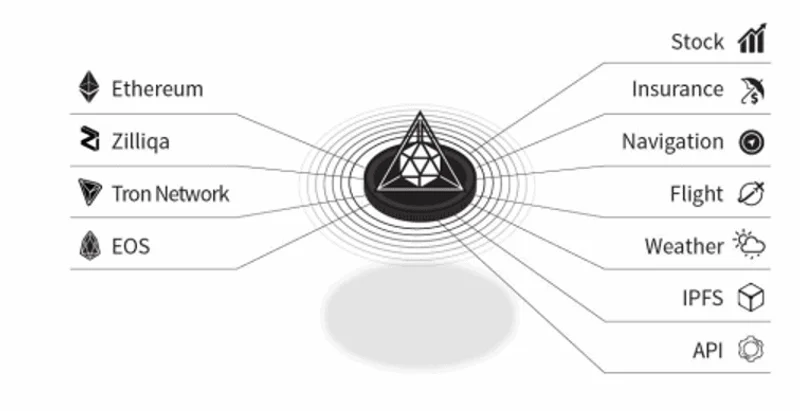

DOS NETWORK ($DOS) is a scalable layer-2 network that offers Decentralized Oracle Service that securely and reliably collects real-world data, event and computation power and delivers them to blockchain systems. Apart from allowing blockchains to interact with external data, the network also allows communication between blockchains.

In this guide, we take a closer look at DOS Network, its use cases, incentives to miners, architecture, as well as two of its main components.

Background

The development of DOS Network was made possible by blockchain technology, with a special focus on smart contracts and decentralized applications (Dapps). At present, these two areas are seeing increased attention but with only a few tangible results. The DOS system seeks to contribute to the crypto space by commercializing Dapps and boosting large-scale adoption of smart contracts.

To do this, the project envisions a scenario where smart contracts can independently fetch internet data and activate web application programming interfaces (APIs). Additionally, the protocol’s background is hinged on making on-chain computations less expensive while improving scalability.

This would allow artificial intelligence model training, matrix multiplication, and 3D rendering, among other applications, to be commercialized while using smart contracts.

The whole project is supported by the DOS Foundation, along with several key partners including QuarkChain, BKEX, Ultrain, Meter SERO, IOST, and Enterprise Ethereum Alliance (EEA).

What is DOS Network?

DOS Network is a decentralized oracle service network meant to boost blockchain-based systems’ interconnection with real-world data. It is built as a scalable layer-2 protocol that offers decentralized data feed oracles.

The protocol is also built to be chain-agnostic and completely decentralized. Therefore, it is compatible with all existing smart contract blockchains. This enables the DOS Network to function as a distributed computational oracle that is verifiable and usable by established blockchains such as Tron and EOS.

Furthermore, the network is also horizontally scalable, which means that the more nodes run on its system, the greater its computation power becomes. Being decentralized and designed with a crypto economic model, the DOS Network is resilient to sybil attacks and other cyber attacks.

Major parts of DOS Network

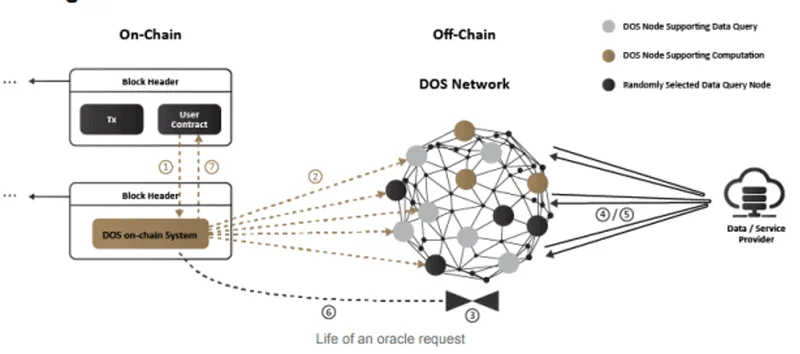

The DOS Network has two key components in its system: the on-chain and off-chain parts.

On-chain

The on-chain component deals with everything on the blockchain. It’s made of a set of the protocol’s contracts that handle computational result verification, node staking, payment processing, and other functionalities on supported blockchains.

For ease of use, the contracts have a uniform user interface across chains.

