Yield ($YLD) is a peer-to-peer cryptocurrency lending/borrowing platform with incentivized mechanism. Decentralized finance (DeFi) has opened new profit-making avenues for people who have additional funds to spare. Instead of just keeping assets in their wallets, DeFi has introduced several models in facilitating peer-to-peer lending and borrowing. Holders of digital assets can now earn interest income from supplying their funds to those who are willing to borrow. Yield introduced an individualized lending pool for each user who wants to earn interest income from their assets.

What is Yield?

Yield is an Ethereum-based, peer-to-peer cryptocurrency lending platform. It connects available lenders to borrowers without the need for any third-party to permit the approval of loan requests. Lenders can also conveniently place their offers on the platform which will then link to current requests.

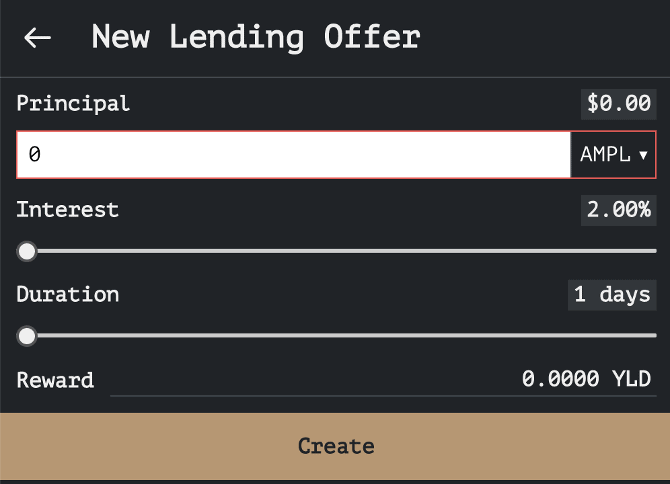

Loans made on the platform can be repaid anytime the borrower wishes to. Furthermore, lenders receive a fixed and guaranteed interest income which starts with 2% of the principal amount of the loan.

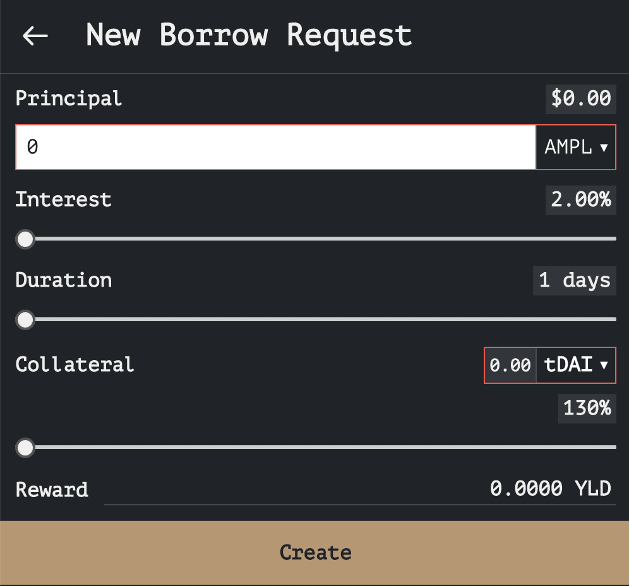

The borrower also earns YLD as a reward for paying their loans. As of now, the reward for borrowers stands at up to 350 YLD.

This peer-to-peer set-up for a lending platform is cheaper and more profitable for both the lender and borrower, as opposed to the traditional system of lending. After all, in conventional financial firms, looking for available borrowers who will not default on their loans is difficult. On the other hand, borrowers also find it difficult to pass the rigorous financial standards imposed by traditional banking institutions for their lending instruments.

The Yield project is still in its Beta stage. There are no recent updates yet as to when the program will be launched on the mainnet.

With Yield, the power to leverage on one’s assets is vested to the owner. Not any bank nor any other financial institution.

How does Yield Differ from Other Crypto-Lending Platforms?

Loans made on Yield do not follow the money-market model in supplying funds to borrowers. What does this mean? Let us first take a look at how its competitors do it.

The biggest crypto-lending platforms, MakerDAO or Compound Finance, for example, have their own pool of funds for specific digital assets available for lending. This is what users see from dashboards that reflect a list of ERC-20 assets, or whichever asset the platform is supporting.

