Keep3r Network ($KP3R) (“Keep3r”) appeared out of nowhere on 28th October 2020 with a Medium article by its creator, Andre Cronje. It is described by Cronje as an “…agnostic, easy to implement, incentivization layer for routine ecosystem maintenance.” Cronje is arguably the the “Father” of decentralised finance (DeFi) and Yield Farming, being the creator of the widely successful yEarn Finance ($YFI) which eventually spawned multiple clones and projects inspired by YFI. Keep3r is another one of Cronje’s experiments, and as per his usual “I test in prod” approach- he will launch the product FIRST, then do the necessary testing etc. Despite Cronje’s repeated and clear warnings on this, many still hope for a quick profit and thus throw their cryptocurrencies at the product as soon as it goes live.

Background

As mentioned in the introduction, Keep3r Network had small beginnings as a Medium article and subsequent Twitter post by creator Andre Cronje. Owing to his reputation in this space (his first project YFI grew from USD$0 to USD$300 in market capitalisation in a mere 2 months and spawned the current DeFi wave), many see that whatever Cronje touches turns into gold and so “aped” in by buying up the KP3R token as soon as it listed on Uniswap. Immediately upon launch, prices of KP3R were going up at the rate of around USD$1 per minute. This of course resulted in the word being further spread around social media, and more people decided to join in because they did not want to miss out on this opportunity.

What is Keep3r Network ($KP3R)?

Keep3r Network ($KP3R) can be described as a “job matching” network for Job posters looking for “Keepers” to do tasks for them, together with an incentive mechanism for all the parties involved.

What are Keepers?

Keepers are persons/teams with technical knowledge who are able to take up Jobs, for example, flash liquidation, providing Uniquote price feeds, collecting harvests, and Metawallet batch executions. These are simple manual tasks but can be tedious as it needs to be done regularly. For example, collecting harvests from yield farming is something that generally needs to be done every day. These tasks are usually done by the programmer i.e. Cronje himself, but it would be time-consuming for them to do.

What are Jobs?

In the Keep3r Network, anyone can add a particular Job for someone to do. Jobs are smart contract calls that want an external entity to perform an action in good faith and without any malicious intent or outcome. So they would register themselves as a Job on the Network and provide the relevant documentation and details such as job name, address etc.

The Keeper i.e. the person/team would then register themselves as being able to perform the job and execute on the Job’s contract. Keepers have the freedom to set up their own DevOps, infrastructure and create their own rules to complete the job.

This process is all done on-chain, and the advantage of this is that everyone can confirm that a particular task has been done.

The Keep3r Ecosystem

Having discovered that the Keep3r Network has the potential to be more than a job registry, creator Andre Cronje has decided to combine all of his projects under the Keep3r ecosystem to be one large liquidity ecosystem: options liquidity mining (olm), fixed forex and some other v3 liquidity incentives Cronje has in the works as follows.

Keep3r Eden

Keep3r Eden is a rule set to order transactions within a block in a way that is fair and transparent. This is important for the Keep3r Network since it prevents keepers and jobs from being front-run yet giving them priority access to block space.

Keep3r is partnered with Eden Network. Through Keep3r’s acquisition of 602,409 EDEN, Keep3r is able to guarantee that it will be an anchor slot tenant. This allows Keep3r jobs to by default have the benefits of MEV and front running protection, as well as priority block inclusion. And if users use the Eden RPC, they also have private transactions.

Keep3r’s Fixed Forex

Fixed Forex aims to bring forex markets into DeFi by allowing for deep on-chain forex liquidity- this provides an alternative to USD denominated stable coins (i.e. USDT, BUSD etc).

Keep3r’s Fixed Forex is a liquidity incentive and fee claim system for Iron Bank’s Fixed Forex. The IBFF and veIBFF tokens will be merged with the KP3R and vKP3R tokens. At the same time, the fee claim of approximately $60k/week will move to vKP3R.

Fixed Forex is partnered with zarp.cash, their token ZARP is a cryptocurrency pegged to the price of the South African Rand (ZAR) on a 1:1 ratio. For security, ZARP tokens are stored in a treasury account and are independently audited by Kempen Audit. Therefore, according to the team, “ZARP is the only fully backed, transparent and audited stablecoin for the South African Rand”. ZARP is intended to be used as a representation of the Rand in DeFi. Other currencies such as EUR, KRW, GBP, CHF, AUD and JPY.

