Davos Protocol is a new type of stable asset protocol that allows users to earn yield from staked assets with low collateral risk. Its mainnet was recently launched on Polygon, and early users could qualify for a potential airdrop. In this article, we will briefly explain what Davos Protocol is and what you can do to position for the airdrop.

Davos Protocol ($DGT) Airdrop Step-by-Step Guide

Here’s how to receive the $DGT airdrop:

- Connect Your Wallet to Davos Protocol

- Deposit $MATIC as Collateral

- Stake $DAVOS to Earn $DGT

- Deposit on Gamma Boosted Vaults

- Provide Liquidity on Uniswap or QuickSwap

See below for more in-depth details!

What is Davos Protocol?

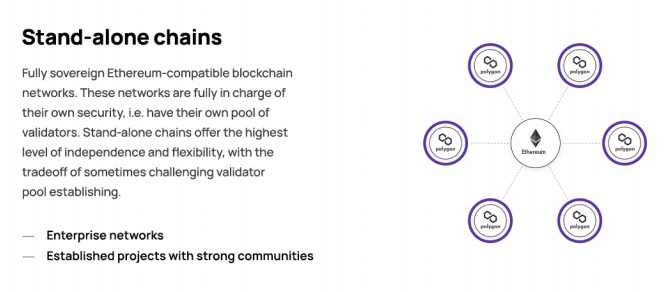

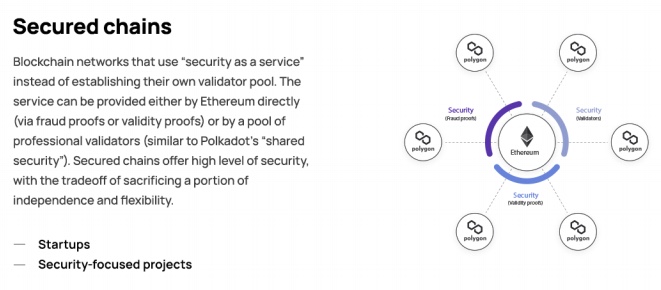

The Davos Protocol is a new type of stable asset protocol that solves the problem of locked-up liquidity in a sustainable way. It achieves this by using liquid staking and over-collateralization to enable a real yield extracted from liquid staking rewards for Davos stable assets on proof-of-stake (PoS) networks.

The monetary policy of Davos regulates the price stability of the stable asset $DAVOS. Through a revenue distribution system, Davos rewards liquidity providers with a stable yield. It accepts coins from multiple PoS networks as collateral to borrow $DAVOS stable assets and runs diverse low-risk strategies to generate yield from the collateralized assets. The generated yield is then redistributed to $DAVOS stakers and DEX liquidity providers.

Does Davos Protocol Have a Token?

Yes, Davos Protocol uses a dual token model consisting of $DAVOS and $DGT. $DAVOS is the stable asset backed by staked MATIC as collateral, allowing users to yield farm. On the other hand, $DGT is used for platform governance, participants incentivization, and voting on upgrades such as adding a new vault or changing protocol parameters and fees.

$DAVOS is already live and in use, but the $DGT token will launch in the future.

How to Get the Davos Protocol ($DGT) Token Airdrop?

The best chance to get the $DGT token airdrop is to interact with the Davos Protocol mainnet. Here’s a step-by-step guide:

