Rio DeFi ($RFUEL) is a blockchain technology company. It aims to bridge the traditional finance with the blockchain space with its powerful digital infrastructure, Rio Chain. It focuses on security, speed, scalability, and interoperability with existing blockchain.

The whole Rio ecosystem promises a wide array of services that users can utilize as an alternative from the traditional financial system. From savings and lending services to trading and insurance opportunities. All of these are accessible with just a smartphone and internet connection.

Background

James Anderson, the CEO of Rio DeFi, as well as his team, believes that today’s financial system is in dire need of new development that can respond to the needs of globalization. Services provided by intermediaries such as payment solutions and money transfers, or control of fiat currencies by local governments, bear multiple concerns that impact the whole financial landscape as we know them today.

The team behind Rio worked on an ecosystem that can easily be used by users in their daily lives to perform financial transactions without much friction and cost. And at the heart of the project is the objective to support the mass adoption of cryptocurrencies among the general public.

There is still a lot of work to do but Rio has developed a model that can respond to the rapidly-changing international financial landscape.

What is RIO DeFi?

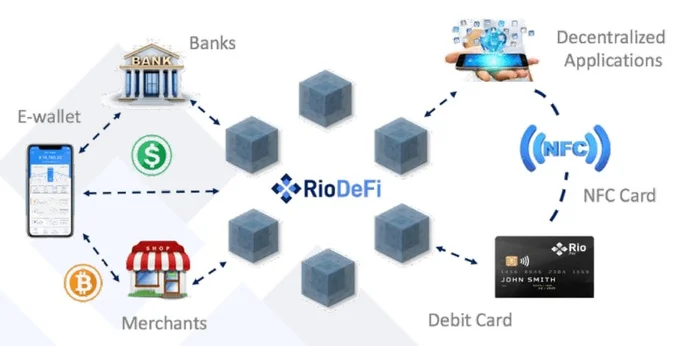

Rio Chain is a decentralized finance (DeFi) service platform powered by smart contracts. The purpose of the platform is to provide an ecosystem that can back decentralized applications (dApps) providing financial services based on a single but effective and fast blockchain.

It is built on its own chain, seeing the problems that the Bitcoin and Ethereum networks are experiencing. Right now, the volume of transactions that are going through those top chains has caused slow transactions, expensive gas costs, and poor adoption rate. There had to be another platform to base their new ecosystem on and it was the Rio Chain that they came up with.

Through Rio DeFi, new dApps can support new wallets, services, and cryptocurrencies.

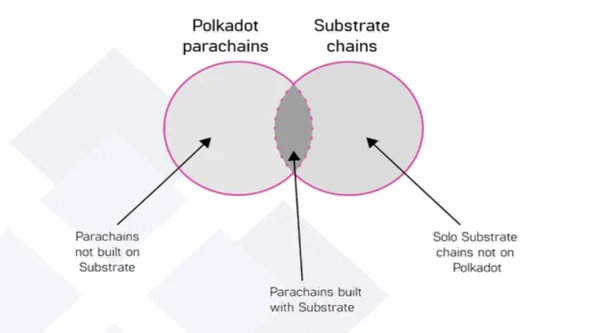

Parity Substrate

Rio’s team believes that the best way to move forward with crypto development is to create a blockchain that can freely interact with the others. That is why they went on to implement the Parity Substrate technology to enable other blockchain projects to easily plug into Rio through parachains.

Parachains are standalone blockchains that can be used to develop new dApps which can be conveniently deployed onto other chains without any interoperability issues.

Three Main Focuses of the Rio project

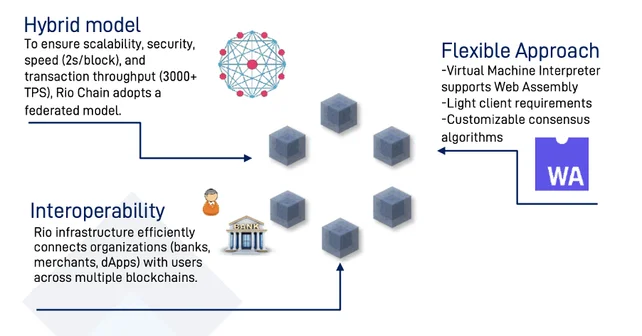

Rio’s solution to the all too common problem of slow, inefficient, and expensive blockchains is a model that supports their three main focuses, namely: usability, scalability, and security.

