Orbiter Finance is the hottest bridge for emerging layer-2 blockchains right now. They have confirmed they will issue a token. No airdrop has been officially announced yet, but it IS hinted. This means that no snapshot has been taken yet, and early users can potentially earn huge airdrop rewards. In this article, we will explain what Orbiter Finance is and what you can do to position yourself for their potential airdrop.

Orbiter Finance Airdrop Step-by-step Guide

Here’s how you can get a potential Orbiter Finance token airdrop:

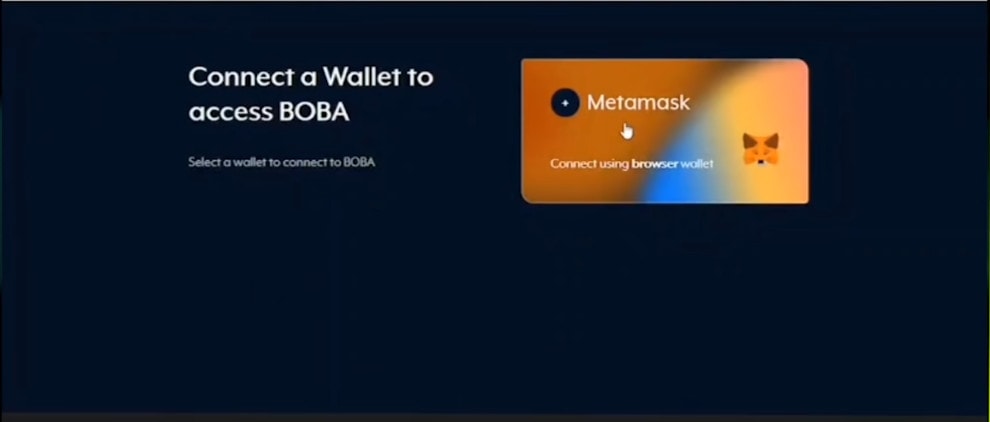

- Connect your MetaMask or other Ethereum/Polygon/zkSync/Arbitrum wallet.

- Select the chain you want to send your assets to.

- Complete the transaction.

- Get Discord Roles

- Claim Orbiter Pilots NFT

See below for more details.

What is Orbiter Finance?

Orbiter Finance is a decentralized bridge that supports cross-rollup transfers between Ethereum and other layer-2 blockchains such as zkSync and Arbitrum. Users can move ETH, USDC, USDT, and DAI between those supported networks.

It is secured by a series of smart contracts that involves two roles: Sender and Maker. The Maker provides liquidity for the transfer initiated by the Sender. If the Maker does not carry out their role, the Sender can initiate an arbitration request to the contract with the Maker’s margin and receive compensation for any excess losses.

Does Orbiter Finance have a Token?

Orbiter Finance does not have a token yet, as they are currently focusing on developing the protocol and improving user experience. However, in a recent Tweet, they strongly hinted at issuing a token as well as a possible airdrop. Moreover, Orbiter Finance has closed its first round of funding with participation from Tiger Global, A&T Capital, StarkWare, and even Vitalik Buterin. As such, DeFi projects backed by major players tend to launch a token after product completion.

How to Receive Potential Orbiter Finance Token Airdrop?

