Polkastarter ($POLS) is a cross-chain decentralised protocol, powered by Polkadot, that allows start-ups to raise funds in a decentralised and interoperable environment.

In 2020, the decentralized finance ecosystem (DeFi) recorded encouraging figures in the number of DeFi protocols, as well as the number of funds locked in these platforms. On the number of protocols, the platforms addressed different spheres such as lending, trading, and insurance.

Unfortunately, not many protocols touched on revolutionizing conventional fundraising models such as initial coin offerings (ICOs), initial decentralized exchange offerings (IDOs), and initial exchange offerings (IEOs).

However, projects like Polkastarter are on their way to bring a sigh of relief to startups looking for innovative ways to attract funding. Before we dig deeper into the project and what it brings to startups, let’s take a look at the group behind it.

Background

Daniel Stockhaus and Tiago Martins are the top brains behind Polkastarter. As project co-founders, Stockhaus is the CEO, while Martins is the CTO. Notably, the two have vast experience spanning from tech entrepreneurship to software development.

Other members of the team include Danilo Carlucci and Matthew Dibb. Carlucci is a serial entrepreneur and angel investor, while Dibb is a strategic advisor.

What is Polkastarter?

Polkastarter is a decentralized platform enabling startups and other projects to attract capital through token auctions and inter-blockchain token pools. As you would have guessed from its name, the project is built on the Polkadot network that sits on Ethereum.

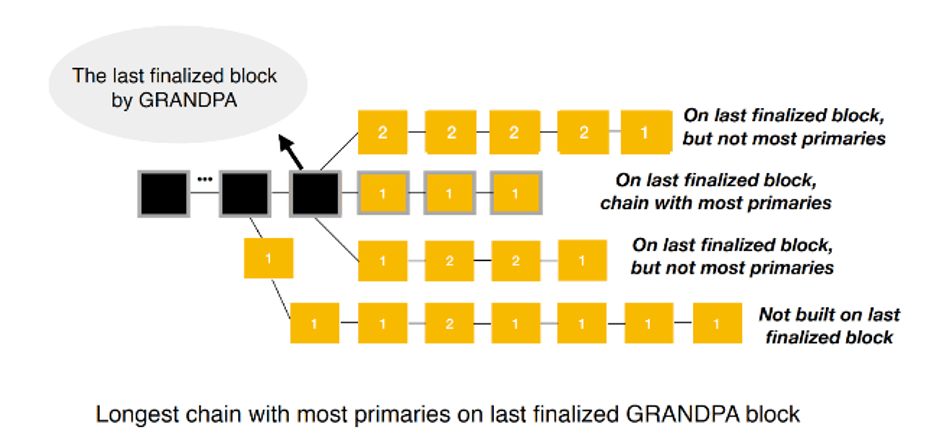

Stockhaus settled on Polkadot because of the network’s major strengths in scalability, speed, interoperability, upgradeability, and governance. To elaborate, Polkadot surpasses Ethereum and Bitcoin transaction speed thanks to its use of parachains, which power horizontal scalability, and Grandpa consensus mechanism, which drives vertical scalability.

Polkastarter taps into these strengths to enable governance through community voting and staking. The network also relies on Polkadot to drive liquidity mining.

Using these features, the project scores better than existing decentralized exchanges and swap protocols such as Uniswap, Bounce, and Primablock. For instance, these networks don’t support cross-chain pools, while Bounce and Primablock support a limited array of virtual assets.

Polkastarter’s Use Cases and Major Features

Polkastarter expands outside the fundraising space to crowdfunding and allows participants to benefit from discounted sales. Additionally, the protocol can increase privacy to over the counter deals by enabling password protection during such trades.

The network differs from other similar projects since it allows:

- Inter-chain swaps

- Fixed and dynamic swaps

- Community voting on critical governance issues

- Decentralized and permissionless token listing

- Comprehensive Know your customer (KYC) procedures

- Users to spot scams from a distance through a built-in anti-scam feature

Notably, combining these features brings low-cost transactions, fast cross-chain token swaps, the ability to move virtual assets across decentralized platforms, and a user-friendly design.

How Polkastarter Handles Fixed Swaps?

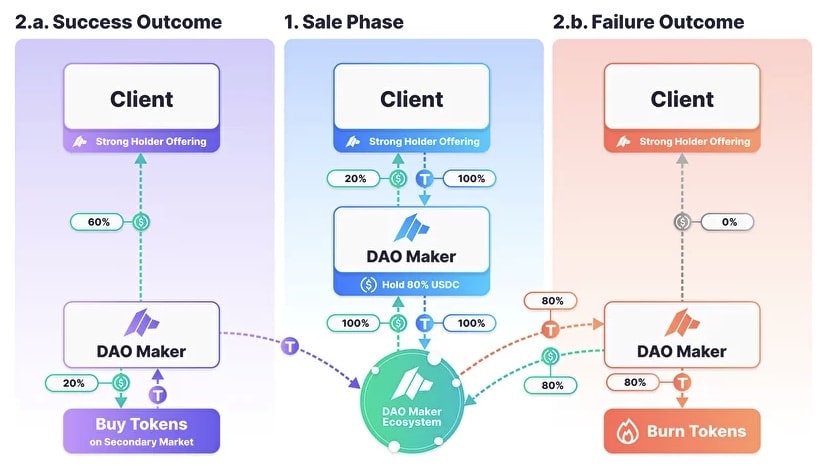

Fixed swaps pools are significant components of the network. Unlike with automated market making, fixed swap counteracts price volatility. Also, fixed swaps provide a greater level of transparency on the amount raised during fundraising.