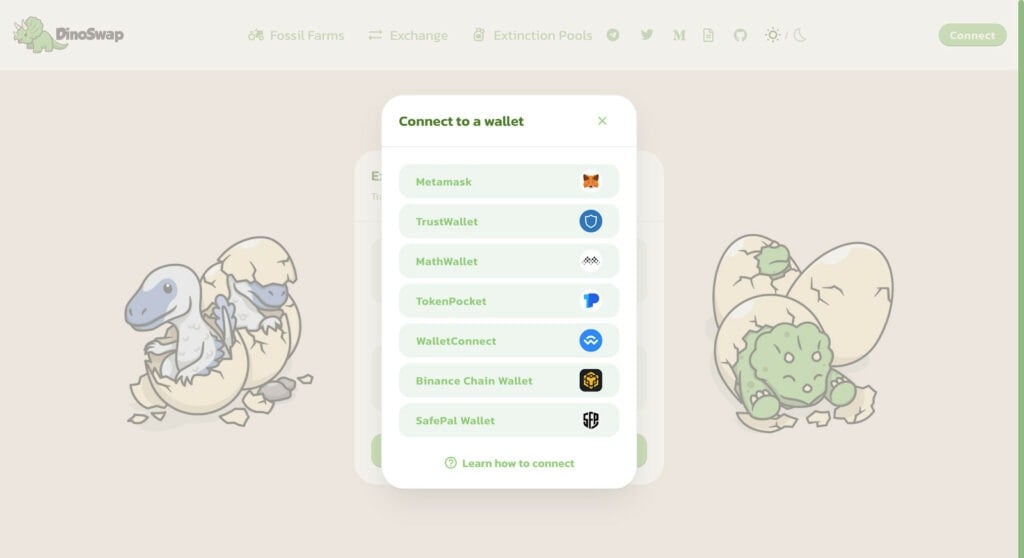

- Connect Your Wallet to Davos Protocol

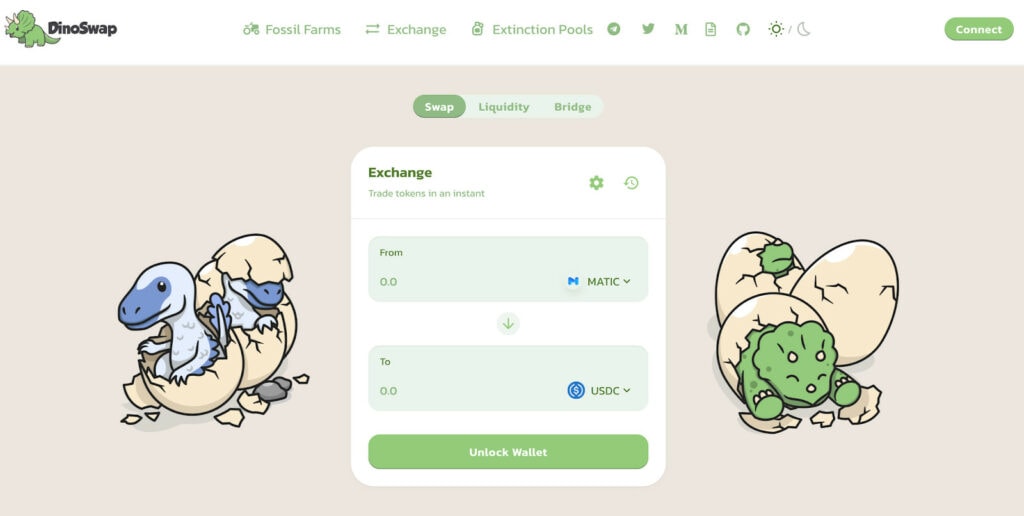

Connect your MetaMask or other supported wallets to the Davos Protocol app. Switch the network to the Polygon mainnet.