Keep3r OLM (Options Liquidity Mining)

Keep3r’s generalized OLM platform for projects allows them to have an instant options-based reward incentivization program. vKP3R holders benefit from this platform as 1% of all exercised option fees will go to them- this will mean around $100k/week in fees will go to vKP3R holders.

Keep3r v3 liquidity incentives

There is a liquidity mining program launched on Keep3r v3 for Uniswap v3. Liquidity providers (LPs) will be able to deposit their UNI v3 NFT positions and earn KP3R. 50% of fees earned will be distributed to vK3PR holders.

Keep3r wonderland

Keep3r Wonderland (also known as DeFi Wonderland) is an activist fund that provides capital and developmental support to protocol development projects.

What are $KP3R tokens?

$KP3R is the native token for the Keep3r Network and having more KP3R represents a higher “reputation” in the Network. As an example, say a Job requires someone to collect a harvest from the YFI contract. This task could impact the prices of different cryptocurrencies and lead to people front running. So you want the person completing this task to act in the interests of everyone and not be selfish.

This is where the KP3R token comes in. Those who complete tasks are rewarded with KP3R, this will be equivalent to the gas spent on the transaction plus a premium, the amount of which depends on the complexity of the Job. The more KP3R tokens you have, the higher your “reputation” in the space and as a result you can take on higher-end jobs. It is also worth noting that there is a mechanism for slashing your bonded KP3R if you are found to be a malicious actor.

By default, this is in the form of bonded KP3R but you can unbond it to become normal KP3R.

Advantages and disadvantages of keeping bonded KP3R

Advantages of keeping bonded KP3R include:

- Higher bonds increase the types of Jobs Keepers can qualify to do;

- only bonded KP3R grants voting rights in governance; and

- bonded KP3R cannot be exploited. This is in case a Job introduces an exploit.

Yet the disadvantage of keeping bonded KP3R is that you cannot immediately recoup ETH for Keeper transactions. Meaning that Keepers had to keep an unbond days amount of ETH as a float. A solution to this is MetaKeep3r (see below).

What are $rKP3R tokens?

rKP3R are redeemable KP3R tokens. They are wrapped KP3R tokens that have the option to be exercised as a KP3R CALL option at a 50% discount at any time. Note however that once created, you only have 24 hours to exercise the CALL, failing which the option will simply expire.

rKP3R can be earned by providing curve.fi/factory. liquidity to ib forex assets or uniswap v3 liquidity to KP3R/ETH (with more pairs to come soon). Furthermore, all distributed KP3R rewards will be in the form of rKP3R for composability with Curve Gauges, Sushi Onsen, etc.

Holders of rKP3R can redeem for the KP3R CALL by selecting “claim” on fixedforex.fi/options. It will then display under “strike” the USDC amount you would have to pay for the amount of KP3R should you choose to exercise the option and the expiry date. If you wish to exercise this option, simply click “redeem”. The amount of USDC would be transferred to the treasury address which then distributes all fees to vKP3R holders.

Keep3r partners with Chainlink

Keep3r tapped into Chainlink’s highly secure and fault-tolerant oracles to advance its services. Although the two have similar functionalities, they serve different target markets.

For example, Chainlink serves companies that require loads of always-online, secure, and fault-tolerant data i.e. the Fortune 500 companies.On the other hand, Keep3r is developed for apps yet to become a Fortune 500. That is, companies still in the research and development stage. Therefore, the coming together of the two protocols smoothens the process of switching to Chainlink when an application’s off-chain data needs to increase.

Most importantly, the cooperation allows Keepers who have already done a substantial number of jobs to become eligible to be part of Chainlink’s node operators running critical jobs. When Keepers upgrade to become Chainlink node operators, they will transition from using K3PR to using LINK for payment and staking.

$KP3R prices

$KP3R launched at around USD$1 per token. However, due to speculators rushing in after hearing of a new Andre Cronje project, prices for the token shot up by 27x within 40 minutes- at around the rate of USD$1 per minute. As word quickly spread about KP3R, more people bought in for fear of missing out, resulting in prices skyrocketing even higher.

Prices reached an all-time high of USD$1,385.62 on 11th November 2021.

Keep3r how-to guide and tutorial

For more details, please check out the Keep3r Network documentation.