Off-chain

The DOS network’s off-chain system focuses on client software operated by third parties in search of economic rewards. The software is made of a blockchain adaptor module, off-chain group consensus modules, among others. Generally, the off-chain part has a distributed data feed and a computation oracle.

DOS Network Mainnet: Caelus

On July 10, 2020, the DOS Network Caelus mainnet officially went live. The mainnet brought with it real-time verifiable results, enhanced security, and scalability. In addition, the launch was accompanied by a blockchain explorer which allows users to query available on-chain information.

DOS Network: Use Cases

Bridging the gap between decentralized systems and real-world data leads to multiple enticing use cases. While the utilities for DOS are limitless, they can be summarized into:

Distributed Derivatives

A financial contract between individuals can be hindered by a lack of trust, especially on a decentralized platform. To promote stability, a smart contract takes care of a derivative’s short and long positions.

Although other projects like Decentralized Derivative Association are working on expanding the use of smart contracts on the derivatives market, DOS Network still has its place. The protocol can be used to securely access and feed the contracts with settlement values and price feeds.

Stablecoin External Data

In this context, Tether (USDT) is eliminated from the equation because it is issued by a centralized company and can be manipulated.

Here, we recognize the likes of DAI and kUSD, which are stablecoins pegged to an underlying asset. As a result, these currencies need systems like DOS Network to trustingly provide data, such as the current exchange rate of their underlying assets.

Decentralized Lending

Decentralized finance (DeFi) has added great momentum to decentralized lending. And to ensure a fair loan process, the DOS protocol can be used to provide market rates and monitor the equivalence between the amount loaned and collateral provided.

Also, it can be used to monitor the loan terms and activate liquidation.

Distributed Insurance

Insurance is one of the top sectors that would greatly benefit from blockchain technology. With projects like Etherisc looking into crop insurance, flight delay insurance, the DOS protocol can be utilized to feed them with the external data they require.

DOS Network enables policy underwriting and making payout decisions on decentralized insurance applications by providing the required external data.

Distributed Casino

With conventional casinos having up to 15 percent house edge, decentralized casinos are the answer to fairness, transparency, and near-instant payouts. But, with random number generation being at the core of every casino game, providing verifiable random numbers on blockchain systems is difficult.

To solve this, DOS Network can feed Dapps with verifiable and secure random numbers that are unstoppable, untamperable, and unbiased.

Decentralized Prediction Markets

This can be anything from election predictions to sports betting. Decentralized oracles provided by the DOS system can help solve these types of disputes safely and quickly.

Decentralized Computation Execution Scalability

The system can allow users to avoid costly on-chain computations and offer privacy to computing tasks. With low costs and private analyses, DOS Network can enhance scalability on Ethereum and other supported smart contract platforms.

DOS Token ($DOS): What is it?

DOS Network ($DOS) has a native virtual currency that follows ERC-20 standards. The token is used for both governance and incentivizing network participants. Participants on the network include Dapp developers, Node runners, and premium data providers. (https://nuttyscientists.com/)

The DOS token supply is hard-capped at one billion. DOS tokens was allocated for mining incentive (35%), ecosystem building (19%), community token promotion (1.5%), private sale (14.5%), team (15%), foundation reserve for marketing, legal, PR & etc (10%) and advisor (5%).

On Aug 17 2020, DOS Network has announced 2 improvements to the DOS token economy: liquidity rewards and token burning.

Liquidity rewards

The team will provide 100,000 DOS tokens every 7 days from the foundation reserve as liquidity rewards, of which 50% will be rewarded to the DOS/ETH pool on Uniswap V2 and 50% to the DOS/USDC pool on Balancer.

Token burning

Another 100,000 DOS tokens from the foundation reserve will be burnt every 7 days. Besides, staking interests incurred by foundational nodes (namely Gaia, Zeus, Hera, Ares, Athena, Apollo, Muses, Hades, Poseidon, Odin, Thor, Loki, and The Oracle of Delphi) will be burnt every 14 days and will not enter circulation.

For more info, please visit here.

Conclusion

The interaction of blockchain-based systems with real-world data is the key to explosive blockchain adoption. This can happen in sectors like insurance, casinos, prediction markets, peer-to-peer lending, DeFi, all thanks to the DOS Network.

Furthermore, allowing decentralized nodes to secure the network through a proof of stake-based system eliminates the need for highly specialized mining equipment, decreases the confirmation time, and increases the capacity of transactions.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.