Hybrid model: Putting together a new network that can provide scalability and higher transaction throughput (with as fast as two seconds per block in confirmation time) is achieved by developing a federated model for the Rio blockchain.

Flexibility: Through the deployment of virtual machine interpreters with very low client requirements and customizable consensus algorithms rid the Rio chain of rigidity and risks of centralization. Everything built on top of the Rio chain can be easily adjusted according to the prevailing market conditions without any friction when it comes to implementation.

Interoperable: Because the Rio chain is designed to support easy linkage between other chains, it can efficiently connect different organizations together despite the difference in their blockchain platforms.

Consensus Algorithm (Proof-of-Authority)

Rio uses the Proof-of-Authority (PoA) consensus mechanism that adopts Substrate’s Aura (Authority round) and GRANDPA (GHOST-based Recursive ANcestor Deriving Prefix Agreement) consensus algorithms.

These two new combinations for the PoA implementation ensures that there are different algorithms that govern how the block data is handled and how finality is achieved for each transaction. By delegating the task of splitting block data writing to Aura, and handing over the finality verification process to GRANDPA, Rio has achieved better flexibility without compromising the security of the transactions performed on-chain.

In the pipeline is Rio’s plan to switch to Proof-of-Stake (PoS), similar to the consensus mechanism implemented on the Bitcoin blockchain. As of now, the team behind Rio is working on shifting to BABE (Blind Assignment for Blockchain Extension) from Aura to lay the groundwork needed for the eventual PoS adoption.

- AURA: It is designated as the consensus algorithm to produce the next blocks from confirmation. It functions through the help of a select set of validators that generate the blocks at a given time. Only the authorized nodes are allowed to become validators.

- GRANDPA: It is delegated with the task of providing block termination with the help of “weighted authorities.” They are not going to produce any block for the network, but they vote on the “best” version of the blocks produced by the validators. If more than two-thirds of the delegated authorities vote on a version of the state of the blockchain, it is then considered final.

Federated Blockchain

Rio believes that a federated blockchain is better than a permissionless public blockchain for several reasons. It provides faster transaction speed, scalability, low transaction costs, low energy consumption, stronger security, and increased ability to provide data privacy features.

The implementation of the federated model allows Rio to achieve a 2-second block time confirmation, faster than other existing blockchains in the DeFi space. And even at this speed, Rio chain is still capable of protecting the network from 51% attacks while being able to process almost 3,000 transactions per second.

Right now, the team behind Rio is considering the implementation of a hybrid PoS and PoA consensus model, complemented by light node validators. This means that anyone can probably be able to participate in network validation with just mobile phones as the assigned nodes.

Rio Fuel token ($RFUEL): Rewards for token holders

Rio rewards its blockchain participants with Rio Fuel ($RFUEL), which is also its native token. RFUEL can be used as a store of value, payment for gas fees, or to execute smart contracts.

1 billion RFUEL tokens will be created via a token generation event (TGE), which 70% of these tokens will be distributed to incentivise applications and users that contributes to the growth of the ecosystem, 20% will be sold through community crowd sales and private sales, and 10% (100 million) will be maintained as reserves that will slowly release over the span of 5 years.

Refer to the chart below for more detailed on RFUEL token distribution:-

Rio Fuel token ($RFUEL): public sale

The first round public sale of Rio Fuel’s RFUEL token was sold out in 40 minutes on 11th September 2020. The first round price is at $0.16, minimum contribution cap is USD $1,000 and maximum contribution cap is USD $10,000. Vesting period is 61 days with unlocks of 1/3 starting at Token Generation Event (TGE) and on days 31 and 61 after TGE.