Polkastarter employs fixed swap pools instead of AMM swap pools. This approach solves, among other challenges, the risk of private investors artificially inflating the price and dumping their holdings and the cost of token offerings.

Additionally, fixed swap pools ensure a fair distribution of tokens while eliminating the risk of rug pulls in a liquidity pool.

Note that instead of using a bonding curve approach to determine token prices in a pool, Polkastarter sets a fixed price when swapping tokens. As such, it’s possible to add other parameters, such as how much a single user can contribute to a project. Additionally, it’s easier to set more parameters to ensure transparency and fairness on new token holders.

Immediate advantages of using fixed swaps are:

- The amount raised and tokens sold can easily be calculated.

- It attracts investors distributed both demographically and geographically.

- Token holders are given a chance to acquire tokens at a standard price.

Polkastarter’s Native Token ($POLS)

Tokenomics

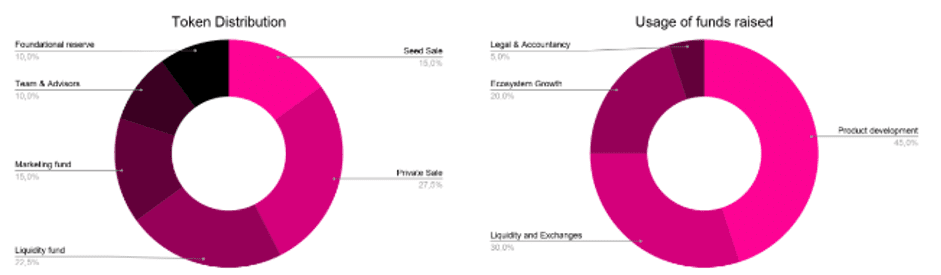

The network has a native token called $POLS, which it uses for various sections on the platform. POLS’s total supply is 100 million tokens. Exactly 42.5 percent of the tokens were sold during the seed sale, private sale, and Uniswap listing. Other tokens went to the marketing fund, team, advisors, and foundational reserve.

Funds raised during the sales periods went into legal/accountancy (5%), ecosystem growth (20%), liquidity/exchanges (30%), and product development (45%).

POLS is used on the Polkastarter ecosystem as a utility token. Among its major uses are governance and fees.

As a governance token, its holders can vote on crucial matters such as protocol features and tokens to be displayed on the network. On fees, transactions on the platform are paid using the native currency.

Other Utilities

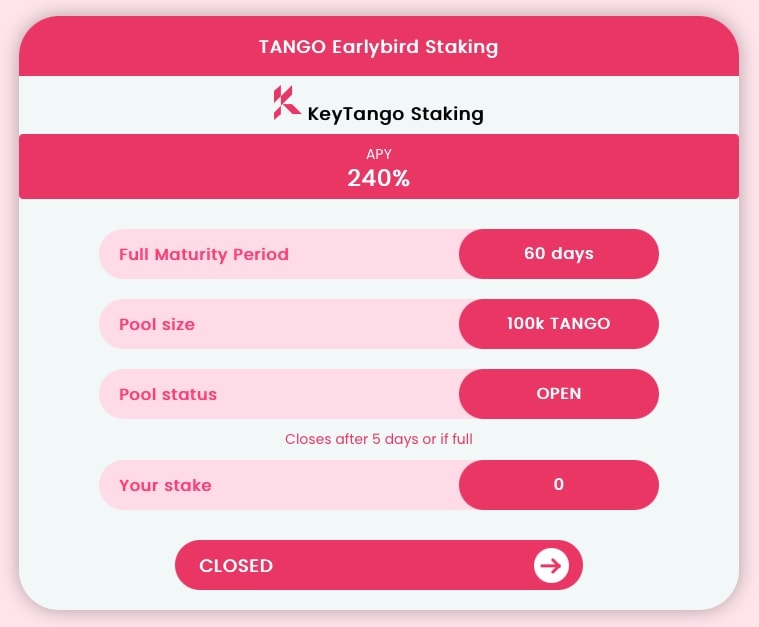

- Staking – The token can be staked to earn staking rewards on various fronts. For example, it can be staked to receive pool rewards or for pool access. Note that the option to stake POL for pool access is solely upon pool creators. However, the choice is ideal for giving top liquidity providers private access to high-end pools.

- Liquidity mining – Additionally, Polkastarter’s native currency can be staked to participate in liquidity mining. Rewards are distributed to entities providing liquidity on the secondary markets, among other subsections.

Two Key Partnerships With Polkastarter

Although Stockhaus and the team have inked many partnerships with reputable decentralized platforms, two stand out.

Polkastarter and Covalent

Covalent is a platform capable of fetching intricate details about a crypto wallet. As such, it allows Polkastarter and its users to check the trustworthiness of a token contract. The users have access to the token contract age, verification, transaction volume, among other details.

Polkastarter and DIA

Decentralized Information Asset (DIA) is a platform that provides distributed oracles on Polkastarter. Thanks to the exceptional qualities of its oracles, DIA helps Polkastarter provide warnings against massive price slippage.

Other partnerships involve Moonbean, Shyft, and Orion Protocol.

Conclusion

By using fixed price swaps instead of AMM, Polkastarter sets the bar higher in decentralized funding. It adds the transparency and fairness aspect that has been missing on similar platforms. The projectl’s partnerships with Covalent and DIA gives its users peace of mind knowing that they can pick a suspicious project from the crowd and avoid price slippage.

Furthermore, Polkastarter’s native token opens the door to distributed governance while giving its holders an extra way to earn rewards through staking.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.