Binance is the world’s most visited and used centralized cryptocurrency exchange in the world. The exchange has over 2 billion average daily volume and over 1.4 million transactions per second. The Binance ecosystem includes not only Binance exchange, but also BNB Chain, Trust Wallet, Binance card, and more. Many crypto traders like to take advantage of an exchange’s funding rates and fees to earn some profit and passive income. In this article, we look at how Binance funding rates and fees work, and how to profit from it.

Sign up for Binance and enjoy 20% off fees!

What is Binance?

Changpeng Zhao (CZ) and Ye He founded Binance in 2017. Since then, Binance has become the world’s most popular cryptocurrency exchange with the largest organic trading volume. Binance is available in most countries, including the United States under Binance.us (with the exception of a few states). The exchange also supports 600 cryptocurrencies on its international site and over 130 cryptocurrencies on Binance.us.

What are crypto funding rates?

Crypto funding rates are periodic payments of the price difference between perpetual contract markets and spot prices. Funding payments are made either to/by long or short traders depending on the funding rate.

Funding rates exist to align the perpetual contract price to the spot price. If the perpetual contract trading price is higher than the spot price, long position holders would pay short position holders. Conversely, if the perpetual contract trading price is lower than the spot price, short position holders pay long position holders.

Learn more about crypto funding rates with our article: Crypto funding rates: How it works and how to earn passive income

What are Binance funding rates?

As mentioned above, the purpose of funding rates is to prevent continued differences between the price s fo the perpetual contract markets and spot prices. Therefore, crypto funding rates are periodically recalculated. Binance recalculates its funding rates every 8 hours.

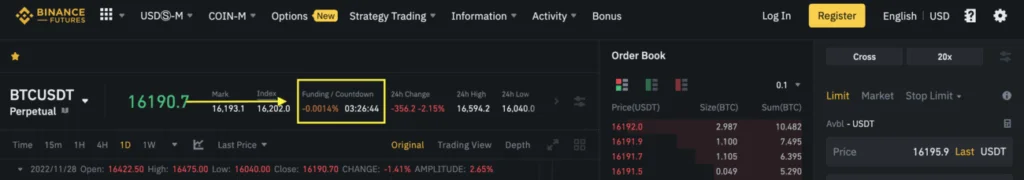

Users can locate the funding rate, and when the funding interval expires at the top of the Binance Futures page. So as seen in the below screenshot, the funding rate is -0.0014% and the funding period will expire in 3 hours 26 minutes.

How does Binance calculate the funding rate?

Binance calculates the funding rate based on two factors: The interest rate, and the premium.

Binance Futures generally fixes the interest rate at 0.03% per day (i.e. 0.01 per funding interval). However, for BNBUSDT and BNBUSD, the interest rate is 0%. Meanwhile, the premium fluctuates depending on the price difference between the perpetual contract and the mark price. A large difference, or spread, equates to a high premium. On the other hand, a low premium means there is only a narrow difference between the two prices.

When the funding rate is positive, it means that the price of the perpetual contract is higher than the mark price. Whereas if the funding rate is negative, the perpetual prices are below the mark price.

Binance uses the following formula to calculate funding rates:

Funding Amount= Nominal Value of Positions x Funding Rate

Where Nominal Value of Positions= Mark Price x Contract Size

How are Binance funding rates paid?

When the funding rate is positive, long traders pay short traders. On the other hand, when the funding rate is negative, the short traders pay the longs. On Binance, funding rates are paid between users i.e. peer-to-peer. This means Binance does not take any fees from users paying or receiving the funding rates.

Funding payments are made every 8 hours at 00:00 UTC, 08:00 UTC, and 16:00 UTC. However, this can be subject to change in cases of extreme market volatility. Traders must have open positions 15 seconds before or after the specified funding times in order to be liable to pay or receive any funding fees.

How to profit from Binance funding rates?

The purpose of funding rates is to encourage traders to take positions that allow the perpetual contract prices to be in line with the spot market. So, traders can develop strategies that allow them to take advantage of funding rates and profit from it.

How to be notified of Binance funding rates

Binance offers a notification feature where they will send you an email/SMS/in-app notification when the funding rate reaches a certain percentage. To activate this feature, log in to your account and go to “Derivatives” and then “USDⓈ-M Futures”. Then, click on the “notification” button, “preference” and then “notification”. Here, you can set the funding fee trigger. The default trigger is 0.25%, meaning that Binance will send you a notification when the funding rate reaches 0.25%.

Crypto funding rate trends

Crypto funding rates are correlated with the price trend of the underlying asset, as seen from historical data. So the spot market generally dictates the funding rate.

The above diagram shows the correlation between Binance’s funding rates and Bitcoin prices for the period from 20 December 2019 to 20 January 2020. As can be seen, the rise in funding rates corresponds to a Bitcoin price pump.

Traders can see Binance’s historical funding rates here.

Sign up for Binance and get 20% off fees!

Angela Wang

Angela loves cryptocurrency, technology that improves our lives...and food. Anything that merges these worlds together is even better.