, if the ETH is held in custodial wallets such as cryptocurrency exchanges, the implications would depend on the custodians’ stance on supporting the forked ETH chain.

The launch of Ethereum 2.0 will not cause a huge impact on users’ interactions with blockchain dApps or cryptocurrency exchanges and services.

Ethereum developers have confirmed that during the Merge, there would not be any downtime.

On 15th September 2022 at 06:42:42 UTC at block 15537393, the Ethereum Merge was completed.

There are currently no plans for an airdrop of new tokens for ETH holders after the launch of Ethereum 2.0. So far, Vitalik Buterin and the Ethereum Foundation have expressed that they are firmly against any forked ETH tokens.

Therefore, any websites or social media accounts purporting to airdrop Ethereum tokens are most likely a scam.

ETHPOW or ETHW is the token that will emerge if there is a fork of the Ethereum blockchain. During the Merge, some community members may disagree (e.g. want to stay with the Proof of Work mechanism) and fork ETH. What they may do, is “copy and paste” the Ethereum blockchain. The result of this is there would be 2 blockchains and 2 tokens. There would be the existing Ethereum blockchain that goes through the Merge with the ETH token. And then there would be the forked chain with a new token called ETHPOW or ETHW.

If you held Ethereum prior to the Ethereum Merge, you will be airdropped (via the fork) free ETHPOW tokens

Those who have staked their ETH cannot stop staking until the Shanghai hard fork, which is expected in the second half of 2023.

The EthereumPoW ($ETHW) token is not widely traded on cryptocurrency exchanges. However, you can buy or trade the EthereumPoW ($ETHW) on these exchanges: OKX, ByBit, Kraken, Huobi, MEXC Global, Gate.io, Bitfinex, Bittrex, Poloniex and Hotbit.

The next upgrade to the Ethereum network is known as the Shanghai upgrade. A major anticipated feature of this upgrade is that withdrawals of ETH stakers/validators from the Beacon Chain will be enabled. The Ethereum network Shanghai upgrade is expected to be in March 2023.

A hard fork is a backward-compatible and permanent split or fork of the blockchain. After a hard fork, a separate version of the blockchain will emerge, as well as a new cryptocurrency token. There is speculation that the Merge may result in a hard fork. This is because some want to take advantage and profit from the Merge. Alternatively, a hard fork may be formed by those who disagree with the direction of Ethereum’s development. A group known as ETHW Core announced they will launch a hard fork within 24 hours of the Merge. This is because they oppose the change to a proof-of-stake mechanism, which essentially puts an end to ETH mining.

Several hours after the Merge, the ETHW mainnet and fork of the Ethereum blockchain was launched.

If The Merge does not result in a hard fork, then there are no tax implications because no new tokens would be created.

If all the phases are completed successfully, Ethereum prices are expected to increase. This is because each phase of the upgrade gives significant upgrades that will improve the performance of the blockchain. This will further grow its utility and value.

Ethereum mining is the process of adding blocks of transactions to the Ethereum blockchain. This is to help secure the Ethereum network through a Proof-of-Work (PoW) mechanism. Miners are then rewarded with ether (ETH) which can be traded on cryptocurrency exchanges. Therefore, many people would run Ethereum miners for profit.

However, the launch of ETH2.0 will fundamentally change the current economics. The existing Proof-of-Work (PoW) consensus mechanism will be replaced by Proof-of-Stake (PoS). The concept of mining will be retired once the Ethereum 2.0 update is fully completed.

For more details check out our article: The end for Ethereum miners after ETH 2.0?

The Shanghai (Shapella) network upgrade took place at 22:27 UTC on 12th April 2023.

No, but how transactions will be confirmed will change. Previously Ethereum uses Proof of Work (PoW) to confirm transactions. However, Ethereum 2.0 will transition to a Proof of Stake (PoS) consensus mechanism.

The Shapella upgrade is another name for the Ethereum Shanghai upgrade. It is called the Shapella upgrade because it combines changes from the Shanghai (execution layer) and Capella (consensus layer). This upgrade took place at 22:27 UTC on 12th April 2023.

Since the Shanghai (Shapella) upgrade, 228.82K $ETH has been withdrawn (as of 10:00am HKT on 14th April 2023). The pending withdrawal amount (including rewards) is 981K ($2.07B). Around 60.99K ($126.89M), is expected to be withdrawn in the next 11 hours.

You can see how much ETH has been withdrawn, deposited or staked since the Shanghai (Shapella) upgrade here.

Ethereum ETH prices eventually received a positive boost hours after the Shanghai (Shapella) upgrade. Before the upgrade, ETH was only trading at around $1,920. Nearly 1.5 days after the Shanghai upgrade, Ethereum is trading at $2,109.87.

The current APR yield for staking Ethereum is around 5.16%

Updates:

Update Nov 2022: Ethereum 2.0 has recently gone through some changes – it is now called the Ethereum Merge.

Update Jan 2023: Added details about Ethereum Shanghai Upgrade

Update Apr 2023: Added details about Ethereum Shanghai Upgrade and its effect on ETH prices.

Resources:

Ethereum Foundation: https://ethereum.org/en/upgrades

Pyrsmatic Labs: https://medium.com/prysmatic-labs/how-to-scale-ethereum-sharding-explained-ba2e283b7fce

Ethereum Wallet holders: https://bitinfocharts.com/comparison/activeaddresses-eth.html

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

Michael Gu

Michael Gu, Creator of Boxmining, stared in the Blockchain space as a Bitcoin miner in 2012. Something he immediately noticed was that accurate information is hard to come by in this space. He started Boxmining in 2017 mainly as a passion project, to educate people on digital assets and share his experiences. Being based in Asia, Michael also found a huge discrepancy between digital asset trends and knowledge gap in the West and China.