- Deposit $MATIC as Collateral

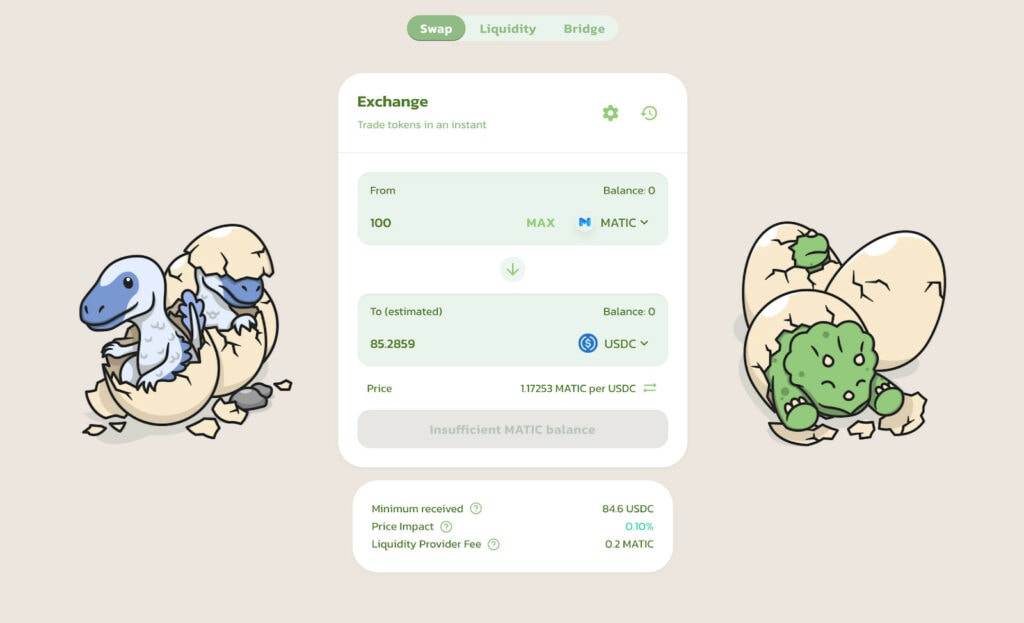

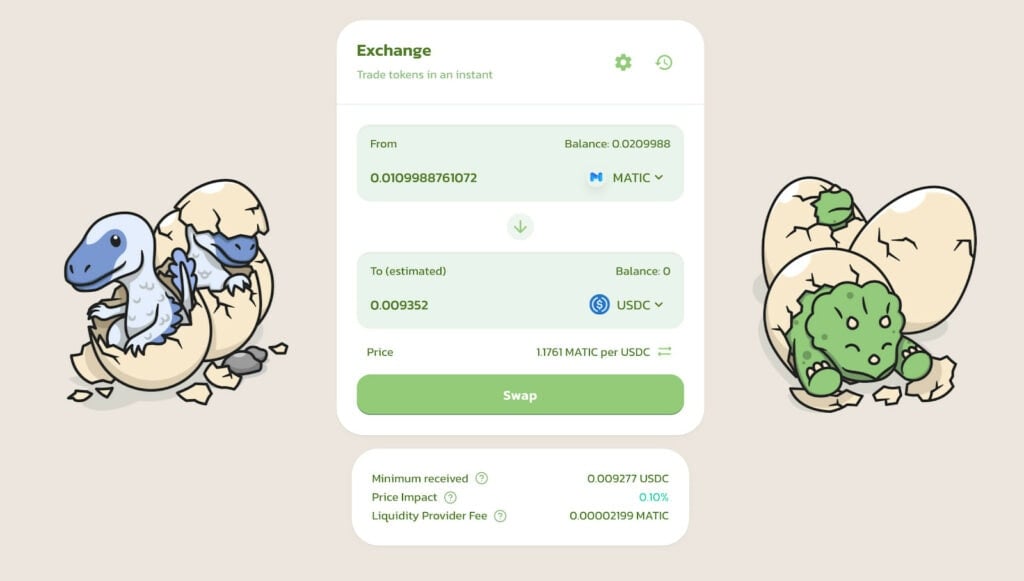

Go to the borrow page, provide $MATIC as collateral to borrow $DAVOS tokens.