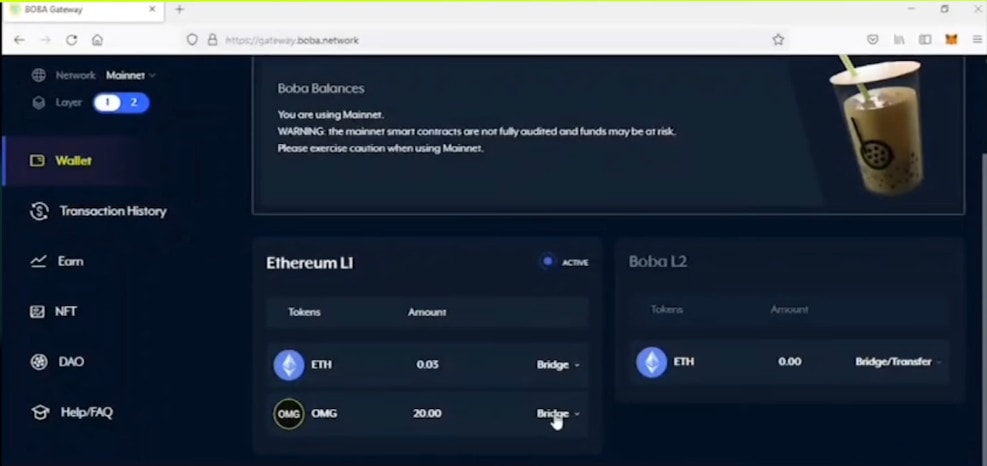

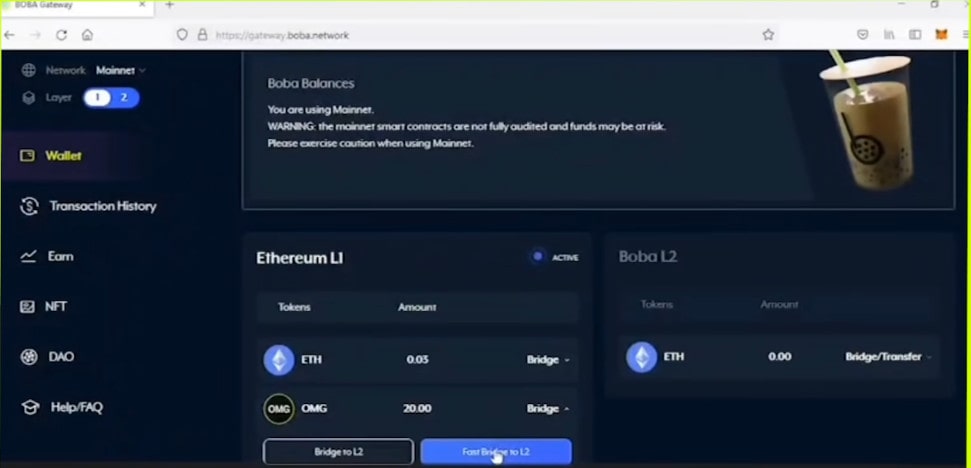

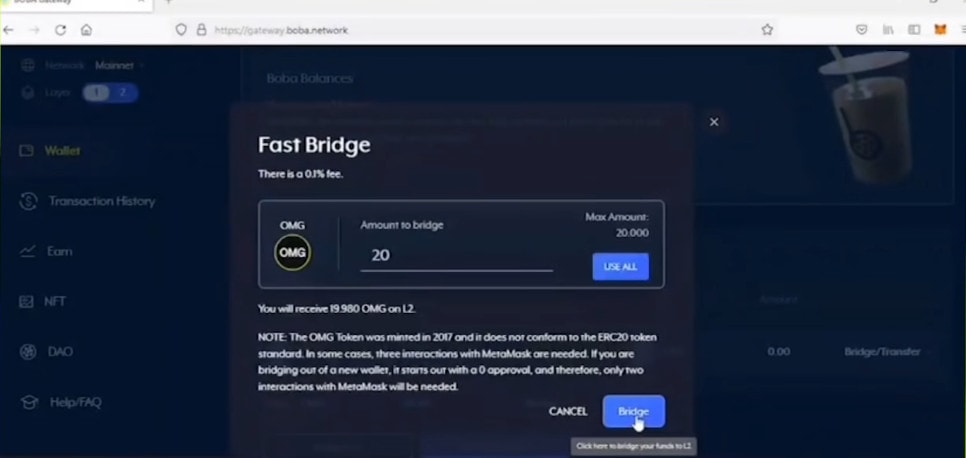

The best chance to receive Orbiter Finance token airdrops is to bridge ETH or stablecoin assets between the 11 supported networks. Here’s how to get a potential Orbiter Finance airdrop:

- Connect your MetaMask or other Ethereum/Polygon/zkSync/Arbitrum wallet.

- Select the chain you want to send your assets to.

- Complete the transaction.

Although it is recommended to bridge assets frequently to increase your airdrop chances, there will be a transaction fee. However, Orbiter will modify its fees based on the Gwei of the destination network to maintain a fee that is below the average, but this will not happen frequently due to the volatile nature of gas fees. The sender can view the current fee on the Orbiter website.

Get Discord Roles

Get higher ranking roles on Orbiter Finance’s Discord by completing tasks on their Guild page. The requirements for the Orbiter Finance roles are as follows:

- Member: Connect your wallet to the Guild page.

- Flying Alien: Have the UFO emoji in your Twitter username and follow Orbiter Finance’s Twitter.

- Trainee Pilot: Complete 3-9 transactions on Orbiter Finance.

- Pilot: Complete 10-49 transactions on Orbiter Finance.

- Elite Pilot: Complete 50-99 transactions on Orbiter Finance.

- Expert Pilot: Complete 100-499 transactions on Orbiter Finance.

- Ace Pilot: Complete 500 transactions or more on Orbiter Finance.

You can check the number of transactions by connecting your wallet here. Note that the allowlist is only updated once a week on Mondays, so you will need to check the Guild page frequently. You must have a role of Trainee Pilot or above in order to be included in their allowlist.

Claim Orbiter Pilots NFT

Orbiter has created an NFT series for Orbiter Pilots (i.e. Orbiter users). There are 5 NFTs based on your Discord role. To claim your Orbiter Pilot NFT, connect your wallet to their Galxe Page and click “Claim”. Note you will need MATIC to pay for gas fees when claiming your NFTs.

Airdrop Review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: There is no confirmation of a token launch and airdrop by Orbiter Finance, but they hinted in their Tweet that they are considering issuing a token as well as a potential airdrop.

Airdropped Token Allocation: Since there is no token launch yet, tokenomics data are not available.

Airdrop Difficulty: If there is a potential airdrop, the steps to be eligible is fairly easy. All you have to do is connect your wallet on their platform and bridge assets to another chain. It is recommended to do this frequently, but be cautious of transaction fee.

Token Utility: Since there is no token launch yet, token metrics are not available.

Token Lockup: Since there is no token launch yet, tokenomics data are not available.