The pools from these platforms come from users who lock their tokens in smart contracts that are designed to supply the requests of borrowers. The supply of these tokens and the number of its borrowers affect the calculation of its annual percentage yield (APY). So normally, the change in the depth of the pool also impacts its APY.

While the commonly employed method of lending in most platforms ensures that lenders earn interest from their idle assets and borrowers have funds to access, there are some disadvantages as well.

One disadvantage that Yield is trying to address is the potential volatility in lending APY. Since the APY for asset pools are automatically computed, lenders do not have control over it. This affects borrowing rates and the amount of profit lenders can earn from supplying funds to a pool.

And most of the time, borrowers lose out on these market shifts, specifically because this can lead to higher collateralization requirements and risks of liquidation.

Personal Non-Pooled Loans

Loans made on Yield are individualized. This means that the supply of a particular asset that you are offering will not be affected by other loan offers since it is not pooled. There are no supply-to-borrower dynamics that will drive wild fluctuations in a lender’s expected APY as well.

In these loans, borrowers stand to benefit from the transaction too. Yield rewards good peers: those who pay their loans through its native token $YLD. This is expected to incentivize lending and borrowing, a feature that not all crypto-lending platforms have.

$YLD Token

$YLD token is the platform’s native utility token. Interest fees on any asset borrowed from the platform are paid in YLD. Transaction fees also use $YLD.

According to the team behind the project, the purpose of these fees is to discourage malicious actors from taking advantage of the platform and incentivize user activity.

YLD’s token supply model is deflationary, which means that each time YLD is used to pay for transaction fees, the YLD is burned.

Additionally, holding YLD gives them benefits such as a 25% discount from transaction fees, an increase in YLD rewards for borrowers, and lower collateral liquidation ratios for borrowers.

Yield Garden

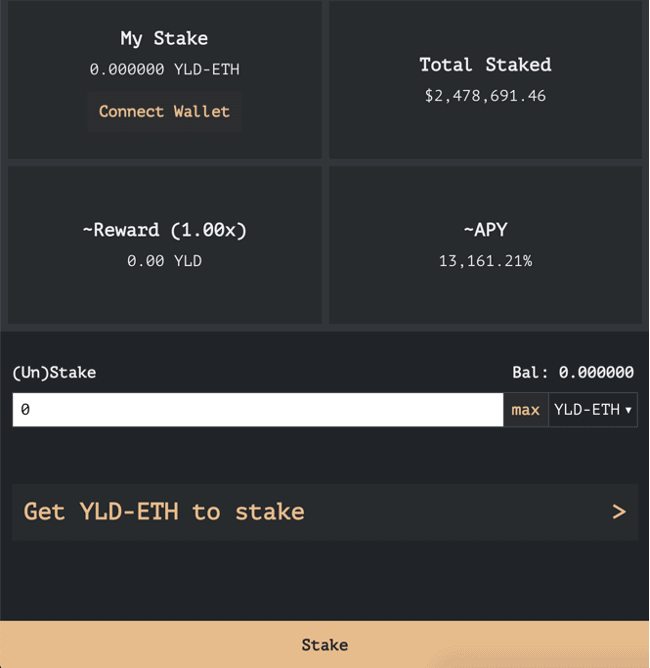

Yield has also set up a liquidity staking pool. Through the Garden, users can stake their YLD and earn rewards in doing so. Available staking pairs are YLD-ETH and YLD-RFI.

According to the team, the Garden is powered by a slightly modified version of the smart contract from Ampleforth’s (AMPL) geyser. There is a cooldown period for stakers (the time that stakers are not yet allowed to unstake or withdraw) which is set at 7 days.

Unstaking also incurs 0.75% unstaking fees if it is done earlier than 14 days since the initial stake, 0.5% after 14 days but before 27 days, and 0.35% after 27 days.

As of now, there is already a total of $2,456,403.31 staked in the platform.

Conclusion

While the DeFi space is still relatively young, it certainly has a lot of potential in helping cryptocurrency holders make the most out of their assets. There are a lot of projects today in the space that aims to provide passive income to asset owners and Yield is among those. As new as it is, the approach of the project in the business of crypto-lending seems positive and promising.

However, how this new approach will work in maintaining a steady supply of funds for borrowers to tap remains to be seen. As of today, Yield’s individualized pooling method on loan supply cannot assure that there will be enough assets to borrow every time. Even with all things considered, Yield is still definitely a project that the DeFi community has to watch out for.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.