The second round was held on 15th September 2020 at 6:00 a.m. UTC. The price for round 2 will be at $0.18, minimum contribution cap is $1,000 and maximum contribution cap is USD $10,000. Vesting period is 1 month with unlocks of 1/4 on TGE and on days 11, 21, and 31 after TGE. All vested tokens are automatically staked to receive RFUEL staking rewards.

RFUEL public sales round 3 is a Uniswap Initial DEX Offering (IDO). RFUEL will be available for trading on Uniswap with a starting price of $0.20 and all tokens will be fully unlocked i.e. immediately available for trading. However $0.20 is only the initial price and considering the previous rounds were all oversubscribed, there is a possibility that prices will immediately fluctuate after trading starts.

For more detailed info, please check on Rio DeFi telegram.

Use Cases of Rio Chain

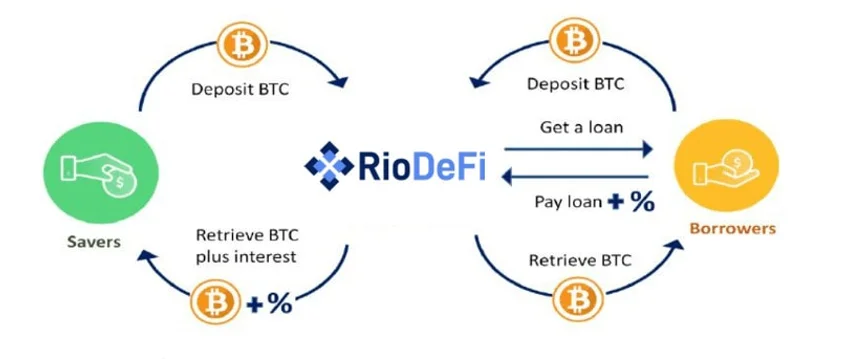

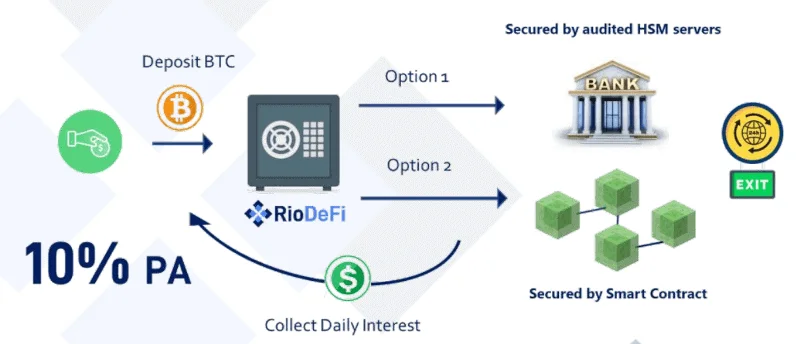

Bitcoin Lending Platform: Users can deposit their BTCs in smart contracts on top of the Rio Chain to earn interests from their assets. Borrowers can also easily leverage their BTC by borrowing through the Rio Chain.

Savings Account: Rio’s security can be a haven for BTC savers too. Users can safely deposit their BTC and other supported cryptocurrencies while earning high-interest rates as compared to traditional savings services from banks and other providers.

Decentralized E-commerce: Merchants can freely tap on the Rio chain to digitize their business and cut huge operational costs in doing so. Establishing their managing and sales operations on the Rio Chain can enable merchants to access a wider array of shoppers thanks to lower costs, better payment gateways, borderless transaction models, and greater consumer data privacy, among others.

Conclusion

The development of the DeFi space relies on the success of projects that are able to bridge all existing developments on multiple blockchains. This is especially true for useful innovations that are stuck in high-traffic networks. If adoption is the goal, building an interoperable blockchain that supports cross-chain implementation is a great way to go about it.

Rio DeFi’s blockchain-agnostic model could create an infantile avenue of innovations in the DeFi space. By bridging different blockchains together, not only can we possibly achieve faster adoption, but also greater interest in developing interoperable DeFi models as well.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.