How to register as a Keep3r

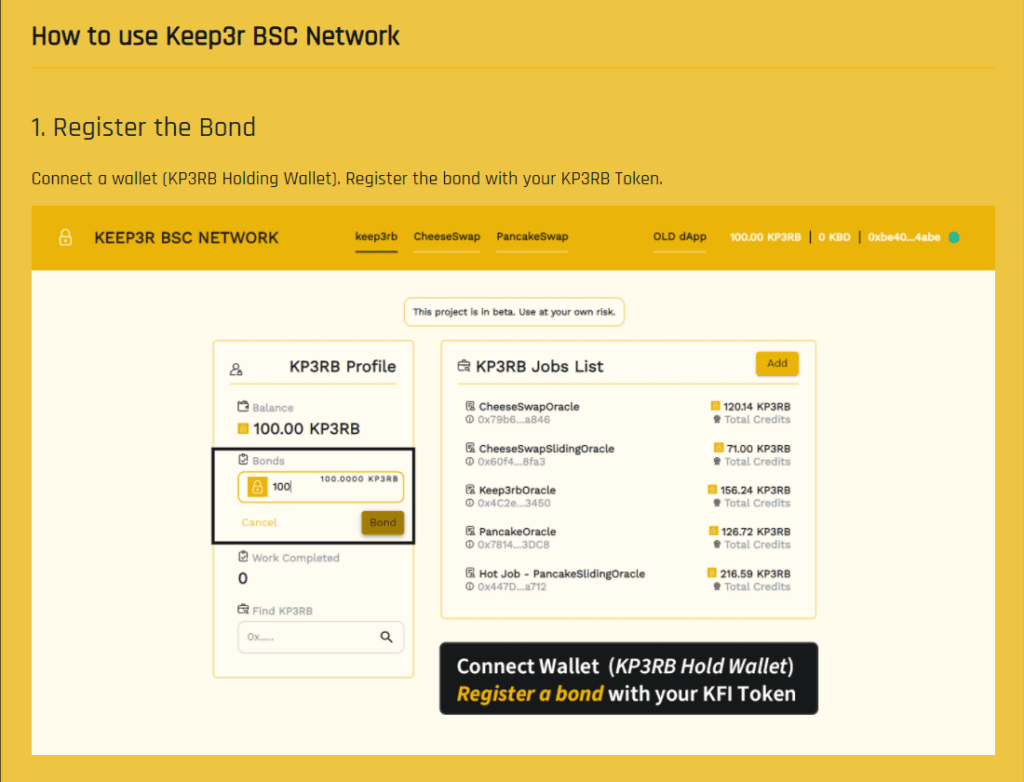

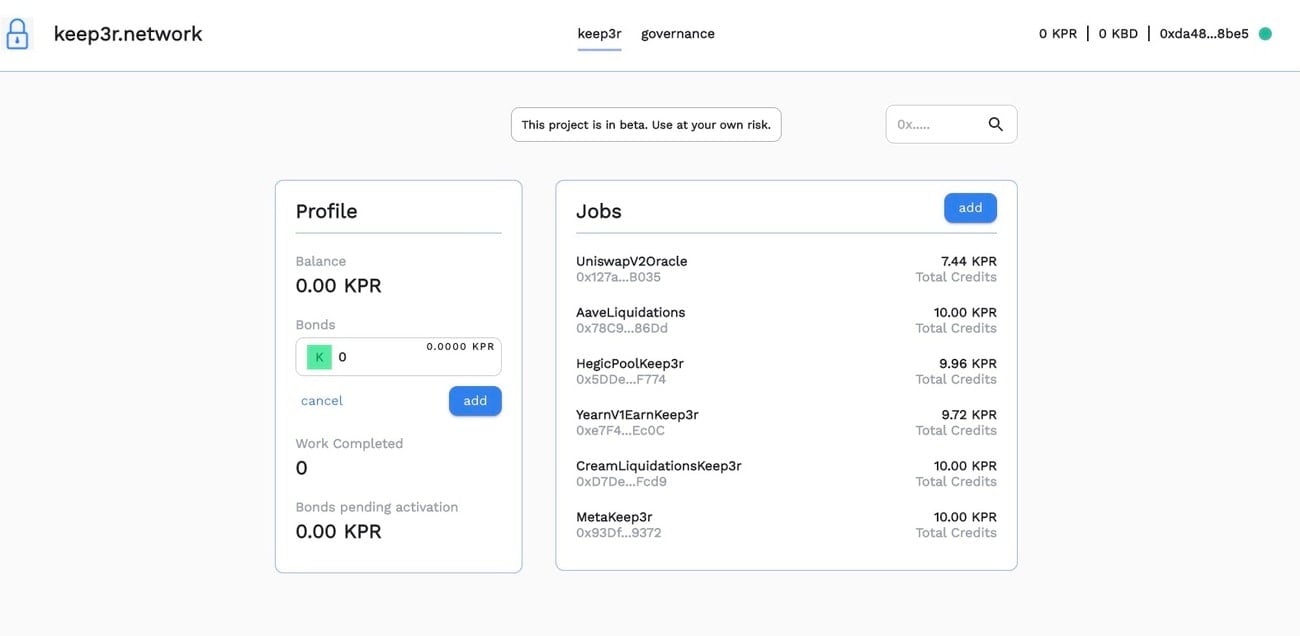

On Keep3r Network, connect your Metamask wallet. If you don’t have one yet, check out our Metamask guide.

Create a bond by clicking “add”, input your amount of KP3R (you can even join without any tokens by inputting “0”) and confirm by clicking “add” again. After 3 days you will be able to activate your Keeper.

How to perform jobs

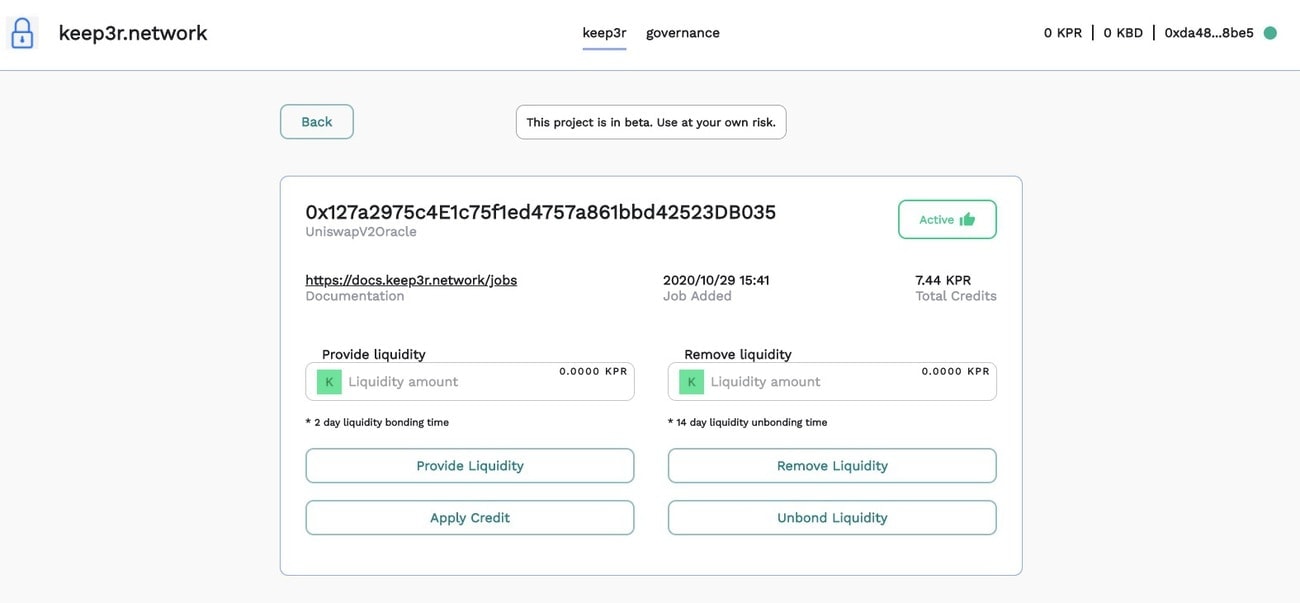

Currently available jobs are listed on the main page. You can click on them to find out more details about the job such as the relevant documentation and the credits (in the form of KP3R) you can receive for the job.

With the newest update, you can also use OpenZeppelin Defender with Keep3r Network. OpenZeppelin Defender is a wrapper for smart contract developers to automate maintenance tasks such as calling specific functions to manage the protocols on these contracts. This is helpful to developers as traditionally they would have to periodically do these tasks manually. Furthermore, the underline layer is written by the OpenZeppelin team (a security audit firm) which would bring stability to the DeFi ecosystem.