The Davos team recommends keeping the borrowing amount under 75% of the maximum limit to prevent loan liquidation, which could occur due to changes in the collateral’s value. - Stake $DAVOS to Earn $DGT

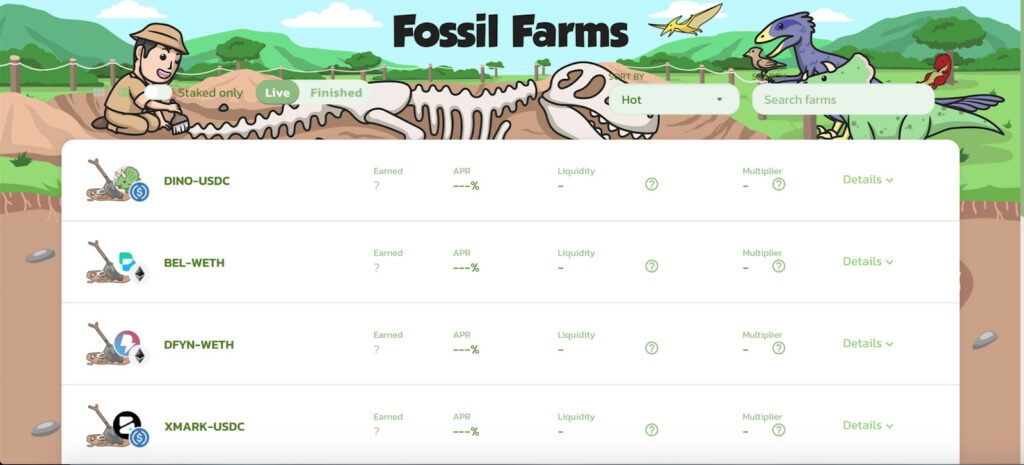

Go to the earn page, stake your $DAVOS to earn $DGT rewards which could translate to the token when it is launched.

If you unstake your tokens, you will need to repay the debt you owe in $DAVOS tokens to close your position. - Deposit on Gamma Boosted Vaults

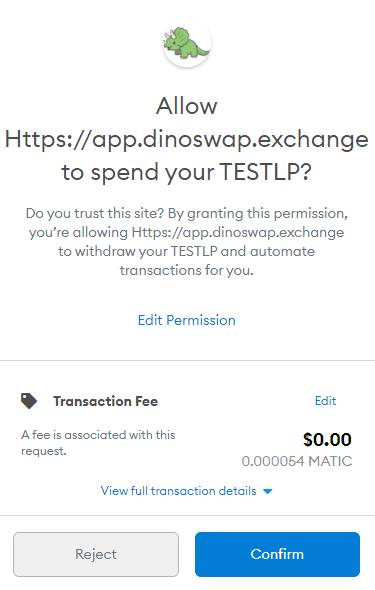

On the same page, you can deposit USDC/DAVOS pair on Gamma via Uniswap or QuickSwap.

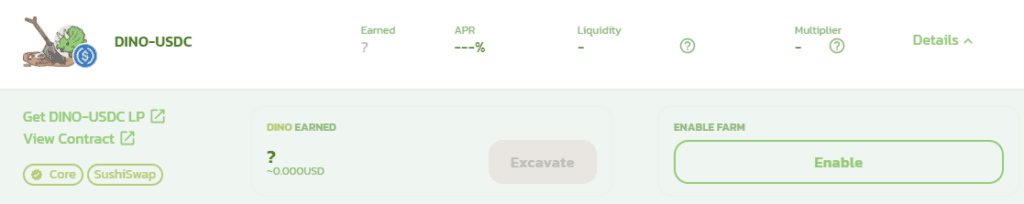

- Provide Liquidity on Uniswap or QuickSwap

You can also directly provide USDC/DAVOS liquidity on Uniswap or QuickSwap.

Airdrop Review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: Davos Protocol has not launched its $DGT token yet, but early users can potentially qualify for an airdrop.

Airdropped Token Allocation: Token allocation for airdrops is not confirmed yet.

Airdrop Difficulty: The steps are straightforward. Just provide $MATIC as collateral to borrow and stake $DAVOS. However, keep in mind that real funds are used, as it is deployed on the Polygon mainnet.

Token Utility: $DAVOS is the stable asset backed by staked $MATIC, whereas $DGT is the governance token of the protocol.

Token Lockup: There is no information on token lockup yet.