How to register a Job

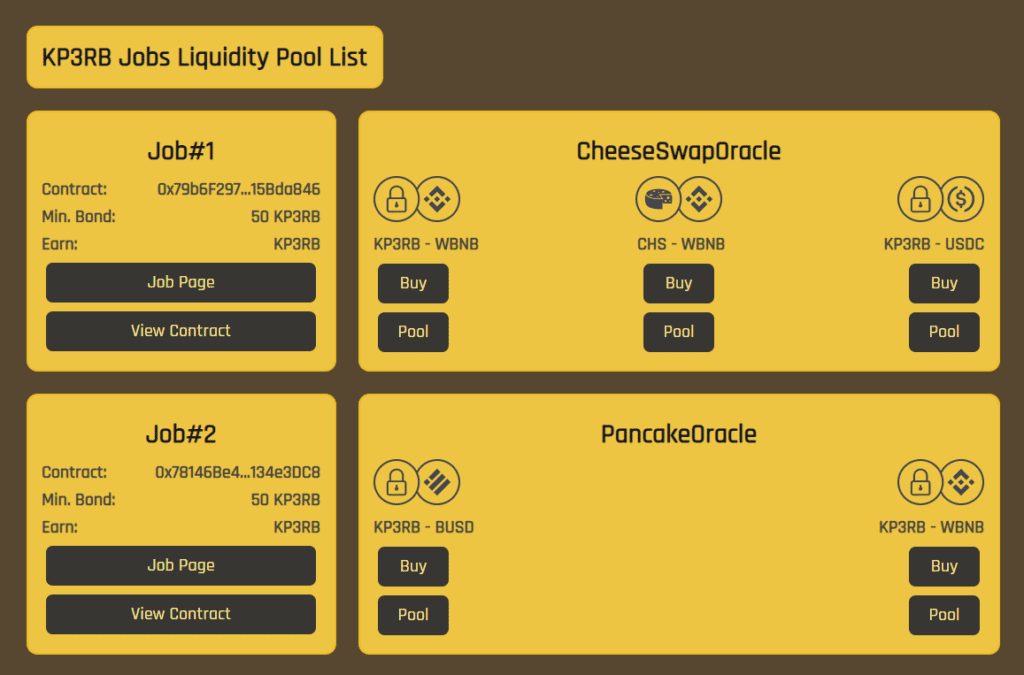

Jobs can be any system or task that requires external execution. Jobs can be registered in 1 of 2 ways, either through governance or the contract interface.

Registering a job through governance is probably the easiest method as it only requires you to submit a Governance proposal which includes the relevant contract as a job. No further action is required if your governance proposal passes. Cronje has stated in his interview with Synthetix that currently, it is relatively easy to pass this proposal as the quorum requirements are not high.

The other method i.e. contract interface is slightly more complex and requires calling the add liquidity to job function on the Keep3r contract. However, you must not have any current active jobs associated with the account to do this and you can only create a Job through this address every 14 days.

How to collect credits for Jobs?

As seen in the Job interface, completing Jobs gets you credits in return. To collect these credits you will need to provide KPR-WETH liquidity in Uniswap, and you will be given an equal amount of KPR tokens in return. Note you are not required to purchase KPR tokens.

By default, this is in the form of bonded KP3R but you can unbond it to become normal KP3R.

MetaKeep3r: How Keepers can instantly recoup their gas fees

According to Cronje’s Medium article, MetaKeep3r keeps the “maintenance” of Keepers to a minimum. By using MetaKeep3r with OpenZeppelin defender, Keepers can instantly recoup their spent gas in the form of ETH. This is really important considering there had been previous “gas wars” when DeFi fever was at its highest- basically any benefit that could have been derived from a particular transaction was less than the amount of gas fees which was required to execute the transaction.

As mentioned previously, Keepers that complete Jobs are rewarded with KP3R. By default, this is in the form of bonded KP3R, and whilst keeping bonded KP3R has its advantages, one issue is that ETH cannot be immediately recouped.

Now with MetaKeep3r, you can immediately get ETH in return for trading bonded K3PR. How this works is that MetaKeep3r would keep the bonded KP3R and swap it for ETH as compensation for gas spent on Uniswap.

Note however that a minimum bond of 100 KP3R is required for MetaKeep3r.

Special thanks goes to Alvin and Crypto Warrior from our Telegram community for their valuable input into this article!

Further resources

Videos

Boxmining explains Keep3r Network and his story with KP3R

Synthetix discussion about Keepers with Andre Cronje from Keep3r.network

Articles

Andre Cronje Medium

Keep3r Network documentation

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.